[ad_1]

“Far more cash has been misplaced by traders making an attempt to anticipate corrections than misplaced within the corrections themselves.” – Peter Lynch

I’ll be trustworthy. I went backwards and forwards about writing this text as a result of I didn’t know the way it could also be obtained. However after seeing a lot noise and misinformation mentioned in regards to the short-term rental trade, I couldn’t take it anymore. Sitting on the sidelines didn’t really feel proper with out giving my perspective of what’s been taking place over the previous couple of months.

This text is about why I nonetheless assume it’s an outstanding time to put money into short-term leases.

The Misinformation Drawback

What I’ve seen lots on social media and the information is people who find themselves in robust positions, whether or not or not it’s in actual property or any trade, touting why we’re in a recession and why their trade is in decline.

I urge you to be very cautious about listening to anybody on social media speak about their declining trade. Why? They’re within the excellent place to learn from a decline.

Take, for instance, somebody who goes on a podcast and owns a big short-term rental firm. It’s very simple for them to foretell a pointy decline in occupancy over the following yr or two due to a recession.

If I heard somebody say one thing like that, the following query I’d ask is, “does your organization nonetheless plan to amass extra properties by means of this recession?”. I assure the reply can be sure, or they wouldn’t be on the podcast within the first place.

If their firm remains to be planning to amass properties by means of a recession, why are they going onto a podcast and saying STRs are usually not a superb funding anymore? The logical reply, for my part, is that they’re scaring folks into not investing in the identical asset class as them.

There’s a lot noise on the market proper now, and it could appear troublesome to find out who’s telling the reality or who has ulterior motives.

The 4 Contributing Components To The “Decline”

Currently, I’ve seen numerous hosts say that their properties have seen a major decline in income and occupancy. Which may be true, but when I needed to guess, they solely have their properties listed on one platform like Airbnb and are usually not doing the rest to advertise their properties.

From all the pieces I’ve seen not too long ago, 4 elements play a serious position within the supposed “decline” of STRs.

The primary issue is that Airbnb not too long ago did a huge overhaul of its web site that modified how properties seem within the search outcomes and the way they’re displayed. Many hosts noticed a decline of their bookings due to this variation. This occurred across the identical time rates of interest began to go up, and I noticed firsthand that many hosts blamed an upcoming recession on the primary rate of interest hike over the algorithm change. That was the primary mistake.

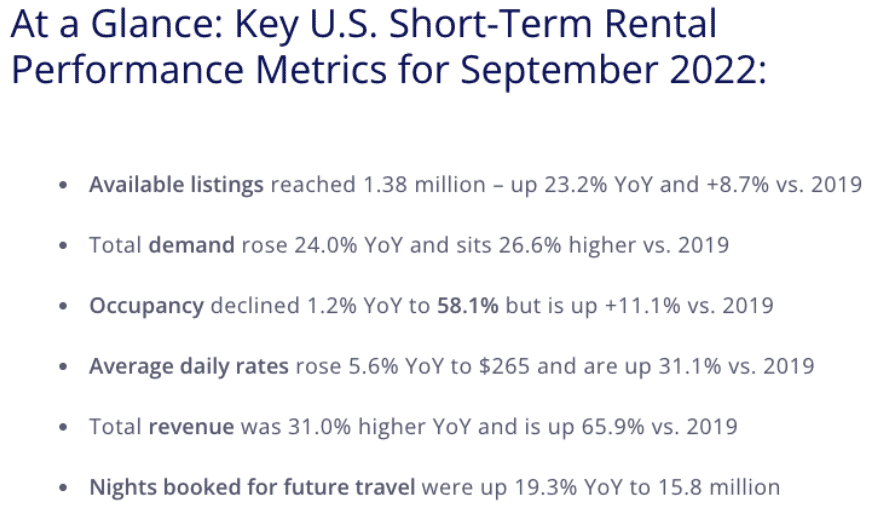

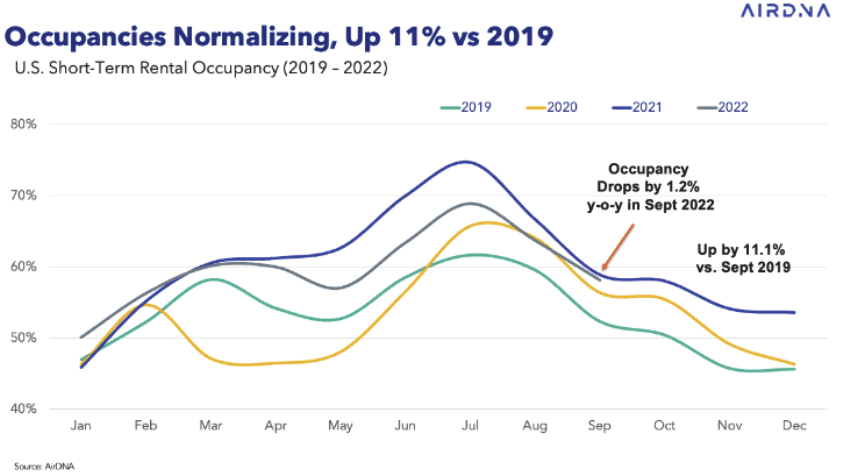

The second half is that rate of interest hikes did trigger a slight drop in bookings. Individuals are touring much less, however that’s a given throughout a correction. It’s not regular to function in 95%+ occupancy. That’s not even the place inns have traditionally operated, even throughout good market situations! The metrics beneath give a superb take a look at how a lot STRs have grown since 2019.

