[ad_1]

Development Reversal methods are most likely the tougher kinds of buying and selling methods. It’s because pattern reversals assume that merchants might appropriately guess when the pattern would finish and time the reversal precisely. Guessing a market pattern’s reversal could be very exhausting to do. Developments often have momentum behind it. Like the rest, stopping an object with momentum behind it’s troublesome. Nonetheless, it may very well be executed.

So, how do you intelligently time the reversal of a market? It’s through the use of instruments that will enable you to establish if the market is close to its peak or trough. It’s because each time the market pattern is close to its peak or trough, momentum tends to decelerate. Consider it this manner, in case you would throw a ball up within the air you utilized momentum behind the ball. Nonetheless, because the ball is nearing its peak the vertical momentum that it has begins to decelerate. The following factor you’d observe is that the ball would fully reverse and speed up its fall. The identical is true with buying and selling. As worth reaches its peak, momentum fades after which it reverses. The secret is in having a device that will assist us assess if worth is nearing or is at its peak. Then, because the pattern begins to reverse, we use one other device to evaluate if worth’s reversal is selecting up.

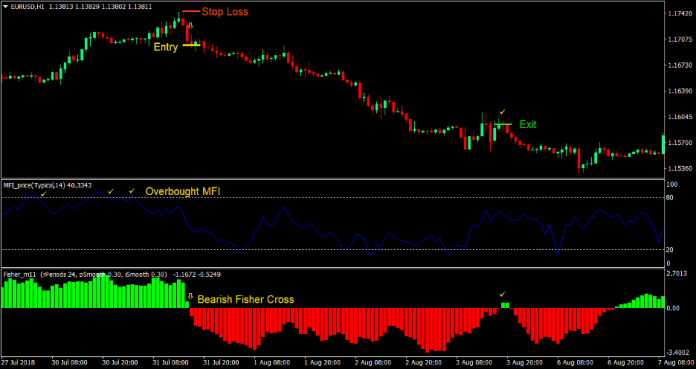

Cash Movement Reversal Foreign exchange Buying and selling Technique makes use of a imply reversal indicator to evaluate if worth is at its peak and a pattern following indicator to verify the pattern reversal.

Cash Movement Index

Cash Movement Index (MFI) is an oscillating indicator which identifies oversold and overbought market circumstances. It’s a bounded oscillating indicator which ranges from zero to 100. Merchants often make use of the 20 – 80 vary as the conventional vary. Each time the MFI line falls beneath 20, merchants would often take into account the market as oversold. Then again, the market can be often thought-about overbought each time the MFI line goes over 80.

The MFI is very like many different oscillating indicators such because the Relative Energy Index (RSI). They’ve the identical traits and are bounded oscillating indicators which permit merchants to learn overextended market circumstances. Nonetheless, they defer in a single factor, the incorporation of quantity. Whereas the RSI computes oscillations based mostly on worth motion alone, the MFI consists of quantity in its computation. Lets say that the MFI is very like a quantity weighted RSI.

When contemplating developments and pattern reversals, momentum is essential. Momentum consists of two variables, quantity and worth or the pace of worth modifications. On condition that quantity ought to be thought-about when momentum, MFI would possibly give a extra full image as a momentum-based oscillating indicator.

The Fisher Indicator

The Fisher Indicator is a pattern following oscillating indicator which signifies the pattern utilizing histogram bars. Constructive histograms are coloured lime and signifies a bullish market situation, whereas destructive histograms are coloured crimson and signifies a bearish market situation.

The Fisher Indicator is a probability-based indicator. It assumes that the likelihood of worth going a sure path isn’t equal. It assumes that worth tends to maneuver in direction of the path of the pattern extra usually than in opposition to it. The Fisher indicator tends to be an excellent indicator for figuring out the overall mid-term pattern path. It doesn’t change too usually, but on the similar time it’s not too lagging as in comparison with different indicators. With the correct parameters, the Fisher Indicator often exhibits reversal alerts at roughly the identical time as when momentum candles break diagonal helps and resistances, that are typical throughout trending market circumstances.

Buying and selling Technique

This buying and selling technique is a pattern reversal buying and selling technique which is initiated by an overextension of a pattern.

To establish doable imply reversal entry setups, we might be making use of the Cash Movement Index indicator. Commerce setups that aren’t initiated by an overextended market situation as indicated by the Cash Movement Index ought to be filtered out. Bullish pattern reversals ought to start from when the market is at an oversold situation, whereas bearish pattern reversals ought to start from overbought circumstances.

Then, because the overextended circumstances are met, we look ahead to the affirmation of a pattern reversal utilizing the Fisher Indicator. Entry alerts are generated by the crossing over of the histogram bars or its altering of colours. The commerce path ought to have the same opinion with the path of the MFI imply reversal commerce setup.

Indicators:

