[ad_1]

There’s an outdated adage of Wall Avenue, which says: “by no means brief a boring market.” And whereas AI is getting all of the press lately, the oil market is about as boring because it will get. This, after all, brings the vitality sector to the highest of my contrarian alert listing.

This isn’t to say that I am shopping for oil-related property with each palms. It simply implies that, at this level, it makes extra sense to take a look at vitality as a worth asset, as it’s oversold and ripe for a transfer up every time the best set of variables required to ship such a transfer line up good.

Within the present world, the variables might line up good as early as at present.

There are No Oil Bulls Left

No one loves oil.

The stage of bearishness expressed by futures merchants is not less than equal to the place it was in the course of the pandemic, and after the Silicon Valley Financial institution (SIVB) collapse. The Worldwide Vitality Company (IEA), forecasts that, of the anticipated $2.8 trillion in vitality investments for 2023, roughly $1.7 trillion can be allotted to low carbon vitality sources, together with nuclear, photo voltaic, and different potential sources. Solely $1.1 trillion can be invested in fossil fuels.

And in line with the Monetary Instances, auctioneers in Texas try to unload two model new fracking rigs, which collectively price $70 million, for a beginning mixed bid of just under $17 million.

Provide is the Major Affect on Oil Costs

In the meantime, oil firms are quietly merging with opponents, and exploration exterior america is continuous aggressively, with new discoveries being incessantly introduced.

Concurrently, the U.S. lively rig rely is slowly falling, led by pure gasoline. The worth of gasoline is steadily rising, because the market begins to cost in future provide reductions. Simply in my neck of the woods, common unleaded is up some $0.32 within the final week alone.

That does not sound like an business that is planning on fading away. It feels like an business that is hunkering down and ready for higher occasions and making ready to squeeze provide with a purpose to increase costs.

Charting the Oil Sector

The worth chart for West Texas Intermediate Crude, the U.S. benchmark (WTIC), exhibits the depressed worth image which has led buyers to stroll away. And, till confirmed in any other case, there are many sellers on the $75-$80 worth space, the place a sizeable Quantity by Value bar highlights the purpose of resistance.

At first look, there little distinction within the basic worth habits for Brent Crude, the European benchmark. (BRENT) the place there’s a resistance band outlined by VBP bars between $80 and $90. A more in-depth look reveals an uptick in Accumulation Distribution (ADI) and the appearance of some nibbling in On Stability Quantity (OBV). It is delicate, nevertheless it’s there.

The oil shares are removed from a bull pattern. The Vitality Choose Sector SPDR ETF (XLE) is buying and selling beneath its 200-day shifting common, dealing with resistance put from $78 to $90 (VBP bars).

So why hassle? Merely acknowledged, OPEC has an upcoming assembly on June 3-4. The cartel just isn’t joyful concerning the costs and the way in which issues are evolving. The Saudi oil minister not too long ago warned bearish speculators to “be careful.” And my intestine is doing flips once I take into consideration oil, as I see gasoline costs creep up once I drive to work.

However principally, it is as a result of there are not any oil bulls left. That is what we noticed within the expertise sector just a few months in the past earlier than its present rally. In early 2023, the tech sector was pronounced useless. The tales have been all concerning the expertise sector shuddering because the financial system slowed. How about this one, from March 2023, which breathlessly introduced a 5.2% lower in semiconductor gross sales on a month to month foundation and an 18.5% yr to yr drop?

But, as validated by the current AI-fueled rally, the dangerous information first marked a backside, whereas previous a big transfer up in tech shares.

By no means brief a boring market.

I’ve not too long ago advisable a number of vitality sector picks. You possibly can take a look at them with a free trial to my service. As well as, I’ve posted a Particular Report on the oil market which you’ll acquire entry to right here.

Bond and Mortgage Curler Coaster Reverses Course

Count on destructive information concerning the impact of rising mortgage charges on the homebuilder business. That is as a result of, because the chart beneath illustrates, there’s a tight and really shut correlation between rising bond yields, mortgage charges, and the homebuilder shares (SPHB).

Furthermore, the rise above 3.75% on the U.S. Ten 12 months Word yield (TNX) has triggered headlines about mortgage charges climbing above 7%. What the information is not reporting is that, as soon as bond yields roll over, which they’re prone to do sooner or later sooner or later when the financial system exhibits extra indicators of slowing and the Fed lastly admits that they have to pause, is that mortgage charges will drop and demand for brand spanking new houses will as soon as once more decide up. Thus, we are going to see the homebuilders decide up the place they left off.

