[ad_1]

America’s financial institution conglomerates – JPMorgan, Citigroup and Wells Fargo – shall ship their Q2 2023 earnings consequence this Friday (14th July) earlier than market open.

S&P500 & Dow Jones U.S. Banks Index Efficiency. Supply: SPGlobal

Generally, the Dow Jones US Banks Index has been subpar than S&P500 for the previous 5 years, yielding a unfavourable annualized return at -1.96%, with the latter yielding +9.77% (Additionally finest H1 efficiency since 2019). YTD return for each indices are recorded at -9.89% and 14.57%, respectively. In March 2023, the decline of the Dow Jones US Banks Index was vital following the failure of US banks. Nonetheless, the index ticked larger lately after main lenders cleared the Fed’s annual stress check, coupled with raised expectations over additional price hikes by the central financial institution (might the constructive sentiment be erased quickly following latest NFP knowledge which carried out beneath expectations?).

JPMorgan

JPMorgan is the world’s largest financial institution by market capitalization (over $410B). It gives a spread of monetary and funding banking companies and merchandise in all capital markets, together with advising on company technique and construction, capital elevating in fairness and debt markets, danger administration, market making in money securities and spinoff devices, brokerage and analysis.

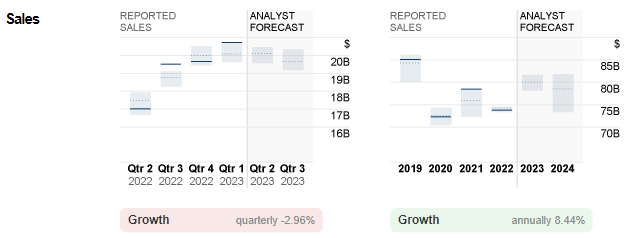

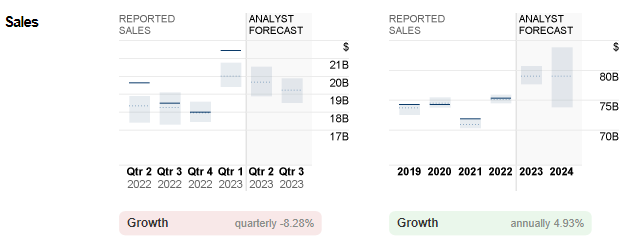

JPMorgan gross sales: Reported versus Analyst Forecast. Supply: CNN Enterprise

JPMorgan gross sales: Reported versus Analyst Forecast. Supply: CNN Enterprise

Final yr, JPMorgan reported gross sales reached a file excessive at $128.7B, up over 5.7% from 2021. This marked the seventh annual consecutive gross sales beneficial properties for the agency. Whole web revenue hit $37.7B, beneath 2021 ($48.3B).

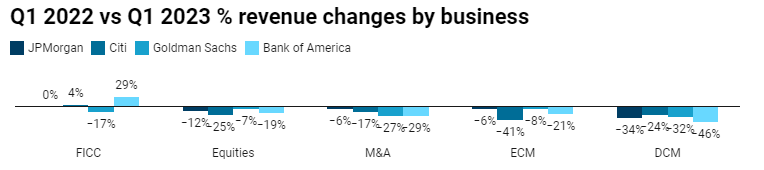

Income Modifications by Enterprise: JPMorgan and its Friends. Supply: efinancialcareers

In Q1 2023, the financial institution displayed resilience essentially (stable buying and selling volumes, funding banking charges, web curiosity margins and revenue from mortgage banking), which led to reported gross sales hitting $39.2B, up over 27% from the identical interval final yr. By comparability, JPMorgan carried out higher than Citi equities gross sales and buying and selling, M&A advisory and fairness capital markets (ECM). Alternatively, JPMorgan outperformed Financial institution of America in each class besides the mounted revenue currencies and commodities (FICC). All in all, the US banking establishment stays wholesome basically, confirmed by the Fed’s stress check carried out lately.

