[ad_1]

INTRODUCTION

CoralMAX is an EA for place buying and selling. It’s obtainable within the MQL5 Market (right here), and there’s a weblog publish that covers its performance, options and choices (right here). This weblog publish will go into extra element of the methods that CoralMAX makes use of, together with backtest outcomes and set information.

The methods described right here embrace:

- H1 RSI / M5 Sign

- H4 RSI / M15 Sign

- ADR / M5 Sign

- H1 Hedging (coming quickly)

You can even use CoralMAX to provide you alerts when these market situations happen, and you’ll determine to enter trades manually however then have CoralMAX take over managing the trades. It is a very versatile device designed particularly for place buying and selling.

I am going to begin with the again check outcomes. A deeper dialogue of place buying and selling and the methods follows beneath.

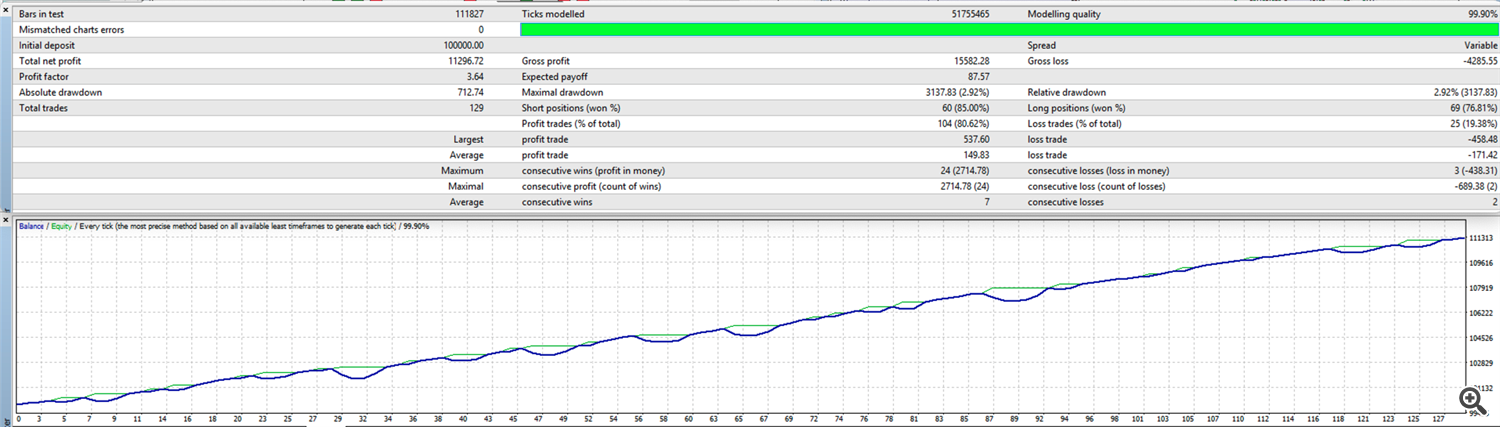

H1 RSI / M5 Sign

Knowledge: EURUSD (2022.01.01 – 2023.06.28)

Mode: Each Tick

It is a very typical kind of progress curve for this technique. The factors the place the darker blue revenue line dips down whereas inexperienced fairness line stays extra flat happens when a place that had a number of commerce closes out at a goal. The sooner trades within the place should be in drawdown, however the later trades will likely be in revenue, and the subsequent worth of the basket is optimistic. The the road exhibits the affect of every particular person commerce closing, not the online affect of the entire basket closing. Therefore we get these little dips. That is a superb signal that the technique is working as meant.

