[ad_1]

(Model 1.0)

–a product by BluesAlgo Ltd 2023

That is person handbook for utilizing BlueSwift’s Grid Rescue Skilled (‘BlueSwift’)

Glossary for phrases used on this handbook:

– TopOrder / BottomOrder: TopOrder signifies that newest order opened within the grid i.e. final order, BottomOrder means the primary order within the grid collection, i.e. the primary order. When grid’s order(s) are closed, the ‘TopOrder’ and ‘BottomOrder’ aliases will probably be ‘handed’ to the present working orders. That’s why I keep away from utilizing ‘First’ or ‘Final’ order phrases as a result of this suggest the very first order being opened by the grid collection, which can be already closed

– Grid Cluster (or Grid Pair): the mix of two or three orders within the grid of which their revenue is tracked and they’d be closed collectively as soon as the particular situation is met.

– Grid Measurement: the rely of orders in a grid. For instance 2 means there are at the moment 2 energetic orders within the grid

– 2-Node: grid order cluster with 2 orders TopOrder and BottomOrder

– 3-Node: grid order cluster with 3 orders TopOrder, BottomOrder and one MiddleOrder. The MiddleOrder will probably be decided as follows:

|

Grid’s measurement |

Components |

Instance |

|

Lower than 7 orders |

two orders beneath the TopOrder |

For a grid with 6 orders, this could be the 4th orders (6-2 = 4) |

|

Greater than 7 however Lower than 10 orders |

three orders beneath the TopOrder |

For a grid with 10 orders, this could be the 7th orders (10-3 = 7) |

|

10 orders or extra |

4 orders beneath the TopOrder |

|

– Revenue-to-close: the sum $ of revenue (-loss) quantity for all orders in a grid cluster at which BlueSwift GridRescue will shut them. That is the full of revenue, swap, and fee $ for every order.

– Rescue Iteration: the iteration 1st, 2nd, 3rd of every order shut occasion. BlueSwift maintain observe of what number of iteration every Rescue Mode has been executed and in addition the full rescue iteration for the entire grid (no matter rescue mode)

– Rescue Mode: the mode that BlueSwift used to shut grid cluster. These are bots working in parallel on each tick with totally different order shut’s logic. On the time of this writing (v1.0), there are 5 modes in BlueSwift with their nickname in brackets:

- Primary Mode (‘SubGrid Shut’)

- Panic Mode (‘Panic Shut’)

- TimeCritical Mode (‘Crit Shut’) (ß this mode utilise the NewsFilter sub-module)

- HardClose Mode (‘Laborious Shut’)

- OutOfTime Mode (‘OutOfTime Shut’)

Enter Parameters instruction

-

BASIC RESCUE MODE

|

# |

Inputs |

Description |

Values & examples |

|

1 |

Permit fundamental Rescue Mode? |

That is toggle to allow / disable rescue mode |

True/False. That is the primary toggle for all rescue modes in BlueSwift. i.e. if you wish to swap off BlueSwift operation, you possibly can simply have to set this to ‘False’ |

|

2 |

Image(s)-separated by comma (,) |

Listing of Image which BlueSwift would function on. Order’s Image that not on this listing will probably be ignore by BlueSwift. For extra details about BlueSwift monitoring mechanism, refer beneath |

String listing of dealer’s symbols, separated by comma(,): – “EURUSD,GBPUSD,USDJPY”In case your dealer use suffix for his or her symbols, you possibly can both use the “Dealer’s image suffix” enter parameter beneath or simply insert it instantly right here as follows: – “EURUSD.professional,GBPUSD.professional,USDJPY.professional“if this discipline left clean, then BlueSwift will solely function on the present chart’s image solely (i.e. the chart’s image the place you drop BlueSwift on) |

|

3 |

Dealer’s image suffix |

Dealer’s designated suffix for his or her tradable symbols |

Apart from #2, it’s also possible to add your dealer’s suffix for buying and selling image right here. For instance: in case your dealer’s devices are EURUSD.ecn then put “.ecn”in case your dealer’s devices are EURUSD.. then put “..”This may be clean in the event you already embody the image suffix within the discipline #3 above |

|

4 |

Monitoring EA’s Magic quantity(s) to rescue – separated by comma (,) |

Listing of Magic Quantity which BlueSwift would function on. Order’s Magic that not on this listing will probably be ignore by BlueSwift |

Instance: 1234,555333,459282 |

|

5 |

Monitoring EA Commerce remark to rescue |

The remark of the tracked EA – This might be useful in case you need to observe separate sub-grid throughout the identical skilled’s magic with a standard remark. |

