[ad_1]

The 12 months 2020 has been one in every of extremes. As people, governments, and industries deal with the direct and oblique results of COVID-19, world securities markets are bracing for a high-stakes US presidential election that might differ dramatically from its latest predecessors.

What can buyers, asset managers, and merchants reeling from the unprecedented volatility of February and March anticipate heading into the ultimate months of 2020?

Indexes provide an environment friendly approach to gauge the market, and listed index-based derivatives can present a basis for evaluation within the type of market costs, implied volatility, open positions, and possibility circulate sentiment.

Broad-based index choices are usually utilized by portfolio managers and merchants for exact changes of danger and publicity. Market-makers and liquidity suppliers play an important position within the course of, risking capital and adjusting costs in response to provide, demand, and expectations of future market habits. In the USA, liquidity is biggest within the S&P 500 Index choices (SPX) on Cboe™, the place roughly 1.2 million contracts, or $5 billion in premium, change fingers on a mean day — surging to triple these ranges on the busiest days.

The distinctive options of SPX choices, mixed with the elemental traits of listed choices, yield beneficial perception into expectations and positioning forward of serious occasions just like the 2020 US presidential election.

Costs and Volatility

In idea, correct valuation of choices is a perform of the underlying value, time to expiration, strike, rates of interest, dividends, and volatility. Whereas all inputs are topic to some extent of uncertainty, volatility receives probably the most consideration in apply as a result of a extreme mis-estimation of volatility can lead to sudden buying and selling outcomes.

When possibility costs, the midmarket degree of implied volatility at any given time signifies the market expectation of the magnitude of day by day returns over the length of the choice. Many possibility merchants “suppose” in volatility somewhat than value phrases, which permits a straightforward comparability throughout merchandise and durations of time.

Implied volatilities of interpolated at-the-money SPX choices on 1 September 2020 and 1 September 2016 present dramatically completely different expectations. In 2016, 90-day choices, which included the 8 November election, have been buying and selling with 13% implied volatility, about 2 factors above the short-term choices. Though a slight election “bump” is seen within the knowledge, the 2016 possibility costs mirrored a comparatively easy time period construction of implied volatility, which rose to 17% within the two-year expiries.

This 12 months, whereas short-term implied volatility stays elevated close to 20%, the uncertainty surrounding the election time period is notably increased with implied volatility close to 24%. The time period construction additionally shows a chronic “hump,” extending one other 90 days to the 180-day time period, or late February 2021, which suggests an extended interval of bigger value variations than 2016.

SPX ATM Implied Volatility: 1 September 2016 vs. 1 September 2020

Computation of ahead volatility from these implied volatilities offers one other perspective on market expectations, isolating the anticipated volatility for particular person durations of time sooner or later. For 2020, the 60- to 90-day ahead interval implied volatility stands out as a excessive level close to 29%, with a reversion towards the 23% vary over the next three months. In contrast, 2016 ahead volatility was comparatively flat, close to 15% into the second quarter of 2017, which turned out to be nicely above the surprisingly low realized volatility of 2017, close to 9%.

SPX ATM Ahead Volatility

SPX Realized Volatility (20d) and Index Degree

Primarily based on present SPX choices costs, market strikes are anticipated to develop bigger into the autumn, peak close to election day on 3 November, and persist a number of months after. In value phrases, the transfer from present 20% volatility to 29% can be felt as widespread (one commonplace deviation) day by day strikes widen from 1.25% to 1.8%.

Open Curiosity

All SPX choices trades are cleared by the Choices Clearing Company (OCC), which publishes web excellent contracts for every listed possibility day by day. As positions are opened and adjusted over time, the open curiosity adjustments, offering transparency into the holdings of market contributors. Open curiosity might be considered on the underlying, time period, and strike ranges. On the highest degree, mixture SPX open curiosity on 1 September stood close to 14 million contracts and represented $4.9 trillion in notional worth.

