[ad_1]

Momentum buying and selling is a well-liked kind of buying and selling technique and for good causes. It’s because momentum buying and selling is a really efficient buying and selling technique. It both is an preliminary section for a longer-term pattern or in lots of circumstances it permits merchants to earn constant earnings over a brief interval.

Momentum breakouts have the tendency to be a catalyst for a market pattern. Many merchants leap into a powerful momentum breakout which might in flip trigger extra shopping for or promoting in the identical path, which then results in a trending market. Merchants might additionally make fast earnings utilizing a momentum breakout technique as a result of worth tends to push within the path of the momentum breakout inside a number of candles from it. The momentum that was generated on the breakout would often carry over to the subsequent few candles giving merchants good buying and selling alternatives proper after a breakout.

There are lots of methods to determine a momentum commerce setup. Some merchants use technical indicators to determine momentum. Nonetheless, this might generally be counterproductive as indicators could present indications of sturdy momentum whereas worth motion isn’t precisely characterizing a momentum breakout. Some merchants determine momentum primarily based on a momentum candle or a powerful full-bodied candle pushing in a single path. Whereas that is very efficient, it is also very subjective. Merchants might interpret completely different candles as such or not.

On this technique, we will probably be combining using a well-liked technical indicator to objectively determine a momentum breakout whereas incorporating the idea of a powerful momentum candle.

Bollinger Bands

The Bollinger Bands is a flexible technical indicator which merchants can use for several types of buying and selling methods. It’s relevant for figuring out pattern path, volatility, momentum breakouts and overbought or oversold market situations.

The Bollinger Bands is without doubt one of the extra common band sorts of indicators. It plots three strains. The center line is a primary 20-period Easy Shifting Common (SMA) line. The 2 outer strains are customary deviations shifted above and under the 20 SMA line.

For the reason that Bollinger Bands use a 20 SMA line, it may also be used to determine pattern path identical to most shifting common strains. Developments could be recognized primarily based on whether or not worth motion is mostly staying on one half of the Bollinger Band. The pattern is bullish if worth motion is mostly within the higher half of the Bollinger Band, and bearish if worth motion is mostly within the decrease half of the Bollinger Band.

For the reason that outer strains are primarily based on customary deviations, the growth and contraction of the outer strains might additionally point out volatility. An increasing Bollinger Band signifies a unstable market, whereas a contracting Bollinger Band signifies a contracting market.

The outer strains may also be used to determine overbought or oversold situations. Worth above the higher line might point out an overbought market, whereas worth under the decrease line might point out an oversold market. Each situations are prime for a imply reversal.

Nonetheless, the identical outer strains can be utilized to determine momentum breakouts. The hot button is in how worth motion reacts because it crosses the outer strains. If worth motion is pushing towards the outer strains, rejecting the worth degree exterior of the road, the market could quickly be on a imply reversal section. Alternatively, if a powerful momentum candle would escape of the Bollinger Band after a market contraction section, the market could also be on a momentum breakout section.

Indicator Arrows

Indicator Arrows is an entry sign indicator which is predicated on a confluence of a number of underlying technical indicators.

This indicator have an underlying shifting common line, MACD, Shifting Common Oscillator (OsMA), Stochastic Oscillator, Relative Energy Index (RSI), Commodity Channel Index (CCI), Relative Vigor Index (RVI), Common Directional Motion Index (ADX), and Bollinger Bands, which it bases its commerce indicators from.

For the reason that indicator considers the pattern indications coming from a number of technical indicators, it tends to provide excessive likelihood commerce setups.

It merely plots an arrow pointing up each time it detects a bullish pattern reversal and an arrow pointing down each time it detects a bearish pattern reversal.

