[ad_1]

INTRODUCTION

CoralMAX is an MT4 EA for Place Buying and selling. The EA can take automated entries based mostly on Imply Reversion or ADR Reversal methods; or you’ll be able to enter manually. You outline the Market Circumstances in your entries, and the EA will enter trades when these situations are met and an Entry Sign is detected. For exiting the commerce there are a number of Exit Circumstances that may be outlined. When a commerce goes into drawdown the EA will Scale In at a specified spacing distance, to maintain the exit situations in attain. CoralMAX can carry out automated drawdown management to maintain your portfolio underneath management as trades go uncomfortably far in opposition to you. And it may possibly optionally improve the lot sizing underneath rigorously managed situations to make sure the exit situations don’t drift farther and farther away.

CoralMAX is accessible within the MQL5 Market right here.

MultiMAX, the multi-symbol model of CoralMAX, is accessible within the MQL5 Market right here.

You may let CoralMAX commerce fully hands-free, or you’ll be able to take management and add your individual entries.

CoralMAX trades a single image on a single chart at a time. You may place CoralMAX on a number of charts to commerce extra pairs as you want. There may be additionally a multi-symbol model referred to as MultiMAX that may commerce all devices from a single chart on the similar time, whereas controlling in your total portfolio publicity, most variety of trades, drawdown and different portfolio situations. MultiMAX is accessible within the MQL 5 Market right here, and you’ll learn extra about it on this weblog put up.

HOW DOES CoralMAX TRADE?

There are two main methods which are supported by CoralMAX for buying and selling: Imply Reversion and ADR Reversal. Buying and selling will typically undergo these phases:

- Market Circumstances – Relying on the technique you’ll be able to monitor the RSI or ADR values on a chart and take entries when sure situations apply, like taking an entry quick when H1 RSI(21) is above 70. As well as there are a selection of affirmation filters which are obtainable to enhance the standard of your entries.

- Market Situation Indicators: RSI or ADR

- Affirmation Filters: HTF MA, HTF Sign route

- Entry Situation – The entry situation is a sign based mostly on value motion that’s meant to determine reversals. Some programs refer to those as “breakers,” generally they’re referred to as “reversals,” and so forth. Visually on the chart these are represented with a line that begins from the primary candle that identifies the candle sample, and when value crosses that line (closes past) then a sign is generated.

- Scaling – When you’re in a commerce, if the commerce goes in opposition to you then the EA will scale in. This implies including one other commerce to the place to maintain the typical shut sufficient to get out when there’s a revenue take transfer, normally round 0.5-1.0 ADR in distance. There are numerous choices for controlling how CoralMAX scales right into a commerce.

- Drawdown Management – Optionally, if a commerce will get too far into drawdown you’ll be able to have CoralMAX carry out drawdown management (DDC). When a single commerce reaches both a specified distance or DD%, cut back its dimension by a share.

- Exit Circumstances – There are two main exit situations obtainable: when the basket reaches a share of revenue (the Goal P.c) and when the basket reaches a specified distance in revenue (the Goal ADR). These may be adjusted in actual time by dragging their respective traces on the chart.

USER INTERFACE

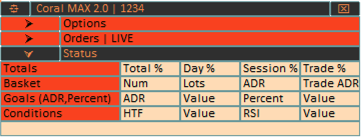

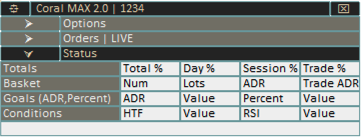

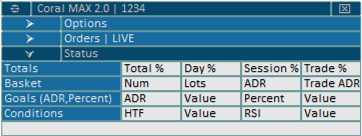

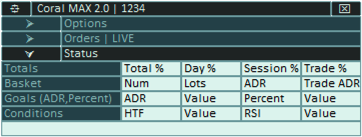

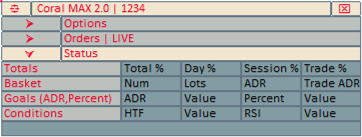

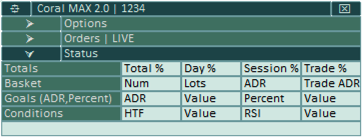

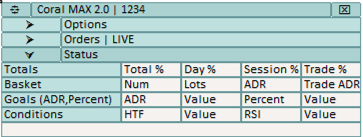

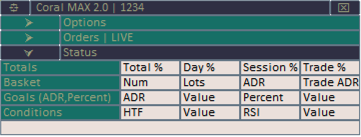

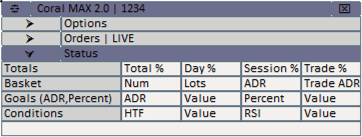

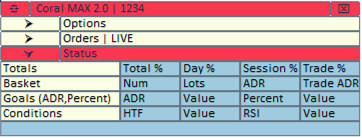

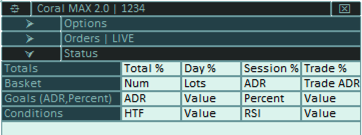

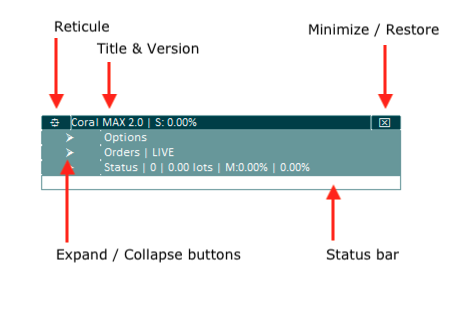

The primary parts of the consumer interface are proven right here:

The “Reticule” can be utilized to pull the window round on the display screen. When you reposition the window and alter the enter settings, the window will bear in mind its place, except you modify the X/Y offset inputs by which case it should transfer to the place you’ve got specified. The complete window may be minimized to simply its title bar, to view the chart beneath extra simply.

The primary options of the EA are organized into three sections, that are all collapsed by default:

- Choices – Allows you to regulate settings reside and visualize info on the chart.

- Orders – Controls for coming into and exiting trades manually, in addition to adjusting cease losses and trailing stops.

- Standing – Info on the operating trades, distances to targets and different controls based mostly on which options are configured.

OPTIONS SECTION

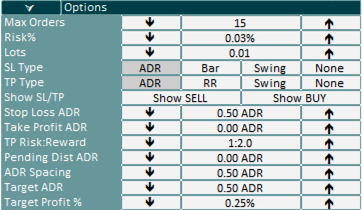

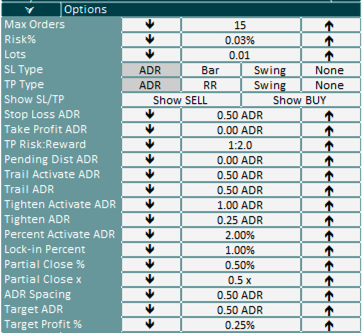

Click on the ⬇︎⬆︎ arrows to step the worth down and up. Click on the worth cell (e.g., the place its says “0.03%” within the “Danger %” row) to toggle between 0/minimal and the default worth (configured within the inputs).

