[ad_1]

After we wrote Tips on how to Develop Your Wealth in 2023, we started with

- Chaos

- Making an attempt to Match a Sq. Peg right into a Spherical Gap

- Searching for Inflation in All of the Mistaken Locations

Might now we have recognized on the time what headlines would emerge? No. But what was apparent is that “from central banks to sovereign spending and borrowing to geopolitics to anti-globalism to ongoing uncooked materials points and meals shortages to rising world debt--nothing is because it was.“

Insert headline?

Listed below are a number of:

- Charges: Whereas ECB raises .50, additionally they say they may cap at 4%

- Banks: Regional Banks ETF appears to be like decrease nonetheless with SIVB submitting Chapter 11

With $300 Billion added to steadiness sheet, that is the alternative of QT, and indicators an additional lack of management.

Banks borrowed $165 billion from the FED, which is greater than in 2008.

Extra from the Outlook on the U.S. Greenback

“Most regarding is that, if greenback drops (simply fell from 114 in September to beneath 104 this previous week) then what?

“Will the speed matter in any respect within the battle towards inflation?”

And so, our prime choose for 2023 was and nonetheless is gold.

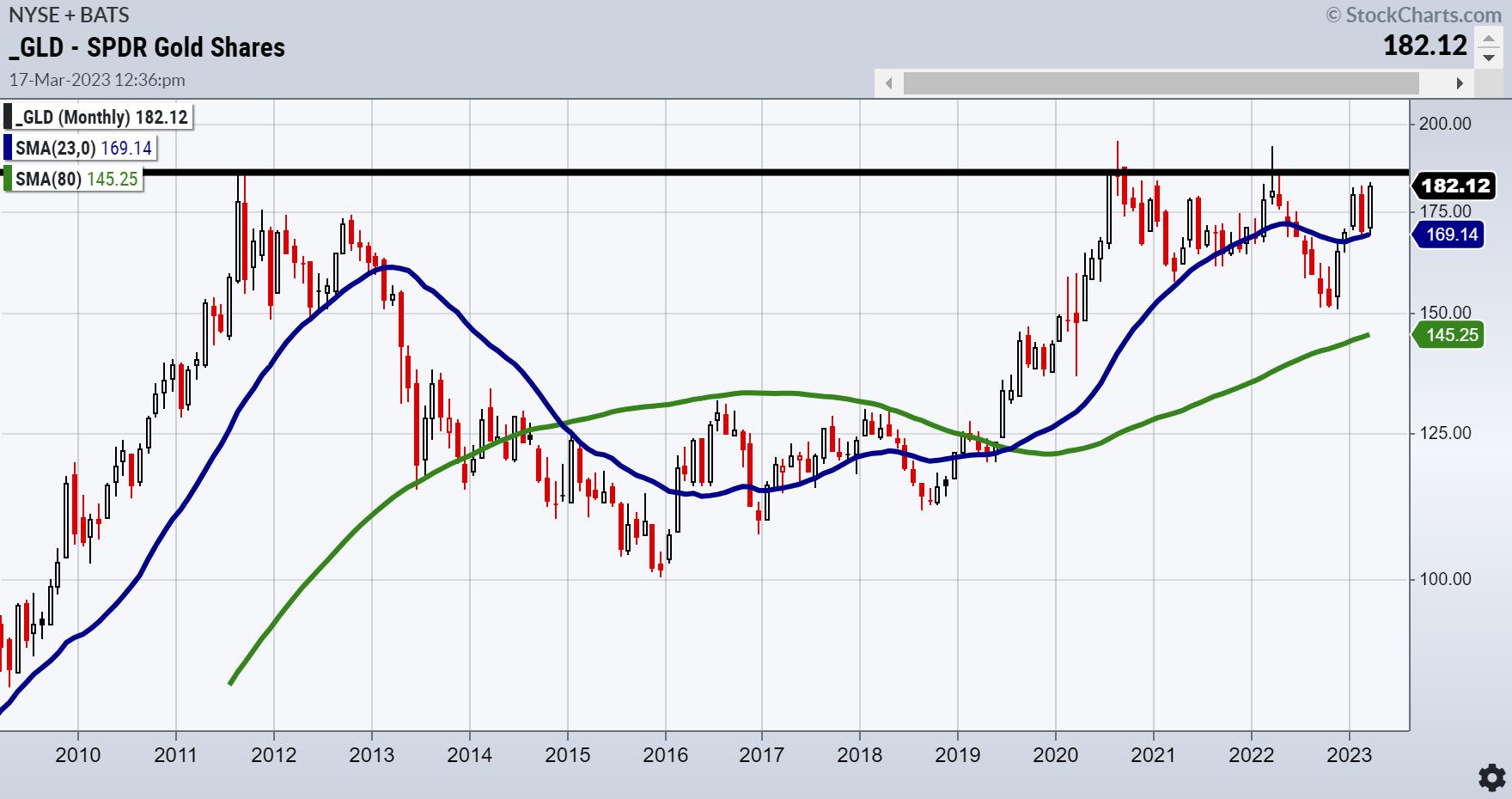

That is the month-to-month chart of gold as seen via the ETF GLD. It dates to pre-2011, when gold was rising after the 2008 disaster.