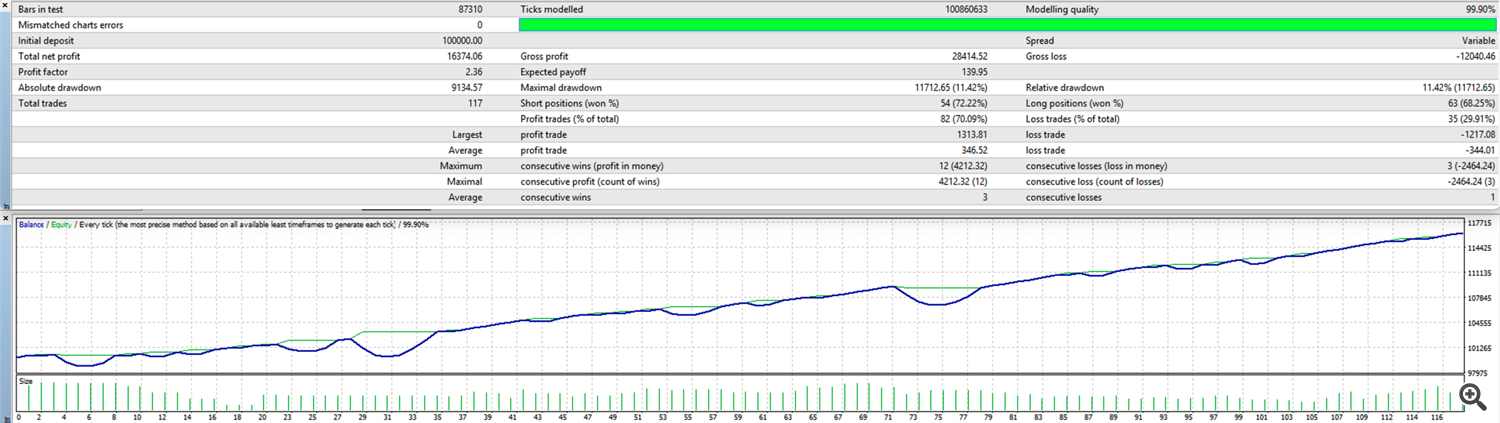

H4 RSI / M15 Sign

Knowledge: EURUSD (2022.01.01 – 2023.06.28)

Mode: Each Tick

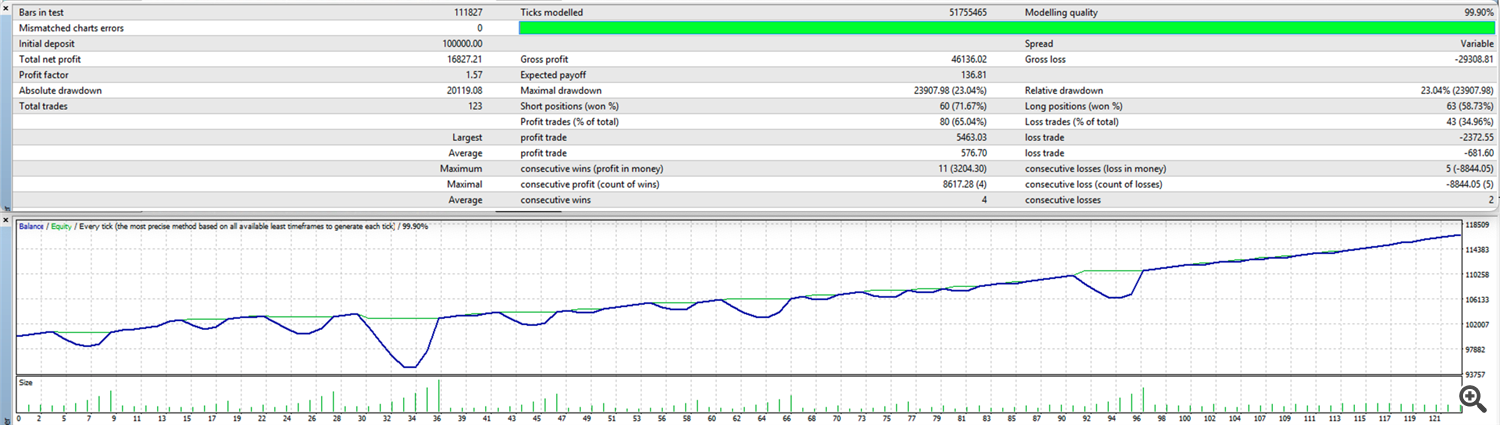

ADR / M5 Sign

Knowledge: EURUSD (2022.01.01 – 2023.06.28)

Mode: Each Tick

The ADR / M5 Sign technique has the identical attribute progress curve as we see with different place buying and selling methods. We have now roughly the identical variety of entries because the H1 RSI / M5 Sign technique, however increased revenue and better drawdown.

POSITION TRADING

Place buying and selling is a way for managing trades. To raised perceive how place buying and selling works, let’s take a look at the standard method retail merchants commerce.

The issue

Retail merchants are historically taught to attempt to time their entries to choose the optimum second to enter, after which to threat 1-3% per commerce with a given risk-to-reward ratio of at the very least 1:1.5 (threat 1x for a 1.5x reward). This implies coming into a commerce with a cease loss a ways away and a take revenue 1.5x occasions the SL distance. Should you will be profitable in doing this at the very least 50% of the time then you’re a worthwhile dealer.

