[ad_1]

A current weblog about ads for Medicare Benefit insurance policies introduced a torrent of criticisms from our readers that the adverts flooding the airwaves and mailboxes are too imprecise and even deceptive.

“What we do to seniors – most of whom have contributed for years to fund Medicare – must be a humiliation to us, as a nation,” one reader wrote in regards to the ways used to promote Benefit plans. A standard grievance from one other reader: “How do I get them to give up calling generally ten occasions a day?”

The gross sales pitches are additionally getting the eye of the federal authorities and analysis and advocacy organizations, as a result of Benefit plans have grown to half of the market for Medicare insurance coverage insurance policies. Two newly launched stories by researchers discovered assist for older People’ complaints that the high-pressure gross sales ways are each deceptive and fail to supply details about two essential features of their protection: out-of-pocket prices and advantages.

(The common out-of-pocket deductible for an Benefit plan is $4,835 in 2023. Individuals who need assistance discovering the suitable plan can contact their state’s SHIP program, which has volunteers to type by way of the various plan choices obtainable.)

Final November, the Senate Finance Committee reported a doubling between 2020 and 2021 in client complaints in regards to the Medicare Benefit telemarketers and adverts in 14 states that tracked them. “Beneficiaries are being inundated with aggressive advertising and marketing ways in addition to false and deceptive info,” the committee concluded.

To be honest, some retirees favor Benefit plans over an costly various: Medigap insurance policies. Whereas some research present that Medigap might have decrease out-of-pocket prices for severely unwell retirees, many retirees can’t afford the month-to-month premiums. And in contrast to Medigap, Benefit plans often embody prescription drug protection and sometimes don’t cost a premium. Retirees are nonetheless accountable for paying the federal government’s Medicare Half B premium.

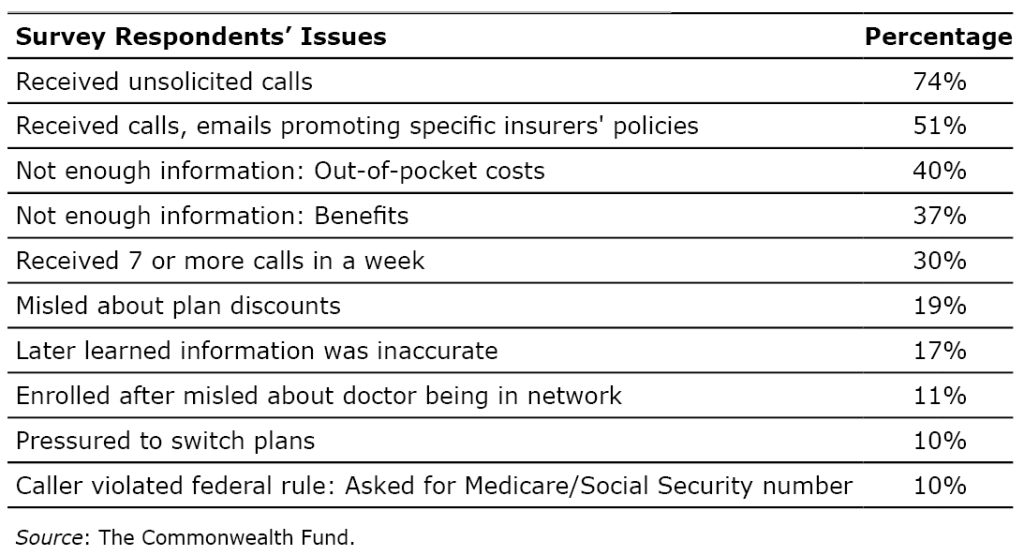

However in a Commonwealth Fund survey, 2,000 customers recognized an array of points with Benefit plan entrepreneurs:

In a second report by KFF, retirees in focus teams stated they didn’t belief claims that some advantages are “free.” And KFF researchers, who watched 1,200 tv adverts, discovered proof of deceptive info. One in 4 adverts seemed the plans are by some means affiliated with the federal Medicare system by utilizing photos of an official Medicare card or offering a toll-free “Medicare hotline.”

To remove confusion, the Biden administration not too long ago accredited a few laws. One banned Benefit plans and insurance coverage brokers from utilizing Medicare’s emblem or any photos that resemble it. One other regulation bans adverts that aren’t about particular insurance policies in an try and remove “overly normal” adverts that “confuse and mislead” seniors.

Within the Commonwealth survey, solely a minority of retirees criticized anybody subject particularly. However their myriad complaints about Benefit plan advertising and marketing, taken collectively, counsel there is sufficient to warrant doing extra to tell and shield older People.

Squared Away author Kim Blanton invitations you to comply with us on Twitter @SquaredAwayBC. To remain present on our weblog, please be part of our free e mail checklist. You’ll obtain only one e mail every week – with hyperlinks to the 2 new posts for that week – if you join right here. This weblog is supported by the Heart for Retirement Analysis at Boston School.

[ad_2]