[ad_1]

Proposals would rip away assist for center class.

The Republican Examine Committee (RSC) has simply launched its FY 2024 Finances Defending America’s Financial Safety and as soon as once more known as for important cuts to Social Safety. The RSC has served because the conservative caucus of Home Republicans since its founding in 1973, and it at present consists of 175 of the 222 Republican Home members. The group has been proposing cuts for many years, however the present spherical places them at odds with the GOP presidential frontrunners. Donald Trump has urged Republicans to not minimize a single penny from Social Safety and Medicare; equally, Ron DeSantis has mentioned that he’s “not going to mess with Social Safety.”

The proposal within the RSC doc is titled Stopping Biden’s Cuts to Social Safety. For those who haven’t heard of any cuts proposed by President Biden, that’s as a result of he hasn’t made any. The provocative title refers back to the cuts that might happen within the early 2030s when the reserves within the belief fund are exhausted. By regulation, Social Safety can’t present advantages for which it doesn’t have financing and – as soon as the belief fund is exhausted – incoming payroll taxes and different revenues could be adequate to pay solely 77 p.c of scheduled retirement advantages. Therefore, present and future beneficiaries would see an across-the-board minimize of 23 p.c in 2033.

The exhaustion of the belief fund is certainly an action-forcing occasion. Nobody needs to see advantages instantly minimize by 23 p.c. The choices are easy. Social Safety is an easy system – cash in/cash out. Both more cash should go in or much less cash should exit.

On the money-in aspect, the RSC factors out that Biden’s prohibition towards elevating taxes on these incomes underneath $400,000 precludes growing the payroll tax charge. I hope that isn’t a binding constraint; a small enhance within the payroll tax charge ought to in all probability be a part of any answer. The RSC additionally guidelines out common revenues by framing such a contribution as coming from borrowing. Certainly, an economically sound strategy would require elevating revenue taxes to generate the required common revenues. And a robust rationale exists for a common income contribution – specifically the fee related to having given away the belief discover to early teams of retirees. Particularly, at the moment’s employees need to contribute far more to Social Safety than they’d to a funded retirement program.

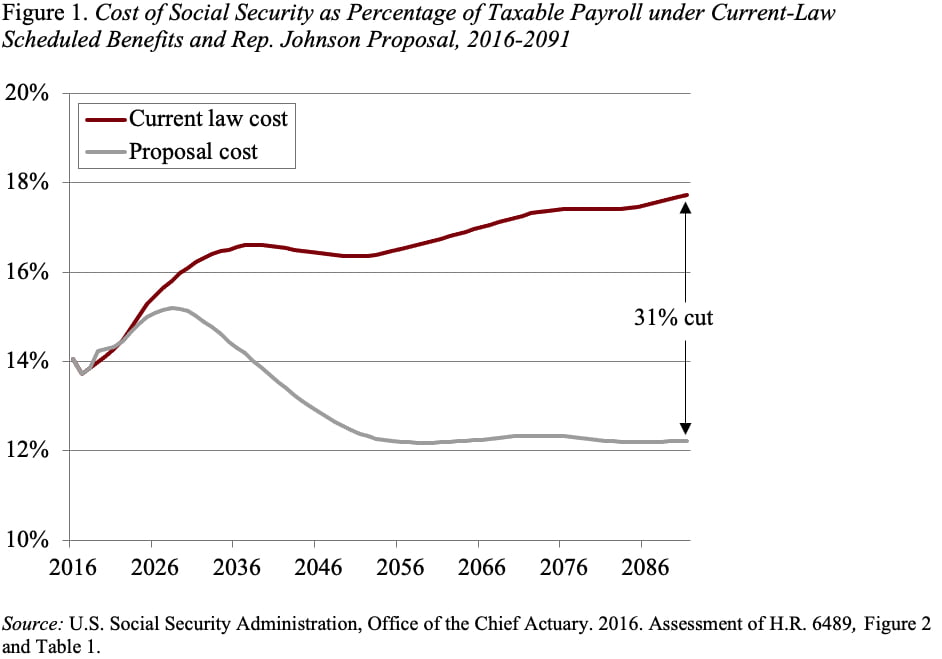

With revenues off the desk, the RSC proposes to remove Social Safety’s 75-year deficit solely by reducing advantages. To the extent the that the present bundle, like final yr’s, is modelled on a invoice put ahead in 2016 by Sam Johnson (R-TX), it’s price taking a more in-depth take a look at that invoice. Based on scoring by the Social Safety actuaries on the time, the Johnson plan would scale back Social Safety prices on the finish of the 75-year projection interval by 31 p.c (see Determine 1).

This 31-percent minimize is the results of three main modifications:

- elevating the Full Retirement Age – at present 67 – to 69;

- dramatically lowering advantages for above-average earners; and

- eliminating the cost-of-living adjustment (COLA) for these with larger incomes and utilizing a chain-weighted inflation index for individuals who qualify for a COLA.

At first look, one would possibly conclude that’s a tremendous final result – minimize the advantages of the properly paid and protect the advantages of the low paid. However the medium employee, who sees advantages drop to 77 p.c of present regulation, had profession common earnings of $58,700 in 2022 and the “excessive” earner, who sees advantages drop to 40 p.c of present regulation, earned $94,000. These will not be wealthy folks.

Furthermore, modifications to Social Safety have to be made within the context of your entire retirement revenue system. Many households are prone to retire with little apart from Social Safety advantages, since at any second in time lower than half the non-public sector workforce participates in an employer-sponsored retirement plan. Policymakers do want to handle Social Safety’s long-run deficit, however the truth that a majority of Home Republicans might assist a plan that cuts Social Safety by a 3rd ought to terrify voters. Why put out such a doc?

[ad_2]