Most retail merchants aren’t profitable. Go to any Foreign exchange dealer and take a look at the underside of their dwelling web page, there will likely be a threat warning, together with an announcement like the next:

79.43% of retail investor accounts lose cash when buying and selling CFDs with this supplier.

Why are 80% or extra of retail merchants failing? As a result of the flaw within the strategy above is to assume that the markets will be timed, that we will choose the optimum second to enter a commerce and that the market will cooperate. Some merchants clearly can do that efficiently and persistently, however that may be a very small proportion of retail merchants. For many of us mortal merchants our psychology will get in the best way. We lose a commerce, so now we have to win twice as a lot to achieve the day/week/month’s aim. We threat the next p.c, or go for an enormous win, to make up for it. And this as a rule accelerates our losses slightly than our positive factors. However it isn’t addressing the basic downside with the strategy, that we can’t time the market with a excessive sufficient stage of accuracy. After we put a commerce available in the market with a cease loss, the most definitely consequence is that the cease loss will likely be hit and we are going to lose the commerce. Time and again. The markets are designed to maneuver in opposition to us. They’re manipulated in opposition to us to take our liquidity. The big establishments that really transfer the markets know the place our liquidity is, and can transfer the markets simply sufficient to take our cash after which make the transfer with out us. They know what we’re doing and beat us.

The answer

After we are place buying and selling, we’re buying and selling with no cease loss, however in a method that doesn’t considerably enhance the danger of loss. As an alternative of buying and selling with 1-3% threat per commerce, we’re going to commerce with a really small quantity of threat, 0.05 – 0.25%. Should you usually commerce 1% threat with a 50 pip SL, then when the commerce goes in opposition to you by 50 pips, you have got misplaced 1% of your account. In case you are buying and selling 0.25% and the commerce goes in opposition to you, when it’s 50 pips in drawdown your are solely in 0.25% of drawdown, and your commerce BE is 50 pips away. Should you had been going for a 1.5 R then your TP is now 125 pips away. That’s a lot farther than our authentic commerce thought of 75 pips (50 pips x 1.5 R). So what can we do?

We scale in. We add a second entry to our place. This will increase the general dimension of the place, however extra importantly it strikes the place common nearer. The BE strikes from 50 pips to 25 pips, and the TP strikes from 125 pips to 100 pips. And if worth continues to maneuver the incorrect method, we proceed to scale in by including trades to the place. If we had been prepared to threat 1%, then the commerce can go in opposition to us by over 100 pips earlier than reaching this stage of drawdown.

Why does this strategy work higher than conventional cease loss buying and selling? As a result of it requires much less accuracy on our half by way of once we are coming into the commerce. We all know the market will typically transfer in unpredictable methods designed to rob us of our liquidity (a elaborate method of claiming they take our cash). If we enter a commerce once we encounter market situations that sign to us that worth could be very prone to reverse from right here, however we simply do not know when, then we plan our entries sufficiently small to resist a continuation with out experiencing extreme drawdown, whereas maintaining our TP shut sufficient to be reached by the pullback that we all know is coming.

Is that this martingale, and is not martingale certain to fail? No, this isn’t martingale. We’re not doubling the lot dimension in response to losses. We will after all enhance the lot dimension to maintain the typical from drifting farther and farther away, however that’s a complicated approach, and one that isn’t normally mandatory. There are mechanisms in CoralMAX to do that beneath fastidiously managed situations. As an example, you possibly can make sure that any lot dimension will increase above a stage of threat alway use a cease loss; and you’ll cap the utmost quantity of threat % allowed.

Okay, so we’re not growing our lot sizes, however then we’re grid buying and selling, proper? No, we aren’t grid buying and selling. For simplicity above I talked about scaling in at a set distance, however in actuality we aren’t scaling in at these fastened distances. Identical to once we took our preliminary entry we had been ready for situations to happen that signaled a reversal was occurring, we wait for the same situation earlier than scaling in. If worth is transferring convincingly in opposition to us and has exceeded our scaling distance, we then watch for worth motion to sign {that a} reversal could also be underway earlier than including an extra commerce to our place. We do not simply add trades as a result of we went the scaling distance, we watch for worth to inform us it’s prone to reverse.