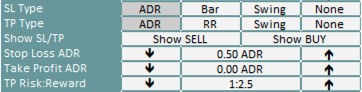

The buttons within the “SL Kind”, “TP Kind” and “Present SL/TP” rows are described in additional element within the Chart Choices / Visualize part beneath.

Once you flip extra options of the EA on within the inputs, in some instances there shall be extra rows within the “Choices” part to provide you management over these choices. As an illustration, for those who allow the Trailing Cease function, the Choices part will seem like this:

ORDERS SECTION

The Orders part comprises buttons for coming into and exiting trades, and managing SL/TP values for all trades within the basket.

Within the “Market” row, the primary column can also be a button that you need to use to toggle between LIVE and SIMULATED buying and selling mode. Once you’re in LIVE mode the Promote and Purchase buttons are proven within the “Dwell Button” colours (set within the inputs), proven in orange right here; and the part title bar will say “LIVE”. When in SIMULATED mode the buttons are proven utilizing the “Simulated Button” colours, and the part title will say “SIMULATED.”

Click on the Promote or Purchase buttons to enter a commerce with present settings instantly.

Within the “Pending” row you’ve got two units of buttons for restrict and cease orders. The 2 buttons underneath the Promote button will create Promote Restrict and Promote Cease orders; and the 2 buttons underneath the Purchase button will create Purchase Restrict and Purchase Cease orders. The pending orders shall be positioned utilizing the Pending Distance possibility, configured within the inputs and displayed within the Choices part.

- Promote Restrict – Positioned Pending distance above Bid

- Promote Cease – Positioned Pending distance beneath Bid

- Purchase Restrict – Positioned Pending distance beneath Ask

- Purchase Cease – Positioned Pending distance above Ask

Within the “Cease Loss” row there are 4 buttons:

- SL to BE – For any trades in revenue, the SL shall be moved to the break even value. In case you have Embrace prices turned off then this would be the similar because the commerce opening value. In case you have Embrace prices turned on then this shall be adjusted to take into consideration any swap and fee prices on the commerce.

- Basket BE – When the complete basket is in revenue, this can transfer the SL for all trades to the value at which the basket is at break even value, with the same adjustment based mostly on the Embrace prices possibility.

- SL Danger – Will transfer the SL for all trades to the value at which the complete basket would lose the Danger % worth. The thought with this function is that when you’ve got one commerce positioned with a cease loss, that commerce is utilizing Danger %. When you then add one other commerce, you now have 2x in danger; for those who add a 3rd you’re risking 3x, and so forth. Clicking SL Danger will reset the cease losses in order that your basket danger is ready to your Danger %, lowering the general quantity in danger. In fact, your basket should not be beneath Danger % in drawdown on the time.

- SL Clear – Will clear the SL from all trades.

Within the “Take Revenue” row there are 4 buttons:

- TP +% – Will improve the TP distance of every commerce to the value the place the commerce would improve its revenue by 0.1%. As an illustration, if the present TP on a commerce would achieve 0.25%, clicking this button would regulate the TP so it could achieve 0.35%.

- TP -% – Will lower the TP distance of every commerce to the value the place the commerce would lower its revenue by 0.1%. As an illustration, if the present TP on a commerce would achieve 0.35%, clicking this button would regulate the TP so it could achieve 0.25%.

- TP Dist – Will transfer the TP for all trades to the Take Revenue distance from present value. As an illustration, in case your present Take Revenue distance is ready to 0.25 ADR and you’ve got 3 trades all open at completely different open costs, clicking the TP Dist button will calculate 0.25 ADR from present value and set the TP value for all trades to this worth.

- TP Clear – Will clear the TP from all trades.

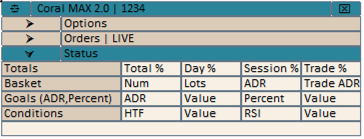

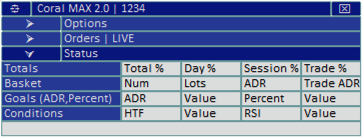

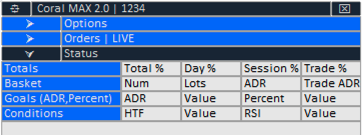

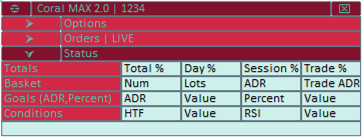

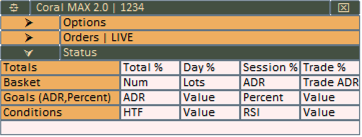

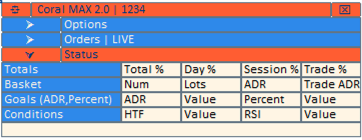

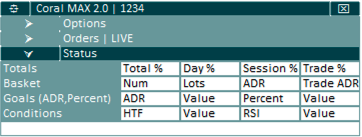

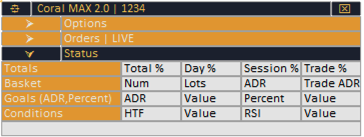

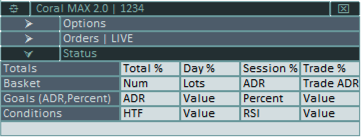

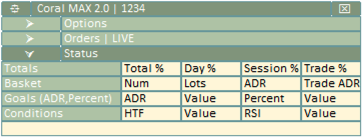

STATUS SECTION

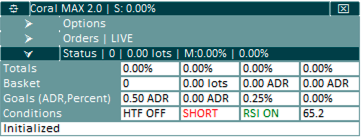

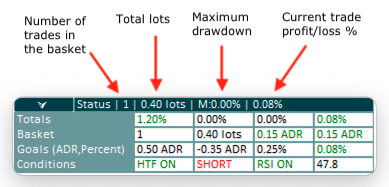

A few of the key knowledge on the operating basket is displayed within the title bar of the Standing part, so you’ll be able to proceed to observe any operating trades whereas the part is collapsed.