The third half is that many hosts overlook the truth that markets are going into their sluggish season. It’s simple in charge the downturn, however you might be simply going into your sluggish season. I do know that will appear too easy, but it surely’s very doable.

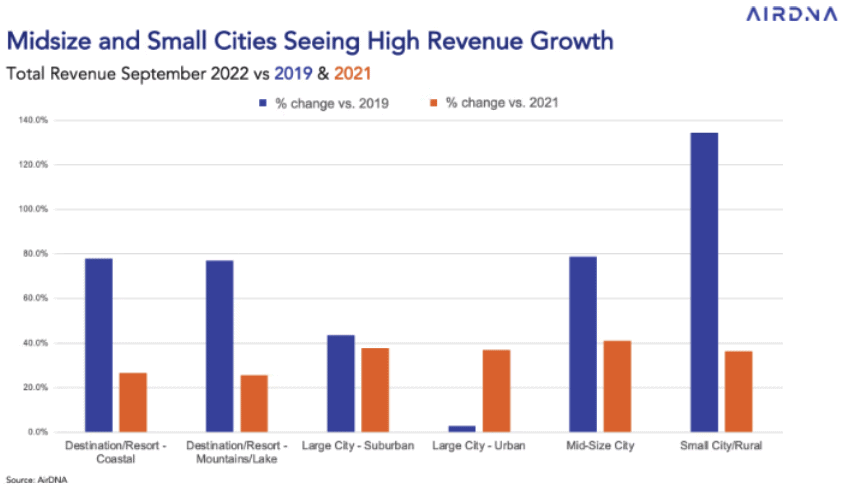

Lastly, many profitable hosts blame the decline on the inflow of short-term leases coming into the market. These consultants fail to speak about how a lot demand has entered the market. With increased demand, the variety of listings hasn’t caught up, negating the argument that extra listings are harming the market.

A mixture of those 4 elements is convincing folks that the sky is falling within the STR trade. There have been factors inside the previous couple of years the place many hosts have been working at 90%+ occupancy. Globally, inns function at 65-80% occupancy.

The expectation for these excessive charges to proceed is absurd.

My firm goes into its first sluggish season throughout this correction. My present occupancy is 77%. We’re nonetheless worthwhile.

Earlier than you disregard investing in STRs, think about the explanations above and see in case your market is at present going by means of a mix of what I discussed.

What You Have to Perceive About STRs

Brief-term leases have been round for a very long time. The one factor that’s modified is how folks e-book them.

Throughout the previous couple of years, many traders jumped into the STR house to money in on the growth. Sadly, many of those traders had no concept what they have been doing and poorly operated their leases.

I’ve mentioned it many occasions. You’ll want to take a look at your STR enterprise as a hospitality enterprise. What does that imply? It means you’re not simply buying a property, placing it on Airbnb or VRBO, then calling it a day. You’ll want to think about your self a lodge and deal with your properties as such.

On-line journey businesses (OTAs) like Airbnb and VRBO must be seen as a advertising device for your enterprise, however not the place your properties ought to solely stay. In case your property is barely on a particular OTA, then that firm fully controls your property.

If they alter their search algorithm like Airbnb did or resolve to ban one in every of your properties based mostly on one thing fully out of your management, then you haven’t any different possibility than to go together with regardless of the OTA decides on your property. I’ve gone by means of this earlier than.

The hosts and property managers which are going to do nicely on this recession are going to be those that take cost of their companies and look past simply posting their properties on locations like Airbnb and VRBO. The hosts that concentrate on producing their very own friends and determining the way to get them to remain once more with you sooner or later are the hosts which are going to prosper over the following couple of years.

It was very simple to do nicely in top-of-the-line financial expansions the U.S. has ever seen. Now, we’re heading right into a recession, and these so-called “consultants” scream that the sky is falling. Don’t fall for it. Deal with your STRs proper and determine methods to regulate your visitor’s expertise. Listed here are a number of methods you are able to do this.

The Way forward for STRs is Direct Bookings

Once I began, there was not a lot info out there on STRs, so I relied closely on lodge textbooks to discover ways to function my trip leases. The primary factor taught in these books was the way to take the friends off the OTAs like Expedia or Reserving.com and convey them into their ecosystem.

Throughout the visitor’s keep, they purchase their info and remarket to them by way of their web site. Now we have all gone by means of this when staying in a lodge. You must deal with your STR enterprise the identical.

Search STR corporations that provide coaching in direct bookings. Direct bookings imply friends are reserving immediately by means of your web site in comparison with having to undergo Airbnb or VRBO. Exterior of BiggerPockets, my favourite free useful resource on this matter is Mark Simpson’s Boostly.

Study to make the most of social media advertising on Fb and Instagram to advertise your properties. I not too long ago began doing this and have seen some wonderful outcomes. I run advertisements in cities {that a} bulk of my friends come from.

Conclusion

I hope this helped clear up some reservations you might have about investing on this market. It isn’t as unhealthy as persons are making it to be. I predict that we’ll see a dip in bookings, however by using the methods above, I’m assured your properties will do nice.

Individuals are buying much less proper now due to rates of interest and being terrified of the long run. That is the primary time in near a decade that properties are seeing important value declines. Should you have been somebody complaining about costs being too excessive during the last three years, that is the time to purchase, not sit on the sidelines.

Grasp the Medium Time period Rental

The primary-ever e-book on medium-term leases, this information will assist you discover the proper markets, properties, furnishings, and tenants to make you a profitable medium-term rental host with most money move and minimal worries.

Notice By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.

[ad_2]