[ad_1]

Capital One is a well known monetary establishment that made its identify within the bank card enterprise. Actually, its hottest bank cards – Capital One Quicksilver Money Rewards Credit score Card and Capital One Enterprise Rewards Credit score Card – routinely make our lists of the greatest money again bank cards and greatest journey rewards bank cards, respectively.

Capital One 360, one in all its main divisions, gives a associated, if much less attractive, suite of merchandise: FDIC-insured on-line banking and private lending companies. When you’re not happy with the brick-and-mortar banking choices in your space, then Capital One 360 ought to be in your radar.

Capital One 360’s standout product is the 360 Efficiency Financial savings Account, or Efficiency Financial savings for brief. It boasts probably the greatest rates of interest of any high-yield financial savings account, tremendous low charges, and a slew of user-friendly options and capabilities. Learn on to study why it stands out from the competitors.

Key Options of the Capital One 360 Efficiency Financial savings Account

The Capital One 360 efficiency Financial savings Account isn’t revolutionary by any means. Nevertheless it has some notable options that set it aside from competing accounts at different widespread on-line banks.

Account Yield

This account gives a variable yield. At 3.50% APY, it’s very aggressive with different on-line financial savings merchandise.

This yield applies to all eligible balances, no matter relationship standing.

Minimal Balances

This account requires no minimal opening deposit and doesn’t have an ongoing stability requirement.

Month-to-month Upkeep Charges

360 Efficiency Financial savings doesn’t cost month-to-month upkeep charges. You’ll by no means pay a price to maintain cash on deposit right here.

A number of Accounts Underneath the Identical Possession

You possibly can open a number of 360 Financial savings accounts without delay, making it rather a lot simpler to separate and handle goal-oriented stockpiles. The method for opening your second account (and past) is identical as for the primary, minus the preliminary identification verification steps.

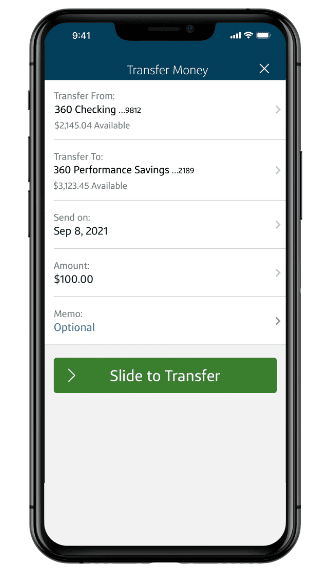

Hyperlink to Your Capital One 360 Checking Account

You possibly can hyperlink your 360 Financial savings account along with your 360 Checking account when you have one. That is handy in case you use Capital One 360 as your major financial institution and have to raid your financial savings account every now and then to make massive purchases — or, ideally, to prime up your financial savings account everytime you receives a commission.

Transfers between your Capital One checking and financial savings accounts happen instantaneously, even outdoors common enterprise hours.

Children’ Financial savings Account

Capital One 360 additionally gives Children Financial savings accounts for kids underneath age 18. They’re principally the identical as 360 Efficiency Financial savings accounts, besides they are often configured as custodial accounts – a worthwhile instrument for instructing the following era learn how to spend and save correctly.

360 Efficiency Financial savings — IRA Choices

You possibly can construction your Efficiency Financial savings Account as a conventional or Roth IRA. While you do, your account earns tax-free curiosity — boosting your return over time due to the magic of compound curiosity.

There’s not a lot daylight between customary taxable and IRA financial savings accounts at Capital One. Yields are the identical, the FDIC insurance coverage restrict is identical, and all the identical digital options and capabilities apply.

Simply bear in mind that in case you haven’t but hit the age threshold to start taking required minimal distributions (RMDs), you possibly can’t withdraw out of your IRA financial savings account with out triggering a tax penalty. This penalty will depend on the kind of account; when you have a standard IRA, you’ll additionally have to pay earnings tax on withdrawals.

Financial savings Objectives and Automated Financial savings Transfers

Capital One makes it simple to prepare and observe your disparate financial savings targets with out leaving the Capital One 360 ecosystem. Use the user-friendly system to designate particular person targets, mechanically put aside cash on a weekly or month-to-month foundation utilizing the Automated Financial savings instrument, observe your progress towards the aim, and rejoice once you’re accomplished.

Cell Examine Deposit

Capital One has a useful cell verify deposit function that facilitates verify deposits anytime, anyplace — so long as you might have your cell phone on you. When you’re planning to save lots of your complete deposit, you possibly can deposit it immediately into the financial savings account and save your self the difficulty of transferring the funds.