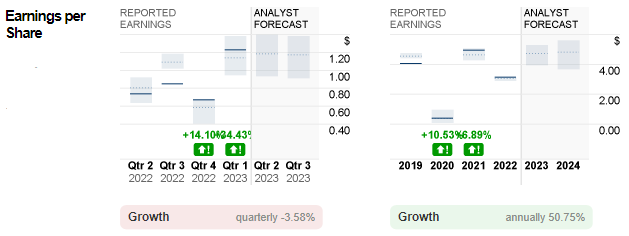

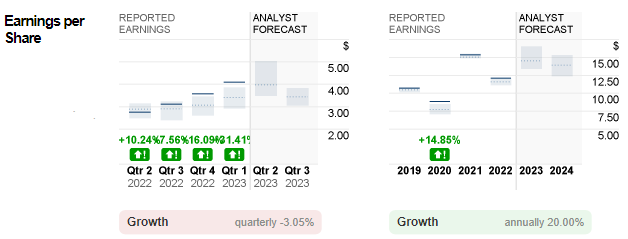

JPMorgan EPS: Reported versus Analyst Forecast. Supply: CNN Enterprise

JPMorgan EPS: Reported versus Analyst Forecast. Supply: CNN Enterprise

EPS of JPMorgan in 2022 was down -21% from 2021, to $12.09. In Q1 2023, reported EPS of the agency was $4.10, in comparison with the $2.63 determine in the identical interval final yr.

Larger rates of interest could function a constructive catalyst for the banks (Certainly, this will probably be one other case if injury from mortgage losses is simply too extreme). Analysts forecast JPMorgan’s gross sales to hit $39.2B within the coming announcement, up 2.35% from the earlier quarter and up 27.7% from the identical interval final yr. Expectation for EPS stood at $3.94, as in comparison with $4.10 within the earlier quarter and $2.76 in Q2 2022.

Citigroup

Citigroup, shaped by the merger of banking big Citicorp and monetary conglomerate Vacationers Group in 1998, has a market capitalization over $88B. It operates by way of International Client Banking (conventional banking companies for retail prospects), Institutional Shoppers Group (mounted revenue and fairness analysis, gross sales and buying and selling, overseas alternate, prime brokerage, spinoff companies, funding banking and advisory companies, personal banking, commerce finance and securities companies), and Company and Different (embrace un-allocated prices of world employees capabilities, different company bills, un-allocated international operations and know-how bills).

Citigroup Gross sales: Reported versus Analyst Forecast. Supply: CNN Enterprise

Citigroup Gross sales: Reported versus Analyst Forecast. Supply: CNN Enterprise

Reported gross sales of Citigroup final yr typically met market expectation, at $75.3B. That is nonetheless the finest efficiency ever since 2015. Quite the opposite, web revenue stood at $14.85B, down over -32% from 2021, however nonetheless greater than 34% above 2020.

In Q1 2023, its gross sales jumped 12% (y/y) and 19% (q/q) to $21.4B. Pushed by larger income (boosted by energy throughout Providers and Fastened Earnings Markets, and robust common mortgage progress in US Private Banking), its web revenue has amounted to $4.6B, up 7% from a yr in the past.

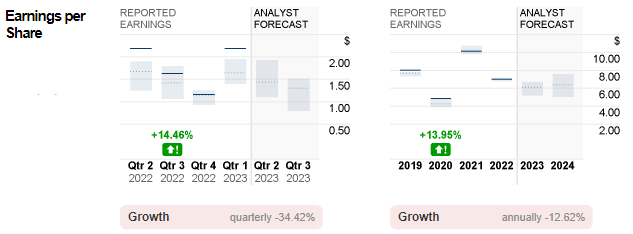

Citigroup EPS: Reported versus Analyst Forecast. Supply: CNN Enterprise

Citigroup EPS: Reported versus Analyst Forecast. Supply: CNN Enterprise

EPS of Citigroup hit $7.00, down -31% from the earlier yr. In Q1 2023, its EPS leaped to $2.19 (was $2.02 and $1.16 respectively in Q1 and This fall 2022).

