[ad_1]

A lot has been stated about inflation hurting society. As folks’s shopping for energy decreases, life will get extra expensive. Heck, the Fed appears hell-bent on inflicting one other recession to comprise inflation.

Nonetheless, as I take a look at the historic worth modifications of a few of our most essential shopper items and companies, I can’t assist however assume combatting inflation is simple.

Additional, for the typical family, maybe the negatives of inflation are overblown. Positive, everyone knows meals, gasoline, and utility costs are larger. Nonetheless, these prices are counteracted by larger wages as effectively.

Apart from these three recurring gadgets, inflation doesn’t appear that unhealthy. Additional, these three gadgets don’t make up a big portion of my total funds. Do they for you?

Let’s first check out an inflation chart of varied items and companies to grasp how costs have modified.

Inflation Of Varied Shopper Items And Providers

Try this nice inflation chart by Visible Capitalist.

Since 2000, the next shopper items and companies have risen essentially the most in worth:

- Hospital Providers

- Faculty Tuition and Charges

- Faculty Textbooks

- Medical Care Providers

- Childcare

- Meals and Beverage

- Housing

- New Automobiles

- Family Furnishings

Since 2000 the next shopper items and companies have declined essentially the most in worth:

- Televisions

- Toys

- Software program

- Cellphone Providers

- Clothes

Easy Options To Combatting Inflation

It’s probably the worth change tendencies for the gadgets above will proceed for the foreseeable future. Subsequently, the simple options to combatting inflation are to:

- Not go to school

- Attend group school or a state school

- Keep in nice bodily and psychological form to lower your probabilities of receiving medical companies

- Eat much less and / or substitute cheaper meals

- Don’t purchase a brand new automotive as a result of the typical new automotive worth is absurd

- Drive your present automotive for so long as doable

- Not have youngsters or have fewer youngsters

- Purchase a home with a fixed-rate mortgage

- Personal shares (S&P 500) and different threat belongings that have a tendency to extend in worth sooner than inflation

Fairly easy proper?

Get Richer From Inflation As an alternative

For those who do the above, you probably gained’t really feel the damaging results of inflation as a lot if in any respect. As an alternative, you’ll probably be ok with inflation as a result of your earnings is probably going inflating at the same or sooner charge.

Inflation typically acts as a tailwind for actual property homeowners because it helps push rents and property costs larger, whereas mortgage charges keep mounted.

Inflation additionally tends to spice up company income as corporations can usually cost extra for items and companies sooner than their improve in bills.

As long as you’re working in a aggressive trade and investing most of your money in threat belongings which have traditionally crushed inflation, you’ll probably find yourself wealthier with the assistance of inflation.

However Counteracting Inflation Is Not Simple

In fact, not all of you’ll utterly agree with all of the above-listed gadgets to fight inflation.

I believe a few of chances are you’ll balk at not going to school, going to a state faculty (the horror!), consuming much less, and never having youngsters essentially the most. Additional, if in case you have youngsters already, it’s not like you’ll be able to simply return them!

Therefore, let’s talk about this stuff in a bit of extra element. Everyone has totally different opinions. We should weigh the prices and advantages of every in comparison with the clear advantages of saving cash.

The extra you need to economize, the extra you’ll agree with the options and vice versa.

Defeat Inflation By Not Going To Faculty

These days, paying full school tuition actually looks like a ripoff. When all the things can now be realized totally free on-line or be realized from studying nice books, it’s baffling why going to school nonetheless prices a lot.

Loads of college students are going to school for 4 years and paying six figures for tuition solely to graduate with no job or a job that doesn’t require a school diploma. Being overeducated and underemployed are horrible in your funds. The hazard in paying full freight to go to school has by no means been larger!

As a public school graduate, I’m telling you issues might be OK for those who select to go the cheaper route. The hot button is to community and be aggressive when making use of for numerous alternatives to get your foot within the door. When you’re in, no person cares the place you went to school. Individuals care about efficiency.

Sure, school graduates are likely to earn extra over their lifetimes than do those that solely went to highschool. Nonetheless, please be smart in regards to the quantity of money and time you’re keen to spend to go to school. The web makes studying far faster than 30 years in the past. But, it nonetheless takes 4 years for the typical individual to get a level.

Take Benefit Of On-line Assets

One of many essential the reason why I persistently write on Monetary Samurai is to supply free private finance schooling to anybody who desires to study.

I additionally firmly imagine for those who learn Purchase This, Not That and subscribe to my weekly e-newsletter, you should have extra monetary information than 99% of the inhabitants.

