[ad_1]

Because the mainstream focuses on unfavourable developments, such because the Fed’s newest utterings and the implosion of subsets of the business actual property (CRE) sector, there appears to be a stealthy migration of cash into different choose areas of the market. This can be a nice instance of why specializing in the markets as a substitute of the exterior noise is the easiest way to commerce.

Commerce What You See

There’s an previous saying amongst clever veteran merchants: “commerce what you see.” And the present market is an ideal place during which this adage holds up.

As buyers await the Fed’s almost sure fee enhance on Might third, the every day choices market-related gyrations in shares proceed to develop. In the meantime, the four-prong post-COVID pandemic megatrend continues to evolve, as I talk about intimately in my newest Your Each day 5 video. Mentioned megatrend consists of:

- The Nice Migration – inhabitants shifts to suburbs, rural areas, and the sunbelt;

- The CRE Implosion from an oversupply of workplace area;

- Bullish Provide Dynamics for Homebuilders; and

- The Evolving Finish of Globalization.

Consequently, the one resolution is to be contrarian, to commerce what you see, and to give attention to investments from a longer-term viewpoint. Said plainly, if a inventory will not be crashing and the underlying enterprise is performing moderately effectively, then it is a keeper till confirmed in any other case.

Even higher, as I element beneath, detecting development modifications early may be very useful.

The Evolution of the Industrial Actual Property Crash

There’s extra nuance than what meets the mainstream eye happening within the beleaguered CRE market.

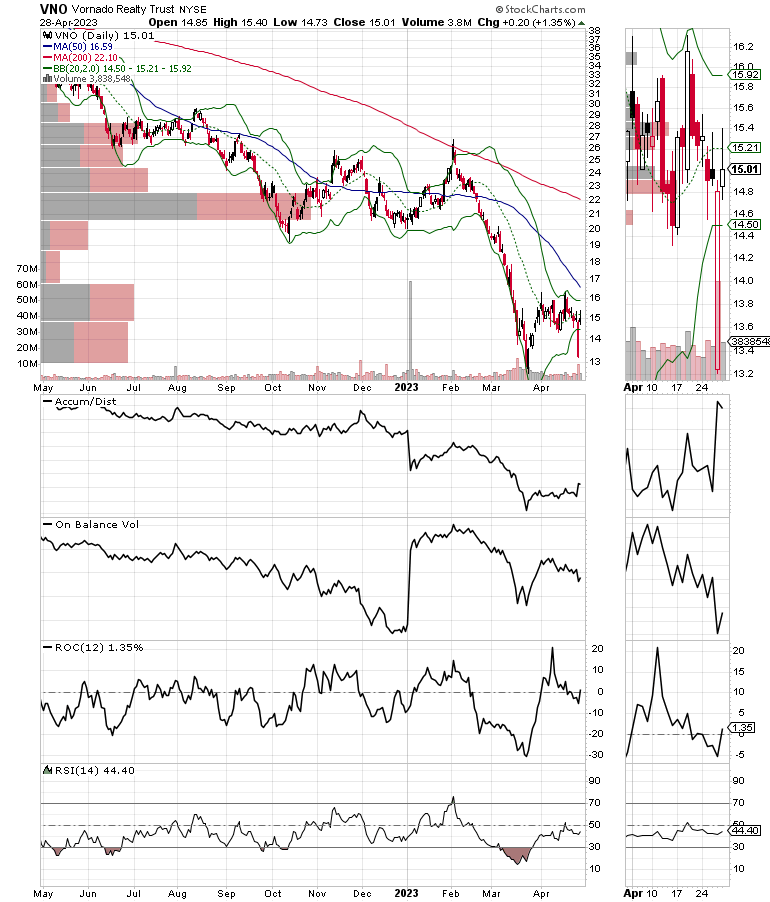

For instance, the massive information of the week was Vornado’s (NYSE: VNO) dividend minimize, which despatched the shares decrease as buyers braced for worse information, similar to the potential of mortgage defaults. If that occurs, few can be shocked.

