[ad_1]

Helps and Resistances are key ranges wherein merchants ought to look out for. These are ranges wherein worth tends to search out it tough to interrupt by way of.

There are a number of eventualities which couple of eventualities which frequently happen on legitimate help and resistance areas. At instances, worth would break by way of such areas. This situation is named a momentum breakout situation which might happen as a breakout from a resistance stage or a breakdown from a help stage. Usually instances, worth would bounce off these ranges. Value would typically reverse again down because it hits a legitimate resistance stage or bounce again up because it hits a legitimate help stage. There are different eventualities which might happen corresponding to a false breakout, wherein case worth would quickly pierce the help or resistance stage as if it might breakout, then reverse simply as an everyday bounce.

In any case, buying and selling on help and resistance areas might be a legitimate buying and selling technique with an excellent potential for earnings due to the exercise that normally happen on these ranges. The query now’s how do we discover legitimate help or resistance ranges?

There are several types of helps and resistances. There are the horizontal helps and resistances, that are like provide and demand zones which have proven to be revered by worth. There are additionally the diagonal help and resistance traces, that are recognized by connecting swing factors and plotting trendlines.

On this technique nonetheless, we might be taking a look at buying and selling bounces off of a dynamic space of help or resistance utilizing a customized technical indicator.

Dynamic helps and resistances are normally recognized based mostly on transferring averages. These are transferring common traces which worth tends to bounce off from every time it’s revisited.

Carter MA

Carter MA is a customized technical indicator which relies on a set of modified transferring averages. Merchants typically use quite a lot of technical averages to symbolize the short-term, mid-term and long-term tendencies. Carter MA plots a set of extensively used transferring averages which many merchants use a foundation for making their commerce selections.

Carter MA plots 5 transferring common traces with transferring common durations as follows: 8, 21, 50, 100 and 200.

Merchants can use these traces to determine the final path of the pattern based mostly on how these transferring common traces are stacked.

Merchants can even the areas in between or close to the traces to determine dynamic areas of helps and resistances the place worth are likely to bounce off from.

Relative Power Index

The Relative Power Index (RSI) is a extensively used momentum indicator which is an oscillator sort of technical indicator. It identifies momentum based mostly on an underlying computation of historic worth actions.

The RSI plots a line that oscillates throughout the vary of 0 to 100 with a median at stage 50. An RSI line above 50 usually signifies a bullish pattern bias, whereas an RSI line beneath 50 signifies a bearish pattern bias.

It additionally sometimes has markers at stage 30 and 70. Imply reversal merchants determine an RSI line beneath 30 as an oversold market, whereas an RSI line above 70 signifies an overbought market. Each situations are prime for imply reversal eventualities.

Momentum merchants alternatively might determine breaches of those ranges as a sign of sturdy momentum. All of it boils right down to how worth motion is behaving because the RSI line reaches these ranges.

Many merchants additionally add the degrees 45 and 55 to assist them in figuring out tendencies. Degree 45 acts as a help for the RSI line in a bullish trending market, whereas stage 55 acts as a resistance for the RSI line in a bearish trending market.

Buying and selling Technique

Carter MA Dynamic Space Bounce Foreign exchange Buying and selling Technique is an easy pattern following technique based mostly on the idea of bounces off dynamic help and resistance ranges.

The dynamic help and resistance ranges are based mostly on the Carter MA traces. The areas adjoining to the blue transferring common line acts because the dynamic areas of help or resistance. You will need to observe that worth motion ought to have beforehand revered the realm as help or resistance to be a legitimate dynamic help or resistance the subsequent time worth revisits the extent.

The RSI line acts as a affirmation of the pattern. The RSI line ought to respect ranges 45 and 55 as help or resistance ranges.

Commerce alerts are legitimate as worth closes again exterior the inexperienced line and the RSI line breaks out of ranges 45 or 55 within the path of the pattern.

Indicators:

- Carter_MA

- Relative Power Index

Most well-liked Time Frames: 1-hour, 4-hour and day by day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