As issues stood final week, SPHB appears to have made a brief time period backside.

For now, anticipate a continuation of the backing and filling within the homebuilder shares. However, if I am proper and bond yields reverse course, the homebuilders are prone to rally once more.

For an in-depth complete outlook on the homebuilder sector click on right here.

NYAD Holds Above 200-Day Shifting Common. SPX Joins NDX in Breaking Out. Liquidity is Shrinking.

The New York Inventory Change Advance Decline line (NYAD) examined its 200-day shifting common on an intra-week foundation however didn’t break beneath the important thing technical stage. However, NYAD remained beneath its 50-day shifting common, which remains to be an intermediate-term destructive.

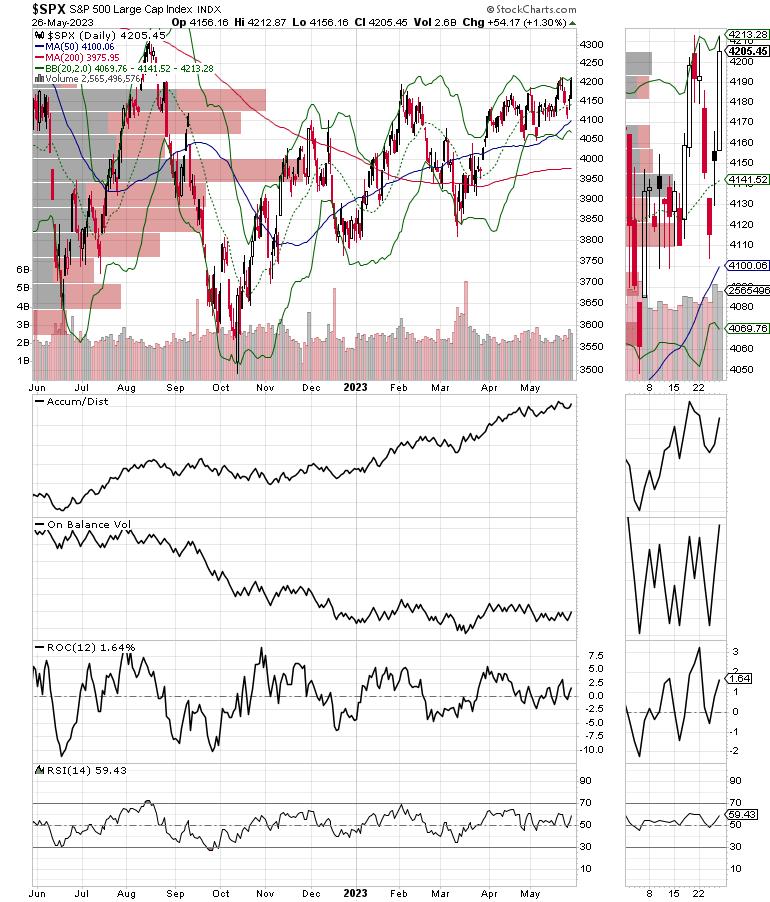

Furthermore, with the main indexes (see beneath) breaking out to new highs, we stay in a technical divergence because the market’s breadth is lagging the motion within the indexes. That is of some concern, given the fade available in the market’s liquidity, as I level out beneath.

