[ad_1]

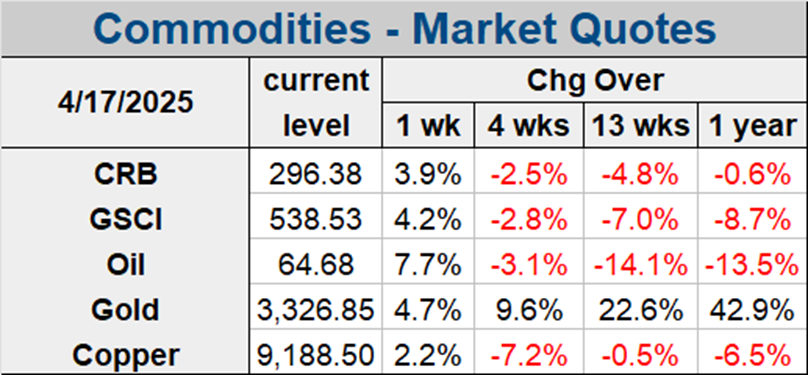

Market volatility and the spike in danger aversion have continued to profit Gold, whereas weighing on Oil costs. Bullion remains to be flirting with the $2,000 mark.

The Fed might have gone forward with one other 25 foundation level hike, however that solely added to concern that aggressive charge hikes will see the worldwide financial system sliding into recession. Oil costs are struggling on this local weather, particularly as China’s restoration has remained subdued to this point.

Oil costs managed a weekly acquire final week however remained capped by ongoing volatility in markets as central banks continued to hike charges. Buyers concern that officers are prioritizing worth stability over monetary stability and that financial circumstances will tighten disproportionately, curbing world progress and capping demand. Bloomberg flagged that cash managers slashed net-long positions in Brent and WTI and boosted outright wagers in opposition to each benchmarks whereas reducing longs. Whole open curiosity for UKOIL hit the very best since February of 2022 on Thursday, in line with Bloomberg.

For now, provide continues to outstrip demand, regardless of Russia’s output discount, which has been prolonged to the top of June. This discount has but to influence international provides, and Bloomberg reported that Russian shipments continued to say no barely however remained above 3 million a day. Certainly, any decline in manufacturing will initially be offset by diminished demand from Russia’s refineries, throughout a interval of seasonal upkeep. On high of this, official knowledge from the US final week additionally confirmed an surprising rise in US crude inventories of 1.1 million barrels, which was the biggest since Could of 2021. Giant builds on the Gulf coast outweighed a decline on the Cushing Oklahoma storage hub.

As lengthy as China’s restoration continues as anticipated, demand ought to begin to rise relative to produce within the second half of the yr. Exercise hasn’t bounced again from Covid lockdowns as quick as hoped at one level, however China’s high power producer, China Nationwide Petroleum Corp, nonetheless recommended in its annual report that oil demand in China might surge 5.1% this yr, whereas fuel demand was predicted to rise 5% this yr.

Gold has corrected to $1944 per ounce initially of week because the US Greenback strengthened and haven demand pale – at the least for now. Central banks and wider market circumstances stay in focus and the dear metallic is buying and selling at excessive ranges.

Demand for Gold may flirt once more with the $2,000 mark amid ongoing market volatility. Financial institution angst continued to linger, and the spherical of central financial institution hikes fueled issues that aggressive tightening may damage the worldwide financial system. The valuable metallic is selecting up extra haven flows within the present local weather of uncertainty, and with traders additionally nonetheless anxious concerning the well being of US regional banks, Gold has the sting over the Greenback as a retailer of worth.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]