Some grid consultants on market use order’s remark to handle their order, as a result of the orders perhaps identical image and magic quantity however with totally different remark. For instance: ”grid_ea-M15” versus “grid_ea-H1” |

|

6 |

Don’t examine Monitoring EA’S comment- ifTrue, observe <SymbolMagicType> |

If True, then ignore grid order’s remark. BlueSwift would solely detect and observe order with identical Image, Path and Magic Quantity |

if that is True, then GridRescue will ignore order’s remark (i.e. worth in #5) |

|

7 |

Order rely To Begin Rescue |

Variety of opened orders within the grid that might set off Primary Rescue bot operation |

Integers.For instance, if person set this worth to 4, which signifies that BlueSwift’s would solely begin to attemp fundamental rescue perform when there are 4 or extra opened orders within the tracked grid |

|

8 |

GridCluster’s Revenue to shut ($) |

the $ quantity of revenue at which might BlueSwift will shut sub-grid cluster |

For instance if that is set to $1, then when the sub-grid cluster’s revenue is $1 or extra, then all order within the sub-grid cluster will probably be closed. This worth could be unfavorable |

|

9 |

Present Monitoring Panel? |

Toggle On/Off grid monitoring panel on the present skilled’s chart |

True/False. If True: show the BlueSwift dashboard panel on chart which might present energetic grid collection positioned by different Consultants (if any) at the moment energetic within the account |

|

10 |

Panel’s textual content measurement |

Change the font measurement of the panel’s textual content |

|

|

11 |

Panel’s textual content shade |

Change the font shade of the panel’s textual content |

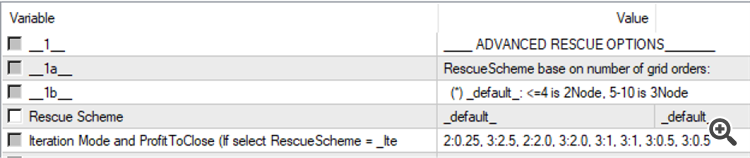

2 ADVANCED RESCUE OPTIONS

2.1 BASIC CLOSE RESCUE MODE – ADVANCE OPTION (dynamic Revenue-to-close($) and Cluster Scheme for every iteration)

Description

This mode right here is an extension of the Primary Shut mode – which permit person to dynamically set the Revenue-to-close($) and the Cluster Mode (2-Node, or 3-Node) for every of the iterations, as a substitute of just one mounted worth of Revenue-to-close ($) and Cluster Scheme

|

# |

Inputs |

Description |

Values & examples |

|---|---|---|---|

|

2.1.1 |

Rescue Scheme |

The scheme for the present iteration (i.e. 2-Node or 3-Node) |

Choices: – _default_, – _3node_only_, – _2node_for_less_than_7_orders_, – _2node_for_less_than_10_orders_, – _iteration_based_, _default_: if grid’s measurement lower than or equal to 4 orders then the default scheme is 2-Node, 5-10 is 3-Node _3node_only_, at all times attempt to use 3-Node scheme, i.e. at all times type a cluster of three grid order and shut them collectively on the Revenue-To-Shut _2node_for_less_than_7_orders_: if grid’s measurement is lower than 7 order than use 2-Node, and when 7 orders for greater than use 3-Node _2node_for_less_than_10_orders_: if grid’s measurement is lower than 7 order than use 2-Node, and when 10 orders for greater than use 3-Node _iteration_based_, this feature let person outline particular Revenue-to-close and the cluster scheme for every iteration with the syntax {scheme}:{profit-to-close} utilizing #2.1.2, separated by comma. For instance: if person put in “2:-1.25, 3:-2.50, 2:2.0, 3:-0.1” which might signifies that – 1st iteration: shut 2 orders when their Revenue-to-close = -$1.25 – 2nd iteration: shut 3 orders when their Revenue-to-close = -$2.5 – third iteration: shut 2 orders when their Revenue-to-close = $2.0 – 4th iteration: shut 3 orders when their Revenue-to-close = -$0.1 In order that person has full freedom to instruct at which stage of Revenue-To-Shut this mode ought to shut and between 2-Node or 3-Node scheme. A greatest follow is to attempt a low, unfavorable Revenue-to-close on the early iteration after which steadily improve this quantity for subsequent iteration so to keep away from chance of deep drawdown and simpler to shut a part of the grid on the early stage. For the _iteration_based_ possibility, the final iteration setting within the enter will proceed for use till the entire grid is closed, so within the instance above, the SubGrid Shut bot will proceed to shut 3 orders at -$0.1 for the fifth, sixth, seventh … iteration and so on. —————————————- *writer observe: more often than not, I exploit solely _default_, _3node_only_ and _iteration_based_ as a result of private choice, as I’m not want to let my grid get to greater than 5 working orders |

|

2.1.2 |

Iteration Mode and ProfitToClose (If choose RescueScheme = _Iteration_based_) |

The listing of RescueScheme and Revenue-To-Shut for every iteration, separate by comma |