Buying and selling Technique

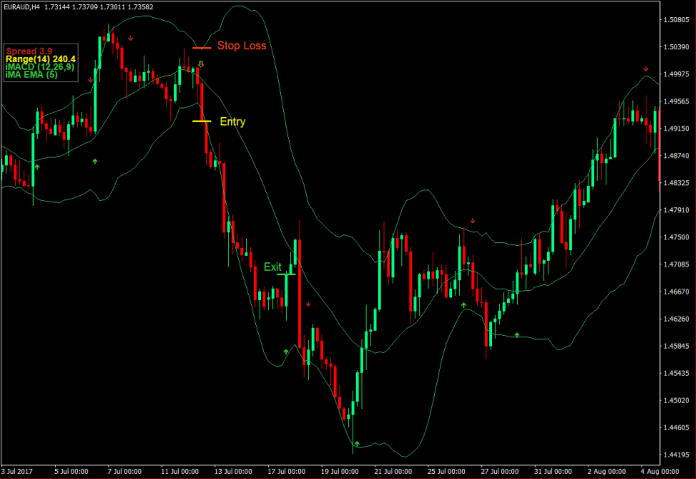

Bollinger Bands Arrow Breakout Foreign exchange Buying and selling Technique is an easy momentum breakout technique which makes use of the Bollinger Bands as a foundation for the breakout. On the similar time, it isolates commerce path primarily based on a confluence of path identified by the Indicator Arrows.

First, potential trades are recognized by a market situation which is contracting. That is primarily based on the Bollinger Band contracting, indicating a low volatility.

Then, we look ahead to the Indicator Arrows to determine the path of the potential momentum breakout primarily based on the arrow it plots.

We then look ahead to the momentum breakout candle to happen coinciding with path identified by the Indicator Arrows.

Indicators:

- Indicatorarrows

- Bollinger Bands

Most well-liked Time Frames: 1-hour, 4-hour and each day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York classes

