[ad_1]

Most merchants would wish to commerce at factors the place the market reverses. Doing so means extra earnings for the least quantity of danger. Merchants who’re capable of catch value because it reverses are inclined to squeeze probably the most revenue out of a value motion. Nevertheless, doing so could be very tough to perform.

So, how will we catch value at a reversal level? One of many telltale indicators of a potential reversal are value rejections. Value rejection just isn’t an precise time period in buying and selling. Nevertheless I’d describe it as some extent on the worth chart the place value was shortly turned again by the market after reaching a sure degree. In different phrases the market shortly rejected that value degree because it was reached. That is recognized by candlesticks with lengthy wicks. It’s because lengthy wicks point out that value shortly reversed after reaching a sure level. The reversals are so fast that value reversed inside one candle interval. Probably the most notable value rejection candlestick sample is a pin bar sample. The lengthy wick and brief physique signify that value certainly was reversed fast sufficient.

Value rejections are very efficient when they’re noticed in key areas on a value chart. These are help and resistance ranges, dynamic areas of helps and resistances, pivot factors, provide and demand areas, and many others.

On this technique, we might be taking a look at how the Bollinger Bands can be utilized to establish potential reversals based mostly on value rejection.

Bollinger Bands

The Bollinger Bands is a extensively used momentum indicator which may present a lot data for numerous merchants. It may be used to establish development path, volatility, overbought or oversold imply reversal indicators and momentum breakout indicators.

The Bollinger Bands is plotted with three traces that type a channel like construction. The center line is principally a 20-period Easy Shifting Common (SMA) line. As such, the center line can be utilized to establish development path. That is based mostly on the overall location of value motion in relation to the center line, in addition to the slope of the center line. The center line may additionally act as a help or resistance degree the place value may bounce off from in a trending market situation.

The outer bands are principally customary deviations plotted above and under the center line. Being based mostly on customary deviations, the outer traces can be utilized to establish volatility. A Bollinger Band that’s contracted signify a foreign exchange pair in a market contraction section, whereas a Bollinger Band that’s increasing signify a foreign exchange pair in an growth section.

The outer traces may also be used to establish momentum breakouts, which generally happen after a market contraction section. Momentum candles strongly closing exterior of the Bollinger Bands point out a momentum breakout within the path the place the candle broke out from.

Inversely, the identical outer traces can be utilized as a foundation for a possible imply reversal sign. That is based mostly on value motion indicating that it’s rejecting the worth degree close to the outer traces of a Bollinger Band. It’s because the realm under the decrease line marks an oversold degree, whereas the realm above the higher line marks an overbought degree. Each situations are prime for imply reversals.

BB Alert Arrows

The BB Alert Arrows indicator is a customized technical indicator which acts as a reversal sign. The indicators it produces are based mostly on key areas on the Bollinger Bands.

The BB Alert Arrows indicator detect imply reversal indicators based mostly on value motion shortly reversing from the outer traces of the Bollinger Bands. It additionally detects bounces from the center line whereas it acts as a dynamic help or resistance degree.

In each eventualities, the indicator merely plots an arrow pointing the path of the reversal. Merchants can merely use these indicators to make commerce selections.

Buying and selling Technique

This buying and selling technique is a reversal buying and selling technique which is initiated by a imply reversal coming from an overbought or oversold market situation.

First, we establish the long-term development utilizing the 200 Exponential Shifting Common (EMA) line. Development path relies on the overall location of value motion in relation to the 200 EMA line, in addition to the slope of the stated line.

Then, we make use of the Bollinger Bands to establish overbought or oversold market situations. That is based mostly on value motion displaying indicators of value rejection on the outer traces of the Bollinger Bands. The BB Alert Arrows ought to then verify such value rejection by plotting an arrow pointing the path of the reversal. This could function a legitimate commerce sign.