{scheme}:{profit-to-close} Instance: 2:1.25, 3:2.5, 2:2.0, 3:2.0, 3:1, 3:1, 3:0.5, 3:0.5 (white-space between the comma will probably be routinely trimmed, so to not fear) |

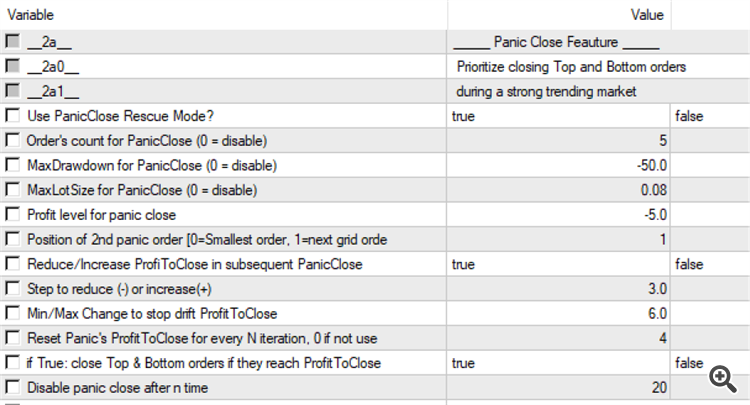

2.2 PANIC CLOSE RESCUE MODE

Description

‘Panic Shut’ rescue mode is a characteristic which specialised for ‘panic’ circumstances, with the next ‘triggers’:

- grid’s drawdown ($) have reached an alarming stage

- grid measurement (rely of order) have develop into many

- grid’s most lotsize has develop into too massive

When a number of of those set off are met, the grid can be thought of in ‘Panic’ mode à the Panic Mode bot will try to shut TopOrder and BottomOrder.

From my reseach and expertise, the components chosen above has been the first issue contribute to the expansion of drawdown and account’s margin name and therefore will have to be managed to ensure that the grid’s drawdown to be ‘sustainable’. Relying on the tracked grid EA logic, customers can outline the metric of those triggers to find out if the grid’s publicity have ‘entered’ Panic mode

|

# |

Inputs |

Description |

Acceptable values & examples |

|---|---|---|---|

|

2.2.1 |

Use PanicClose Rescue Mode? |

That is toggle to allow / disable PanicClose rescue mode |

True/False |

|

2.2.2 |

Order’s rely for PanicClose (0 = disable) |

The variety of order within the grid once you need the PanicClose mode to start out execute rescue. |

For instance, in the event you set this to five, then PanicClose would solely begin execute rescue when there are 5 or extra orders within the grid. That is to keep away from PanicClose being executed prematurely and cut back the chance for the entire grid being closed as a substitute |

|

2.2.3 |

MaxDrawdown for PanicClose (0 = disable) |

The extent of Drawdown ($) once you need the PanicClose mode to start out execute rescue |

Identical as above, PanicClose bot is not going to try to shut orders till the grid’s drawdown has reached this stage. Instance: if this set to -90, then PanicClose bot would begin shut TopOrder and Backside Order (on the Revenue-to-close outlined) ONLY when grid’s drawdown is at -$90 or extra (i.e. working revenue of TopOrder + BottomOrder is -$90 or much less). |

|

2.2.4 |

MaxLotSize for PanicClose (0 = disable) |

The Most lot measurement to find out if grid is in ‘Panic mode’. |

Identical as above, PanicClose bot is not going to try to shut orders till the grid’s most lot measurement has reached this stage

Instance: If person set this to 0.12 then the tracked grid can be thought of ‘Panic’ when an order with 0.12 lot measurement is opened |

|

2.2.5 |

Revenue stage ($) for panic shut |

The sum of TopOrder and BottomOrder at which PanicClose bot woud shut them |

Will be unfavorable – which might enable PanicClose at small loss |

|

2.2.6 |

Place of 2nd panic order [0=Smallest order, 1=next grid order …] |

‘2nd panic order’ means the BottomOrder to be tracked along with the TopOrder. This enables person to select an alternate ‘BottomOrder’ as a substitute of the default one |

That is used when the gap between the present Prime and Backside order within the grid is just too far-off which make it tough for the their revenue’s sum to succeed in the Revenue-to-close stage (in #2.2.5). Thus person can set an ‘various’ BottomOrder with a smaller distance, therefore improve the possibility for PanicClose bot to execute. |

|

2.2.7 |

Cut back/Enhance ProfiToClose in subsequent PanicClose |

This toggle enable person to alter the preliminary Revenue-to-close for each subsequent PanicClose iteration

|

True/False If True, the Panic’s preliminary Revenue-to-close (outlined in #2.2.5) will probably be ‘drifted’ by the quantity (in #2.2.8 beneath) upward (if “+ve”) or downward (if “-ve”) |

