[ad_1]

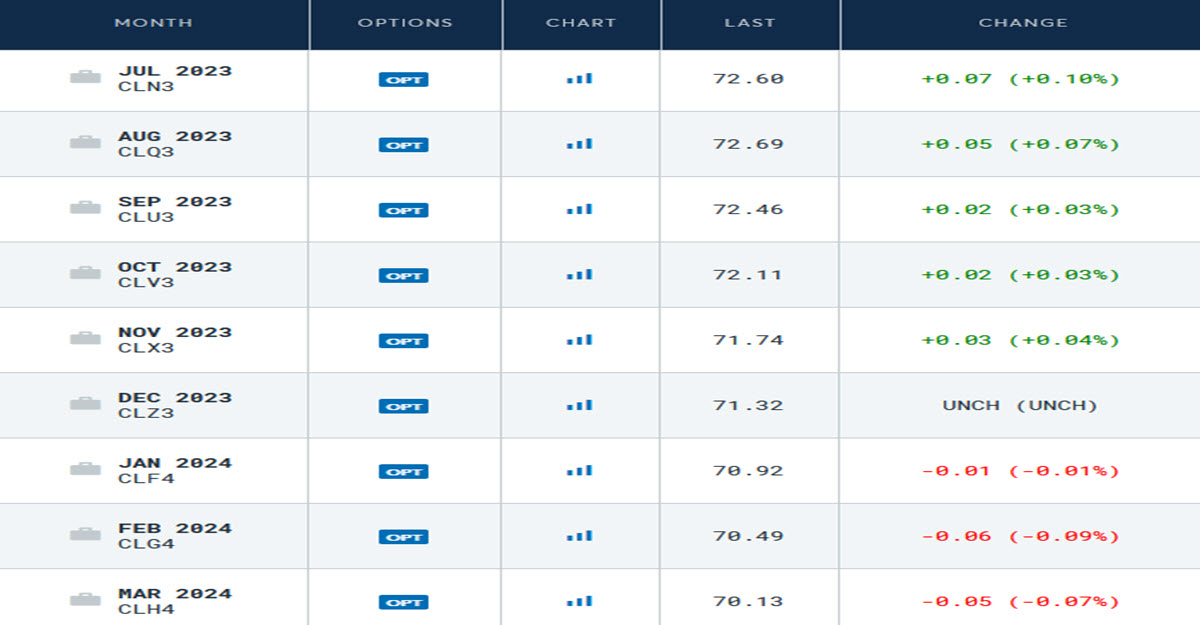

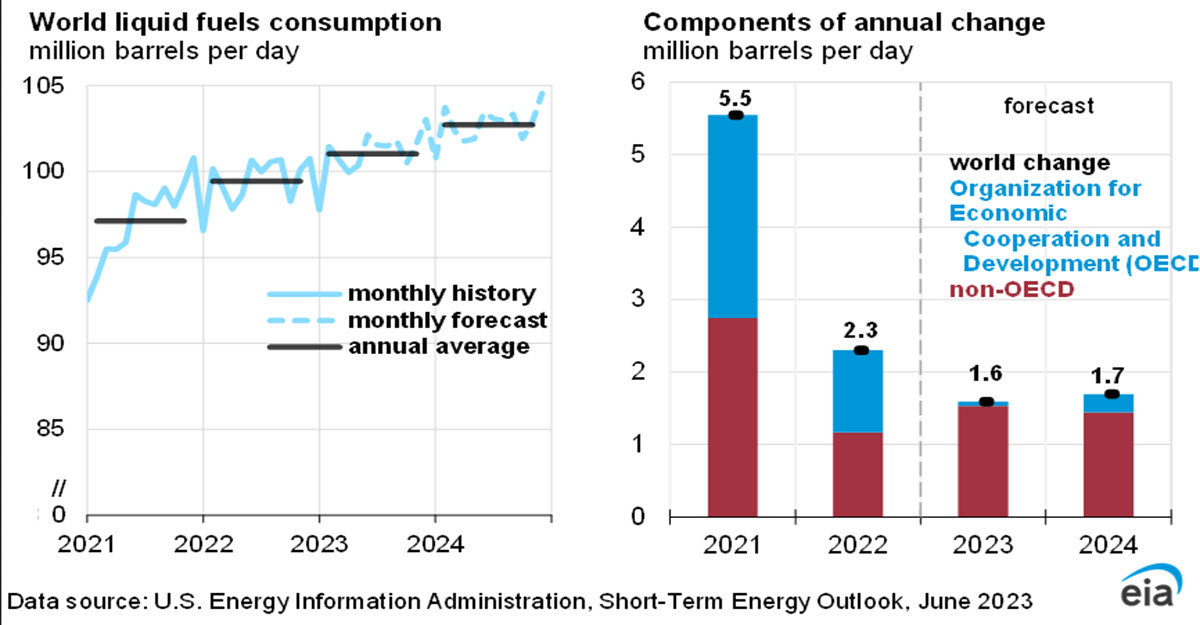

We had already talked about it, but it surely’s again within the information: IEA (Worldwide Power Company) Govt Director Fatih Birol expressed his worries about world oil demand on Bloomberg TV yesterday, as of the 2 million bpd progress anticipated in 2023, not less than 60% is anticipated to come back from China, whose progress appears to be a lot much less vivid than beforehand anticipated. Solely the evening earlier than, API (American Petroleum Institute) information had proven an enormous improve in Gasoline and Distillates normally in US shares (+2.417mm from 02/23 and +4.5mm from 12/22 respectively), a transparent signal that processed merchandise are momentarily oversupplied.

International Oil Demand Projections, EIA