The value chart’s Accumulation Distribution (ADI) exhibits that brief sellers have had a area day with the shares over the previous twelve months, particularly over the last quarter. On Steadiness Quantity (OBV) additionally signifies extra sellers than consumers have been the norm of late.

However issues could also be altering in different areas of the actual property enterprise. And a more in-depth take a look at VNO’s shares exhibits that the sooner or later mini-crash within the inventory on 4/27/23 was adopted by a bounce which, after all, was short-covering.

As I described in my latest Your Each day 5 video, the evolution of the post-pandemic megatrend is evolving into a brand new and fairly investable section. That is as a result of the market is slowly adapting to its circumstances as companies alter to the altering panorama. And as one part of the actual property funding belief (REIT) world is struggling, different areas are beginning to present indicators of life.

To be particular, REITs, that are closely laden with workplace constructing properties which can be having hassle paying their payments. Mortgage defaults have gotten fairly widespread; foreclosures and bankruptcies are more likely to rise. Then again, these REITs who derive their revenue from residential properties are faring higher. The result’s an sudden enchancment within the value chart for the iShares U.S. Actual Property ETF (IYR).

The value chart for IYR exhibits that the whole sector nonetheless has loads of work to do. However amazingly, REITs might have bottomed out. All of which means that the inventory market could also be beginning to quietly value in a pause within the Fed’s interest-raising cycle after the almost-certain fee enhance, which is predicted on Might 3.

IYR’s Accumulation/Distribution indicator (ADI) means that brief sellers might have misplaced their enthusiasm for the sector. Then again, On Steadiness Quantity (OBV) remains to be bottoming out, which means that consumers haven’t overwhelmed sellers altogether.

Nonetheless, the ETF is buying and selling tightly close to the $84 space, the place there’s a massive Quantity by Worth bar (VBP). If the value can transfer above this key value level, we’re more likely to see a problem of the 200-day shifting common.

A transfer above that may be bullish. I’ve simply added two lengthy REIT performs to my portfolio. Get the small print with a free trial to my service right here.

Bond Yields Flip Decrease at 3.5%. House Consumers Play Cat and Mouse with Mortgage Charges.

The bond market continues to cost in a slowing of the financial system, whereas homebuyers proceed to play a nifty sport of cat and mouse as they attempt to time the mortgage market. Homebuilder shares proceed to maneuver greater.