|

2.2.8 |

Step to scale back (-) or improve(+) |

The ‘drift’ step by which the Panic Revenue-to-close can be modified by |

Instance: Provided that the preliminary Revenue-to-close (#2.2.5) is -8 and #2.2.7 is True, if person set this to six then: – 1st PanicClose iteration: Revenue-to-close = -$8 – 2nd PanicClose iteration: Revenue-to-close = -$2 (-8 + 6) – 3rd PanicClose iteration: Revenue-to-close = $4 (-2 + 6) – 4rd PanicClose iteration: Revenue-to-close = $10 (4 + 6) and so forth…

|

|

2.2.9 |

Min/Max Change to cease drift ProfitToClose |

The full quantity of change past which the drift would cease |

This cease additional drift of Revenue-to-close when to complete accrued change from the step reached this quantity. Proceed from the instance in #2.2.8 above: if person set this to 12, then the drift will cease on the 2nd iteration as a result of 6 (1st iteration) +6 (2nd iteration) = 12 |

|

2.2.10 |

IsPanicCloseBottomOrderIfBetter? |

Instruction for PanicClose bot to match the revenue sum for default Prime/Backside pair alternate options |

True/false Provided that the worth in #2.2.6 is just not 0, i.e. the PanicClose pair is shaped utilizing the choice BottomOrder, then when that is True, PanicClose bot will examine the 2 pairs’ revenue sum and decide the perfect one which reached present Revenue-to-close:

That is for the state of affairs the place the tracked grid Skilled subsequent order opened would possibly change the optimum pair between the (1) and (2), in order that person received’t be ‘locked in’ by the selection he/she made in #2.2.6 above |

|

2.2.11 |

Disable panic shut after n time |

This specify what number of occasions BlueSwift would use Panic Shut for a grid collection. As soon as this restrict has reached then BlueSwift would NOT proceed to execute panic shut. That is to keep away from panic shut getting used an excessive amount of and in case of unfavorable revenue to shut (as specified above) would erode the revenue earned by the tracked EA |

Integer: 1,2,3,.. and so on., Really helpful values ought to be between 8 to fifteen occasions |

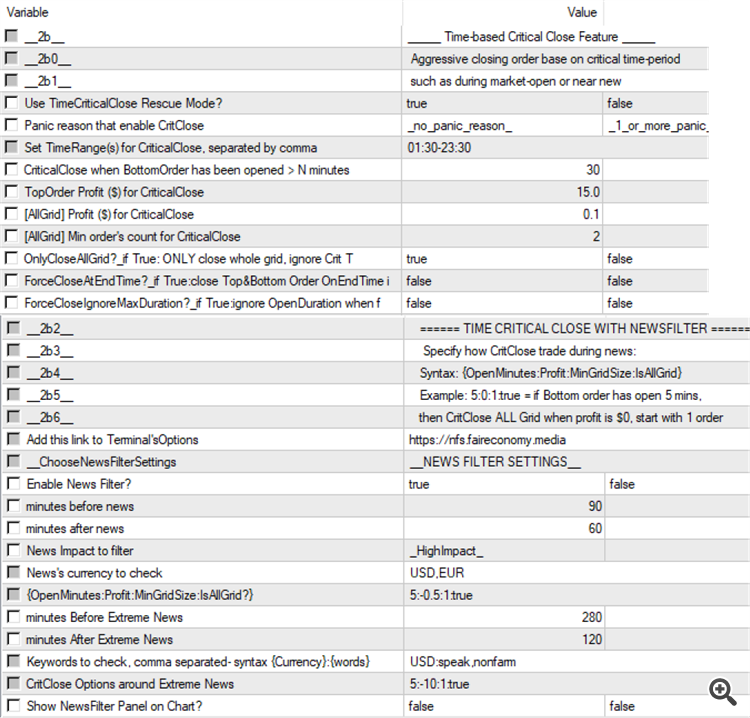

2.3 TIME CRITICAL CLOSE RESCUE MODE

Description

Instruct GridRescue to shut order base on time interval. This mode is helpful for grid system that’s time-sensitive for instance, buying and selling system entry / exit base on Information occasion or outlined time-range (akin to London or US open)

On this mode, the primary set off parameter are:

- The TopOrder’s revenue

- The BottomOrder’s opening period

The primary rationale for the 2 triggers above is that: the longer the BottomOrder keep open the upper the possibility person being caught in unfavorable place if market transfer in opposition to the grid. Thus person can set the period worth so the CritClose bot will kick-in to try shut out the grid

The built-in NewsFilter module is mix with this mode to permit person outline exiting situation & technique throughout pre- and post-Information occasions durations

|

# |

Inputs |

Description |

Values & examples |

|---|---|---|---|

|

2.3.1 |

Use TimeCriticalClose Rescue Mode? |

That is toggle to allow / disable TimeCriticalClose rescue mode |

True/False |

|

2.3.2 |

Panic cause that allow CritClose |

<utilized in mixture with PanicClose> This selection is used when person need to restrict CritClose to being executed ONLY when the grid is in throughout Panic mode (detected by PanicClose bot). if you do not need this restriction you possibly can select the explanation = _no_panic_reason_ |