In fact, I’m biased. Nonetheless, I’ve obtained the expertise and the checking account to again up my beliefs. Then there’s the plethora of free on-line programs (MOOC) from loads of main universities as effectively. Take benefit.

Except your loved ones is already wealthy, it could be higher to skip school and pay instantly for programs you wish to specialise in. For instance, you’ll be able to go to a coding boot camp the place you solely pay after you get employed. Or you’ll be able to grow to be an apprentice to somebody within the vocational trades.

Train Your Children All the pieces You Know

I requested my son what he realized the opposite day. And he informed me about some issues he had realized two years earlier once we homeschooled him.

This was once I realized all we dad and mom should do is train our youngsters all the things we all know! If our youngsters study all the things we all know, then they could be capable of do what we do for a residing.

If we’re school graduates, there’s truly no have to spend $500,000 on school ten years from now if we spend time educating them. We simply should dedicate extra time to them.

As a graduate of The Faculty of William & Mary, a liberal arts faculty, I ought to be capable of train my youngsters all the things from historical past to Mandarin. As a graduate of UC Berkeley’s Haas College of Enterprise, I ought to be capable of train them about money stream statements, advertising and marketing, and group habits.

If we’re unable to show our youngsters something we realized, did we actually study something? In a meritocracy, we have to train helpful expertise.

Eat Much less, Don’t Waste Meals, Keep In Higher Form

I’m unsure why these suggestions to counteract inflation could also be controversial. Absolutely, consuming much less will prevent cash. Staying in higher form will improve your probabilities of residing a extra snug and longer life.

As soon as we realized in 2020 that the individuals who died essentially the most from COVID-19 had essentially the most comorbidities, most of us determined to train extra and eat more healthy. We rationally feared dying earlier from a virus, so we collectively did one thing to enhance our odds of surviving.

Sadly, American well being care is outrageously costly. We spend essentially the most per capita but should not have the best life expectancy on the earth.

If the rising value of meals is insufferable, we’ll eat cheaper meals and ration our meals extra rigorously. We additionally gained’t waste as a lot meals.

Based on FeedingAmerica.org, every year, 119 billion kilos of meals is wasted in the USA. That equates to 130 billion meals and greater than $408 billion in meals thrown away every year. Shockingly, practically 40% of all meals in America is wasted.

Meals waste in our properties makes up about 39% of all meals waste – about 42 billion kilos of meals waste. Let’s say 16% of our meals will get tossed within the trash each week. If we ate 100% of the meals we bought a 12 months, we’d simply counteract 16% annual meals inflation.

Saving Cash By Not Having Children

Not having youngsters is a non-starter for a lot of of us who need youngsters.

However for those who don’t have youngsters, you gained’t have to avoid wasting for his or her school tuition, pay for childcare, purchase school textbooks, get as huge of a home, get as massive of a automotive, purchase as a lot meals, purchase as many aircraft tickets, and pay as a lot in healthcare bills!

Not having youngsters is likely one of the greatest methods to fight inflation. You possibly can’t purposefully determine to have lots of youngsters then be upset by how a lot they value.