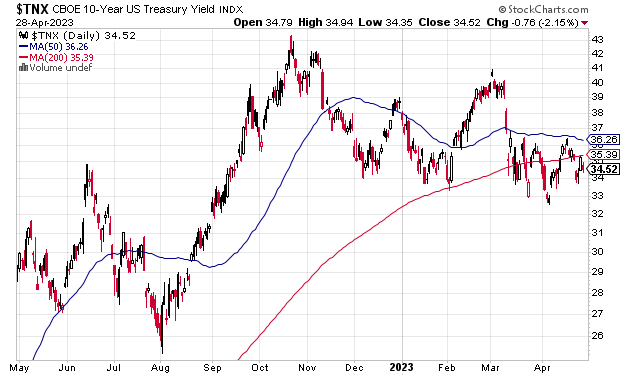

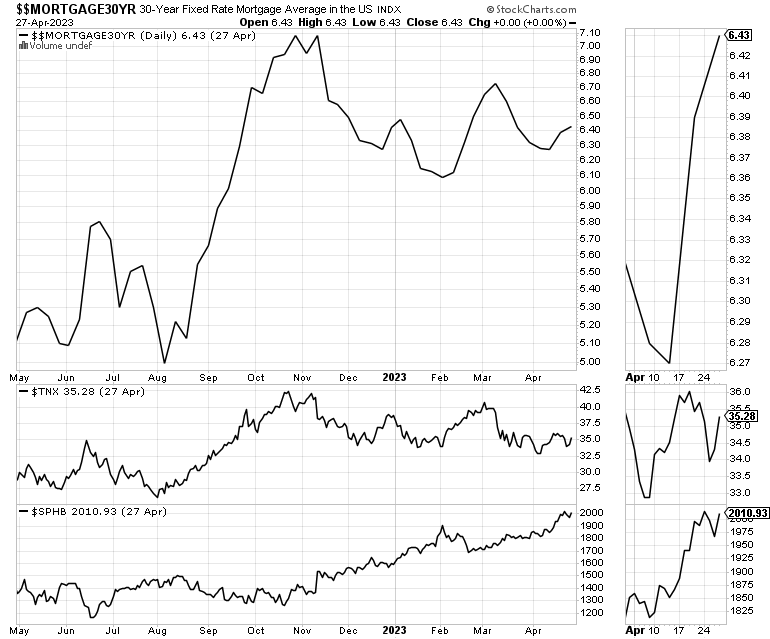

Over the previous few weeks, the Fed hinted that one other fee enhance was coming at its Might 2-3 FOMC assembly. Initially, this bearish speak pushed the U.S. Ten Yr Word (TNX) regardless of above the three.5% yield space. This resulted in an increase of the 30-year mortgage to six.4%, the place it has remained for the final couple of weeks.

This upside reversal delivered a slowing in present residence gross sales. However the reversal in bond yields on the week ended on 4/28 is more likely to result in yet one more reversal in mortgage charges. Furthermore, savvy potential homebuyers are seemingly calling their bankers as I write as a way to lock in charges earlier than the official numbers are launched subsequent week.

Word the shut relationship between TNX, mortgage charges, and the regular uptrend within the homebuilder sector (SPHB). Particularly, check out the rally in SPHB, which was spawned when the typical mortgage fee topped out in late 2022 above 7%. The following decline in mortgages has been a boon for homebuilders.

For an in-depth complete outlook on the homebuilder sector, click on right here.

NYAD Appears to Have 9-Lives. NDX Breaks Out.

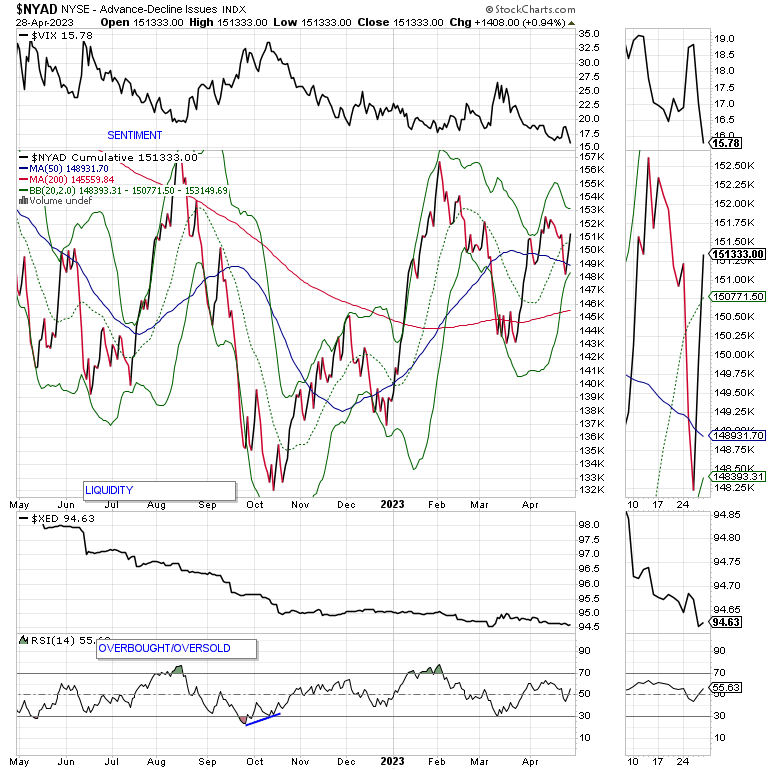

The New York Inventory Change Advance Decline line (NYAD) as soon as once more survived a possible breakdown because it continues to hug its 50-day shifting common, whereas remaining effectively above its long-term dividing line between bull and bear traits, the 200-day shifting common. It will be good to see breadth enhance, however the truth that it has not damaged down altogether may be very encouraging.