ATM Entry

Capital One’s fee-free ATM community has about 40,000 machines, bigger than many brick-and-mortar banks’ networks. Third-party ATMs could cost charges, nevertheless.

Buyer Assist

Capital One’s automated banking assist hotline is out there 24/7. If it’s good to speak to a human being, assist brokers can be found 7 days every week from 8am to 11pm Jap.

Benefits of Capital One 360 Efficiency Financial savings

Capital One 360 Efficiency Financial savings has rather a lot going for it. Prime benefits embrace no charges or minimums, the power to open a number of goal-oriented accounts, and a few useful automation options.

- No Opening or Ongoing Stability Necessities. 360 Efficiency Financial savings doesn’t have opening or ongoing stability necessities. You possibly can open an account with just about nothing, and also you’re by no means required to keep up a stability to maintain your account open and keep away from charges.

- No Upkeep Charges. This account doesn’t cost a month-to-month upkeep price — ever. In a world the place brick-and-mortar banks routinely cost month-to-month charges on common checking accounts, this can be a massive deal.

- Seamless Cell Examine Deposit. Given the sheer mobile-unfriendliness of lots of Capital One 360’s smaller opponents, Capital One’s breezy cell verify deposit is a breath of recent air. It’s simple to deposit paper checks on the go right here.

- Simple Financial savings Automation and Transfers. 360 Efficiency Financial savings comes with some novel options that encourage and reward common saving, together with goal-setting and financial savings automation that pads your account each time you receives a commission. And since it’s really easy to hyperlink your Capital One checking and financial savings accounts, you by no means have to fret about funds getting misplaced within the shuffle.

- Custodial Accounts for Children. Capital One’s Children Financial savings account is a detailed cousin of 360 Efficiency Financial savings — the principle distinction being it’s a custodial account for fogeys and minor children. There’s no higher option to train your child the worth of a greenback or convey the miracle of compound curiosity.

- Tax-Advantaged Financial savings IRAs. You possibly can construction your Efficiency Financial savings account as a standard or Roth IRA and reap the tax benefits thereof. Simply mid the withdrawal restrictions.

- About 40,000 Charge-Free ATMs. All advised, Capital One has about 40,000 ATMs in its nationwide community, all of which supply fee-free withdrawals, deposits, and stability checks. Worldwide ATMs could cost charges, nevertheless.

Disadvantages of Capital One 360 Efficiency Financial savings

- No Cash Market Account. Capital One doesn’t have a cash market account to enrich its financial savings account. This can be a draw back in order for you check-writing privileges or a debit card alongside a savings-like yield.

- Different On-line Banks Have Higher Yields. Although they’re topic to alter, Capital One 360 Efficiency Financial savings doesn’t fairly pay industry-leading rates of interest. You’ll do higher right here than at most conventional banks although.

- No 24/7 Telephone Assist. Capital One 360 has a reasonably strong buyer care infrastructure that features a formidable “data database” of assist subjects and FAQs. Nonetheless, many banking clients nonetheless like to speak to a stay particular person about potential issues, and the financial institution is much less regular on this entrance. Not like some on-line opponents, which have 24-hour cellphone banks, 360’s name heart is barely open from 8am to 11pm Jap. That’s not nice information for evening owls.

How Capital One 360 Efficiency Financial savings Stacks Up

Capital One 360 Efficiency Financial savings is a well-liked on-line financial savings account with a strong yield, just about no charges, no minimums, and a number of different advantages.

Why would you want another financial savings account?

Effectively, as a result of some financial savings accounts are simply nearly as good — if not higher. Let’s see how one widespread competitor stacks up: the Ally Financial institution on-line financial savings account.

| Capital One 360 | Ally Financial institution | |

| Month-to-month Charges | $0 | $0 |

| Curiosity Fee (Yield) | 3.50% | 3.60% |

| 24/7 Assist? | No | Sure |

| Minimal to Open | $0 | $0 |

Last Phrase

Capital One 360 is a full-service on-line financial institution that gives checking, financial savings, funding, and enterprise merchandise. It’s removed from good — whereas it does place a transparent emphasis on monetary training and ease of use, it lacks lots of the user-friendly options that older on-line banks, akin to Ally Financial institution, have honed over time.

However one Capital One 360 account actually does stand out: 360 Efficiency Financial savings. When you’re available in the market for a brand new high-yield financial savings account, you would do a lot worse. Actually, in case you can open just one account with Capital One, there’s a robust argument to be made that Efficiency Financial savings ought to be it.

[ad_2]