- MFI_price

- ExtMFIPeriod: 14

- Applied_price: 5

- Fisher_m11

Timeframe: 1-hour, 4-hour and each day charts

Forex Pairs: main and minor pairs

Buying and selling Session: Tokyo, London and New York periods

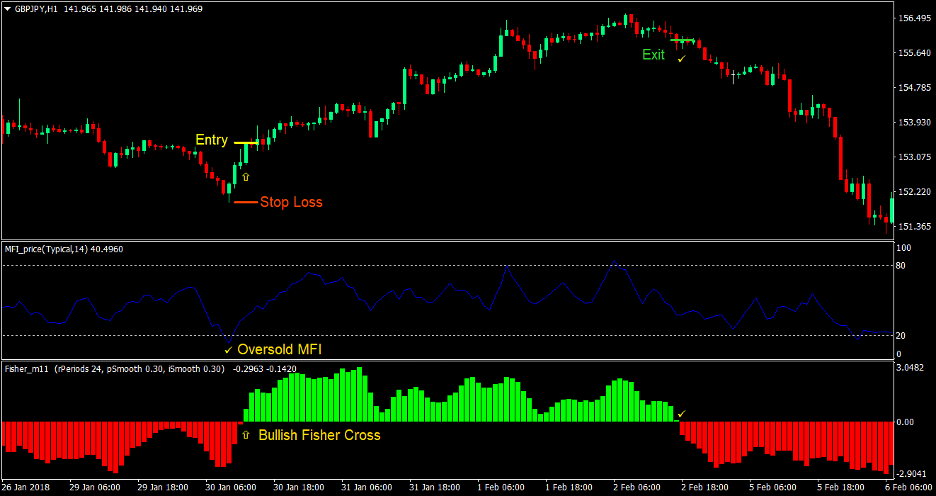

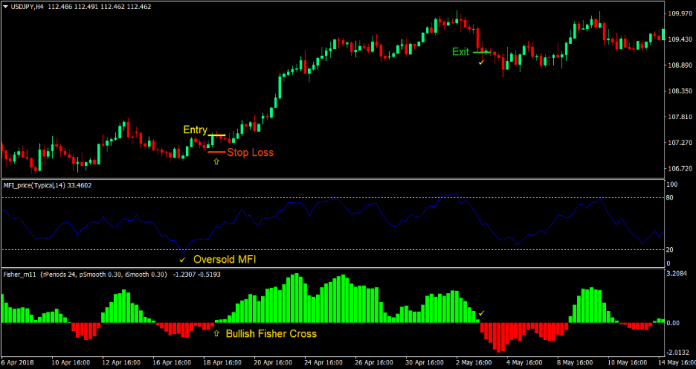

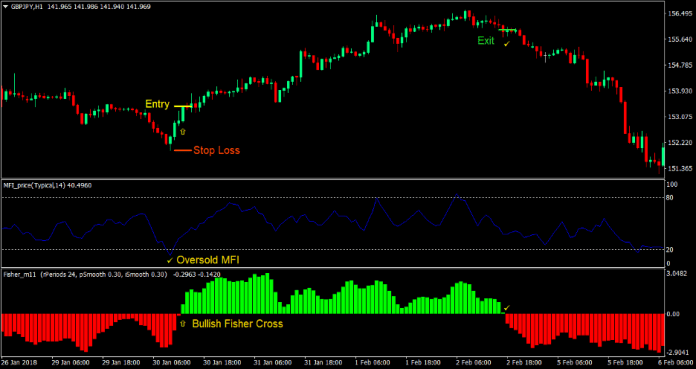

Purchase Commerce Setup

Entry

- The MFI line ought to go beneath 20 indicating an oversold market situation

- The Fisher indicator ought to crossover above zero and alter to lime indicating a bullish pattern reversal

- These reversal circumstances ought to be considerably shut to one another

- Enter a purchase order on the confluence of the above circumstances

Cease Loss

- Set the cease loss on the help stage beneath the entry candle

Exit

- Shut the commerce as quickly because the Fisher indicator modifications to crimson

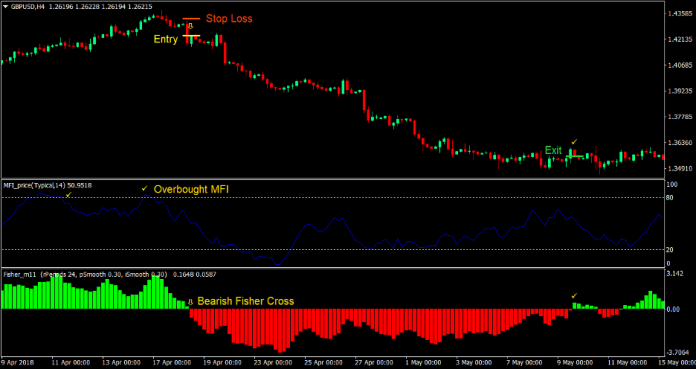

Promote Commerce Setup

Entry

- The MFI line ought to go above 80 indicating an overbought market situation

- The Fisher indicator ought to crossover beneath zero and alter to crimson indicating a bearish pattern reversal

- These reversal circumstances ought to be considerably shut to one another

- Enter a promote order on the confluence of the above circumstances

Cease Loss

- Set the cease loss on the resistance stage above the entry candle

Exit

- Shut the commerce as quickly because the Fisher indicator modifications to lime

Conclusion

The Cash Movement Reversal Foreign exchange Buying and selling Technique is a superb buying and selling technique which mixes each imply reversal and momentum buying and selling.

Imply Reversal buying and selling methods are inclined to have larger returns as soon as the reversal outcomes into a brand new pattern. However how will we get to anticipate imply reversal commerce setups that might outcome to a brand new pattern? This buying and selling technique does that. It anticipates imply reversals utilizing the MFI indicator and confirms the brand new momentum based mostly pattern utilizing the Fisher indicator.

Foreign exchange Buying and selling Methods Set up Directions

Cash Movement Reversal Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the gathered historical past information and buying and selling alerts.

Cash Movement Reversal Foreign exchange Buying and selling Technique gives a chance to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional worth motion and alter this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Methods to set up Cash Movement Reversal Foreign exchange Buying and selling Technique?

- Obtain Cash Movement Reversal Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Cash Movement Reversal Foreign exchange Buying and selling Technique

- You will notice Cash Movement Reversal Foreign exchange Buying and selling Technique is offered in your Chart

*Word: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]