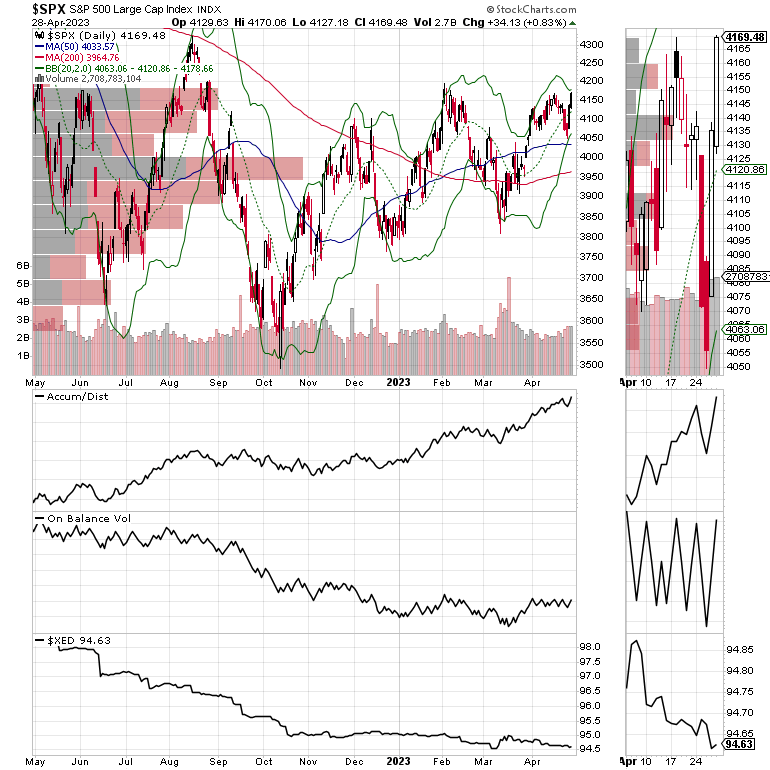

The S&P 500 (SPX) continues to carry between 4100 – 4200, however is getting nearer to what could possibly be a significant breakout if it will probably get above the 4200 space. On Steadiness Quantity (OBV) and Accumulation Distribution (ADI) stay very constructive for SPX.