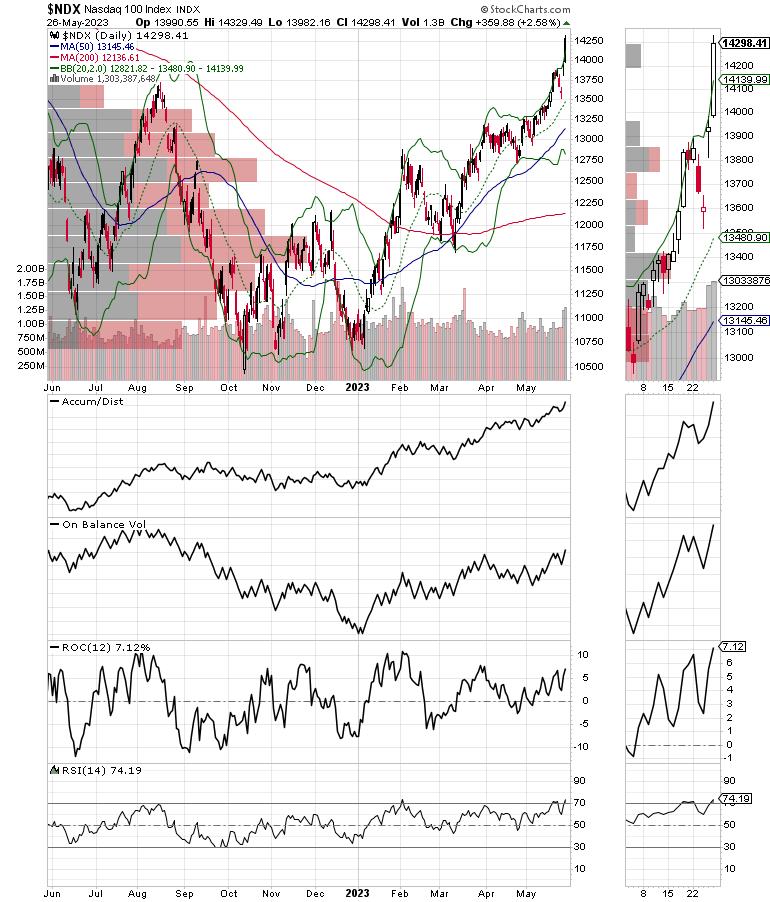

The Nasdaq 100 Index (NDX) prolonged its current breakout, closing the week effectively above 14,200. The present transfer is unsustainable, so some form of pullback and consolidation are possible over the subsequent few days to weeks. Each ADI and OBV stay encouraging.

What’s extra bullish is that the S&P 500 (SPX) lastly broke out above the 4100–4200 buying and selling vary on 5/24/23. On Stability Quantity (OBV) is perking up whereas the Accumulation Distribution (ADI) indicator could be very encouraging.

We could also be seeing a shift from a short-covering rally to a fear-of-missing-out purchaser’s rally.

VIX Holds Regular

The CBOE Volatility Index (VIX) remained beneath 20, because it has since March 2023. This stays a optimistic for the markets, because it exhibits brief sellers are staying away in the intervening time.

When the VIX rises, shares are likely to fall, as rising put quantity is an indication that market makers are promoting inventory index futures to hedge their put gross sales to the general public. A fall in VIX is bullish, because it means much less put choice shopping for, and it will definitely results in name shopping for, which causes market makers to hedge by shopping for inventory index futures. This raises the chances of upper inventory costs.

Liquidity is Getting Squeezed

The market’s liquidity is now in a downtrend. The Eurodollar Index (XED) is now beneath 94.5, and appears weak. A transfer above 95 can be a bullish growth. Often, a secure or rising XED could be very bullish for shares.

To get the most recent up-to-date info on choices buying and selling, take a look at Choices Buying and selling for Dummies, now in its 4th Version—Get Your Copy Now! Now additionally obtainable in Audible audiobook format!

#1 New Launch on Choices Buying and selling!

#1 New Launch on Choices Buying and selling!

Excellent news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 movies) and some different favorites public. You could find them right here.

Joe Duarte

In The Cash Choices

Joe Duarte is a former cash supervisor, an lively dealer, and a widely known unbiased inventory market analyst since 1987. He’s writer of eight funding books, together with the best-selling Buying and selling Choices for Dummies, rated a TOP Choices Ebook for 2018 by Benzinga.com and now in its third version, plus The Every little thing Investing in Your 20s and 30s Ebook and 6 different buying and selling books.

The Every little thing Investing in Your 20s and 30s Ebook is on the market at Amazon and Barnes and Noble. It has additionally been advisable as a Washington Put up Colour of Cash Ebook of the Month.

To obtain Joe’s unique inventory, choice and ETF suggestions, in your mailbox each week go to https://joeduarteinthemoneyoptions.com/safe/order_email.asp.

Joe Duarte is a former cash supervisor, an lively dealer and a widely known unbiased inventory market analyst going again to 1987. His books embody the very best promoting Buying and selling Choices for Dummies, a TOP Choices Ebook for 2018, 2019, and 2020 by Benzinga.com, Buying and selling Evaluate.Internet 2020 and Market Timing for Dummies. His newest best-selling e-book, The Every little thing Investing Information in your 20’s & 30’s, is a Washington Put up Colour of Cash Ebook of the Month. To obtain Joe’s unique inventory, choice and ETF suggestions in your mailbox each week, go to the Joe Duarte In The Cash Choices web site.

Study Extra

Subscribe to High Advisors Nook to be notified every time a brand new submit is added to this weblog!

[ad_2]