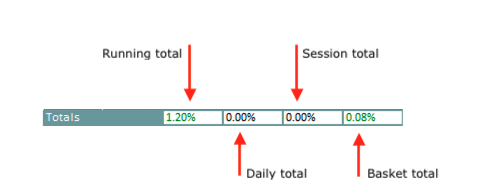

Within the “Totals” row, there are 4 values:

The “Working complete” will monitor all revenue/lack of this EA for this pair. When you shut down the EA and restart it, it should bear in mind the operating complete displayed right here. The “Day by day Complete” worth tracks all revenue/loss through the present day. It’s mechanically cleared on a brand new day. Equally, the “Session Complete” will monitor all revenue/loss through the present session (the classes are configured within the inputs), and is cleared on the beginning of a brand new session. The “Basket Complete” tracks internet achieve/lack of all open trades (the present basket).

All of those totals are saved within the International Variables part of MT4, for this image, and with separate values for LIVE and SIMULATED mode. When you change back-and-forth between these modes the suitable values are loaded and displayed. If you wish to clear these values, for instance to reset the “Working complete” for this pair, then shut off the EA, clear the worth from International Variables in your terminal, and restart the EA.

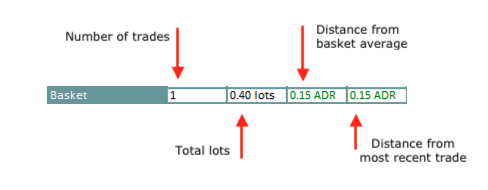

The “Basket” row additionally comprises 4 values:

“Variety of trades” and “Complete tons” check with the complete basket. The 2 distance values are exhibiting you ways far present value is from the basket common and the newest commerce. Inexperienced means in revenue, crimson means in drawdown.

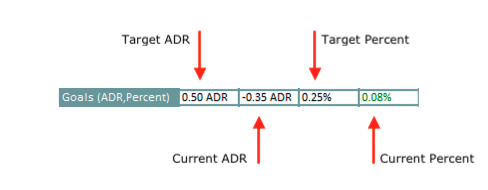

The “Objectives (ADR, P.c)” row is exhibiting the present configured targets and the present values for every.

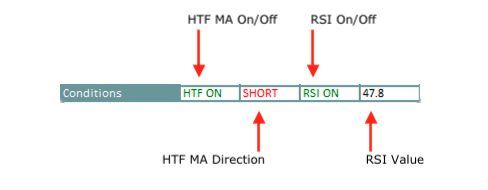

The standing of the HTF MA Filter and RSI Filter are displayed on the “Circumstances” row.

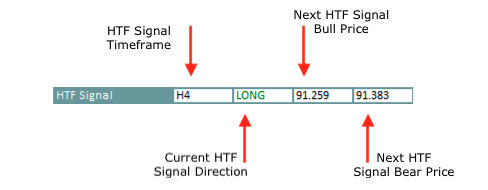

If the HTF Sign Filter is enabled, the “Standing” part features a row for the HTF Sign:

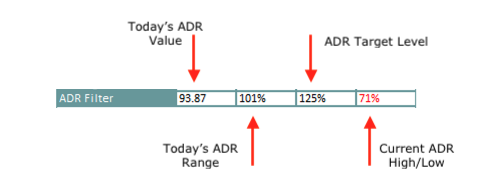

If the ADR Filter is enabled, the “Standing” part features a row for ADR:

The ADR Worth is the D1 ATR(10) measured as much as the day past. It’s the common distance this image strikes as measured over the earlier 10 days (the ten day interval may be configured within the inputs with the ADR Interval enter). It’s displayed right here in pips.

The ADR Vary is how far this image has moved at present as a share of ADR. It’s measured from the day’s excessive to low. Immediately to date, this image has moved 101% of it’s common motion.

The ADR Goal Degree is how far value has to maneuver from the excessive or the low of the day with a purpose to set off an ADR Reversal entry. At its present setting CoralMAX will search for ADR reversal entries as soon as value has crossed 125% ADR. As soon as value has exceeded the ADR Goal Degree this cell background shade will change to both crimson (crossed ADR HIGH) or inexperienced (crossed ADR LOW).

The Present ADR worth is a measure of how far value has moved from the excessive or low, in ADR. Whether it is proven in inexperienced then value is nearer to the ADR LOW (since you can be on the lookout for a LONG entry close to the low); and whether it is proven in crimson then value is nearer to the ADR HIGH. Within the picture above value is nearer to the ADR HIGH than the ADR LOW, however it has solely moved 71% of the way in which in the direction of 100% ADR HIGH.

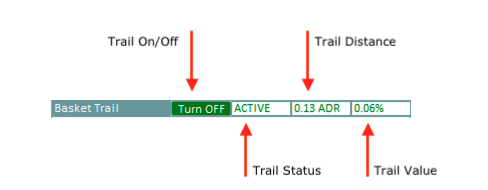

If the Trailing Cease is enabled, the “Standing” part features a row for the Trailing Cease:

The “Path On/Off” cell is a button. Once you’re in a commerce in revenue, you probably have not but reached the path activation value you’ll be able to click on this button to start trailing the basket common. If the trailing cease has been activated you’ll be able to click on this button to show the trailing cease off. This solely helps the primary trailing cease.

The “Path Distance” and “Path Worth” will present how a lot has been locked in by the present trailing cease.

