[ad_1]

Momentum breakouts is a sort of market situation whereby value is transferring strongly in a single course, often inside just a few candles and at instances even began with only one value candle. These candles usually breakout of a market contraction part that are often characterised by small value, indecisive value candles. The sudden look of lengthy full-bodied candle point out {that a} market occasion has occurred that induced merchants to both purchase or promote instantly.

Momentum breakouts have a lot potential. It’s because momentum breakouts are sometimes the start of a recent development. Merchants who may catch these recent tendencies and experience it out till the tip may earn big yields in a single commerce.

Nevertheless, momentum merchants additionally are inclined to chase value because the market strikes in a sure course. Momentum merchants want a scientific momentum buying and selling technique which ought to permit them to objectively establish a correct momentum breakout sign which may lead to a recent development.

Bollinger Bands

The Bollinger Bands is likely one of the most versatile technical indicators. It’s a development following technical indicator, which additionally offers merchants info relating to volatility and is also used to establish imply reversals in addition to momentum breakouts.

The Bollinger Bands indicator consists of three traces.

The center line is a 20-period Easy Transferring Common (SMA) line. As such, merchants can use it as a development indicator. Pattern course could be recognized based mostly on the slope of the center line, in addition to the overall location of value motion in relation to the road. Pattern reversal indicators is also recognized based mostly on the crossing over of value motion and the center line.

The 2 outer traces are principally commonplace deviations from the center line. These traces are often set at two commonplace deviations shifted above and beneath the center line.

Because the outer traces are based mostly on a normal deviation, the Bollinger Bands can be utilized to establish volatility. Increasing bands point out an increasing market part, whereas contracting bands point out a contracting market part.

Imply reversal merchants additionally use the Bollinger Bands to establish possible imply reversals from overbought or oversold value situations. The world exterior the outer traces are thought of oversold and overbought areas. Worth candles exhibiting indicators of value rejection exterior of the road may point out that value is both overbought or oversold and will quickly reverse.

Momentum merchants however use the outer traces as a foundation for a momentum breakout. Robust momentum candles breaking exterior of the Bollinger Bands could be interpreted as a momentum breakout coming from a market contraction part.

Exponential Transferring Averages Indicators

Some of the common methods merchants establish potential development reversals is predicated on the crossover of transferring common traces. With the fitting parameters and when utilized in the fitting market situation, transferring common crossover indicators could be very efficient.

Exponential Transferring Averages Indicators is predicated on this idea. It plots arrows each time it detects its underlying transferring common traces crossing over. The course the arrow is pointing signifies the course of the development.

This indicator makes use of Exponential Transferring Averages (EMA) as a result of this kind of transferring common line tends to be very responsive to cost actions, making it superb for development reversal indicators.

Coppock Indicator

The Coppock indicator is a customized technical indicator used to assist merchants establish development course. It’s an oscillator sort of indicator which plots histogram bars to point development course.

This indicator plots histogram bars which oscillate round its median, zero. Constructive bars point out a bullish development bias, whereas adverse bars point out a bearish development bias.

Though its parameters could be modified to suit the buying and selling model of the dealer, it’s naturally suited to point long-term tendencies.

Merchants can use the shifting of the bars to constructive or adverse to point a attainable development reversal.

Merchants may also use the indicator as development course filter to keep away from taking trades that’s going towards the course of the development.

Buying and selling Technique

Coppock Momentum Pattern Foreign exchange Buying and selling Technique is a development following technique which is initiated by a momentum breakout state of affairs.

The Bollinger Bands indicator is used to establish the momentum breakout. A powerful momentum candle ought to escape of the Bollinger Bands to point a momentum breakout. Worth motion ought to keep on the half of the Bollinger Bands the place the breakout has occurred, indicating that it’s respecting the center line as a dynamic help or resistance.

The Exponential Transferring Common Indicators also needs to plot an arrow pointing the course of the possible development reversal.

Then, the Coppock bars ought to shift over zero indicating that the development has shifted within the course of the development.

Indicators:

- Bollinger Bands (default settings)

- ExponentialMovingAveragesSignals

- Sooner EMA: 25

- Slower EMA: 30

- Coppock

Most well-liked Time Frames: 30-minute, 1-hour and 4-hour charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York classes