Choices: _1_or_more_panic_reason_: allow CritClose base on any ‘panic’ standards: e.g. as a result of both drawdown stage, order’s rely or max lotsize opened _for_drawdown_or_maxlot_only_: allow CritClose will probably be executed when the tracked grid is below any both drawdown stage or max lotsize opened triggers _for_drawdown_only: allow CritClose base on the Drawdown standards in PanicClose bot _for_maxlot_only_: allow CritClose base on the MaxLot standards in PanicClose bot _for_drawdown_and_maxlot_only_: allow CritClose base on each Drawdown and MaxLot standards in PanicClose bot _no_panic_reason_ : no want Panic mode to allow CritClose |

|

2.3.3 |

Set TimeRange(s) for CriticalClose, separated by comma |

The time vary during which CritClose is energetic base on dealer’s server time (displayed within the Terminal’s MarketWatch) |

String of time-range, separate by comma (,) Format for every time vary (Begin Time and Finish Time): “hh:mm” The time-range syntax can be {Begin Time}-{Finish Time} For instance 04:30-10:00 means Begin Time = 4:30 and Finish Time = 10:00 Consumer can set a number of timeranges, separated by comma: 04:30-10:00,14:30-22:59 In order that CritClose will solely be energetic inside these ranges |

|

2.3.4 |

CriticalClose when BottomOrder has been opened > N minutes |

Open period of BottomOrder. CritClose will solely activated when the BottomOrder’s open period has handed this quantity |

Integer Instance, if person set this to 30 → CritClose will try to shut Prime and BottomOrder as soon as BottomOrder has been opened greater than half-hour (offered that TopOrder’s revenue standards meet the worth in #2.3.5 beneath) |

|

2.3.5 |

TopOrder Revenue ($) for CriticalClose |

Minimal revenue ($) of TopOrder at which CritClose will shut TopOrder with BottomOrder |

Float Will be unfavorable |

|

2.3.6 |

[AllGrid] Revenue ($) for CriticalClose |

<Extented possibility> when the monitoring grid attain this revenue stage CritClose will attempt to shut the entire grid as a substitute of simply TopOrder and BottomOrder |

|

|

2.3.7 |

[AllGrid] Min order’s rely for CriticalClose |

<Extented possibility used with #2.3.6> Minimal Grid Measurement enable for CritClose to shut complete grid |

|

|

2.3.8 |

Solely Shut all Grid? |

<Prolonged possibility> shut all opened orders for the entire grid as a substitute of simply the Prime and Backside order |

True/False if True : instruct CritClose bot to ONLY shut complete grid, i.e. this can ignore Prime&BottomOrderClose (#2.3.5) and ForceClose parameters (#2.3.9 and #2.3.10) |

|

2.3.9 |

Pressure-Shut At EndTime |

<Prolonged possibility> execute TimeCriticalClose another time proper on the finish of the required time-range |

True/False Utilizing the instance in #2.3.3: if True, then CritClose bot will try to shut Prime and Backside orders when server time is 10:00 and 22:59 |

|

2.3.10 |

Pressure-Shut Ignore Max Period |

<Prolonged possibility used with #2.3.9> used with Pressure-Shut At EndTime possibility. This specified if ForceClose bot ignoring the open-duration attribute of the Backside order within the grid |

True/False If True: ignore Backside order’s open-duration when carry out ForceClose. That is for additional aggressive exit technique, CritClose will skip the BottomOrder period standards ———————————— *Writer observe: use this with warning as this will likely trigger CritClose to shut Prime and Backside order with massive loss if the TopOrder revenue (#2.3.5) is just too low to compensate for the loss in BottomOrder |

|

2.3.11 |

Allow Information Filter? |

This toggle to allow/disable including NewsFilter for CritClose rescue mode. |

True/False |

|

2.3.12 |

Minutes earlier than information |

Integer Really helpful values to be 30, 60, 90, or greater than 120 |

|

|

2.3.13 |

Minutes after information |

Integer Really helpful values to be 30, or 60 |

|

|

2.3.14 |

Information Affect to filter |

The Information occasion’s impression for NewsFilter. Solely information with this impression or larger would allow CritClose bot motion |

Choices: _LowImpact_ _MediumImpact_ _HighImpact_ |

|

2.3.15 |

Information’s foreign money to examine |

CritClose would solely motion on the tracked grid’s image if it comprises the foreign money impacted by the present energetic Information occasion |

Listing of foreign money, separated by comma Instance: USD,EUR,GBP This might have an effect on:

|

|

2.3.16 |

{OpenMinutes:Revenue:MinGridSize:IsAllGrid?} |

That is the OrderClose setting for activate CritClose bot to shut Prime and BottomOrder when NewsFilter detect energetic Information occasion |