Over the weekend, on the OPEC+ assembly, the Saudis determined to implement a brand new manufacturing reduce of 1mm bpd from July, bringing the whole reduce from 08/2022 to 4.66mm bpd; the total organisation determined to increase the cuts to the tip of 2024. Regardless of this, the worth of Crude Oil is down -41% from the summer season 2022 excessive within the $123 space.

US Oil Manufacturing and Rigs Depend

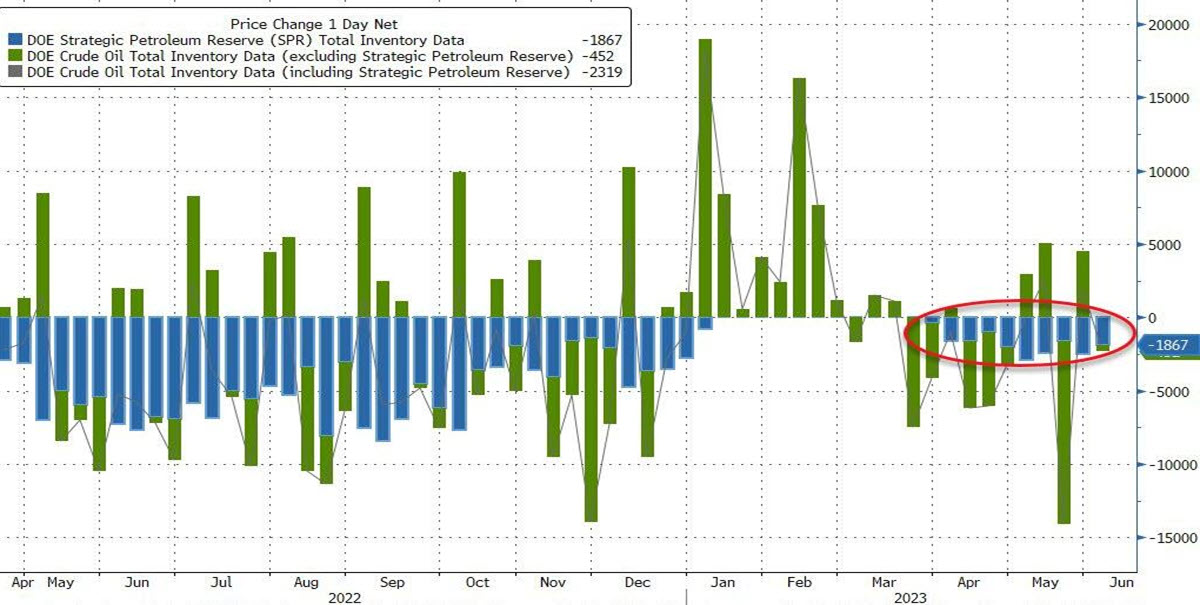

The US, alternatively, the world’s prime producer final yr with 11.88mm bpd, is making an attempt to compensate and its manufacturing has reached an all-time excessive (12.4mm bpd) though the variety of lively wells continues to fall; moreover, the usage of SPR (Strategic Petroleum Reserve) continues to fall to 40-year lows, after a sale of 1.8mm barrels final week.

