[ad_1]

Shares and ETFs buying and selling at or close to new highs are main with clear uptrends. These are the names we would like on our watchlist or in our portfolio. We are able to discover leaders by checking the listing of 52-week highs or by utilizing the StochClose indicator, which is a part of the TIP Indicator Edge Plugin. In the present day’s article will present how StochClose works and supply a listing of present leaders.

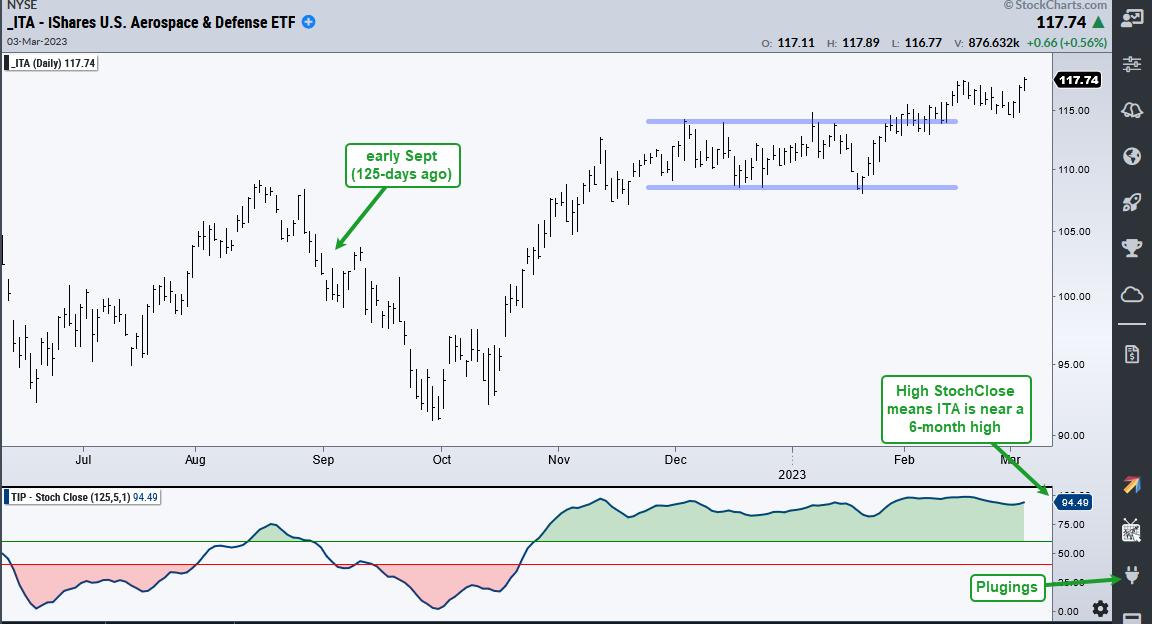

The chart under exhibits the Aerospace & Protection ETF (ITA) hitting a brand new excessive final week and the StochClose indicator captures this worth energy. StochClose is the Stochastic Oscillator based mostly on closing costs. StochClose (125,5) covers 125 days and this era extends again to early September. Six months is my private candy spot for worth rating. StochClose measures the extent of the present shut relative to the closing high-low vary over the past 125 days. Values above 90 imply worth is close to a six month excessive, whereas values under 10 imply worth is close to a six month low. Word that uncooked values are smoothed with a 5 day SMA, which introduces slightly lag.

The underside window exhibits StochClose (125,5) shifting above 60 and turning inexperienced in late October. Values above 60 point out that worth is within the higher half of its six month vary (cup is half full). StochClose is at the moment at 94.49 and this implies worth is close to a six month excessive. The uncooked worth could be increased as a result of there’s a 5-day smoothing, however I desire a brief smoothing durations as a result of it reduces whipsaws.

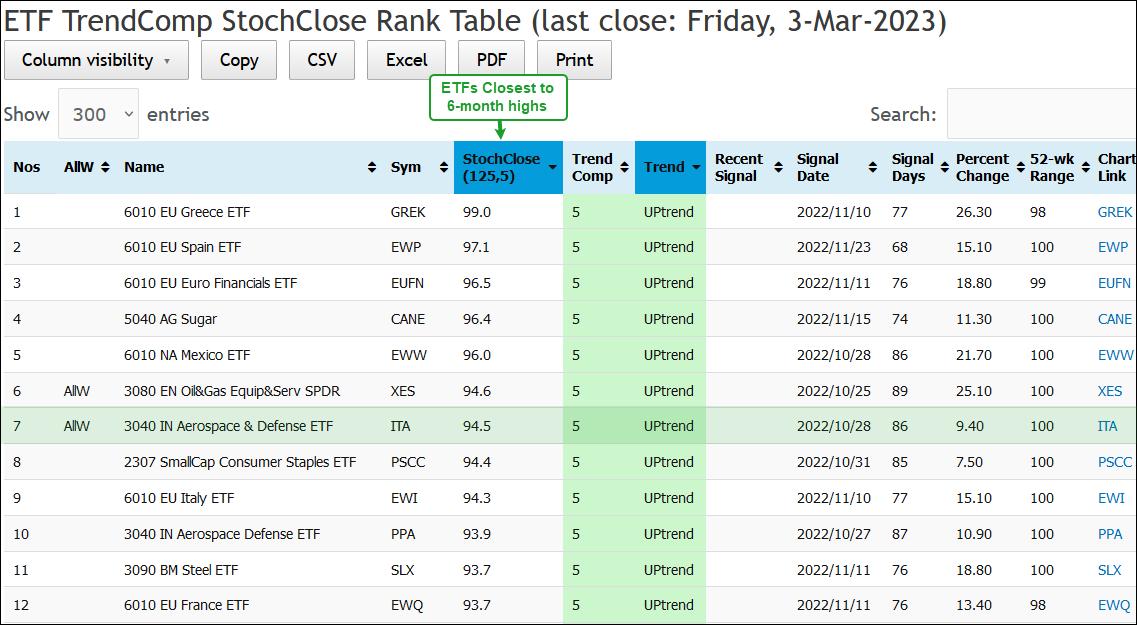

The picture under exhibits the ETF TrendComp StochClose Rank Desk from TrendInvestorPro. This desk exhibits Pattern Composite alerts and the StochClose rank for 275 ETFs in our Grasp Checklist. ITA is quantity seven on the listing, proper under the Oil & Fuel Tools & Companies ETF (XES). The “Allw” in column two refers back to the 50 ETFs which can be a part of the All Climate Checklist. TrendInvestorPro runs a quantified technique buying and selling these 50 ETFs utilizing Pattern Composite alerts and StochClose rating.

TrendInvestorPro is at the moment working with three quantified methods for buying and selling ETFs. Along with the All Climate Technique, now we have a Pattern-Momentum Technique for 74 stock-based ETFs and a Imply-Reversion Technique for a broad listing of 138 ETFs. Every technique comes with an in depth article and quantified outcomes. We additionally replace sign tables every day. Click on right here to study extra.

StochClose, the Pattern Composite, ATR Trailing Cease and eight different indicators are a part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click on right here to study extra and take your evaluation course of to the subsequent degree.

—————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out pattern, discovering alerts inside the pattern, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise Faculty at Metropolis College in London.

Subscribe to Artwork’s Charts to be notified each time a brand new put up is added to this weblog!

[ad_2]