The methods

Place buying and selling is the approach we use to handle our trades. We all know we wish to enter a commerce (begin a brand new place) when market situations are favorable to cost motion. And we all know that we can’t time these entries with a substantial amount of accuracy, so we get in with smaller threat to provide ourselves room to attend for the motion, with a plan for deal with the scenario in instances the place the market is simply too cussed to reverse. So how can we choose these moments once we wish to enter? The methods carried out in CoralMAX are primarily based on the speculation ofreversion to the imply. More often than not worth is ranging, sticking inside a variety from a excessive to a low. Whenever you put a transferring common on a chart, that is displaying you the place that common is. There are occasions when worth strikes very strongly away from this common, both due to some elementary financial situations, a information occasion, or easy market manipulation. The farther worth pulls away from the typical, the stronger the impetus for worth to tug again in the direction of that common turns into (to revert to the imply). We’re in search of methods to detect these moments of sturdy extension away from the typical, after which to enter when worth indicators that it’s reverting. We catch these strikes and take small income from them, as incessantly as we will.

The 2 major indicators that we use to detect these moments of extension are theRelative Power Indexand theCommon Every day Vary.

HTF Relative Power Index

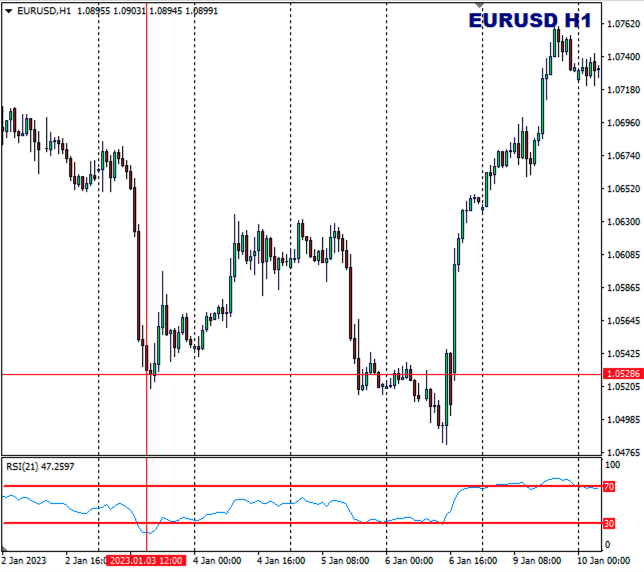

On this technique we’re wanting on the RSI on the next timeframe, the H1 chart. For instance:

That is the H1 RSI(21) set to an RSI Excessive of 70 and RSI Low of 30. When RSI is above the RSI Excessive we search for alternatives to enter quick; and when the RSI is beneath the RSI Low we search for alternatives to enter lengthy. I’ve recognized a second when RSI exceeded the RSI Excessive, and drawn two strains to find this with worth on the chart.

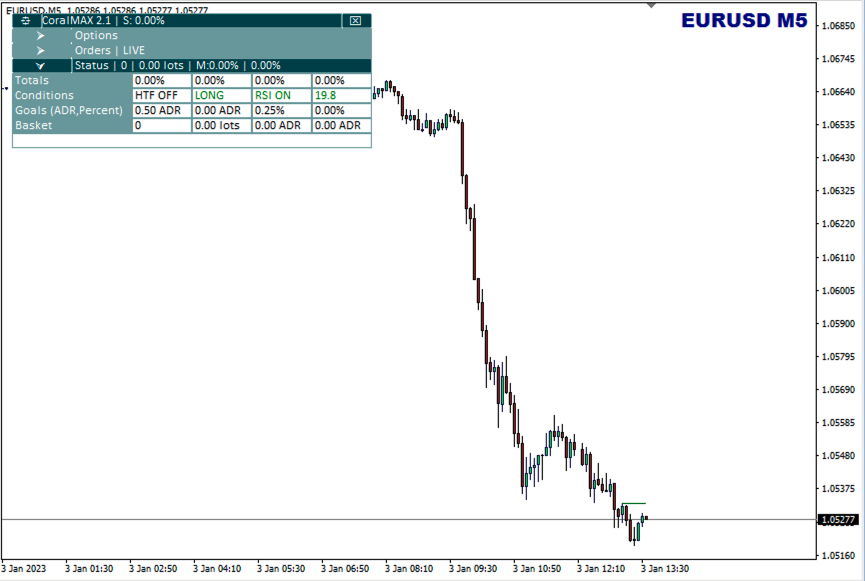

As soon as the market situation has been noticed within the HTF chart, we then search for a second to enter on the LTF chart. For this technique the HTF chart is H1, the place we search for RSI extensions. For entries we use the M5 chart and are in search of an entry sign. The entry sign is break of market construction that signifies that worth is altering instructions; as a result of we noticed an RSI Low on H1, we’re in search of a bullish entry sign on the M5. Right here is identical second on the M5 chart, earlier than the sign is triggered:

