[ad_1]

Scanning the marketplace for a tradable “occasion” would possibly get you an categorical ticket to the “quick cash” line of alternative and threat. Keep in mind that an “occasion” is one thing that has already occurred. Leaping on the chance means you may be just a little late to the sport, however, typically, the technical situation could also be robust sufficient to justify your late response.

Such is the case for Breakaway Gaps on excessive quantity, whether or not up or down.

What’s a Breakaway Hole and What Makes It a Probably Favorable Commerce?

A breakaway hole happens when a inventory opens increased (or decrease than) its earlier day’s closing worth in a “counter-move” that “breaks away” from a short-term pattern, congestion degree, or space of assist and resistance. As for what makes them favorable, breakaway gaps have robust efficiency stats beneath the precise set of situations (notice, lots of the concepts under are from Thomas Bulkowski’s Encyclopedia of Chart Patterns):

- Breakaway gaps typically sign the beginning of a brand new and sustained pattern or the resumption of a prevailing pattern (following a pullback).

- Breakaway gaps on excessive quantity that transfer towards a bigger prevailing pattern are likely to have the strongest efficiency.

- Breakaway gaps typically end result from a sudden and important shift in market sentiment (which tends to result in a sustained transfer within the course of the hole).

- Breakaway gaps have a low fee of being stuffed throughout the week of the hole (round 1%)

- Median time for breakaway gaps to be stuffed is 85 days for upward gaps and 84 days for downward gaps.

Total, breakaway gaps present interesting buying and selling potentialities on account of their constant directional and statistical nature. It is important to rapidly analyze and capitalize on probably the most favorable conditions, as these alternatives will be short-lived.

How one can Scan for Breakaway Gaps

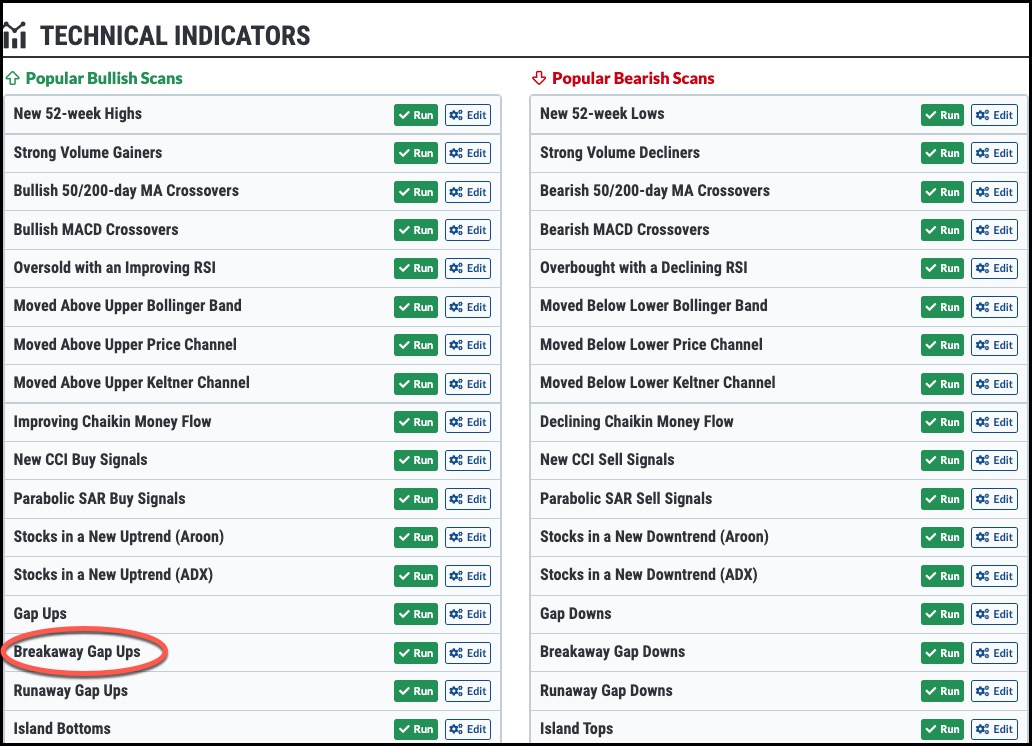

From Your Dashboard, head to Member Instruments and scroll to Pattern Scan Library. Then, click on on “Run” for Breakaway Hole Ups.