Syntax: {OpenMinutes:Revenue:MinGridSize:IsAllGrid?} Instance: “5:0:2:true” This implies: – `5’: as soon as the BottomOrder has been opened for greater than 5 minutes – `0’: at $0.00 revenue (break even) – `2’ when there may be at the least 2 orders within the grid – `True’: Shut complete grid solely, i.e. #2.3.8 |

|

2.3.17 |

minutes Earlier than Excessive information |

period size (in minutes) Earlier than excessive information occasion |

As per #2.3.12 |

|

2.3.18 |

minutes After Excessive information |

period size (in minutes) After excessive information occasion |

As per #2.3.13 |

|

2.3.19 |

Key phrases to examine, comma separated- syntax {Foreign money}:{phrases} |

The key phrases and foreign money filter to find out if a Information occasion is of ‘Excessive’ class |

As per #2.3.16 |

|

2.3.20 |

CritClose Choices round Excessive Information |

That is the OrderClose setting for activate CritClose bot to shut Prime and BottomOrder when NewsFilter detect energetic Excessive Information occasion |

As per #2.3.16 This parameter enable person to set a separated, extra aggressive exit standards round Excessive Information occasions like Non-farm payroll or Fed speaker. |

|

2.3.21 |

Present NewsFilter Panel on Chart |

Toggle On/Off for show of NewsFilter Panel |

True/False Observe: advocate to show this off in Technique Tester to hurry up the back-test pace in the event you don’t want to check the CritClose exercise round Information occasion |

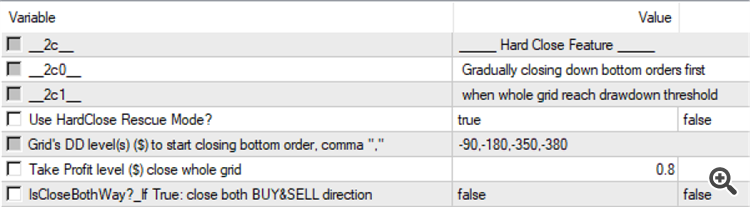

2.4 HARD CLOSE RESCUE MODE

Description

This mode will enable person to shut the present BottomOrder within the grid as soon as the grid’s drawdown has reached a sure stage. This thus act a delicate ‘stop-loss’ for the grid, forestall margin name and presever fairness (i.e. emergency mode)

|

# |

Inputs |

Description |

Values & examples |

|

2.4.1 |

Use HardClose Rescue Mode? |

Toggle to allow/disable HardClose rescue mode |

True/False |

|

2.4.2 |

Grid’s DD stage(s) to start out closing backside order, comma “,” separated |

Steadily closing down backside orders first when this Drawdown stage was reached |

Float-negative worth Instance -500.90 -> which implies a drawdown of -$500.90 Consumer-error-proofed: BlueSwift EA has a built-in validation to make sure that in case person, by mistake, key in a constructive worth, HardClose bot wouldn’t be executed. Please bear in mind to double-check this worth to make sure you sort in a unfavorable worth Consumer can set a number of drawdown stage for every HardClose iteration: Instance: “-90,-160,-120” -> this implies: – 1st HardClose iteration: shut BottomOrder when grid’s drawdown is -$90 – 2nd HardClose iteration: shut BottomOrder when grid’s drawdown is -$160 – third HardClose iteration: shut BottomOrder when grid’s drawdown is -$120 As soon as it get to the ultimate iteration within the listing, the drawdown stage will probably be reset again to the primary merchandise within the listing, i.e. with the instance above, HardClose bot will shut BottomOrder in 4th iteration at -$90 drawdown ———————- Writer’s observe: advisable to make use of a growing drawdowns listing with round 4 or 5 iteration: akin to: -90,-150,-260,-390. This could enable HardClose exercise whereas on the identical time enable room for brand spanking new order with greater lotsize to shut out the grid when market come again |

|

Take Revenue stage ($) shut complete grid |

Revenue ($) stage for HardClose bot to shut the entire grid |

||

|

IsCloseBothWay? If True: shut each BUY&SELL route |

If there are at the moment each BUY and SELL grids on a symbol-magic: this feature would allow HardClose bot to shut each grids. |

True/False If true: Shut out grids of each route That is helpful for hedged grid system the place they’ve working BUY and SELL grids concurrently |