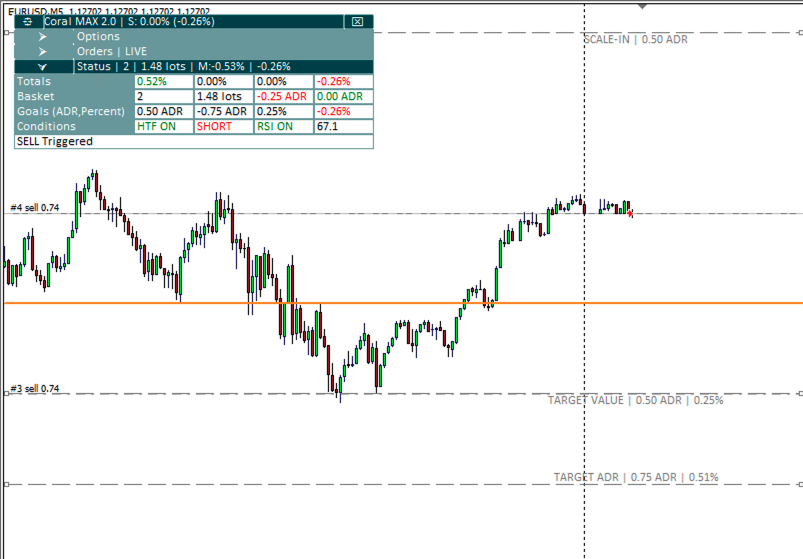

CHART OBJECTS

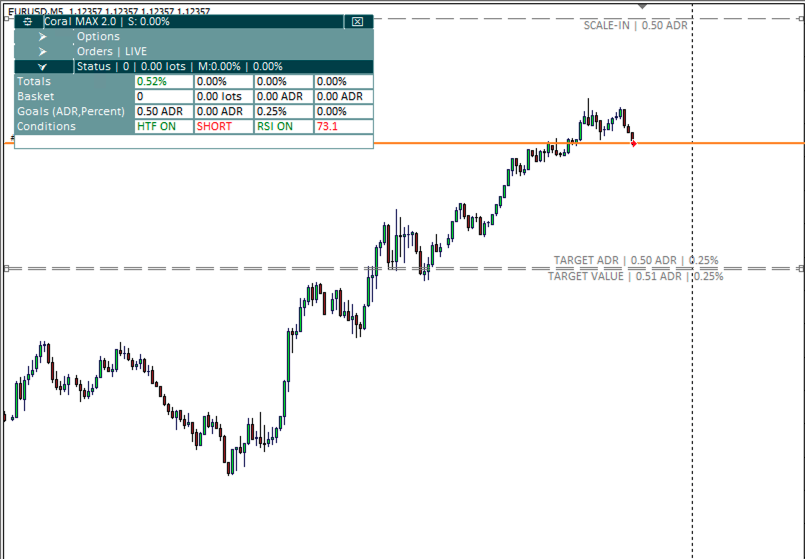

Once you’re in a commerce there are a selection of objects which are drawn on the chart to tell you about what the EA is doing.

Right here we’re in a commerce on EURUSD. The chart is exhibiting the place the Goal ADR and Goal Worth costs are, in addition to the place the Scale-In value is. These present the place value wants to succeed in to ensure that the commerce to be closed, or to ensure that the EA to scale-in. There may be additionally the orange line exhibiting the place the commerce common is situated.

When utilizing the default values of 0.25% danger over 0.5 ADR and targets of 0.5 ADR and 0.25% revenue, the Goal ADR and Goal P.c traces are initially within the the identical place.

As trades are added, these traces are adjusted.

Right here we’re in 2 trades. You may see that the Goal Worth line is far nearer to the basket common now than the Goal ADR line.

These traces not solely present you the present value for the targets/scaling relying on the configured choices; they can be dragged reside on the chart to alter the place the EA will scale in or shut the commerce in revenue. Usually while you’re in a commerce you will note that value is reaching for some key degree, and you might need to regulate the place the commerce will shut to maximise your revenue. You may merely drag the road to regulate the goal reside.

SHOW BUY/SELL

The “Present” buttons will allow you to see and regulate what the SL and TP distances shall be for a commerce earlier than you place it.

Click on the Present SELL and Present BUY buttons to activate the show. The primary button within the “SL Kind” and “TP Kind” rows relies on the Cease Loss and Take Revenue distances configured within the inputs, utilizing the Unit for enter distances that’s configured. Within the picture above the models are set to ADR.

It’s also possible to toggle the standing of the visualize buttons with the “v” key on the keyboard. Press it as soon as to allow the function LONG; press once more to change to SHORT; after which once more to show it off.

When enabled, the SL and TP zones are displayed on the chart in your present settings:

If we had been to open a Purchase commerce now, this exhibits the place the SL and TP can be positioned. By visualizing this on the chart we are able to make changes based mostly on what we see on the chart, such because the excessive/low ranges being displayed within the picture above (these are coming from a separate indicator, simply proven right here as an example). When you’re pleased with the settings you’ll be able to place the commerce, at which level the SL/TP zones are turned off and the commerce is entered.

SL Kind:

- ADR – Use the configured Cease Loss Distance from the inputs.

- Bar – Place the SL above/beneath the present bar +/- the Buffer Distance (models) distance

- Swing – Place the SL on the latest swing excessive/low.

- None – Turns off the show of the SL zone.

TP Kind

- ADR – Use the configured Take Revenue Distance from the inputs.

- RR – Set the TP as a a number of of the SL, utilizing the TP Danger:Reward worth.

- Swing – Place the TP on the latest swing excessive/low.

- None – Turns off the show of the TP zone.

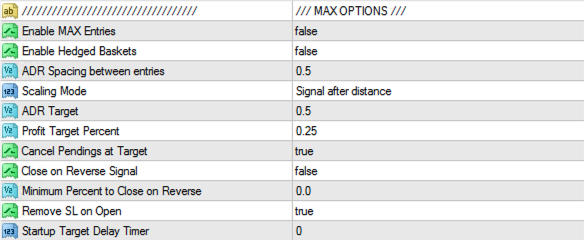

OPTIONS

- Allow MAX Logic – Whether or not the EA will take automated entries. When false the EA is not going to enter new trades or scale in, however will nonetheless shut operating trades after they hit their targets.

- Allow Hedged Baskets – When true the EA will take each lengthy and quick positions when entry situations are happy. When false the EA will commerce in just one route at a time.

- ADR Spacing between entries – The space a commerce have to be in drawdown earlier than a further commerce is added to the place.

- Scaling Mode – Choices for the way the EA will scale into trades in drawdown. The space is all the time measured from the commerce that’s the farthest from the basket common.

- Sign after distance – The farthest commerce have to be higher than the scaling distance, and obtain an entry sign within the route of the commerce.

- Distance solely – The EA will scale in on the primary candle that closes farther than the scaling distance.

- ADR Goal – All trades within the basket shall be closed when value has reached this distance previous the basket common.

- Revenue Goal P.c – All trades within the basket shall be closed when the basket has reached this quantity of revenue.

- Cancel Pendings at Goal – In case you have positioned any pending orders, then these orders shall be canceled when the basket closes on the Goal ADR or Goal P.c values. This may solely affect pending orders positioned with Max and having the identical magic quantity. When you place a pending order manually it is not going to be closed by Max.

- Shut on Reverse Sign – If you’re in a commerce in a single route and also you obtain an entry sign within the different route, this controls whether or not the EA will shut the earlier commerce. If the RSI Filter is enabled, then RSI should even be prolonged within the route of the brand new sign.

- Minimal P.c to Shut on Reverse – When > 0.0, the earlier commerce will solely be closed on a reverse sign when it’s above this worth in revenue.

- Take away SL on Open – When true, when the EA enters a commerce it will likely be positioned and not using a cease loss. The Cease Loss Distance will solely be used for calculating lot sizes. That is usually how trades are created when place buying and selling.

- Startup Goal Delay Timer – When > 0.0, when the EA is began or re-started (e.g., enter choices are modified) any trades which are in revenue past the Goal ADR or Goal P.c is not going to be closed till this timer has expired. That is to guard you from having trades in revenue closed, when you’ve got manually dragged the goal traces to provide the commerce extra room to run.