Since there are two scans for both course—Breakaway Hole Ups and Breakaway Hole Downs—let’s give attention to gaps up for the sake of simplicity.

Whereas, on some days, you could get loads of scan outcomes, on different days, you could find yourself with only a few (possible on account of market situations). This morning we’ve got solely two outcomes: Molson Coors Brewing Co (TAP) and CVR Companions LP (UAN). The less scan outcomes you must work with, the smaller the pool of “high quality” candidates you must work with.

Let’s take a look at TAP (see chart under), an organization lots of you is likely to be acquainted with.

CHART 1: UP, UP, AND AWAY. Molson Coors (TAP) gapped up above its June 2021 excessive. Chart supply: StockCharts.com. For illustrative functions solely.

Rather a lot is happening on this chart. The breakaway hole catapulted worth above the two-year excessive (June 2021) excessive.

However what did it “breakaway” from? There are a few methods to have a look at it: A two-year narrowing buying and selling vary with loads of smaller areas of thick congestion. However, for those who mark the collection of decrease lows over two years, you’ll be able to see that, arguably, the “pattern” (if we are able to even name it that based mostly on the upper swing lows) is kind of upward and in opposition to a two-year resistance degree, making for a powerful case in favor of this explicit hole occasion.

Let’s zoom in for a better look.

CHART 2: BREAKAWAY GAP ON TAP. Wanting on the every day chart, TAP’s worth closed above its higher Bollinger Band. The Stochastic Oscillator and RSI are in overbought territory.Chart supply: StockCharts.com. For illustrative functions solely.

Whereas breakaway gaps sometimes do not get stuffed for a median of 85 days, the shut above the higher Bollinger Band (and the present response to that shut) might need us considering that the present hole will possible be an exception. Worth tends to revisit the center band after such a transfer, and its present degree under 68 is nicely under the breakaway hole vary. In the meantime, the relative power index (RSI) and Stochastic Oscillator are clearly signaling “overbought,” but each these ranges can stay on the higher threshold for an prolonged interval.

At this level, it helps to herald the basics. The breakaway hole was a market response to TAP’s Q1 earnings which say a 109.11% shock in earnings (EPS of 0.54 vs. 0.25 anticipated) and a 5.38% income beat (a shock of $119.70 million over estimates).

So, would possibly it make for a positive commerce, contemplating the technical setup, historic stats, and fundamentals context? We’ll go away that as much as you. Keep in mind, the purpose of this text was to focus on a scan course of for potential high-probability buying and selling setups.

The Backside Line

Breakaway gaps provide an intriguing alternative for merchants to capitalize on a sample with robust directional and statistical traits. By actively scanning for these gaps, merchants can pinpoint potential high-probability setups, even when they’re just a little late to the sport. It is important to rigorously consider the technical situation and underlying fundamentals earlier than making any buying and selling selections, as every dealer’s threat tolerance and technique will range.

One level to emphasise is that for those who take the initiative to scan and analyze market occasions actively, it may well reveal hidden buying and selling alternatives which may have been simply missed in any other case. That is what the scanning software program is designed to do, and we hope you’ll be able to reap the benefits of it in a method that enhances your general market efficiency.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

Karl Montevirgen is an expert freelance author who makes a speciality of finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Sequence 3 and Sequence 34 licenses along with a twin MFA in important research/writing and music composition from the California Institute of the Arts.

Be taught Extra

Subscribe to ChartWatchers to be notified every time a brand new put up is added to this weblog!

[ad_2]