[ad_1]

The US500 broke free from the bear market final Thursday, ending the downtrend which lasted for 248 buying and selling days. Historic knowledge suggests that there’s a median of 75% chance that the index will proceed to rise for a subsequent yr after getting into the bull market. Is that this a brand new starting for the bulls?

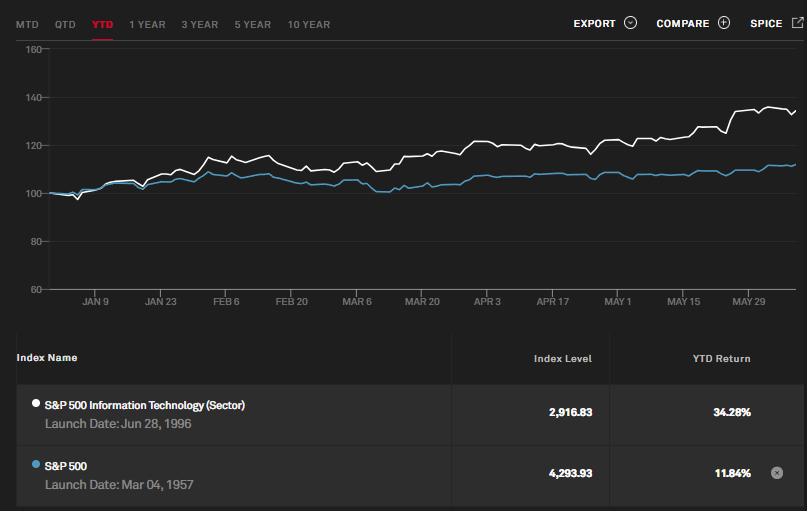

The data expertise sector alone has risen over 34% this yr, significantly better than the US500 which achieved YTD positive factors barely over 11%. Weaker-than-expected labour knowledge final week has been a optimistic catalyst for the shares market basically. Fedwatch displayed that market contributors count on the Fed to keep up its benchmark price unchanged within the coming assembly (14th June), as an alternative of a price hike (perhaps subsequent month?).

In the present day, we’ll take a look at Cognizant Know-how Options Corp. Based in 1994, the corporate engages within the provision of data expertise, consulting, and enterprise course of outsourcing providers. It operates through a number of enterprise segments, particularly Monetary Providers (banking and insurance coverage), Healthcare, Merchandise and Assets (retail and shopper items, manufacturing and logistics, journey and hospitality, and power and utilities), Communications, Media and Know-how.

Final month, Cognizant introduced the launch of an enterprise-wide generative AI platform (Cognizant Neuro), which aimed to help purchasers to raised perceive, devour and customise AI fashions that drive enterprise outcomes, ultimately harnessing its enterprise worth in a scale-able, versatile, safe and accountable manner. Whereas these options might sound thrilling, it is usually essential to notice that within the week via June 7, tech funds sustained $1.2 billion of outflows, the primary time in eight weeks – a pause within the AI frenzy?

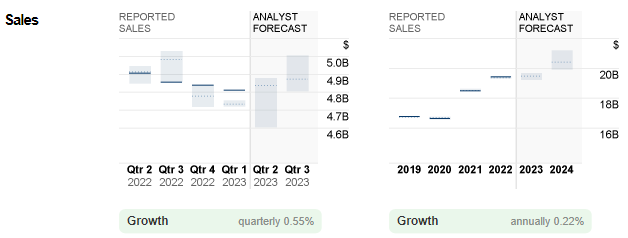

In Q1 2023, the corporate generated $4.8B in gross sales (unchanged from This autumn 2022), barely down -0.3% from the identical interval final yr. Essentially, a robust partnership with firms like Amazon, Microsoft and Alphabet might act as a plus level for Cognizant. Nevertheless, to some extent this has been offset by headwinds equivalent to difficult macroeconomic circumstances and stiff competitors amongst friends.

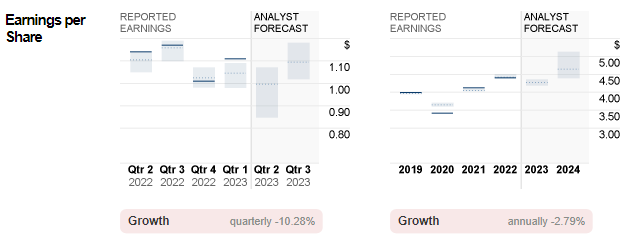

Adjusted diluted EPS for the quarter hit $1.11, up 9.9% from the earlier quarter, and up 2.78% from the identical interval final yr. The corporate will report its earnings end result for Q2 2023 on 26th July. Consensus forecast for gross sales and EPS stood at $4.8B (unchanged from earlier quarter) and $1.00 (down -9.9% (q/q)), respectively.

Technical Evaluation:

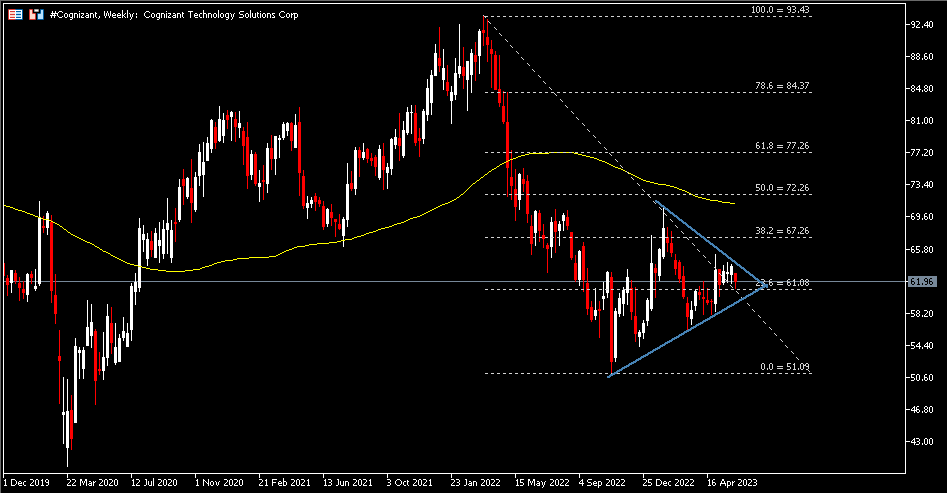

The #Cognizant (CTSH.s) share worth printed its yearly excessive in early February, at $70.84, earlier than paring all of the positive factors by the top of the primary quarter. The asset worth has remained consolidated round $7 within the second quarter, at the moment simply closed above assist $61.08 (FR 23.6% prolonged from March highs 2022 to November lows in 2022). The shares stay pressured beneath the 100-week SMA. A detailed beneath the stated assist might result in sellers pushing the worth decrease, testing the decrease line of symmetry triangle, adopted by the subsequent assist which is final yr’s low at $51.09. In any other case, the higher line of the triangle serves as the closest resistance. A break above this line might lead the bulls to proceed testing $67.25 (FR 38.2%), adopted by the 100-week SMA and $72.25 (FR 50.0%). A break above the latter two ranges might point out correction of the present pattern.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is supplied as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]