[ad_1]

Value motion and technical indicators go hand in hand. Technical merchants might observe the route of value primarily based on value motion and ensure development route objectively utilizing technical indicators. Doing so would enable merchants to answer value actions extra successfully whereas being goal with their commerce choices. The technique mentioned under is an instance of how merchants can incorporate value motion and technical indicators inside a commerce setup.

ATR Adaptive T3 Indicator

The ATR Adaptive T3 indicator is a development following technical indicator which is virtually a modified transferring common. This methodology of calculating for the transferring common line is derived from the Triple Exponential Transferring Common (T3) and the Common True Vary (ATR).

The Triple Exponential Transferring Common, developed by Tim Tillson, can be a modification of the basic Exponential Transferring Common (EMA). The T3 indicator makes an attempt to enhance on the smoothing characteristic of the EMA line with the intention of getting a extra dependable development indication.

The ATR alternatively is a calculation of the typical vary of value actions inside a given interval. This indicator offers merchants an goal evaluation of the market’s volatility.

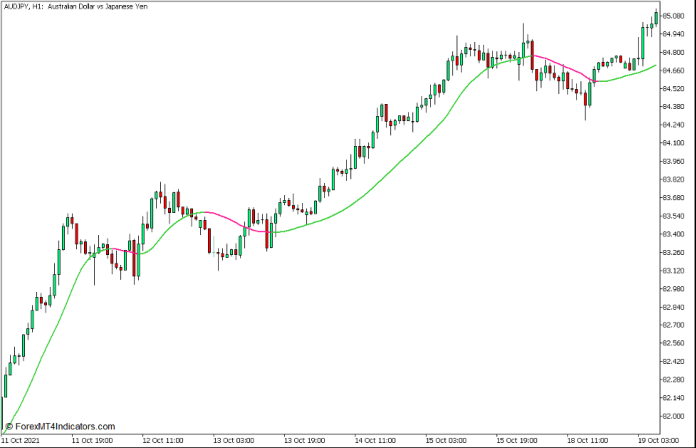

The ATR Adaptive T3 indicator is mainly a T3 indicator which provides weight on every bar primarily based on the normalized Common True Vary. This creates a transferring common line which retains the smoothening traits of the T3 line, whereas permitting the transferring common line’s responsiveness to cost actions develop into adaptive to the market’s volatility.

The ATR Adaptive T3 indicator additionally has a characteristic whereby the colour of its line would change relying on the route of its slope. It plots a lime inexperienced line at any time when the road begins to slope up and a deep pink line at any time when it begins to slope down. Merchants can use this characteristic to establish and ensure possible development reversals.

Relative Energy Index

The Relative Energy Index is a momentum technical indicator which was developed by J. Welles Wilder Jr. launched in his e book, “New Ideas in Technical Buying and selling Techniques”, in 1978. It presents the route of the momentum of value as an oscillator, measuring the magnitude of current value adjustments by evaluating the present value with current historic value information.

The RSI plots a line which oscillates throughout the vary of 0 to 100. The stated vary additionally has markers at ranges 30 and 70. These markers point out the traditional vary of the RSI. Something past this vary could also be thought-about overextended. RSI values above 70 are thought-about overbought, whereas values under 30 are thought-about oversold. Any reversal sign indication which will develop whereas the RSI is past the stated vary are thought-about excessive likelihood imply reversal indicators.

Apart from being an oversold and overbought indicator, the RSI may also be modified in order that it may be used to establish development route. Merchants might add markers at ranges 45, 50, and 55 to do that. The marker at 55 can be utilized to point the final development route or bias. The degrees 45 and 55 alternatively could also be used as help and resistance ranges for the RSI. In an uptrend market, the RSI ought to typically keep above 50 whereas the RSI line finds help at 45. Inversely, in a downtrend market, the RSI ought to keep under 50 and discover resistance at 55. Ranges 45 and 55 can also be used to verify development continuation because the RSI line would sometimes break above 55 as value motion expands upward or drop under 45 as value motion expands downward.

