[ad_1]

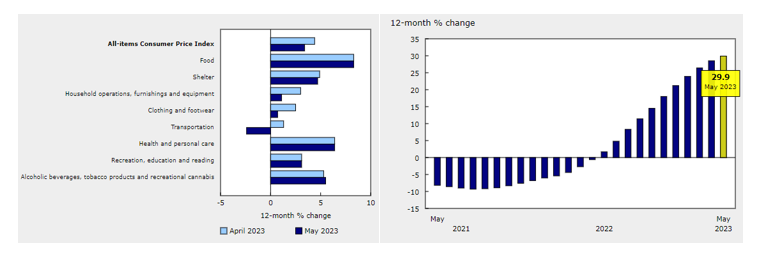

Canadian CPI recorded 3.4% year-over-year in Might final 12 months (the smallest improve since June 2021), in keeping with market expectations and the earlier worth of 4.4%; YoY, the determine recorded 0.4%, under market expectations of 0.5% and the earlier worth of 0.7%. Core CPI excluding auto gross sales shops recorded 3.7% year-on-year final 12 months, the smallest improve since November 2021; YoY final month, the information recorded 0.4%, decrease than the earlier worth of 0.5%.

Statistics Canada reported that the catalyst for the decline in headline CPI got here primarily from the decline in gasoline costs (-18.3% year-over-year final 12 months). Decrease oil costs additionally drove a slowdown in transportation inflationary pressures (-2.4% year-over-year vs. 1.3% beforehand). Nonetheless, numerous sub-data recommend that value pressures stay, with mortgage curiosity prices making the biggest contribution to annual CPI progress (up almost 30% year-over-year (-2.7% year-over-year) and at a document excessive for the third consecutive month).

Earlier, the Financial institution of Canada raised its benchmark rate of interest to 4.75%, a 22-year excessive. Cash markets anticipate a 59% chance (beforehand 64%) that the Financial institution of Canada will increase charges by 25 foundation factors on July 12 after a continued slowdown in headline CPI. They consider there’s a 100% chance that the central financial institution will increase charges once more by 25 foundation factors at its September assembly as a result of “core inflation stays sticky and has but to point out indicators of a protracted slowdown”.

Alternatively, the yen depreciated additional towards the greenback, hitting 144 yesterday, a brand new low since November final 12 months. The trade charge is getting nearer to the 145 that individuals are involved about, a key degree at which they anticipate the Japanese authorities could also be able to intervene within the international trade market. Lately, Finance Minister Shunichi Suzuki and the highest official answerable for international trade affairs, Makoto Kanda, have made it clear that if the yen falls too far, “we are going to reply sooner or later” and “don’t rule out the potential for intervention”. In any case, the impact of intervention is predicted to be restricted, because of the persistence of the rate of interest differential between Japan and the U.S. (and different main international locations). So long as the BOJ has no inclination for a coverage flip, a weaker yen appears affordable.

Technical evaluation:

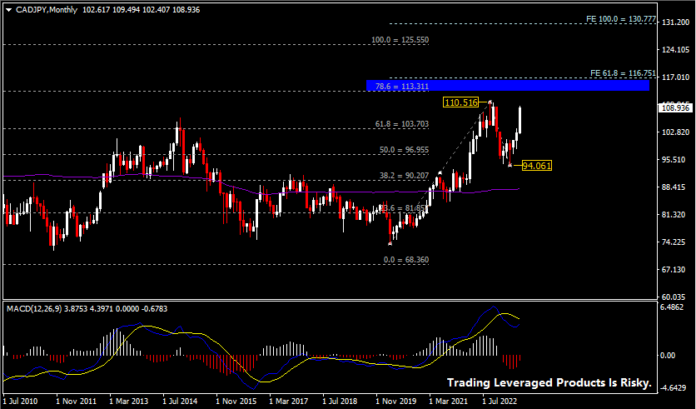

CADJPY: The month-to-month chart reveals the trade charge opening a wave of features since bottoming in March 2020, extending from a low of 73.80 to a peak of 110.516 in September 2022 (which is a brand new excessive since January 2008). The trade charge confronted a technical pullback within the fourth quarter of 2022 and is about to document a three-month shut after bottoming once more in March 2023 (94.061). The trade charge is buying and selling above the 100-month SMA with a bullish MACD configuration.

The each day chart means that the forex pair’s lengthy momentum could present indicators of slowing within the close to time period. Nonetheless, the route stays biased to the upside so long as assist at 103.70 and 96.95 is undamaged. Close to-term resistance is the height of 110.516 final September after which the main space of 113.30 to 116.75.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]