[ad_1]

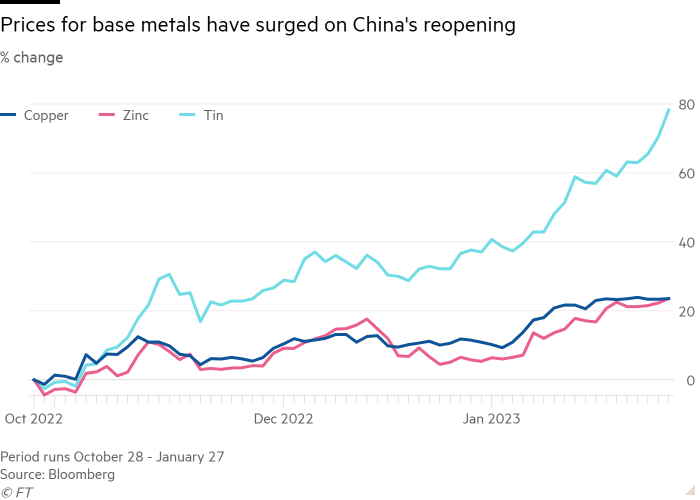

Industrial metals have ripped increased since November on bets that China’s reopening will increase demand for uncooked supplies.

A bunch of “base metals” led by tin, zinc and copper have surged greater than 20 per cent in three months, additional supported by the US Federal Reserve signalling a slowdown within the tempo of rate of interest rises and a softening within the US greenback, which importers use to purchase commodities.

Star performer tin has rocketed nearly 80 per cent to $32,262 per tonne, the best stage since June, whereas copper costs have rallied by a tenth this month to $9,329 per tonne on brighter prospects for China’s economic system following the easing of its zero-Covid insurance policies.

Traders have largely shrugged off issues about slowing manufacturing exercise within the face of unprecedented coronavirus outbreaks in Asia’s largest economic system.

“On the starting of the 12 months everybody got here in very nuanced, saying we had been going to have a [global] recession, that copper would dip within the first quarter after which go increased, however we’ve achieved precisely the alternative,” mentioned Al Munro, a dealer at Marex. “Cash stream is what has pushed metals in 2023 to this point, and that’s a couple of China reopening story.”

Mining trade executives say the present state of affairs marks a stark reversal from just a few months earlier when sentiment was weak however bodily shopping for from Chinese language clients remained sturdy.

“It has shifted between the place we had been that perceptions had been dangerous and on-the-ground was good, to now perceptions are higher however on-the-ground is unsure,” mentioned Richard Adkerson, chief govt of Freeport-McMoRan, one of many world’s largest copper producers.

Jeremy Pearce, who leads market intelligence on the Worldwide Tin Affiliation, mentioned that a lot the identical may very well be mentioned of the steel used primarily to solder electronics.

“The problem is all demand indicators are very damaging as international manufacturing buying managers’ indices have been nosediving,” he mentioned. “The demand image is the alternative and disconnected from the worth.”

Additional fuelling the rally for some base metals has been a spate of provide disruptions from protests roiling copper and tin producers in Peru and manufacturing snags in Chile, to Indonesia stalling export license renewals for tin smelters forward of a mooted tin ingot export ban.

The value of tin, which is turning into more and more strategic due to its use in photo voltaic panels and microchips, has additionally been pushed increased by speculative shopping for by China, resulting in a construct in inventories.

Regardless of weak demand, final 12 months China swung from web exports of 9,000 tonnes in 2021 to web imports of 20,000 tonnes, in keeping with Amalgamated Metallic Buying and selling, a metals brokerage.

“To what extent is it merchants or governments constructing the inventories up?” asks Daniel Smith, head of analysis at AMT. “If it’s the federal government then they might sit on it longer”, which might maintain costs increased long term.

[ad_2]