Buying and selling Technique Idea

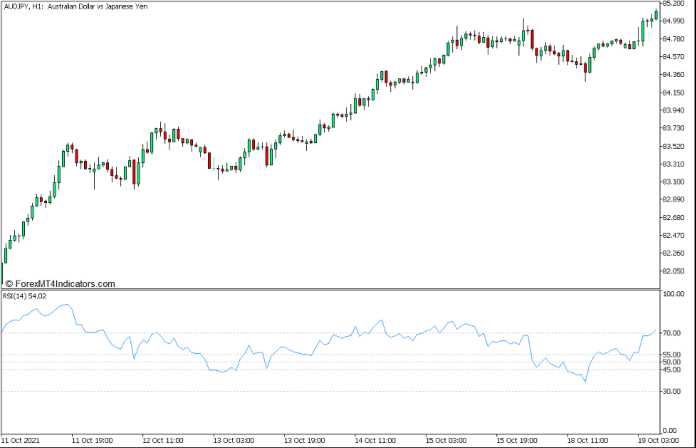

ATR Adaptive T3 Pattern Continuation Foreign exchange Buying and selling Technique is a development continuation technique which makes use of the confluence of the RSI indicator and the ATR Adaptive T3 indicator with a view to discover excessive likelihood commerce alternatives.

First, we must observe value motion with a view to establish the final development route primarily based on value swings. We must always then affirm the development primarily based on the final location of the RSI line in relation to the 50 marker. On the similar time, the ATR Adaptive T3 indicator must also point out a momentum route which is in confluence with the development.

As quickly as these situations are confirmed, we might then observe for pullbacks. The pullbacks would trigger the ATR Adaptive T3 line to quickly change colour towards the development and trigger the RSI line to quickly cross the 50 marker. Nevertheless, the RSI line ought to both discover help at 45 or resistance at 55, which might affirm the development. Commerce indicators are then confirmed on the confluence of the ATR Adaptive T3 colour change and the reversion of the RSI line again to the route of the development.

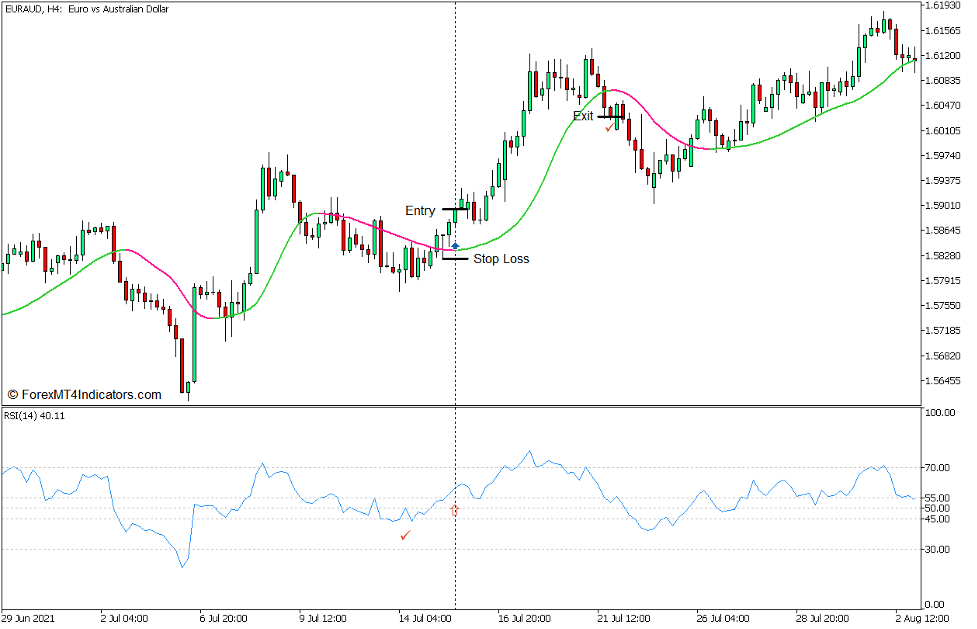

Purchase Commerce Setup

Entry

- Value swings ought to point out an uptrend market.

- The RSI line ought to typically be above 50.

- The ATR Adaptive T3 line must be lime inexperienced.

- Value ought to pull again inflicting the RSI line to quickly drop under 50 and the ATR Adaptive T3 line to quickly change to deep pink.