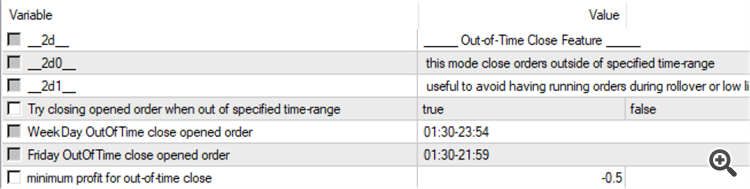

2.5 OUT-OF-TIME CLOSE RESCUE MODE

Description

This mode will enable person to instruct BlueSwift to attempt closing the entire grid when outdoors of specified time-range (the other of CritClose). That is helpful to keep away from having working orders throughout rollover or low liquidity durations akin to weekend, mid-night rollover, market vacation

|

# |

Enter |

Description |

Values & examples |

|---|---|---|---|

|

2.5.1 |

Is OutOfTimeClose Enabled? |

toggle to allow / disable Out-of-Time Shut rescue mode |

True/FalseIf True: BlueSwift would attempt closing grid’s opened order when out of specified time-range |

|

2.5.2 |

WeekDay OutOfTime shut opened order |

The Out-of-time for weekdays (Monday – Thursday) |

String of time-range, separate by comma (,) much like #2.3.3 Instance: – “01:30-22:59“: – “01:30-08:30,16:00-20:15“ OutOfTimeClose will activate outdoors of those ranges. For instance if person set “01:30-08:30,16:00-20:15” then orders can be shut if dealer’s server is between the next for Monday to Thursday: – 00:00 – 01:29 – 08:31 – 15:59 – 20:16 – 23:59 |

|

2.5.3 |

Friday OutOfTime shut opened order |

The Out-of-time for Friday |

Identical as 2.5.2 above however for Friday solely -> helpful for these person who need to keep out of market going into weekend |

|

2.5.4 |

Minimal Revenue ($) for OutOfTimeClose |

The Revenue-to-close for OutOfTimeClose bot |

——————————————————–

Why utilizing this Skilled

Do you utilize a grid/martingale system in your buying and selling? Do the next issues sound acquainted to you:

-

You solely have small capital $100-$500 to start out with buying and selling however you need the 8-10% month-to-month return from a grid system?

-

You employ grid / martingale technique however always have to maintain Drawdown at a cushty stage beneath your “pain-tolerance” threshold?

-

You need to shortly get out of opening grid/martingale on market pull-back / trending?

In a method or one other, everybody would admit it: Grid and martingale are the MOST PROFITABLE programs … till it BLOW your account. Have you ever ever needed to excruciatingly undergo dozen of grid programs, backtest them, put them on reside account, see they works for a couple of weeks or months (dreaming about quitting your day job and purchase costly automobiles) after which BOOM, your account is gone to mud, collectively along with your hard-earn financial savings. Throughout my +10 years of buying and selling foreign exchange, having blowned numerous of accounts as a result of martingale or grid-like methods, I do know the frustration.

The primary points, and I means systematic points, with most of grid/martingale methods EA available on the market are:

1. Not appropriate for small account measurement: They haven’t any Drawdown rescue mechanism and solely have some fundamental protecting measures just like the level-to-start-averaging, which simply decelerate the Drawdown and mildly cut back the blow chance. These EA would require a really massive deposit like $3000~$5000 to start out. Finally, they may nonetheless BLOW, dropping you $3000~$5000.

2. Rescue received’t cease drawdown proceed: Some grid EAs have Drawdown rescue built-in. Nonetheless the rescue mechanism could be very “linear” and inflexible: it should pair up and shut solely the highest (largest) and backside (smallest) orders in revenue. This method appears engaged on paper, however in actuality it received’t. As market begin trending deeper in opposition to you, greater lotsize order must opened to proceed rescue the smallest backside order (which truly not impression your drawdown a lot!), and whereas a giant chunk of orders in the course of the grid (the account-killer ones) nonetheless opened, thus Drawdown proceed to develop after which BLOW your account ultimately. The diagram beneath illustrate this whack-a-mole downside:

3. Threat of margin-call / account blow continues to be vital: Regardless of the above measures, with all grid/martingale programs, there are a sure point-of-no-return (relying in your account’s capital and margin stage), once you solely have TWO selections:

- All-in: hopefully the subsequent order EA opened will probably be sufficient to shut out all the entire grid in revenue (and dropping sleep throughout the entire course of), or

- Fireplace-sales to protect fairness: Painfully shut out all / a part of the grid to launch deposit load, swallowing enormous losses.

each of the above approaches are very deterimental to your capital in addition to your buying and selling psychology and mentality.

4. EA authors merely don’t care: Sadly, the above issues are persist as a result of most grid/martingale EA authors are both persuade you laborious sufficient that their Drawdown rescue characteristic is secure sufficient to have you ever worthwhile utilizing their EA, or they’re busying publish subsequent “promising” new bots to proceed milk out $$$ from the exsiting & new consumers, leaving us with the prevailing incomplete EA that can BLOW your account any minute.