Within the coming quarter, analysts forecast the gross sales of Citigroup to hit $19.5B, down practically -9% from the earlier quarter, and barely beneath that in Q2 2022 ($19.6B). Alternatively, EPS is anticipated to be down over -36% (each quarterly and yearly) to $1.39.

Wells Fargo

Wells Fargo, a diversified and community-based monetary companies firm, can be engaged within the provision of banking, investments, insurance coverage, mortgage services and products, in addition to shopper and business finance. It’s ranked fifth by market capitalization (over $160B).

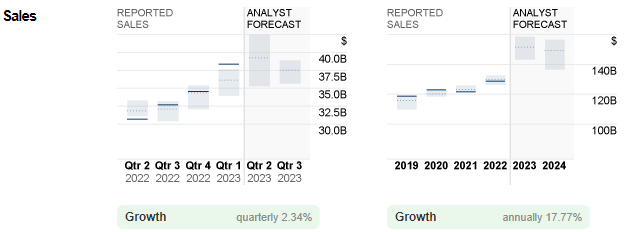

Wells Fargo Gross sales: Reported versus Analyst Forecast. Supply: CNN Enterprise

Whole gross sales income of Wells Fargo have been beneath $80B for the previous three years ($74.26B, $78.49B and $73.79B from 2020 to 2022). Apart from the Covid-19 pandemic and deteriorating economic system headwinds, a collection of inside points (federal regulatory fines, faux accounts scandal, excellent litigation, buyer remediation, and many others) additionally hit the financial institution.

Nonetheless, in Q1 2023, Wells Fargo reported $20.7B in gross sales income, a lot above consensus estimates ($20.1B, versus $19.7B in This fall 2022). Web revenue was additionally up over 30% (y/y) to almost $5.0B.

Wells Fargo EPS: Reported versus Analyst Forecast. Supply: CNN Enterprise

EPS was reported at $3.14 in 2022, down over -36% from a yr in the past. In Q1 2023, its EPS hit $1.23 (was $0.88 and $0.67 respectively in Q1 and This fall 2022). Analysts forecast the gross sales of the financial institution within the coming earnings announcement to barely right down to $20.1B, whereas EPS is anticipated to achieve $1.18.

Technical Evaluation:

On the weekly chart, #JPMorgan (JPM.s) traded above 100-week SMA, at the moment testing FR 61.8% at $146. An in depth above this stage could point out steady correction of the downtrend prolonged from October 2021-2022. $158 (FR 78.6%) could be the subsequent resistance to observe. In any other case, if the bullish breakout is unsuccessful, the 100-week SMA which can intersect with FR 50.0% at $137 which stays the closest help to observe, adopted by $129 (FR 38.2%).

#Citigroup (C.s) stays pressured beneath 100-week SMA, whereas it has remained range-bound beneath $55 since Q2 2022. It hit $40 in October final yr, which was the bottom since Might 2020. Previous to this help, the agency’s share worth might have to check $42 (FR 78.6%). In any other case, any rebound will hold resistance $50 (FR 61.8%) in focus, adopted by the 100-week SMA and $56 (FR 50.0%).

#WellsFargo (WFC.s) traded larger since gaining floor within the first quarter this yr, with lows at $35.25. By the top of Q2 2023, the agency’s share worth closed above $40.50, or FR 50.0%. It might nonetheless want to beat resistance at $45, the 100-week SMA and in addition a pattern line shaped by the highs seen in Feb 2022 and Feb 2023, to start one other uptrend. So long as these ranges stay unbroken, draw back strain stays, with $40.50 (FR 50.0%) serving as the closest help, adopted by $36 (FR 61.8%) and $29 (FR 78.6%).

Click on right here to entry our Financial Calendar

Market Evaluation Group

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]