The day by day RRG for US sectors is displaying an attention-grabbing image. Out of all 11 sectors, solely 4 are on a damaging trajectory. Industrials is contained in the lagging quadrant at a really brief tail and roughly in a static place which implies that the sector is in a steady relative downtrend. Shopper Discretionary may be very near the benchmark and crossing over into lagging after it rotated by way of bettering however was not capable of make it over to main.

And the 2 most vital sectors for the time being, Communication Providers and Expertise are rotating by way of weakening after they’ve led the dance over the previous couple of weeks.

Once we break down the sector panorama into offensive, defensive, and delicate we get a extra granular image.

Offensive

Apart from XLY, the offensive sectors are all contained in the bettering quadrant at lengthy tails and they’re beginning to decide up relative energy, ie transferring increased on the JdK RS-Ratio scale. The sort of rotation is supportive for an increase in broad market indices just like the S&P 500

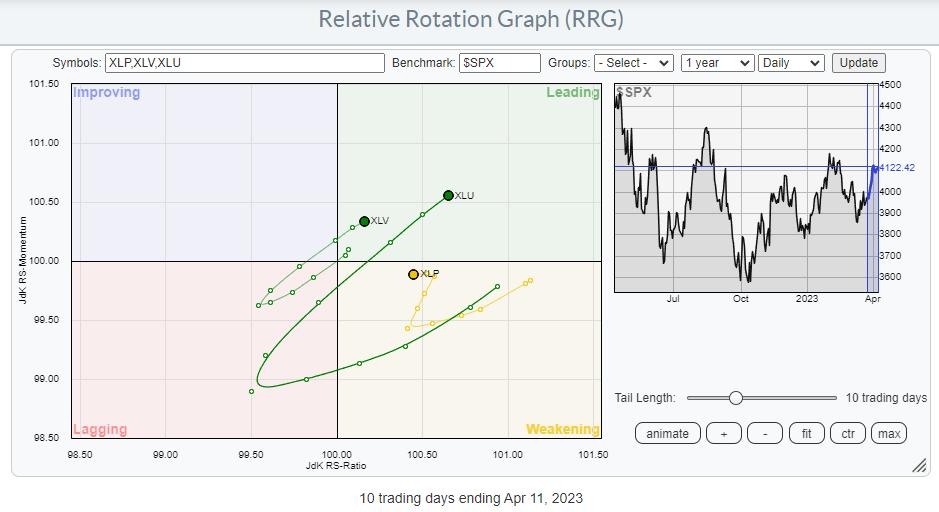

Defensive

The group of defensive shares is displaying a good stronger rotation, Healthcare, and Utilities have made it into the main quadrant, whereas Shopper Staples is inside weakening however transferring again as much as main after a rotation decrease since late March.

Such a rotation to protection is normally an indication of weak spot within the common market.

The truth that each the offensive and the defensive sectors are typically displaying a powerful rotation, the one one that isn’t taking part in alongside is Shopper Discretionary, is sending combined alerts with regard to the outlook for the S&P 500.

Delicate

The RRG that holds the group of delicate sectors confirms that combined picture. Communication Providers and Expertise are rotating out of favor whereas Vitality and, to a lesser diploma Industrials are choosing up steam.

The general “downside” right here is that the sectors which can be on a weaker rotational trajectory are a couple of of the extra vital (learn heavyweight) sectors. XLK : 26%, XLY: 10%, XLC: 8%

Nevertheless, the “excellent news,” if you want, is that discretionary is not the second sector within the universe. On account of value modifications and rebalancing, XLY is now solely the fourth sector by way of market capitalization at slightly beneath 10%. Simply to remind you, it was round 13%. Healthcare is now the second sector at 15%, whereas Financials are available in third at nearly 13%.

So the weak spot in XLC (8%), XLK (27%), and XLY (10%) is now including as much as round 44% of the market cap. Nonetheless a giant chunk however means lower than it was. Because of this it’s simpler for the opposite sectors, that are on a optimistic rotation, to offset this drag.

With the S&P 500 struggling to essentially decide up steam after breaking from the Feb-March correction, it’s now vital to start out seeing broader participation for the present rally to turn into extra sustainable.

To ensure that this to occur, I’m primarily watching the charts for XLC and XLK

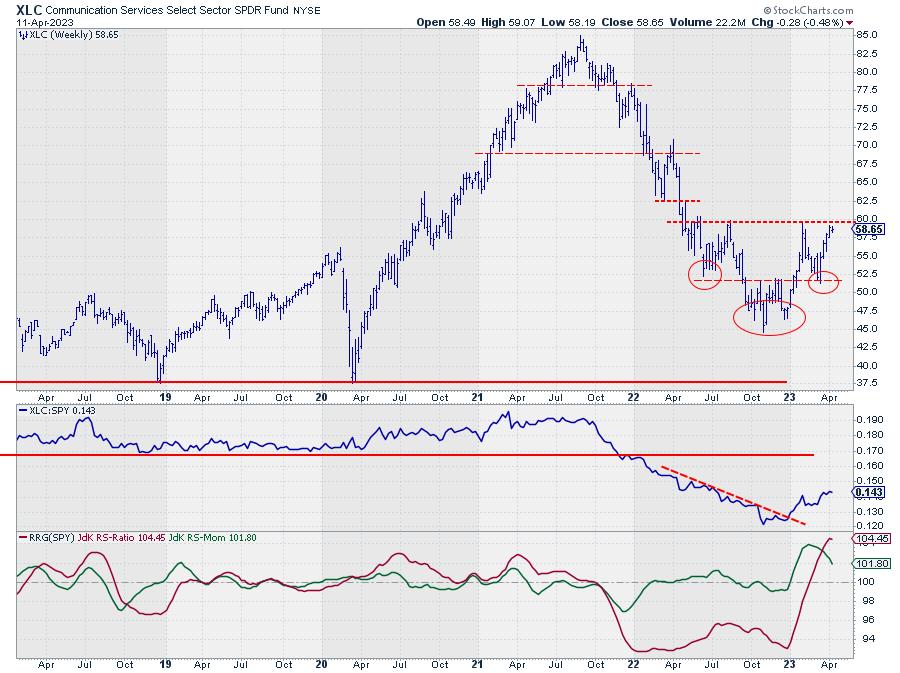

Communication Providers

XLC is presently operating into resistance slightly below 60. That horizontal barrier appears to be like to be the neckline of an enormous reversed H&S formation that shaped in Q2-2023. If and when XLC can break above that neckline, say $60, an infinite quantity of upside potential can be unlocked.

Based mostly on that formation, a (conservative) goal value may be calculated at round $70. I might say that could be a very tradable alternative the place the draw back is properly protected on the stage of the neckline as soon as damaged. Such a transfer will definitely contribute to the efficiency of the S&P 500.

Expertise

Expertise simply failed on the stage of its overhead resistance close to 150. So long as XLK stays above its final low at 135 however ideally above 143, the outlook stays optimistic. However we do must see a break above 150 within the coming weeks to maintain up the momentum and assist push $SPX increased.

#StayAlert, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to each message, however I’ll actually learn them and, the place moderately potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Study Extra