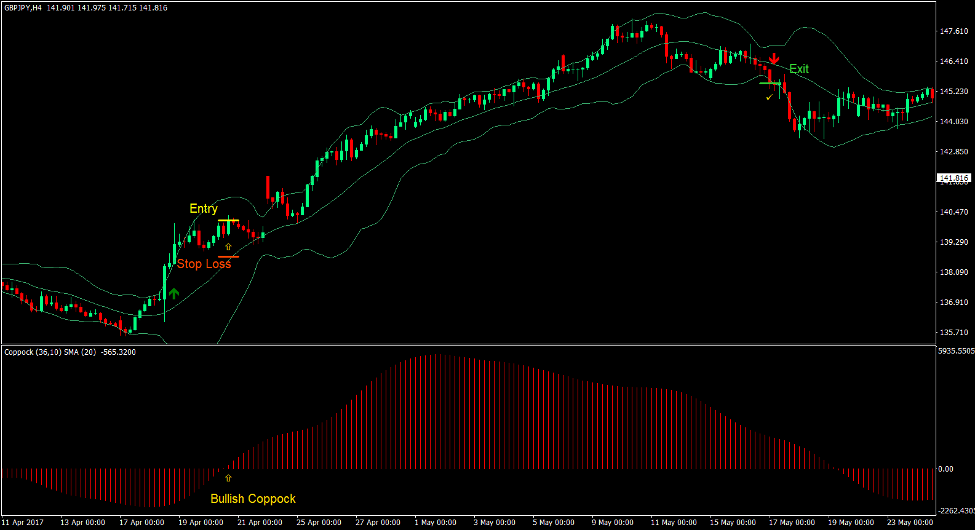

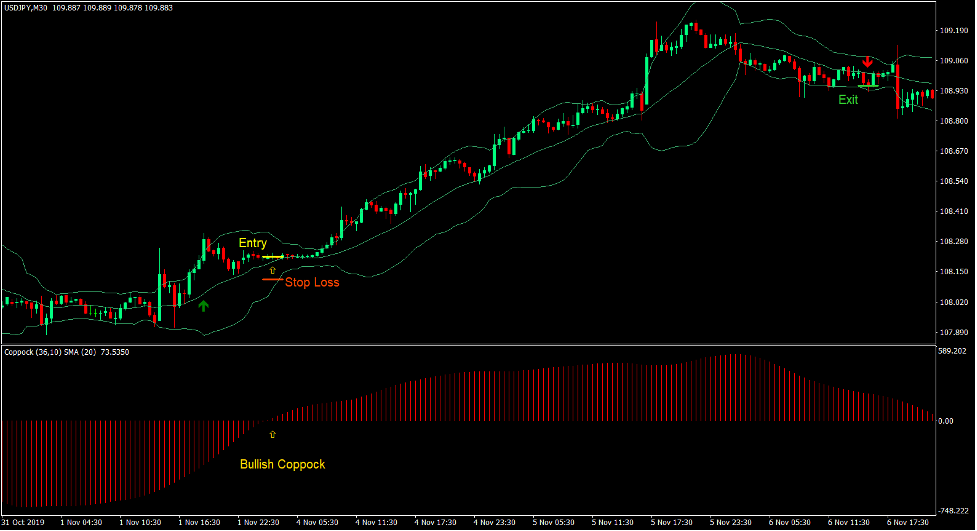

Purchase Commerce Setup

Entry

- A bullish momentum candle ought to break above the higher line of the Bollinger Bands.

- The Exponential Transferring Averages Indicators indicator ought to plot an arrow pointing up.

- The Coppock bars ought to shift above zero.

- Enter a purchase order on the affirmation of those situations.

Cease Loss

- Set the cease loss on a help beneath the entry candle.

Exit

- Shut the commerce as quickly as a candle closes beneath the decrease Bollinger Bands line.

- Shut the commerce as quickly because the Exponential Transferring Averages Indicators indicator plots an arrow pointing down.

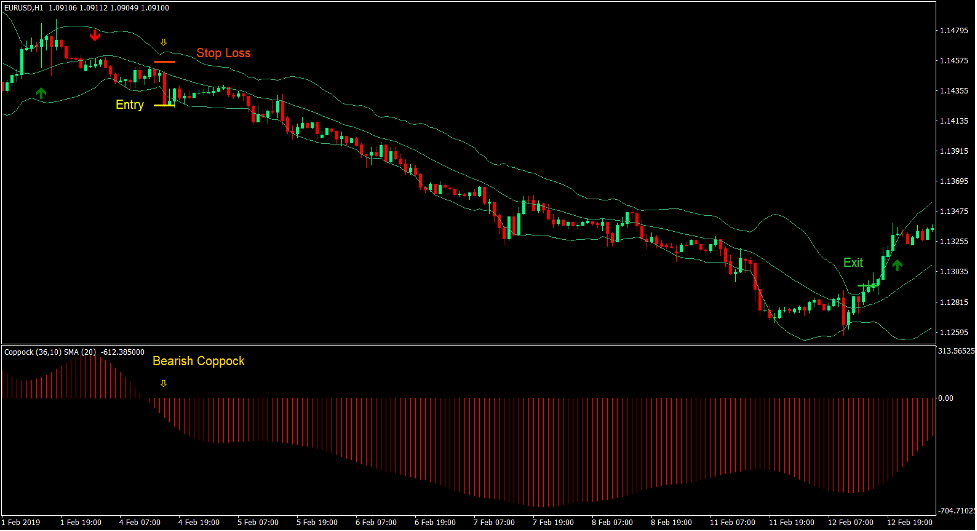

Promote Commerce Setup

Entry

- A bearish momentum candle ought to break beneath the decrease line of the Bollinger Bands.

- The Exponential Transferring Averages Indicators indicator ought to plot an arrow pointing down.

- The Coppock bars ought to shift beneath zero.

- Enter a promote order on the affirmation of those situations.

Cease Loss

- Set the cease loss on a resistance above the entry candle.

Exit

- Shut the commerce as quickly as a candle closes above the higher Bollinger Bands line.

- Shut the commerce as quickly because the Exponential Transferring Averages Indicators indicator plots an arrow pointing down.

Conclusion

This buying and selling technique may produce commerce setups with the potential to supply excessive yielding trades. It’s because momentum breakouts may usually lead to a trending market situation.

Nevertheless, the breakout candle itself doesn’t imply {that a} development reversal is imminent. There are a lot of situations that must be met. It may very well be the shifting within the course of value motion swings and retests of dynamic helps or resistances.

This buying and selling technique systematically confirms the development reversal based mostly on a algorithm, which permits merchants to mechanically enter trades with out second guessing themselves.

Foreign exchange Buying and selling Methods Set up Directions

Coppock Momentum Pattern Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the gathered historical past information and buying and selling indicators.

Coppock Momentum Pattern Foreign exchange Buying and selling Technique offers a possibility to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional value motion and regulate this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Methods to set up Coppock Momentum Pattern Foreign exchange Buying and selling Technique?

- Obtain Coppock Momentum Pattern Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Coppock Momentum Pattern Foreign exchange Buying and selling Technique

- You will notice Coppock Momentum Pattern Foreign exchange Buying and selling Technique is obtainable in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]