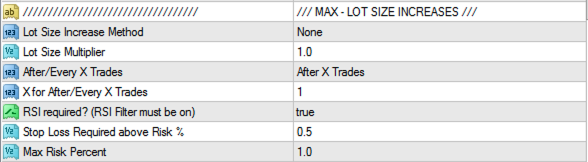

LOT SIZE INCREASES

When scaling in, Max will examine each the “regular lot dimension” (calculated at this second based mostly in your danger settings) and can discover the most important lot dimension for open trades in the identical route; and it’ll choose the bigger of the 2 as the place to begin for lot dimension will increase. This ensures that you probably have carried out drawdown management on earlier positions, Max will nonetheless scale in on the regular dimension. Nonetheless this additionally signifies that you probably have scaled in with an aggressive place of a bigger dimension, that’s the lot dimension that shall be used for lot dimension will increase. There isn’t a approach for Max to inform the distinction between a standard commerce and an aggressive commerce. You need to maintain this in thoughts for those who manually add aggressive trades AND have enabled Lot Measurement Will increase.

- Lot Measurement Improve Methodology – Choose the logic for use for rising the lot dimension.

- None – Flip off lot dimension will increase

- Lot dimension multiplier – Multiply the lot dimension by this quantity.

- Scale tons to distance – Calculate the lot dimension wanted to maneuver the basket common to the ADR Spacing distance. This ensures that while you scale within the basket common stays at this distance.

Bear in mind that this feature can create trades with VERY massive lot sizes. It’s endorsed to set a Max Danger P.c or a Cease Loss with this feature, to guard your self in opposition to unexpectedly massive lot sizes.

- Lot Measurement Multiplier – When the Lot Measurement Improve Methodology is ready to Lot dimension multiplier, that is the quantity by which the lot dimension is multiplied for will increase.

- After/Each X Trades – When rising lot sizes you’ll be able to management how usually the rise is utilized.

- After X Trades – On this mode the rise will solely be utilized when the brand new commerce would exceed this variety of trades. As an illustration, if X is 4, then trades 1-4 will use the conventional lot dimension, after which each commerce after (5, 6, 7, …) can have the logic to extend lot sizing utilized.

- Each X Trades – On this mode the rise will solely be utilized every time the variety of trades reaches a a number of of X. If X is 3, then the lot sizing will step up each 3 trades. For instance, with quite a bit dimension multiplier of two, an preliminary lot dimension of 0.1 and a rise each 3 trades, your lot sizes for every commerce shall be: 0.1, 0.1, 0.2, 0.2, 0.2, 0.4, 0.4, 0.4, 0.8, and so forth.

- X for After/Each X Trades – The variety of trades used for figuring out whether or not the lot sizing improve logic is utilized, in accordance with the mode chosen within the earlier possibility.

- RSI required? – When true, the lot dimension improve logic will solely be utilized if RSI is prolonged within the route of this commerce. The RSI Filter have to be enabled for this rule to use. The thought is that we need to improve the lot sizing when there’s a higher chance that value will reverse; in any other case we might not apply the rising logic.

- Cease Loss Required above Danger % – When rising lot sizes, we need to watch out to not let a commerce with a bigger lot dimension go into drawdown. Set this feature to a worth > 0.0 to have a cease loss used with a commerce after we apply the logic to extend lot sizes, when the Danger % of this new commerce exceeds this worth.

- Max Danger P.c – When set to a worth > 0.0, by no means exceed this quantity of danger when rising lot sizes.

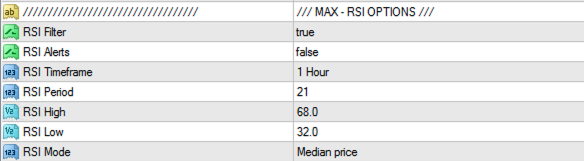

RSI FILTER

- RSI Filter – When true, RSI have to be prolonged above the RSI Excessive worth for a SELL, and beneath the RSI Low worth for a BUY.

- RSI Alerts – When true, and if alerts are enabled (see beneath), then Max will ship an alert when RSI crosses the RSI Excessive or RSI Low values.

- RSI Timeframe – The timeframe to make use of for the RSI Filter. If the timeframe is increased than the present chart timeframe then Max will take a look at the RSI worth of probably the most just lately closed candle on the upper timeframe. If the RSI Timeframe is similar or decrease than the present chart timeframe then Max will take a look at the RSI worth of each candle on the RSI Timeframe, ranging from the beginning time of the entry sign line.

- RSI Interval – The interval to make use of for RSI.

- RSI Excessive – The worth that RSI should exceed above to allow a SELL.

- RSI Low – The worth that RSI should exceed beneath to allow BUY.

- RSI Mode – The RSI calculation mode; i.e., the value used for calculating RSI. Shut value, Open value, Excessive value, Low value, Median value, Typical value or Weighted value.

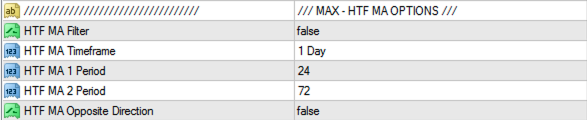

HTF MA FILTER

- HTF MA Filter – When true Max will solely take a brand new commerce within the route of the Higher Time Frame (HTF) MAs. When MA 1 is above MA 2 then BUY trades are permitted; when MA 1 is beneath MA 2 then SELL trades are permitted.

- HTF MA Timeframe – The timeframe to make use of for the HTF MAs.

- HTF MA 1 Interval – The interval of the primary MA.

- HTF MA 2 Interval – The interval of the second MA.

- HTF MA Reverse Course – Set this to true to reverse the route of the HTF sign.

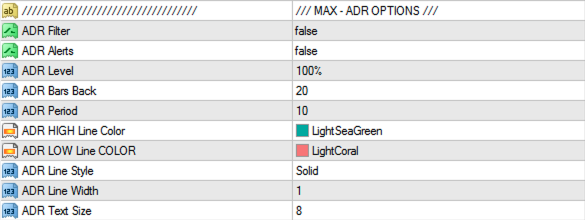

ADR FILTER

- ADR Filter – Set to “true” to allow the ADR Reversal entry situation.

- ADR Alerts – When true, and when alerts are enabled (see beneath), obtain an alert when value exceeds the configured ADR Degree.

- ADR Degree – Measures how far above the day’s excessive or low that value has moved, as a share of ADR.

- ADR Bars Again – When contemplating whether or not the ADR Filter has utilized, specifies what number of bars again will the EA look to see whether or not the ADR Degree has been exceeded.

- ADR Interval – The interval to make use of for ADR calculations. Observe that this is applicable to all ADR calculations used all through Max, not simply the ADR Filter right here.

- ADR object properties – When the ADR Filter is enabled, ADR traces are drawn on the chart. These properties management the looks of these traces.

