[ad_1]

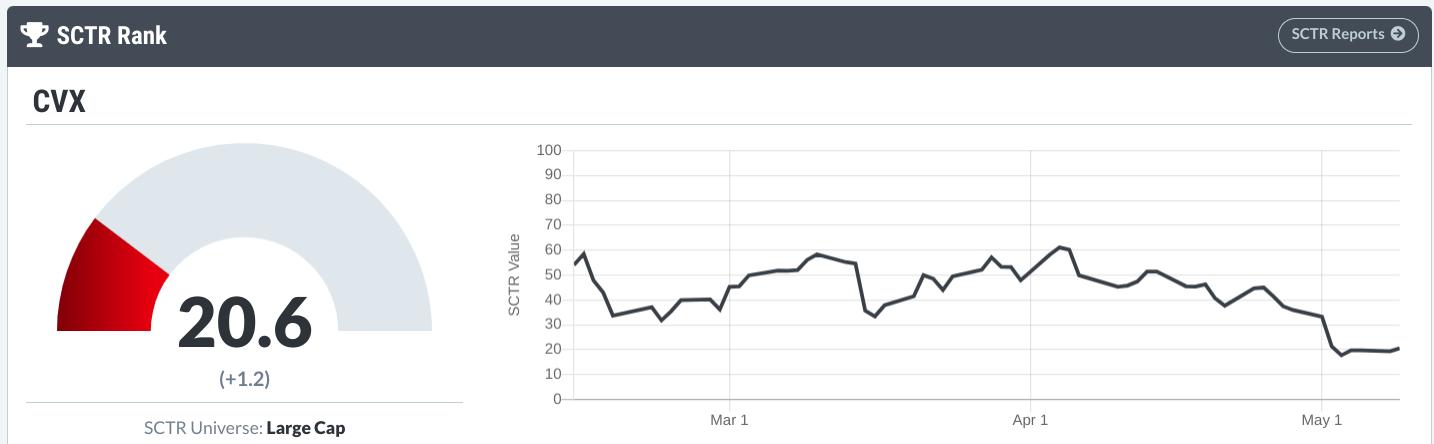

Chevron’s (CVX) technical well being might be in higher form based on quite a few indicators greatest summed up by the StockCharts Technical Rank (STCR) rating. Speaking about underwhelming efficiency, CVX is clearly in decline.

However a decline from the place and to what? (A greater query, maybe). CVX is declining from its all-time excessive of $186.57, which it hit final November. The inventory is sitting between its 52-week excessive and 52-week low of $129.20. However the place’s it going?

Proper now, CVX is just some factors above a rising development line that may be traced way back to July 2022. On one hand, CVX’s technical outlook appears a little bit precarious, particularly if it breaks under the development line. Nonetheless, we now have to ask if there’s some other motive—technically or essentially—why CVX would possibly maintain.

The Elementary Image

Chevron is Berkshire Hathaway’s third-largest holding and among the many firm’s dividend-yielding shares. The value of oil is more likely to stay at comparatively excessive ranges because of restricted provide, steady demand, and geopolitical tensions. Chevron is well-positioned to learn from this.

However CVX does not essentially depend on excessive oil costs to revenue. The corporate has each “upstream” and “downstream” operations. This implies CVX can revenue from downstream operations when crude oil costs are low or static. Plus, the corporate’s dividend appears dependable, making CVX a stable alternative for investing within the vitality sector.

Enter CVX within the Image Abstract software to take a look at firm dividends.

The Technical Image

The 50-under-the-200 SA crossing (aka Demise Cross) seems to bear down, like a crushing weight, towards the promising development line (inexperienced) that is beginning to look a little bit skinny. One other potential problem for upward momentum is the “native” swing excessive at $172.88. This value level have to be surpassed to overturn the inventory’s six-month downward development. It additionally aligns with the Quantity by Worth indicator’s longest bar on the $172 vary. These factors counsel the probability of sturdy resistance due to its historic promoting stress.

On the upside, CVX appears to be armed with a powerful Q1 2023 earnings shock that bucked declining oil costs, a powerful upstream/downstream enterprise mannequin, a rising trendline, a pleasant bounce from an oversold Stochastic Oscillator studying, and an RSI low.

The upside case could not appear to be a lot. However on this geopolitically-charged house that just about powers the worldwide economic system, sturdy basic prospects, paired with simply sufficient of a technical catalyst, could also be ample to set off a contrarian reversal.

Buying and selling CVX

For commerce entry concepts, let’s change to the StockChartsACP platform.

A comparatively secure early entry could be upon a breakout of the downsloping trendline (see dashed blue line). Robust quantity could be preferable.

There are two locations you would possibly wish to contemplate in your cease loss. The primary is correct under the rising trendline (highest crimson horizontal line). That is not a set place; it may be a trailing cease for wherever the development line occurs to be on the time of entry. The second cease could be under the native low, at round $150.00.

So far as your revenue goal is worried, it will depend on whether or not you are seeking to maintain on for the lengthy haul (an funding place) or a swing commerce. When you’re swing buying and selling this place, resistance on the $170 and $186 vary would make sense.

The Backside Line

Chevron presents a fancy funding panorama that intertwines technical and basic realities.

Though the technical outlook is considerably precarious, there are encouraging indicators to counter overly-bearish sentiment. The elemental case stays promising. CVX is a significant holding for Berkshire Hathaway, indicating notable investor confidence, and its diversified enterprise mannequin permits it to revenue in various oil value circumstances. Moreover, the corporate’s constant dividend makes it a sexy alternative for income-focused traders. Nonetheless, lots can change in a short while. So, if you wish to add CVX to your portfolio, regulate each (technical and basic) elements when planning your entry.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Karl Montevirgen is knowledgeable freelance author who makes a speciality of finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Sequence 3 and Sequence 34 licenses along with a twin MFA in crucial research/writing and music composition from the California Institute of the Arts.

Study Extra

Subscribe to Do not Ignore This Chart! to be notified every time a brand new submit is added to this weblog!

[ad_2]