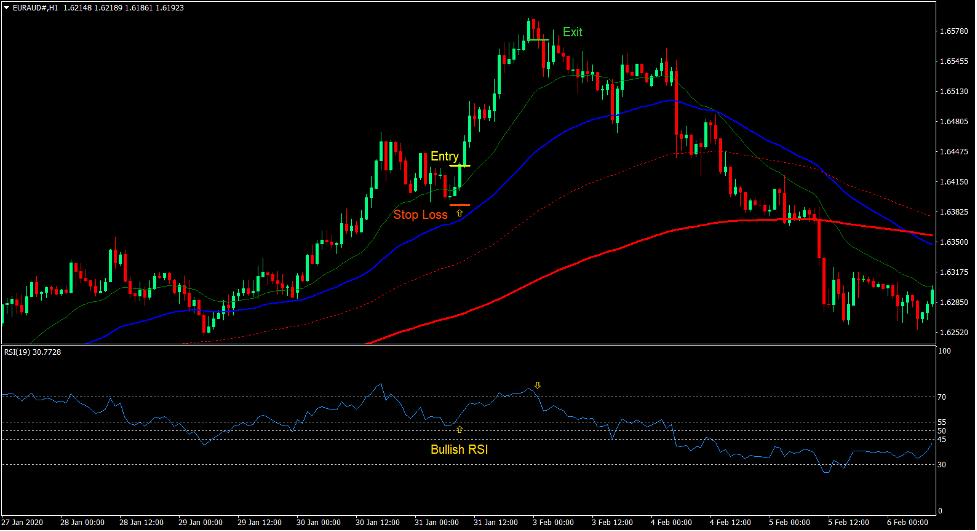

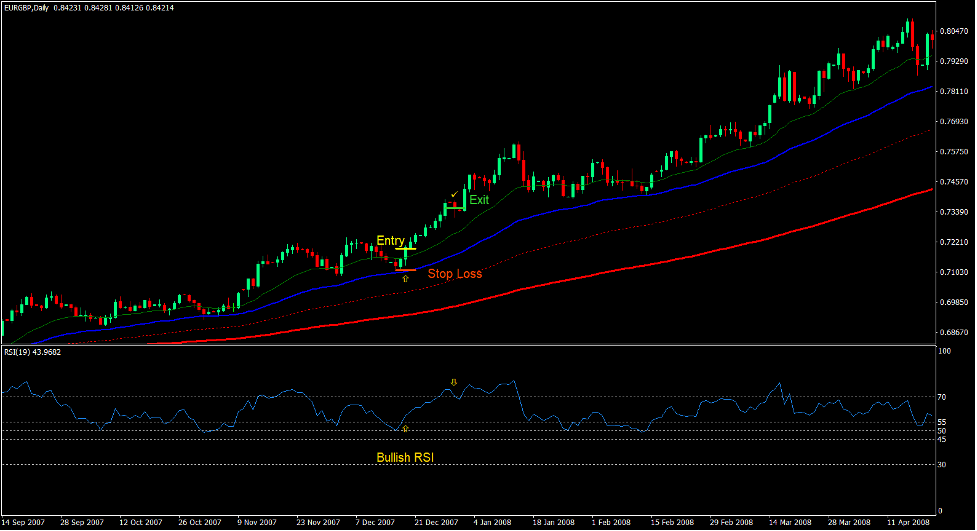

Purchase Commerce Setup

Entry

- The Carter MA traces needs to be stacked within the following order:

- Inexperienced line: prime

- Blue line: second from the highest

- Dotted purple line: second from the underside

- Strong purple line: backside

- Value ought to have beforehand bounced off the realm adjoining to the blue line.

- Value ought to retrace again in the direction of the realm close to the blue line.

- Value ought to shut above the inexperienced line.

- The RSI line ought to cross above 55.

- Enter a purchase order on the affirmation of those situations.

Cease Loss

- Set the cease loss on a help stage beneath the entry candle.

Exit

- Shut the commerce because the RSI line crosses again beneath 70 after a bullish momentum breakout.

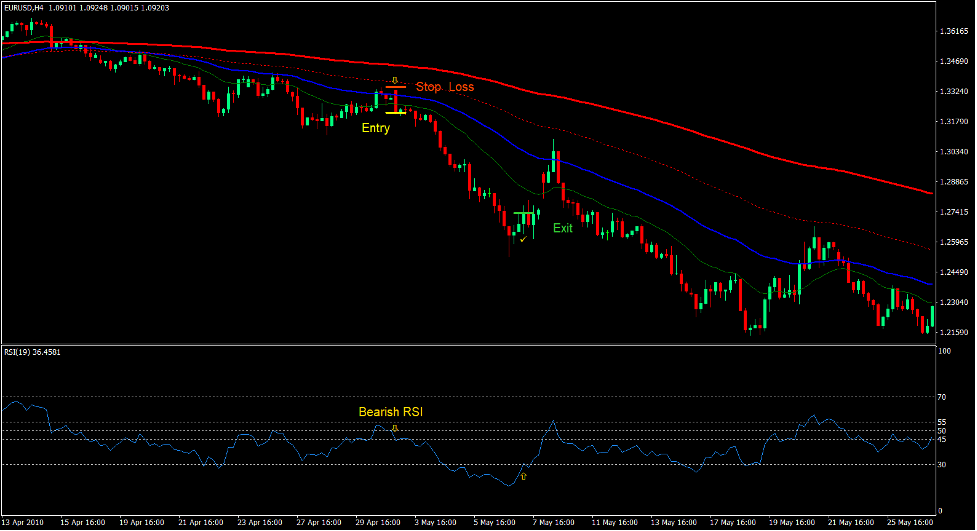

Promote Commerce Setup

Entry

- The Carter MA traces needs to be stacked within the following order:

- Inexperienced line: backside

- Blue line: second from the underside

- Dotted purple line: second from the highest

- Strong purple line: prime

- Value ought to have beforehand bounced off the realm adjoining to the blue line.

- Value ought to retrace again in the direction of the realm close to the blue line.

- Value ought to shut beneath the inexperienced line.

- The RSI line ought to cross beneath 45.

- Enter a promote order on the affirmation of those situations.

Cease Loss

- Set the cease loss on a resistance stage above the entry candle.

Exit

- Shut the commerce because the RSI line crosses again above 30 after a bearish momentum breakout.

Conclusion

This easy pattern following technique is a working technique which many beneficial merchants use. Regardless of its simplicity, the setups produced by this technique are likely to work rather well.

The important thing to buying and selling this technique efficiently is find a foreign exchange pair that’s trending sufficiently. This may be recognized based mostly on the traits of worth motion, whether or not it’s plotting larger or decrease swing factors.

Foreign exchange Buying and selling Methods Set up Directions

Carter MA Dynamic Space Bounce Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past knowledge and buying and selling alerts.

Carter MA Dynamic Space Bounce Foreign exchange Buying and selling Technique gives a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional worth motion and regulate this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Methods to set up Carter MA Dynamic Space Bounce Foreign exchange Buying and selling Technique?

- Obtain Carter MA Dynamic Space Bounce Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Carter MA Dynamic Space Bounce Foreign exchange Buying and selling Technique

- You will note Carter MA Dynamic Space Bounce Foreign exchange Buying and selling Technique is offered in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]