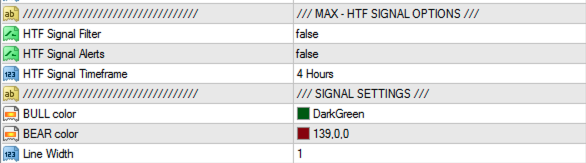

HTF SIGNAL FILTER

- HTF Sign Filter – When “true” Max will solely think about entries within the route of the newest HTF sign.

- HTF Sign Alerts – When true, and when alerts are enabled (see beneath), obtain an alert when the HTF Sign route adjustments.

- HTF Sign Timeframe – The Higher Time Frame to make use of for the HTF Sign.

- BULL Coloration – The colour to make use of for the bullish sign line on the chart (used with the present timeframe’s sign, not the HTF sign)

- BEAR Coloration – The colour to make use of for the bearish sign line on the chart (used with the present timeframe’s sign, not the HTF sign)

- Line Width – The width to make use of for the sign traces on the chart (used with the present timeframe’s sign, not the HTF sign)

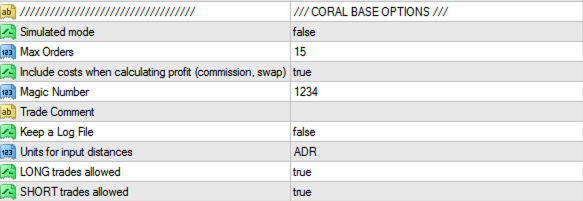

BASE OPTIONS

- Simulated Mode – When true the EA will function in SIMULATED mode. It’s also possible to toggle this with the Market button within the Orders part.

- Max Orders – The overall variety of trades that may be entered. Set to zero to forestall Max from taking any automated trades (handbook trades will nonetheless be allowed).

- Embrace prices – When true, Max will embrace swap and fee prices in revenue calculations for trades and the basket. This impacts reported values in addition to the location of traces on the charts.

- Magic Quantity – Set this to a novel worth for every occasion of Max that’s operating. EAs use magic numbers to permit them to restrict their buying and selling logic to solely their very own trades within the terminal. Set this to zero to have the EA handle all trades for this image no matter magic quantity. The magic quantity can also be displayed within the EA’s title bar for fast reference.

- Commerce Remark – Place this because the touch upon all trades positioned by the EA. The remark can also be displayed within the EA’s title bar for fast reference.

- Maintain a Log File – When true, Max will maintain its personal log file in <your knowledge folder>MQL4Files. The log file identify is “cmax-<magic>.txt”. See the part on Logging beneath.

- Models for enter distances – Max can measure distances in Pips (2 pips), Factors (0.00020 factors) or ADR (0.5 ADR). Any of the inputs that describe distances can have “(models)” as a part of their identify, and the unit relies on what you choose right here. When you change the unit right here, be sure you change the values for any inputs which are measuring distances! In case you have “20 pips” set for Take Revenue Distance and you modify the unit to ADR with out altering the worth, then the EA can be utilizing 20 ADR because the take revenue distance; it could take a really very long time for this commerce to hit its goal!

- LONG/SHORT trades allowed – Set to true/false to allow/disable automated buying and selling on this route. Observe that this can NOT apply to scaling in, solely to new entries.

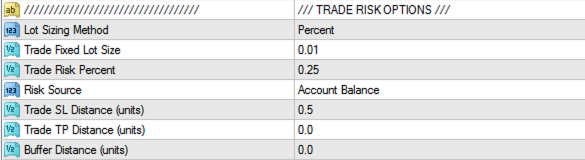

TRADE RISK OPTIONS

These choices apply to particular person trades which are positioned by Max.

- Lot Sizing Methodology – Mounted or calculated based mostly on Danger P.c.

- Mounted Lot Measurement – When the Lot Sizing Methodology is “Mounted”, all the time use this lot dimension.

- Danger P.c – When the Lot Sizing Methodology is “P.c”, calculate lot sizes based mostly on this danger %.

- Danger Supply – When the Lot Sizing Methodology is “P.c,” this determines whether or not the Danger P.c is calculated utilizing the “Account Stability” or “Account Fairness.”

- SL Distance (models) – The cease loss distance within the chosen unit. That is the space used for calculating lot sizes when the Lot Sizing Methodology is “P.c.” If Take away SL on Open is “false” then that is additionally the SL set on trades which are opened by the EA.

- TP Distance (models) – The take revenue distance within the chosen unit.

- Buffer Distance (models) – The buffer distance within the chosen unit is used for pending orders, and with the SL/TP distances which are positioned relative to candles and swing excessive/low costs. See the part on “Visualize” for extra info.

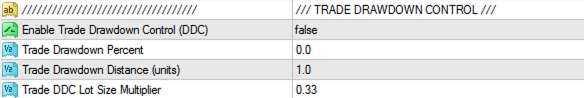

DRAWDOWN CONTROL

Drawdown Management means performing closes or partial closes of trades in drawdown with a purpose to maintain your total drawdown from getting too excessive, and to trigger the basket common to maneuver nearer to present value.

⚠️ WARNING: DRADOWN CONTROL is an automatic mechanism to shut trades for a loss. When you allow this function and these situations happen, Max WILL be taking a loss in your account. This can be a strategic resolution: it’s usually higher to take a small loss now, quite than letting a commerce proceed to build up increased and better ranges of drawdown. Taking the smaller loss additionally signifies that the basket common strikes nearer, permitting the commerce to succeed in its exit situation sooner.

- Allow Drawdown Management (DDC) – When set to true the drawdown options on this part are enabled.

- Drawdown P.c – When DDC is enabled and this worth is > 0.0, then a commerce shall be topic to DDC when it reaches this quantity of drawdown. Present a optimistic worth right here; a worth of 0.25 means -0.25% in drawdown.

- Drawdown Distance (models) – When DDC is enabled and this worth is > 0.0, then a commerce shall be topic to DDC when it reaches this distance in drawdown. Observe that the space is measured within the unit chosen within the Models for enter distances possibility. For instance, if the at present chosen unit is ADR, then a worth of 1.0 right here means 1.0 ADR in drawdown.

- This selection will repeat at every increment of this distance. Max is aware of when a commerce has been partially closed, and what number of occasions.

- DDC Lot Measurement Multiplier – When a commerce has triggered DDC, both via Drawdown P.c or Drawdown Distance (or each), then that is the portion of the commerce that shall be closed, based mostly on the conventional lot dimension.