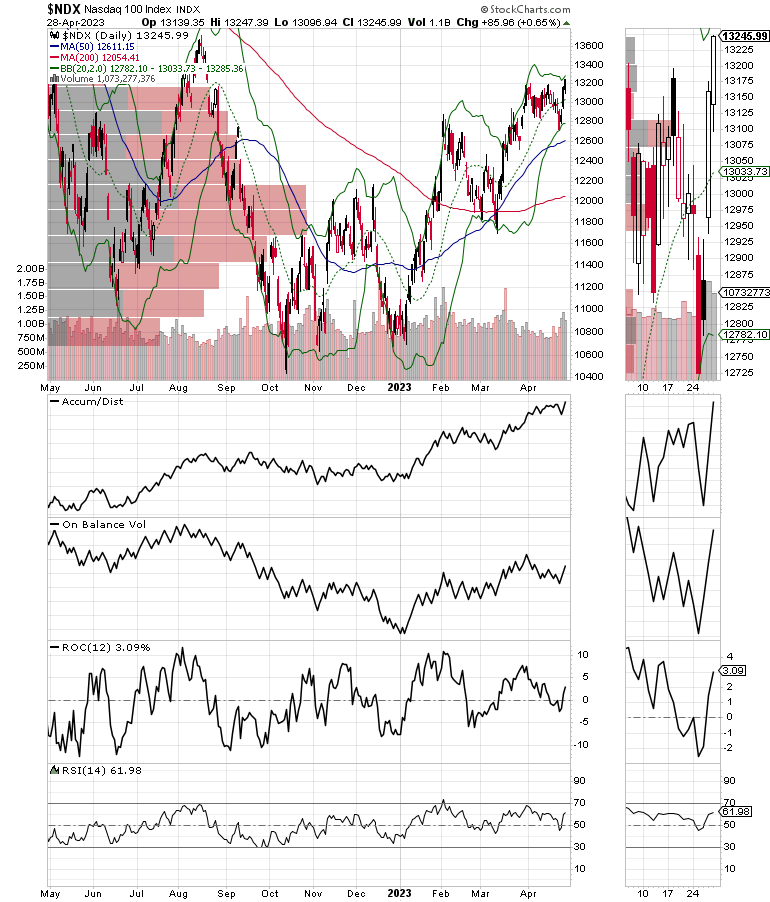

For its half, the Nasdaq 100 Index (NDX) closed above 13,200 on 4/29/23, scoring a nifty breakout with OBV beginning to flip up a bit extra decisively. If NDX can keep above 13,200, the percentages of a big transfer greater are effectively above-average.

These are bullish developments, which suggests cash is shifting into expertise shares. When tech shares rally, they usually give the entire market a lift.

VIX Makes New Lows

The CBOE Volatility Index (VIX) once more broke to a brand new low and is now effectively beneath 20, an indication that the bears are falling by the wayside. This stays bullish regardless of the intraday volatility within the choices market.

When VIX rises, shares are likely to fall, as rising put quantity is an indication that market makers are promoting inventory index futures as a way to hedge their put gross sales to the general public. A fall in VIX is bullish, because it means much less put possibility shopping for, and it will definitely results in name shopping for, which causes market makers to hedge by shopping for inventory index futures. This raises the percentages of upper inventory costs.

Liquidity is Steady. Upcoming Fee Hike May Crimp.

The market’s liquidity retreated because the Eurodollar Index (XED) stays a query mark, despite the fact that, for now, it stays steady, but beneath 94.75 on Fed hike expectations. A transfer above 95 shall be a bullish improvement. Normally, a steady or rising XED may be very bullish for shares. Then again, within the present setting, it is extra of an indication that concern is rising and buyers are elevating money.

To get the newest up-to-date data on choices buying and selling, take a look at Choices Buying and selling for Dummies, now in its 4th Version—Get Your Copy Now! Now additionally obtainable in Audible audiobook format!

#1 New Launch on Choices Buying and selling!

#1 New Launch on Choices Buying and selling!

Excellent news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 movies) and some different favorites public. You’ll find them right here.

Joe Duarte

In The Cash Choices

Joe Duarte is a former cash supervisor, an lively dealer, and a widely known impartial inventory market analyst since 1987. He’s creator of eight funding books, together with the best-selling Buying and selling Choices for Dummies, rated a TOP Choices Ebook for 2018 by Benzinga.com and now in its third version, plus The All the pieces Investing in Your 20s and 30s Ebook and 6 different buying and selling books.

The All the pieces Investing in Your 20s and 30s Ebook is on the market at Amazon and Barnes and Noble. It has additionally been beneficial as a Washington Submit Coloration of Cash Ebook of the Month.

To obtain Joe’s unique inventory, possibility and ETF suggestions, in your mailbox each week go to https://joeduarteinthemoneyoptions.com/safe/order_email.asp.

Joe Duarte is a former cash supervisor, an lively dealer and a widely known impartial inventory market analyst going again to 1987. His books embody one of the best promoting Buying and selling Choices for Dummies, a TOP Choices Ebook for 2018, 2019, and 2020 by Benzinga.com, Buying and selling Assessment.Web 2020 and Market Timing for Dummies. His newest best-selling e book, The All the pieces Investing Information in your 20’s & 30’s, is a Washington Submit Coloration of Cash Ebook of the Month. To obtain Joe’s unique inventory, possibility and ETF suggestions in your mailbox each week, go to the Joe Duarte In The Cash Choices web site.

Be taught Extra

Subscribe to High Advisors Nook to be notified at any time when a brand new publish is added to this weblog!

[ad_2]