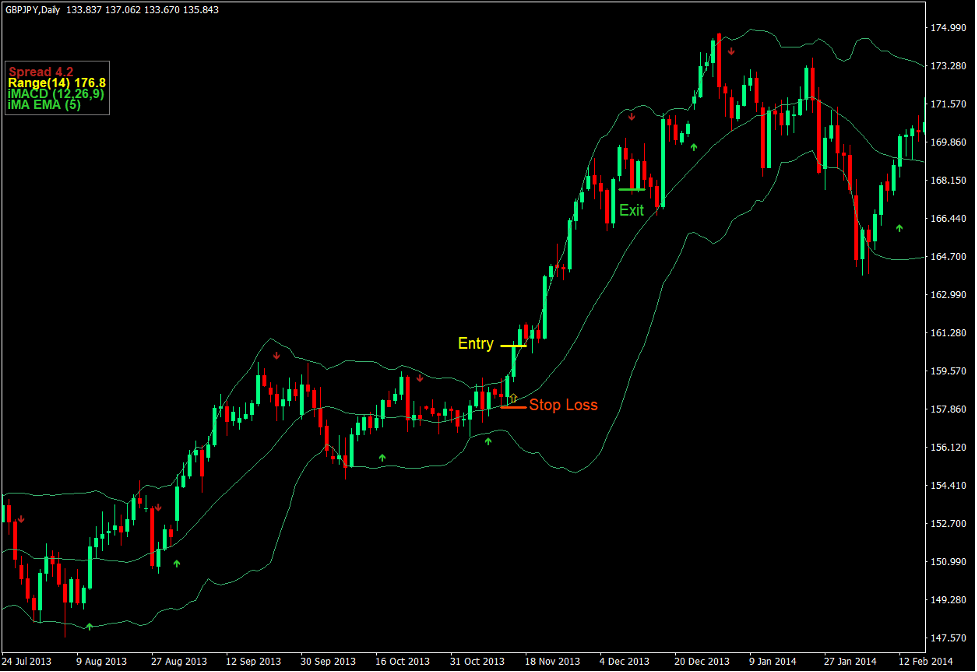

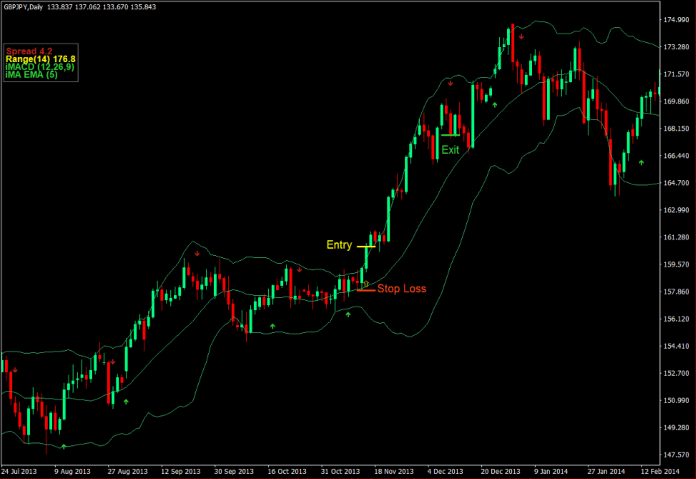

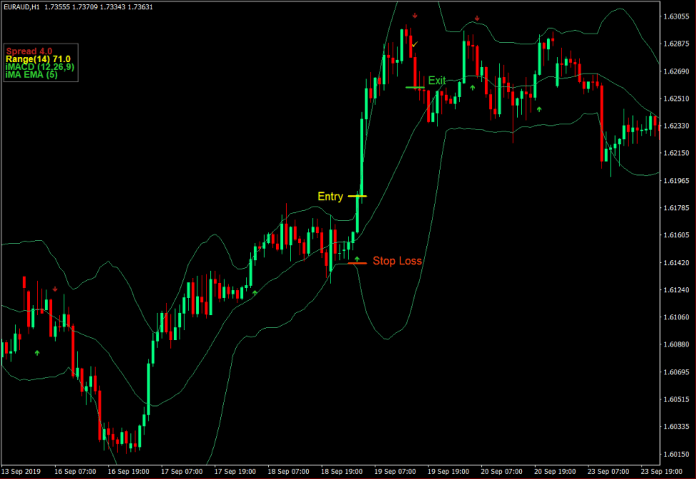

Purchase Commerce Setup

Entry

- The Bollinger Bands ought to contract indicating a market contraction section.

- The Indicator Arrows ought to plot an arrow pointing up.

- Enter a purchase order as quickly as a bullish momentum candle breaks above the higher Bollinger Band line.

Cease Loss

- Set the cease loss on the assist under the entry candle.

Exit

- Shut the commerce as quickly because the Indicator Arrows plots an arrow pointing down.

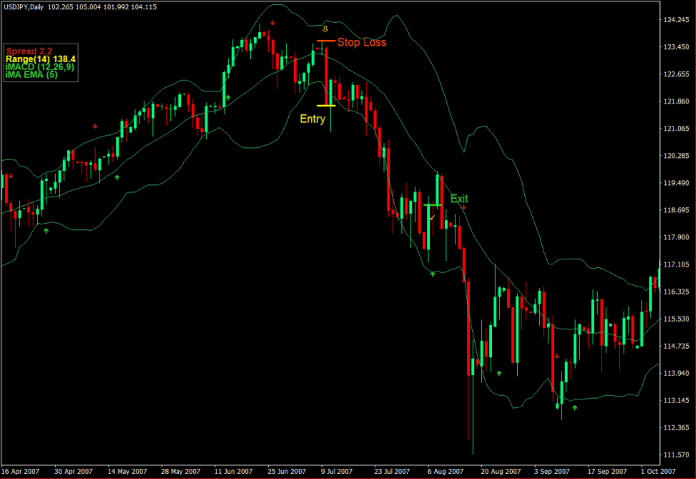

Promote Commerce Setup

Entry

- The Bollinger Bands ought to contract indicating a market contraction section.

- The Indicator Arrows ought to plot an arrow pointing down.

- Enter a promote order as quickly as a bearish momentum candle breaks under the decrease Bollinger Band line.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Shut the commerce as quickly because the Indicator Arrows plots an arrow pointing up.

Conclusion

Momentum breakouts coming from a contracted Bollinger Band is a working momentum buying and selling technique. Many merchants use this kind of technique with nice success.

Nonetheless, new merchants could usually mistake a non-contracted Bollinger Band as a market contraction section, which can lead to a failed momentum breakout commerce. Momentum breakouts are often profitable due to the pent-up quantity that’s not but traded as indicated by the market contraction section. Merchants who can have a really feel for such contraction and growth phases can generate income utilizing this kind of technique.

Foreign exchange Buying and selling Methods Set up Directions

Bollinger Bands Arrow Breakout Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past information and buying and selling indicators.

Bollinger Bands Arrow Breakout Foreign exchange Buying and selling Technique supplies a possibility to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional worth motion and modify this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

How one can set up Bollinger Bands Arrow Breakout Foreign exchange Buying and selling Technique?

- Obtain Bollinger Bands Arrow Breakout Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Bollinger Bands Arrow Breakout Foreign exchange Buying and selling Technique

- You will note Bollinger Bands Arrow Breakout Foreign exchange Buying and selling Technique is obtainable in your Chart

*Word: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]