- Which means the lot dimension to begin with is calculated now based mostly in your present Danger settings, and the share discount is utilized to that quantity. Why? For instance you’ve got a commerce of 1.0 tons and also you cut back by 0.25x. The primary time DDC is utilized, Max will cut back 0.25 tons and the commerce can have 0.75 tons remaining. The following time is when it will get fascinating. You would both apply the 0.25x multiplier to the present lot dimension of 0.75 to scale back it by 0.18 tons, or calculate the conventional lot dimension of 1.0 and cut back it by 0.25 tons. Max will do it the second approach, so the reductions are extra uniform (though variations in ADR over time and your account stability/fairness may even have an effect on the calculated regular lot dimension, so it will not be precisely the identical because the preliminary lot dimension on the commerce).

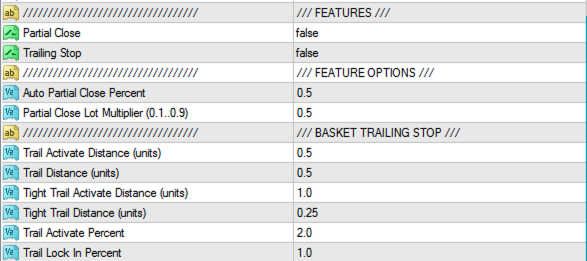

FEATURES

These two options may be independently turned on and off right here; turning them off (setting the worth to false) will stop them from being displayed within the Choices part of the UI, and can suppress their performance.

- Partial Shut – Allow the Partial Shut function.

- Trailing Cease – Allow the Basket Trailing Cease function.

- Auto Partial Shut P.c – When the Partial Shut function is enabled and when this commerce reaches this quantity of revenue, then a partial shut of this commerce shall be carried out. For instance, if a commerce reaches 1% in revenue, shut 1/2 of the commerce.

- Partial Shut Lot Multiplier – This multiplier is utilized to the lot dimension of this commerce to find out what number of tons to shut. Should be within the vary 0.0 .. 1.0. Partial closes are solely utilized one one; as soon as a commerce has been partially closed, it is not going to be topic to additional partial closes, even when it features in worth as much as the Auto Partial Shut P.c once more.

BASKET TRAILING STOP

The trailing cease applied right here applies to the basket as an entire, to not particular person trades. MT4 already has a mechanism for trailing particular person trades.

There are three trailing cease mechanisms obtainable. The primary two are based mostly on distance: when value reaches the activation distance previous the basket common the trailing cease kicks in, after which it trails by the required distance. When value pulls again and crosses the trailing cease line, the complete basket is closed. The third trailing cease relies on commerce worth: when a basket reaches this % in revenue (say, 1% revenue) then lock on this quantity of revenue (say, 0.75% revenue). Max will convert these values to distances for the present basket and present them on the chart.

All three trailing cease mechanisms can be utilized on the similar time. The primary two are designed to allow you to outline a standard trailing cease (e.g., path by 0.5 ADR when the commerce reaches 0.5 ADR in revenue); after which to “tighten” the trailing distance as soon as a second distance goal is reached (e.g., when the commerce reaches 1.0 ADR in revenue, tighten the trailing distance as much as 0.25 ADR). There is just one energetic trailing cease at a time: the one which was most just lately activated as a result of its activation value was the closest. After the primary one is activated then the second’s activation value is proven on the chart, and after that the subsequent one is proven. You should utilize any variety of them as you want and Max will determine which applies at any given second.

- The primary trailing cease:

- Path Activate Distance – The space past the basket common in revenue at which this trailing cease shall be activated.

- Path Distance – As soon as activated, the space by which value shall be trailed.

- The second trailing cease (“tighten”)

- Tight Path Activate Distance – The space past the basket common in revenue at which this trailing cease shall be activated.

- Tight Path Distance – As soon as activated, the space by which value shall be trailed.

- The third trailing cease:

- Path Activate P.c – The basket worth at which this trailing cease shall be activated.

- Path Lock In P.c – As soon as activated, the quantity of revenue that shall be protected by this trailing cease. As value continues to maneuver and the basket will increase in worth, this quantity trails present value, rising the locked in worth of the basket. In different phrases, Max makes use of this “lock in %” to calculate a distance at which the basket can be price this worth, after which trails by this distance.

As a facet notice, why trouble implementing a basket trailing cease function when MT4 already helps trailing stops on trades? Due to the character of place buying and selling. Max could also be managing a place with a number of trades the basket, which signifies that the basket has been in drawdown. As soon as the basket begins to return into revenue you might discover that regardless that the basket is in revenue, a number of the earliest trades within the basket are nonetheless in drawdown. You may’t put a trailing cease on any of the person trades in revenue, as a result of they’re there to maneuver the basket common. If a type of trades in revenue had been to shut then the basket common would transfer farther away and the basket would in all probability now not be in revenue. It’s the basket common that must be trailed on this case, not any particular person trades.

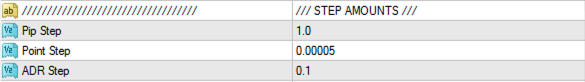

STEP AMOUNTS

This is applicable to the Models for enter distances possibility. Relying on which unit is chosen, the up/down arrows within the Choices part will step values up and down by this quantity. When you discover that you simply desire that pips step by bigger quantities than 1.0 pip at a time, you’ll be able to regulate that right here.

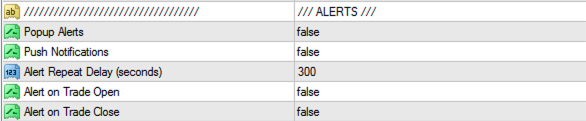

ALERTS

Regular MT4 alerts are supported, each popup alerts in MT4 and push notifications to ship alerts to your cellular system.

- Popup Alerts – Allow popup alerts in MT4.

- Push Notifications – Allow push notifications to your cellular system.

- Alert Repeat Delay – Some alerts might repeat a number of occasions when sure situations happen, resembling RSI crossing a Excessive/Low worth. Worth doesn’t typically transfer in a straight line, it may possibly cross a worth a number of occasions because it’s shifting. This repeat delay timer will cut back the amount of such alerts ready for the delay interval to cross earlier than sending extra alerts.

- Alert on Commerce Open – Ship alerts when a brand new commerce is opened or when a place in added.

- Alert on Commerce Shut – Ship an alert when a commerce is closed.

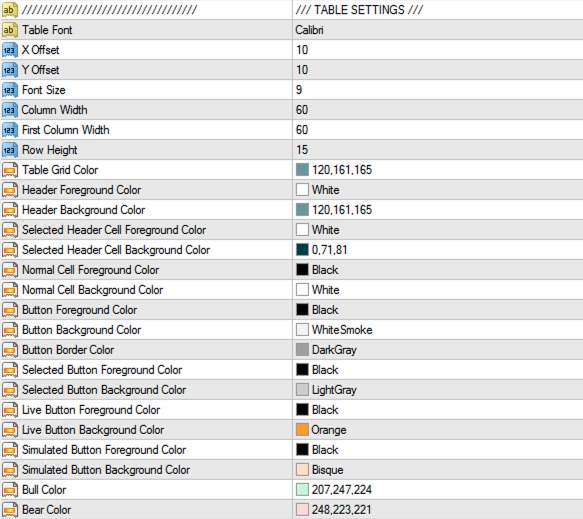

TABLE SETTINGS

The primary window of the CoralMAX utility is organized in a desk. The properties for objects on this desk are specified on this part.