Indicators:

- BBalert_Arrows

- Bollinger Bands

- 200 EMA

Most popular Time Frames: 30-minute, 1-hour, 4-hour and each day charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

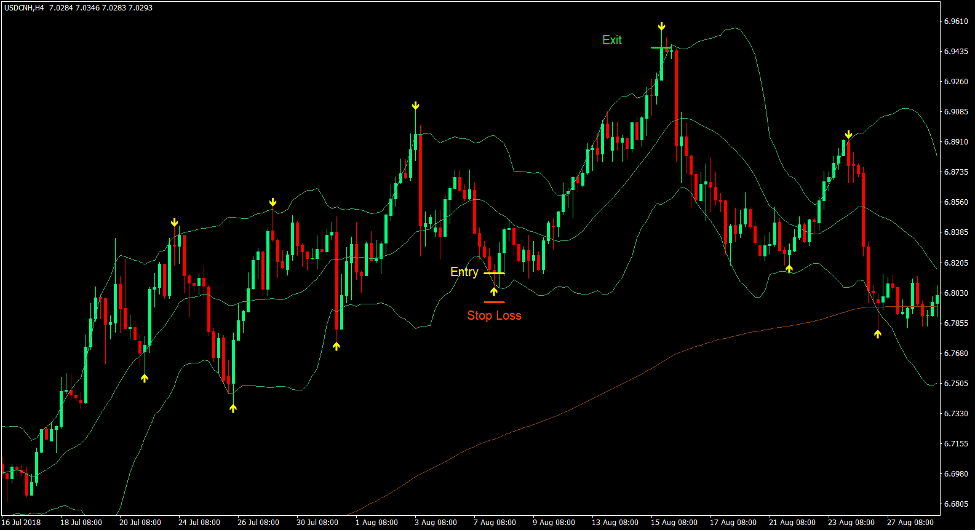

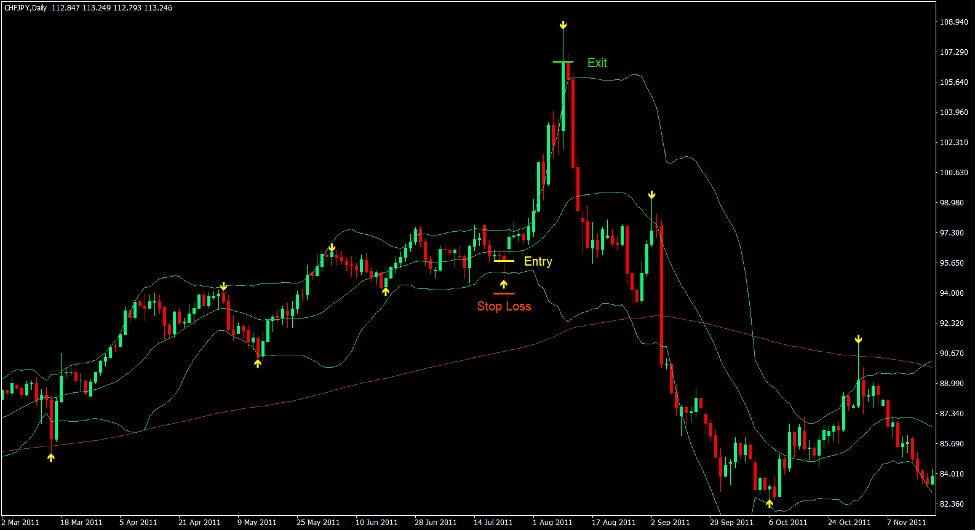

Purchase Commerce Setup

Entry

- Value motion ought to be above the 200 EMA line.

- The 200 EMA line ought to slope up.

- Value motion ought to present indicators of value rejection on the realm touching the decrease outer Bollinger Band.

- The BB Alert Arrows ought to plot an arrow pointing up.

- Enter a purchase order on the affirmation of those situations.

Cease Loss

- Set the cease loss under the arrow.

Exit

- Shut the commerce as quickly because the BB Alert Arrows plot an arrow pointing down.