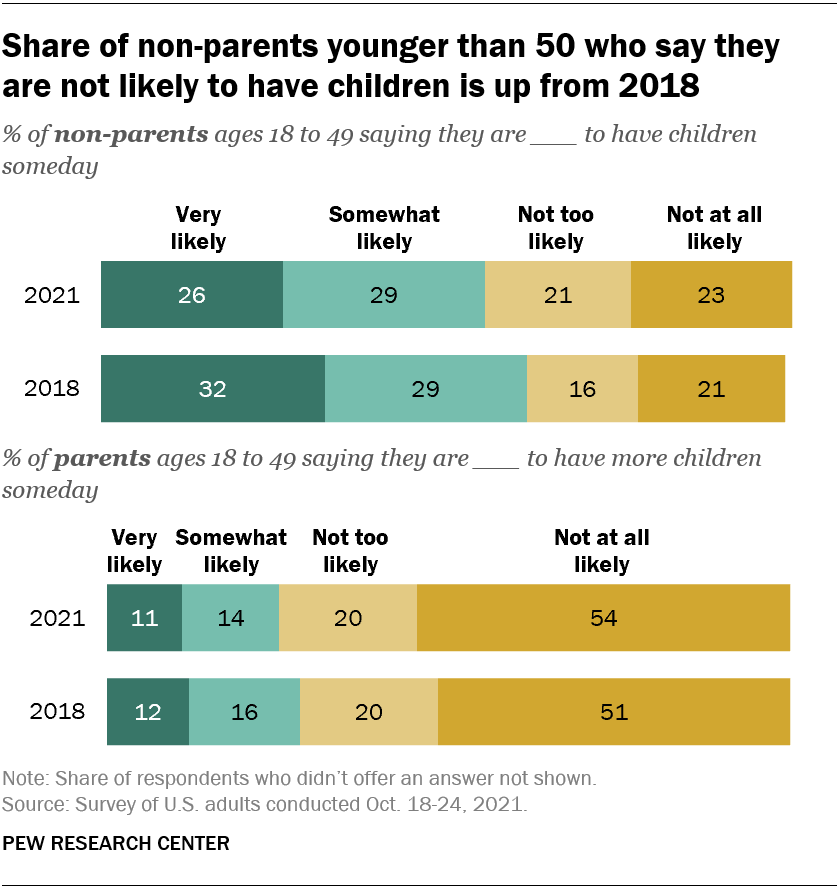

Based on Pew Analysis, some 44% of non-parents ages 18 to 49 say it isn’t too or in no way probably that they may have kids sometime, a rise of seven proportion factors from the 37% who stated the identical in a 2018 survey.

In the meantime, 74% of adults youthful than 50 who’re already dad and mom say they’re unlikely to have extra youngsters, just about unchanged since 2018. 17% of respondents say that gained’t be having youngsters for monetary causes.

If such a big proportion of the child-bearing inhabitants is deciding to not have youngsters or to not have extra youngsters, then inflation will not be as insidious in society as we predict.

Life Is Fairly Reasonably priced With out Children

With out youngsters, our money stream can be a lot larger.

First, we wouldn’t have purchased one other home 2020. The 1,920 sq. toes, three bed room, two rest room home we purchased in 2014 would have been lots for the 2 of us. We had already downsized in value by about 40% from the home we lived in from 2005 – 2014.

Second, we wouldn’t have all these childcare, preschool, and kindergarten bills. Preschool in San Francisco prices $2,000 – $2,500. If we hold each youngsters in language immersion faculty, our annual tuition expense might be about $96,000 a 12 months after taxes. I ought to simply train my youngsters Mandarin and transfer to Taiwan!

Third, our month-to-month healthcare premiums would probably be about $500 cheaper. We at the moment pay $2,300 a month for a household of 4.

Fourth, I could have saved our Honda Match that I leased for $225/month. I liked Rhino as a result of he may slot in 20% extra parking spots. As an alternative, we purchased a safer automotive for about $60,000 after taxes. The Honda Match’s crumple zone was tiny and it felt just like the doorways had been made from cardboard.

Retiring early with youngsters is not less than 3 times tougher than retiring early with out youngsters. I clearly perceive why many dad and mom attempt to work till after their youngsters graduate from school. The prices carry on coming.

Fortunately, most dad and mom love their youngsters a lot that the added prices of getting them really feel price it. However that doesn’t imply dad and mom gained’t complain how costly youngsters are.

Life Typically Feels Cheaper When Inflation Is Excessive

Through the bull market, life felt cheaper as a result of our investments had been rising far better than our prices. When the bear market hit in 2022, we clearly felt the alternative means. Finally, threat belongings will begin appreciating once more, making residing with excessive inflation simpler.

Moreover not having kids or having fewer kids, proudly owning our main residence might be the simplest technique to fight inflation. Upon getting your residing prices mounted, all the things else doesn’t appear as painful.

We’ve got choices to cut back our family burn. We don’t should ship our youngsters to personal colleges. As an alternative of taking an Uber residence, we are able to take a bus. There’s no have to eat a $78 dry-aged rib-eye when a $10 cheeseburger tastes simply pretty much as good.

As long as we’re repeatedly investing our money stream, fixing our largest bills, and residing inside our means, we ought to be web beneficiaries of inflation.

As I stated, combatting inflation is simple. However as a result of human nature, conserving our prices down just isn’t simple.

Reader Questions And Recommendations

Is inflation materially affecting your spending habits? How are you combatting inflation, if in any respect? What are a number of the best issues most individuals can do to maintain prices down?

Choose up a replica of Purchase This, Not That, my on the spot Wall Avenue Journal bestseller. The ebook helps you make extra optimum funding choices so you’ll be able to dwell a greater, extra fulfilling life.

For extra nuanced private finance content material, be part of 55,000+ others and join the free Monetary Samurai e-newsletter and posts by way of e-mail.

Hear and subscribe to the Monetary Samurai podcast on Apple, Google, and Spotify. Monetary Samurai is likely one of the largest independently-owned private finance websites that began in 2009.

[ad_2]