————————————

With this painful expertise, and have been fed-up with requesting the opposite grid EA authors to alter / enhance their program, I’ve coded this BlueSwift myself that’s specifically designed to:

-

Work with any current grid/martingale EA: no extra nagging your EA authors into including Drawdown rescue characteristic to their EA, simply use my EA to handle their orders (*)

-

2-Node / 3-Node rescue: EA will neatly choose three orders from present grid and shut them at a revenue that you simply specify, not simply Prime and Backside orders. This not solely cease the Drawdown to spiral bigger when market proceed to pattern in opposition to you, but in addition get you out of the grid nightmare quicker earlier than it passes the point-of-no-return.

-

Versatile fundamental and superior rescue schemes: you possibly can select from both 4 predefined rescue schemes with the BASIC RESCUE MODE which have been back-tested with most of Fx pairs and Gold (XAUUSD) along with your level-to-start-rescue (optimum is 4th or fifth) or you possibly can specify rescue Modes (2Node | 3Node) and ProfitToClose at every iteration (utilizing iteration-base scheme). Which means that you’re completely in management and might swap between 2-Node and 3-Node rescue mode as you want. If BASIC RESCUE MODE usually are not adequate, you possibly can leverage the ADVANCED RESCUE MODES, every was added for a really particular buying and selling type / situations:

1. PANIC CLOSE: ought to be used when market begin robust trending in opposition to your grid’s route or when DD begin inching additional away out of your most well-liked stage

2. TIME CRITICAL CLOSE: ought to be used when your monitoring consultants have a really time-sensitive entry/exit set off akin to mid-night scalper, breakout, Information scalper

3. HARD CLOSE: this mode is much like the Fireplace-sales method to protect fairness. Nonetheless as a substitute of closing out all orders within the grid directly, HARD CLOSE steadily shut the earliest orders within the grid one after the other. This varied benefit over custom fairness safety, which I’d analyse intimately beneath

4. OUTOFTIME CLOSE: this mode enable person to specified situation to shut any working grids through the interval outdoors the required time-range(s). That is to keep away from having publicity throughout low-liquidity interval akin to mid-night rollover, week-end, market-holiday, and so on.

-

Handle Purchase and Promote grid individually: no fear about being tangled in artificial hedged positions with each purchase and promote grids. GridRescue EA will handle purchase and promote grid orders individually.

-

OneChart Setup: You solely want one chat for GridRescueEA to handle a number of grasp EA and Symbols

———–

Grid collection monitoring mechanism

BlueSwift EA detect and observe grid collection utilizing 2 sort of entities:

1. Image-MagicNumber-OrderType

2. Image-MagicNumber-OderType-OrderComment

With these two monitoring mechanism, it permits BlueSwift with the ability to tailored to numerous monitoring necessities and person profile:

– Customers need to handle Purchase and Promote orders individually

– Customers who use one Skilled on a number of Image

– Customers who use one Skilled however with mulitple MagicNumber

– Customers who use a number of Skilled on one Image

– Customers who use a grid Skilled that handle their grid orders with a standard Feedback string sample: for instance {grid-comment}-0, {grid-comment}-1, {grid-comment}-2, {grid-comment}-3 and so on.

———–

Conclusion

BlueSwift GridRescue is a one-stop store of threat mamagement utility for anybody on the market who at the moment use or intend to make use of a grid / grid-like buying and selling system. I’ve accomplished a variety of analysis, evaluation, testing and ensuring BlueSwift functionalities described right here can be utilized to fit your buying and selling portfolio and threat intolerance. In the event you assume you’ve got additional enhancement concepts for BlueSwift – please don’t hesitate to contact me by way of MQL message, e mail blue.algoplus@gmail.com after buy in the event you want additional help

———–

(*) Phrase of warning: Please observe that Blueswift Grid Rescue might not be appropriate for grid methods the place they don’t ‘reset’ lotsize averaging the upcoming order after an in depth of some orders in collection (see illustration beneath). This might result in an insanely-big lotsize opened by your tracked grid ea and will blow the account.

It is at all times extremely advisable to forward-test BlueSwift along with your meant grid skilled(s) in a demo account for a interval of 2-3 months to see how your grid skilled(s) behave after some a part of the collection opened by them had been closed by BlueSwift.

(**) whereas this device would cut back account blowing threat considerably, it doesn’t assure 100% of no blow. Utilizing any grid EAs will at all times include margin name sooner or later in time (as it might depend upon many components just like the tracked grid Skilled commerce entry’s logic, the account’s obtainable margin, brokers situations like slippage, black swan occasion, and so on.). I extremely advocate you to make use of BlueSwift to scale back / delay the chance of margin name and withdraw closed revenue steadily or tranfer them to a non-grid system. BlueSwift has been examined rigorously each in backtest and ahead take a look at atmosphere greater than a 12 months previous to launch, and I’m assured that it functionalities would cowl most market situations and situations. Whereas utilizing BlueSwift, in case you have necessities for situations in buying and selling that BlueSwift has not but lined, please do attain out to me, I’ll do my greatest to include that into this EA.

[ad_2]