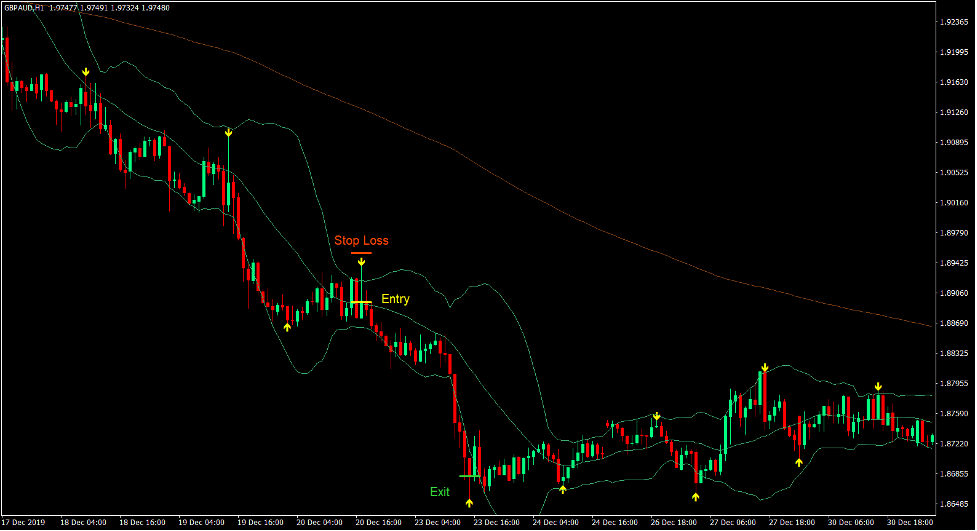

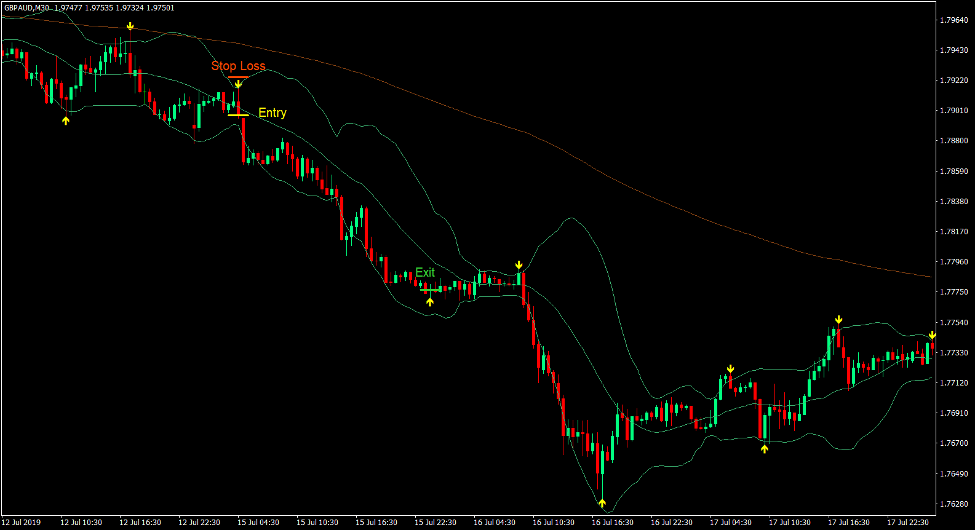

Promote Commerce Setup

Entry

- Value motion ought to be under the 200 EMA line.

- The 200 EMA line ought to slope down.

- Value motion ought to present indicators of value rejection on the realm touching the higher outer Bollinger Band.

- The BB Alert Arrows ought to plot an arrow pointing down.

- Enter a promote order on the affirmation of those situations.

Cease Loss

- Set the cease loss above the arrow.

Exit

- Shut the commerce as quickly because the BB Alert Arrows plot an arrow pointing up.

Conclusion

Imply reversal indicators which may flip into potential full-blown development reversals are nice buying and selling alternatives. Nevertheless, recognizing these reversal factors are very tough to perform.

Using Bollinger Bands as a way of figuring out potential reversal factors is widespread amongst many merchants. In truth, many advantageous merchants use this technique. Most use their information of candlestick patterns are their gutfeel to make selections. Nevertheless, new merchants nonetheless do not need this talent.

This technique permits new merchants to systematically establish such reversal factors making it simpler for them to commerce.

Foreign exchange Buying and selling Methods Set up Directions

Bollinger Bands Value Rejection Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past knowledge and buying and selling indicators.

Bollinger Bands Value Rejection Foreign exchange Buying and selling Technique supplies a chance to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional value motion and regulate this technique accordingly.

Really helpful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

The right way to set up Bollinger Bands Value Rejection Foreign exchange Buying and selling Technique?

- Obtain Bollinger Bands Value Rejection Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you wish to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Bollinger Bands Value Rejection Foreign exchange Buying and selling Technique

- You will notice Bollinger Bands Value Rejection Foreign exchange Buying and selling Technique is accessible in your Chart

*Word: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]