[ad_1]

The fast development of the curiosity of huge firms in cryptocurrencies may be on account of expectations of their approval by the world’s regulatory authorities as a way of cost.

So, after the Fed assembly ended on June 14, its head Powell introduced the necessity for the Fed to become involved within the regulation of the stablecoin market, which he known as “a type of cash”, and never securities. If the Fed approves stablecoins as a way of cost, then they may develop into an actual different to fiat cash.

From media experiences on the finish of final month, it additionally grew to become recognized that BlackRock, the most important US asset administration firm, filed an software with the SEC to create a spot bitcoin ETF. After these messages, buying and selling volumes on the crypto market started to develop and at first of final week they already amounted to $19.5 billion.

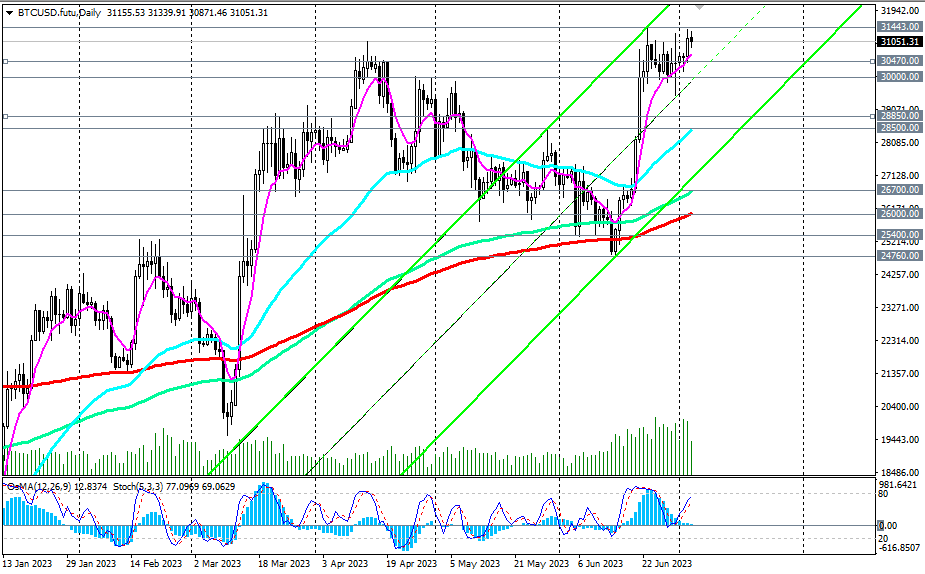

After the ultimate breakout of the resistance ranges of 30800.00, 31000.00 and the breakdown of the final week’s excessive of 31443.00, we must always anticipate additional development of BTC/USD in direction of the native most in 2022 of 48184.00, after which in 2021 and the mark of 69138.00.

Of the unfavourable moments for the crypto market, it’s value noting the continuing strain from the Securities and Alternate Fee (SEC) on the main digital platforms Binance and Coinbase, which can also be spreading in European nations.

On the finish of final month, it was additionally reported that US President Joe Biden promised to reform the tax system, “eliminating loopholes for bitcoin and crypto merchants.” We’re speaking right here, particularly, in regards to the short-term buying and selling operations of crypto merchants who promote and redeem cryptocurrencies in a short while, which permits them to keep away from larger tax charges.

As well as, talking final week on the European Central Financial institution Discussion board, Fed Chairman Powell confirmed the potential of additional rate of interest hikes, which may assist the US greenback, together with in relation to cryptocurrencies (in pairs with the USDT stablecoin).

Thus, regardless of the bullish temper of Bitcoin consumers, a considerably contradictory scenario has developed within the digital foreign money market, which doesn’t enable Bitcoin and different widespread altcoins to develop a extra assured upward momentum.

In another situation, the breakdown of assist ranges 30470.00, 30000.00 might develop into a sign for the event of a downward correction and decline, for a begin – to assist ranges 28850.00, 28500.00. With the additional growth of the unfavourable dynamics, the breakdown of the important thing assist ranges 26000.00, 25400.00 will return BTC/USD into the zone of the long-term bear market.

Help ranges: 30470.00, 30000.00, 29000.00, 28850.00, 28500.00, 28000.00, 27000.00, 26700.00, 26000.00, 25400.00, 24760.00

Resistance ranges: 31000.00, 31443.00, 35000.00, 46000.00, 47000.00, 48000.00

[ad_2]