LOGGING

![]()

- Logging – Select the logging degree.

CoralMAX has a built-in logging system that stories numerous sorts of data to the Specialists tab in MT4 and the log information.

The log information in your MT4 set up may be discovered right here:

<your knowledge folder>MQL4Logs

That is an actual copy of what will get printed to the Specialists tab. MT4 will maintain the the messages printed to Specialists in reminiscence and solely write them often. To power MT4 to flush this cache and write all messages, go to your Specialists tab, right-click and choose “Open” from the menu. This may write all messages to the log and open the log folder.

These are the logging ranges supported by Max:

| LOG LEVEL | DESCRIPTION |

|---|---|

| TRACE | Supposed for the developer; exhibits when the code enters and exits sure perform calls to observe program execution. |

| DEBUG | Supposed for the developer. Accommodates values of variables and outcomes of calculations vital to inner program operation. When you’re having hassle with some function of this system, it may be useful to ship this info to the developer for triage. |

| PROFILE | Efficiency profiling. When this system exits, when this degree is chosen the entire profiling knowledge that has been collected whereas this system has been operating is printed to the log. |

| FAIL | Much like an INFO message, however particularly to report conditions when the EA is contemplating taking a commerce however has been blocked by some inner logic. If you wish to know if some rule that has been configured is stopping the EA from buying and selling, this may occasionally present you why. |

| INFO | Vital moments in this system’s operation, for example when it opens or closes a commerce, sends an alert or sends some non-error associated message. Many standing bar messages are logged at this degree, for example. |

| WARN | One thing didn’t go as anticipated, however it’s not a severe error. For instance, the EA tried to open a commerce however MT4 didn’t settle for the commerce (e.g., the SL is simply too near the open value). |

| ERROR | This can be a extra severe error. One thing this system was making an attempt to do failed, and this system might be not behaving as anticipated. If there may be an error code returned by MT4, it will likely be printed as properly. It’s best to in all probability determine what’s going on earlier than persevering with to make use of this system. |

| FATAL | One thing actually horrible has occurred and this system was not in a position to proceed. |

| NONE | Honey Badger don’t care. |

When you choose a logging degree, messages at that degree and better are printed to the log. As an illustration, if you choose WARN, you will note WARN, ERROR and FATAL messages. If you choose TRACE, you will note EVERYTHING.

It’s best to often go to your logging folder and delete older log information. They have a tendency to construct up over time and devour disk area.

There may be additionally a function within the base code to maintain a separate log file, which shall be present in MQL4Files. The file identify is “cmax-<magic>.txt”, utilizing the magic quantity.

SET FILES / STRATEGIES

There are numerous methods to commerce with CoralMAX. You may have Max ship you alerts of varied commerce situations after which you’ll be able to determine to enter trades manually; or you’ll be able to have it totally automate your buying and selling for you. The 2 principal methods supported are Imply Reversion and ADR Reversals. These set information present a place to begin for various methods of configuring Max. These are offered as a comfort solely; there isn’t a intent to indicate that these are the one or greatest settings, or that they’re assured to be worthwhile over time. NOTE: The set information right here are usually not appropriate with the set information obtainable for MultiMAX, and the set information for MultiMAX are usually not appropriate with CoralMAX. Use solely the set information designed for the EA you’re utilizing.

ALERTS ONLY – MANUAL TRADING

CoralMAX – Alerts Solely.set

With these settings CoralMAX is not going to open any new positions mechanically, however will nonetheless have the ability to scale into trades in drawdown, shut trades at targets, and apply any of the opposite buying and selling logic (e.g., trailing stops). You’re going to get alerted when RSI goes above RSI Excessive or beneath RSI Low; when ADR reaches the configured ADR Degree (125% by default), or when the HTF Sign is triggered. You’ll then analyze your chart to determine whether or not to take an entry, and place the commerce manually utilizing the controls within the Orders part.

Why no choice to alert on a sign? As a result of these alerts happen continuously, you’ll be getting alerts on a regular basis. The vital factor isn’t that there was a sign, it is that there was a sign when the market situations utilized. So that you get an alert for market situations, and then you definately determine concerning the entry.

MEAN REVERSION

CoralMAX – M5 MR.set

CoralMAX – M15 MR.set

With these settings CoralMAX will observe a Imply Reversion technique based mostly available on the market situations of RSI extensions adopted by entry alerts. The M5 technique will monitor H1 RSI(21) 70/30, and the M15 technique will monitor H4 RSI(21) 70/30. You’ll put CoralMAX on both the M5 or M15 chart.

ADR REVERSAL

CoralMAX – ADR.set

Put CoralMAX on an M5 chart. With these settings CoralMAX will enter when value exceeds ADR 125% after which will get a sign for a reversal. Observe that this technique makes use of a Lot Measurement Multiplier and a smaller ADR Spacing distance.

H1 HEDGE

CoralMAX – H1 Hedge.set

Put CoralMAX on an H1 chart. With these settings an entry shall be taken at every H1 sign, with a goal of 0.5 ADR. Hedging mode is enabled, so trades may be taken in each instructions on the similar time.

SKINS

The “Skins” are settings information for simply the item properties on the charts, to provide a distinct visible look to the CoralMAX window. You may apply these set information with out altering some other settings. As an illustration, if you wish to use considered one of these skins with the H1 Hedge file, then you definately would apply the H1 Hedge set file first to get the technique settings in place, then you definately would apply the pores and skin of your alternative to alter the looks. Not one of the H1 Hedge technique settings can be modified by making use of a pores and skin file, simply the desk’s object properties.

| Blue and Gentle Brown

|

Blue Sea

|

Blue Silo

|

Cherry and Tomato

|

| Chocolate and Orange

|

Espresso

|

Chilly Blue

|

Chilly Cash

|

| Darkish Olive and Gold

|

Darkish Orange and Khaki

|

Default

|

Gold Silo

|

| Gentle Tan and Slate

|

Cash

|

Cash Sky

|

Olive and Mustard

|

| Pastel Inexperienced

|

Plum and Inexperienced

|

Purple and Gentle Slate

|

Purple Yellow Blue

|

| Sea 3

|

Sky

|

Winter

|

[ad_2]