Specializing in contracts that expire after the 2016 and 2020 elections reveals similarities in total configuration, with 2020 contract totals 16% above these of 2016, and the biggest positions held in December when year-end hedges are widespread. In comparison with 2016, 2020 SPX open curiosity is considerably increased within the January and March phrases, in keeping with positioning for a unstable interval extending nicely into 2021.

SPX Choice Open Curiosity

In notional phrases, 2020 post-election open curiosity stands out with complete ranges close to $20 billion, 88% above 2016, outpacing the 62.4% progress within the underlying and reflecting a bigger scale use of the contracts presently.

SPX Choice Curiosity: Notional Worth

Strike-level open curiosity presents a more in-depth have a look at the timing and market ranges managers are centered on, in addition to notional quantities concerned, topic to the understanding that multi-leg spreads, which compose practically 70% of SPX choices quantity, should be thought of.

SPX Open Curiosity by Strike, 1 September 2020 – OI>5k, Chosen Phrases

As of 1 September, positions over 5,000 contracts span a broad vary of draw back strikes, with notably giant positions close to 160,000 contracts on the 2500 and 3000 strike, representing roughly 30% and 15% draw back publicity, respectively, from the S&P 500 Index closing worth that day.

Order Circulation

Choice order circulate may give one other view on market dynamics. On the primary degree, order circulate evaluation contextualizes buying and selling exercise to establish if the customer or vendor initiated the commerce, based mostly on methods similar to side-of-market modeling, comparability of commerce value to theoretical worth, and value and implied volatility influence. With added evaluation to interpret multi-leg trades and algorithmic executions, order circulate evaluation helps establish the main target and expectations of market contributors for durations of curiosity.

SPX order circulate in post-election contracts over the previous three months is dominated by December places, which isn’t uncommon given the recognition of the product for hedging portfolios. Essentially the most lively contract, Dec 2500 places, is among the largest blocks of open curiosity in the present day, offering a hedge struck 29% beneath spot.

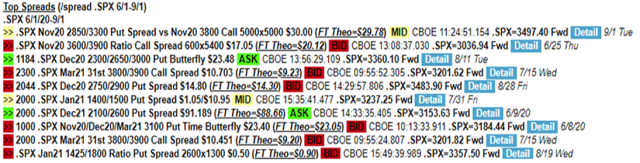

Most Energetic Inventory Choices, Combination, SPX, 1 June to 1 September 2020

A pattern of the biggest outright trades with expiration dates after the election reveals a persistent bias to places, in keeping with the long-term put/name ratio of the product close to 3:2. One of many largest blocks was opened in June, when 10,000 12/31 expiry 2500 strike places have been purchased for $90, a $90 million premium commerce with a strike 20% out of the cash that will hedge a place of $3.1 billion notional worth.

Amongst advanced orders, places made up seven of the highest 10 non-complex trades over the interval, led by a put unfold collar on 1 September, which supplies a possible acquire of $225 million within the occasion of transfer down 20% to 2850 in change for the upside danger on the 3800 (+7%) strike.

Whereas correct prediction of market habits stays elusive, index choices present a data-driven window into the collective expectations of merchants, portfolio managers, and buyers. Primarily based on the 1 September knowledge, merchants anticipate volatility to extend as 3 November approaches adopted by a sustained interval of volatility increased than that seen for many of the previous decade. Whereas the preponderance of draw back strikes isn’t uncommon, the notional worth related to positions expiring after the election is considerably bigger than the earlier cycle. This displays a mixture of year-end hedges and longer-term positions supposed to guard portfolios and replicate the views of managers.

That is the second installment of a sequence from the Index Trade Affiliation (IIA). Cboe is a member of the IIA and helps the Affiliation’s objectives of independence, transparency, and competitors of index suppliers.

In case you preferred this publish, don’t overlook to subscribe to the Enterprising Investor.

All posts are the opinion of the writer. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially replicate the views of CFA Institute or the writer’s employer.

Picture credit score: ©Getty Pictures / photovs

[ad_2]