In August 2011 one other large headline hit the market:

In August 2011, gold ran as much as 184.82 earlier than the political dance resolved and everybody performed good once more.

Since then, as seen within the thick horizontal line you see that stretches throughout the web page to this month, GLD has not had a month-to-month shut above these 2011 highs. Nevertheless, in August 2020 the GLD every day excessive was a short-lived pop to 194.45, but later that month GLD closed a lot decrease.

Technicians can see this chart in 2 methods. First, as triple, and even quadruple tops round 184-185. Alternately, an enormous inverted 12-year head and shoulders backside, which if the neckline clears, measures the gold transfer to round 260. Just about near the 2023 name for gold to double or go to round $3000 an oz.

You determine which facet of the TA name you wish to be on. Nevertheless, watch the greenback as your finest indicator.

Below 104, inflation hits us in 2 methods: Excessive value of products and decrease buying energy. In fact, preserve chaos in your evaluation, assuming now we have but to see all of the ripple results of latest headlines (to not point out China, Russia, North Korea all persistently on the again burner).

Neglect the Analysts, Observe the Math

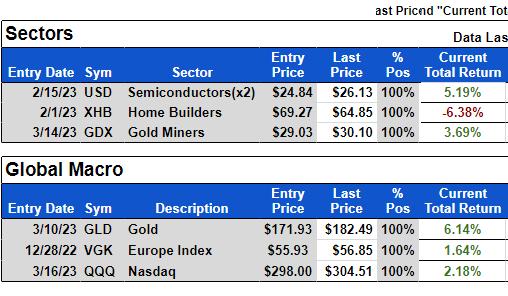

Above is MarketGauge’s GEMS World Macro (World Equities: Macro Sectors). Present holdings based mostly on MG’s proprietary indicators present GLD and gold miners GDX within the portfolio. Moreover, the mannequin holds NASDAQ QQQ and Semiconductors. It is going to be fascinating to see how the quants will resolve going ahead.

Lastly, take a look at my interview with Dave Keller on The Last Bar. A lot of wonderful info.

For extra detailed buying and selling details about our blended fashions, instruments and dealer training programs, contact Rob Quinn, our Chief Technique Advisor, to study extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-E book in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

Mish sits down with Kristen on Cheddar TV’s closing bell to speak what Gold is saying and extra.

Mish and Dave Keller of StockCharts take a look at long run charts and focus on motion plans on the Thursday, March 17 version of StockCharts TV’s The Last Bar.

Mish covers present market situations strengths and weaknesses on this look on CMC Markets.

Mish sees alternative in Vietnam, is buying and selling SPX as a spread, and likes semiconductors, as she explains to Dale Pinkert on ForexAnalytix’s F.A.C.E. webinar.

Mish and Nicole focus on particular inventory suggestions and Fed expectations on TD Ameritrade.

Coming Up:

March twentieth: Madam Dealer Podcast with Ashley Kyle Miller

March twenty second: The RoShowPod with Rosanna Prestia

March twenty fourth: Opening Bell with BNN Bloomberg

March thirtieth: Your Each day 5, StockCharts TV

March thirty first: Competition of Studying Actual Imaginative and prescient “Portfolio Physician”

April 24-26: Mish at The Cash Present in Las Vegas

Might 2-5: StockCharts TV Market Outlook

- S&P 500 (SPY): 390 pivotal and 380 help.

- Russell 2000 (IWM): Nonetheless weak comparatively — 170-180 vary now.

- Dow (DIA): 310 help, 324 resistance.

- Nasdaq (QQQ): 328 is the 23-month MA resistance, 300 help.

- Regional banks (KRE): 44 help, 50 resistance — nonetheless appears to be like like decrease in retailer.

- Semiconductors (SMH): 255.64 final month’s excessive. 248 nearest help.

- Transportation (IYT): Clutch maintain 218 and must clear 224 weekly shut.

- Biotechnology (IBB): Closed contained in the prior week’s buying and selling vary.

- Retail (XRT): 60 massive help and 64 massive resistance.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For practically 20 years, MarketGauge.com has supplied monetary info and training to hundreds of people, in addition to to massive monetary establishments and publications reminiscent of Barron’s, Constancy, ILX Techniques, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary individuals to comply with on Twitter. In 2018, Mish was the winner of the Prime Inventory Choose of the 12 months for RealVision.

Subscribe to Mish’s Market Minute to be notified each time a brand new put up is added to this weblog!

[ad_2]