[ad_1]

John is afraid inflation will eat away a lot of his pension the couple will solely have sufficient for groceries

Evaluations and suggestions are unbiased and merchandise are independently chosen. Postmedia might earn an affiliate fee from purchases made by means of hyperlinks on this web page.

Article content material

John* is able to retire and never look again. The programming analyst has constructed his profession with the federal authorities over the previous 33 years and plans to retire on the finish of this yr.

Commercial 2

Article content material

“I’m 62 years previous and I’m carried out with work, however I fear that inflation will eat away at my pension till it’s solely sufficient for groceries.”

Article content material

John at present earns about $90,000 a yr earlier than tax (about $60,000 after tax). His authorities defined-benefit pension plan is listed to inflation and can pay $62,000 a yr earlier than tax if he retires as deliberate this yr. A part of the pension is a bridged profit to approximate Canada Pension Plan (CPP) funds till age 65.

Article content material

His spouse Cathy is 55 and works within the personal sector. Her annual revenue is about $60,000 earlier than tax. She plans to work one other 5 to eight years earlier than retiring. Her employer transformed their as soon as defined-benefit pension plan to a defined-contribution plan, so she used a part of that cash ($68,000) to buy a automobile and put the remainder in a locked-in retirement plan.

Commercial 3

Article content material

“It may take some time to pay again the pension cash used to purchase the automobile,” John mentioned.

Every of them has about $60,000 in a registered retirement financial savings plan (RRSP) invested in moderate-risk mutual funds. They personal a single-family residence in Ottawa value about $500,000, however don’t have a mortgage or another massive money owed. John estimates their present month-to-month bills run about $3,500 with the excess revenue going into the financial institution and to “repay” the pension cash used to buy the automobile.

My fundamental imaginative and prescient for retirement is that I cease working. I’ve quite simple wants

John

The couple dwell modestly and haven’t any massive plans for retirement apart from to pursue private pursuits, so long as there’s sufficient cash to take action.

“My fundamental imaginative and prescient for retirement is that I cease working. I’ve quite simple wants,” John mentioned. “I need to study to play guitar. We don’t have any massive journey plans in thoughts. It will be good to have the ability to afford to journey, whether or not we do or not, is a unique factor. Our final journey was to Disney World again in 2000.”

Article content material

Commercial 4

Article content material

The couple don’t have kids, however they want to go away cash to their nieces and nephews.

In the event that they have been to splurge, they’d wish to buy a swim spa, which might require some residence renovations so it might be used year-round. John estimates it could price between $80,000 and $100,000 and they might take out a mortgage on their home to do it. That mentioned, their greatest precedence is to make sure they’re comfy in retirement.

“Is that this going to work?” he requested.

What the consultants say

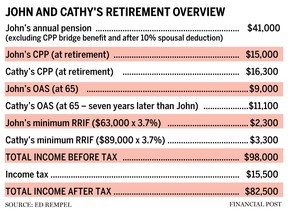

Primarily based on the numbers supplied and their desired way of life, John and Cathy can each retire in the present day, Ed Rempel, a fee-for-service monetary planner, tax accountant and blogger, mentioned.

“Their present way of life bills are about $3,500 a month, or $42,000 a yr, which might require an revenue of $46,000 a yr earlier than tax,” he mentioned. John’s pension alone is greater than this.”

Commercial 5

Article content material

Eliott Einarson, a retirement planner at Ottawa-based Exponent Funding Administration, agrees.

“I see this quite a bit in my very own follow. Persons are in search of readability on what’s doable,” he mentioned. “They’re debt free and John’s pension plus CPP and OAS (Outdated Age Safety) when he claims them will possible come near his present web revenue. They’re nice.”

However Rempel is worried they haven’t thought of all their potential spending wants, akin to leisure, medical bills, presents, and many others.

“I added an extra $2,500 a yr for medical bills assuming any well being advantages cease when he retires, $5,000 for holidays and a $68,000 automobile each 10 years, assuming they need to preserve an analogous automobile to what they’ve and drive it for a very long time,” he mentioned. “This quantities to $56,000 a yr — $64,000 earlier than tax — or $4,700 a month to spend to attain their desired retirement way of life.”

Commercial 6

Article content material

He recommends they take a better take a look at the additional cash (about $2,200) they’ve coming in every month. Proper now, it’s not clear the place it’s going. In the event that they do nothing with it, they’ll slowly begin to spend extra and it’ll change into a part of their way of life spending.

Rempel recommends John break up $18,000 of his pension with Cathy to allow them to each be within the lowest tax bracket. This may save $1,500 a yr and guarantee their OAS funds is not going to be clawed again.

“Each ought to convert their RRSPs to a registered retirement revenue fund and a life revenue fund, and begin taking the minimal withdrawal when Cathy retires at 63 and John is 70,” he mentioned.

As for when to say CPP advantages, Rempel mentioned the highest two concerns are funding returns and tax.

Commercial 7

Article content material

“Since they spend money on balanced mutual funds, their fee of return must be just like CPP, about 5 per cent a yr,” he mentioned. “They’ll most likely pay much less tax if they begin John’s CPP and OAS at age 70 when Cathy retires, and Cathy’s CPP at 63 when she retires and OAS on the earliest age of 65.”

Relying on its worth, Einarson mentioned it might make sense to not take the pension bridge John has entry to and as a substitute use his RRSP to beat any gaps till he claims CPP, however the swim spa is nicely inside their attain.

“Retirement is about money movement. If bills are solely about $3,500, they may take out a line of credit score or a mortgage and comfortably work that price into their cash-flow wants,” he mentioned. “It’s very doable, notably if Cathy goes to proceed working for the following seven to eight years. They may make certain the swim spa reno is paid off by the point she retires to really feel an extra little bit of security.”

Commercial 8

Article content material

Einarson added that in the event that they psychologically don’t thoughts having debt, they may take out a longer-term mortgage to repay the spa upfront.

He additionally recommends investing their surplus revenue inside tax-free financial savings accounts.

-

Retired man dwelling on money financial savings making a mistake

-

Couple needs to retire early, hope authorities pensions sufficient

-

Can we retire on $170,000 and keep our way of life?

“They’re an incredible financial savings instrument for the couple in the event that they do want extra funds and likewise to construct up cash for the property, which they may go away to their nieces and nephews,” he mentioned.

*Names have been modified to guard privateness.

_____________________________________________________________

If you happen to like this story, join the FP Investor Publication.

_____________________________________________________________

[ad_2]

Feedback

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. Now we have enabled electronic mail notifications—you’ll now obtain an electronic mail if you happen to obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a person you comply with feedback. Go to our Neighborhood Pointers for extra info and particulars on how one can regulate your electronic mail settings.

Be a part of the Dialog