[ad_1]

As I’ve already talked about this morning, I spent final night studying speeches by members of the Financial institution of England Financial Coverage Committee while watching protection of Trump. I’ve already commented on Trump. Let me now flip to the Financial institution of England.

There have been two speeches. One was by chief economist Huw Tablet. It was the same old bilge that Tablet all the time has to supply. Because the Financial institution mentioned of the speech:

On this speech Huw Tablet discusses the outlook for the financial system, together with how decrease vitality costs would possibly push down on inflation within the quick time period, however may additionally enhance demand and due to this fact influence inflation within the medium time period. He stresses that the MPC should proceed to watch how these exterior shocks to inflation would possibly grow to be embedded within the financial system, and due to this fact danger persistently excessive domestically pushed inflation.

If I decode that Tablet is saying that he is aware of worth will increase are going to gradual and quickly. However, for a excessive interest-rate fetishist like Tablet that is no good cause to suppose that the battle on inflation is over. As a substitute, he says {that a} discount within the charge of worth will increase will launch all our animal spirits (despite the fact that wage charges are lagging far behind worth rises) and we are going to all go on a spending spree (though with what cash, since persons are working wanting it, he doesn’t say) and in consequence, inflation will growth once more.

All I can presume that Tablet is describing is the potential behaviour of his personal equally very well-heeled mates, as a result of in the true world this isn’t going to occur. However then Tablet is aware of he has an obligation to these mates to maintain charges up. In any case, they are going to be incomes optimistic charges on curiosity on their financial savings very quickly if he manages to take action, and that’s as they want it. Blow the remainder of us. Tablet believes persons are pushed by self-interest, and he brings that perception to his job.

Politely, Tablet is speaking whole nonsense.

The speech by Professor Silvana Tenreyro, an impartial member of the committee whose time on it is extremely almost up, was very way more attention-grabbing. She has opposed rate of interest rises for a lot of months now. I’ll ignore her feedback on QE for the second, fascinating and equally possibly a bit of disingenuous as they’re as a result of I believe she is aware of that there’s way more to that difficulty than she mentions within the speech. As a substitute, I’ll think about her feedback on what the Committee must do proper now, which got here on the finish of the speech. She mentioned:

With Financial institution Charge transferring additional into restrictive territory, I believe a looser stance is required to fulfill the inflation goal within the medium time period. Usually, a looser stance could be achieved both by means of decrease Financial institution Charge at this time, or by means of decrease Financial institution Charge in future… So I count on that the excessive present stage of Financial institution Charge would require an earlier and sooner reversal [of interest rate policy], to keep away from a major inflation undershoot.

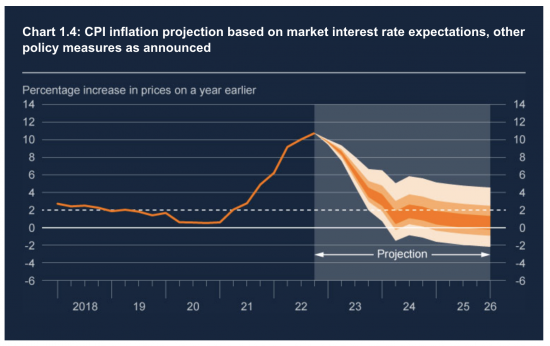

Her opinion is, in that case, diametrically against that of Tablet. She needs larger and sooner cust in financial institution base charge, as Danny Blancflower and I’ve referred to as for. Her cause is easy: she thinks it possible that the inflation charge is not going to solely get to 2% a lot sooner than the MPC suggests at current, however has a really actual likelihood of turning detrimental, as was forecast by the MPC in February. Preserving charges excessive now would, in her view, make the probability of this very a lot stronger. And because the Financial institution is supposed to ship a charge of two% a right away reduce in charge is, in Professional Tenreryo’s view, important.

I couldn’t agree along with her extra. The proof all stacks in her favour, and none of it does in favour of Tablet. Right here is the important chart from Februray:

That is an MPC forecast displaying deflation is probably going. She is just confirming that probability. Tablet is in fantasy land off the upward scale of the projection.

The query is, who will win this argument? I’ve little doubt Tablet will. Depart misogyny and the truth that Prof Tenreyro is leaving out of it. I believe that the Financial institution of England is ready on a course of destruction, of which Governor Andrew Bailey and Huw Tablet are the architects and the remainder of the employed apparatchiks on the Financial institution is not going to dare problem them, and they also will get their manner.

The worth of this folly shall be paid by us all. The times of getting an impartial central financial institution should be numbered.

[ad_2]