The inexperienced horizontal line extending above present worth is the bullish sign line, indicating the place worth wants to shut above to set off an entry. As a result of RSI is prolonged on the H1, when worth closes previous this line and generates a bullish sign, the EA will enter the commerce.

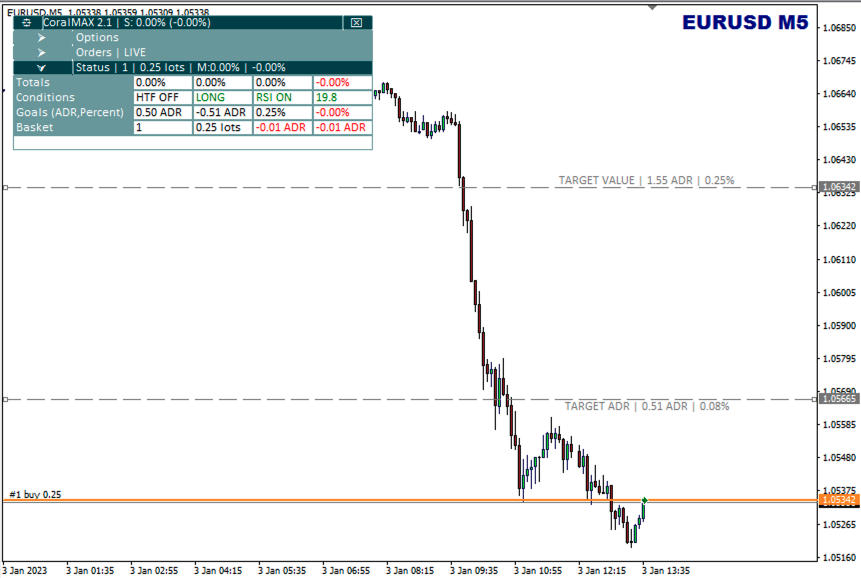

Now that we’re in, the commerce will both scale in if worth goes 0.5 ADR farther down; or will shut at goal if worth strikes 0.5 ADR increased.

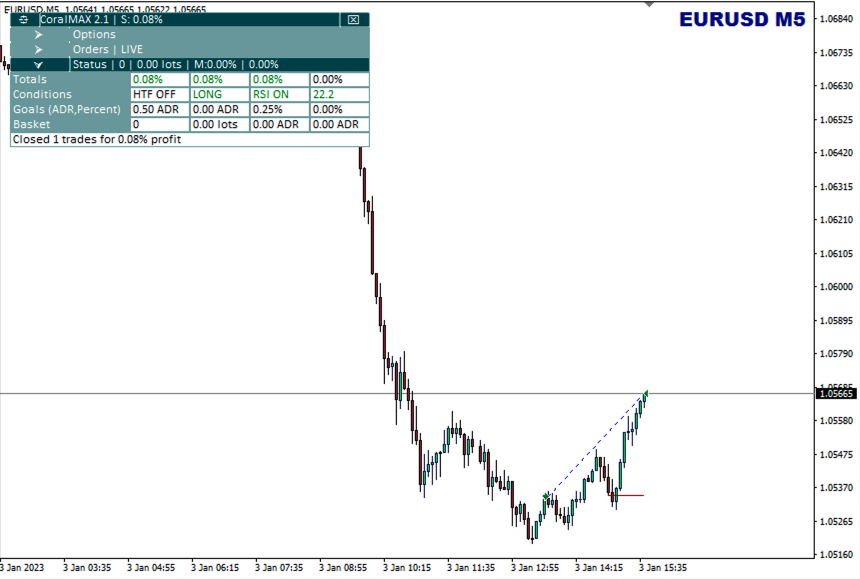

It is a easy instance, a commerce being entered on H1 RSI extension adopted by an entry sign, and operating speedy to hit the revenue goal. If solely all trades had been that easy!

[ad_2]