SPR Weekly Change (Blue), US Division Of Power

All this exercise on the manufacturing aspect has brought about one impact: the Crude Oil futures chain is in backwardation. Because of this contracts with future maturities value lower than the front-end contract. It’s regular for giant industries or – for instance – airways to plan their purchases months and years upfront to lock within the value at a sure degree. There’s a sensible implication to this: speculators {and professional} merchants corresponding to the large oil firms will are inclined to promote the spot contract (placing additional downward stress on the worth all of us see) and purchase the following futures on the identical time, as costs will converge at expiry. That is till a brand new equilibrium is reached: for the time being plainly the destructive tilt is pretty restricted (the Mar24 trades $2.47 decrease than the Spot which is at $72.60 proper now).

TECHNICAL ANALYSIS

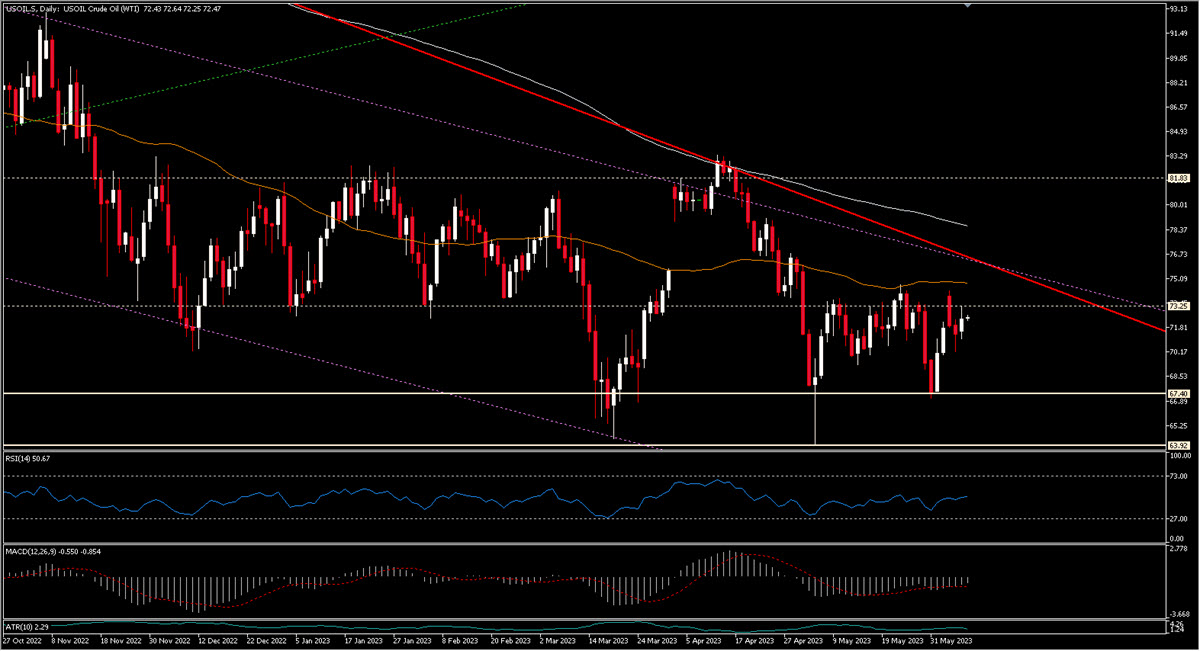

On the long-term chart, we word 2 issues: 1) the clearly bearish development of the final 15 months 2) the relevance of $67.40 and $63.90 as helps.

Crude Oil, Day by day, 2018 – At the moment

Zooming in, we are able to discover that we’re near resistance zones: $72.60, $73.50 then there will probably be $74.60 or so the place the Day by day 50MA presently passes and the bearish development will in all probability go. RSI is impartial, MACD barely rising however destructive. Downwards, there are numerous minor ranges corresponding to $71, $70, $69.15 and $68.40. However the actually essential ones are 67.40$ and 63.92$: in the event that they had been damaged, there can be a critical chance of falling to the 58.60$ space within the medium time period (though $61.80 can be one other minor help). In case of great financial issues, $51 is the long-term pivotal degree.

We might begin to be constructive within the medium time period solely above the bearish development and the Day by day 200 MA , so in all probability above the GAP opened after the April OPEC assembly, above 79$.

Crude Oil, Day by day, 10/22 – At the moment

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]