- The RSI line ought to discover help at 45.

- Open a purchase order on the confluence of the RSI line breaking again above 55 and the ATR Adaptive T3 line reverting again to lime inexperienced.

Cease Loss

- Set the cease loss on the fractal under the entry candle.

Exit

- Shut the commerce as quickly because the ATR Adaptive T3 line adjustments to deep pink.

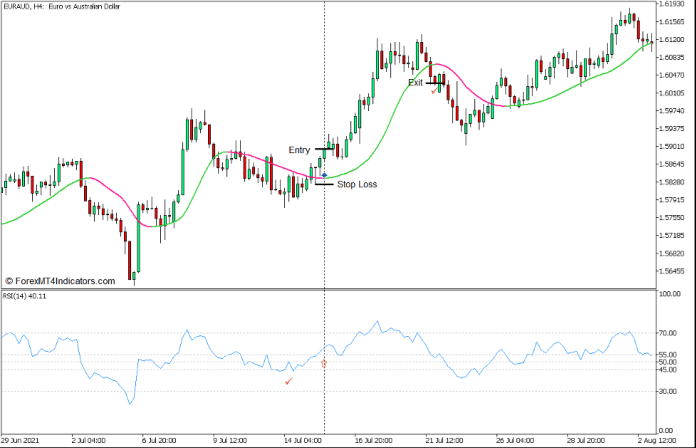

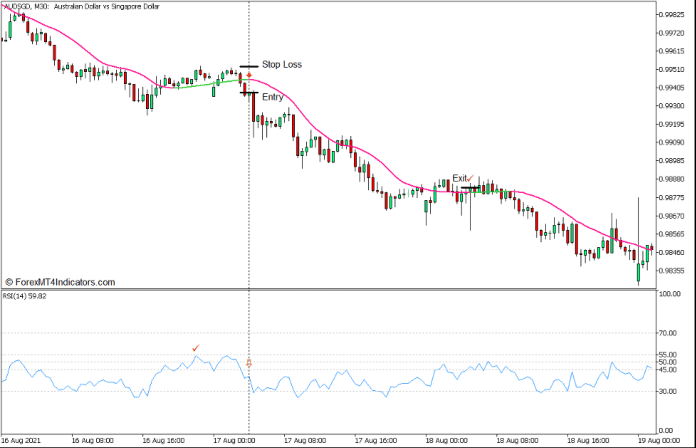

Promote Commerce Setup

Entry

- Value swings ought to point out a downtrend market.

- The RSI line ought to typically be under 50.

- The ATR Adaptive T3 line must be deep pink.

- Value ought to pull again inflicting the RSI line to quickly breach above 50 and the ATR Adaptive T3 line to quickly change to lime inexperienced.

- The RSI line ought to discover resistance at 55.

- Open a promote order on the confluence of the RSI line dropping again under 45 and the ATR Adaptive T3 line reverting again to deep pink.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce as quickly because the ATR Adaptive T3 line adjustments to lime inexperienced.

Conclusion

This buying and selling technique will be an efficient development following technique because it has the factor of being goal whereas on the similar time having a direct enter of what the market is doing primarily based on value motion. Nevertheless, merchants utilizing this technique ought to first learn to learn development route primarily based on value motion as that is the important thing factor to this technique.

Foreign exchange Buying and selling Methods Set up Directions

ATR Adaptive T3 Pattern Continuation Foreign exchange Buying and selling Technique for MT5 is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past information and buying and selling indicators.

ATR Adaptive T3 Pattern Continuation Foreign exchange Buying and selling Technique for MT5 supplies a chance to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional value motion and regulate this technique accordingly.

Beneficial Foreign exchange MetaTrader 5 Buying and selling Platforms

#1 – XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

#2 – Pocket Possibility

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 Total Score!

- Mechanically Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

The right way to set up ATR Adaptive T3 Pattern Continuation Foreign exchange Buying and selling Technique for MT5?

- Obtain ATR Adaptive T3 Pattern Continuation Foreign exchange Buying and selling Technique for MT5.zip

- *Copy mq5 and ex5 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out ATR Adaptive T3 Pattern Continuation Foreign exchange Buying and selling Technique for MT5

- You will notice ATR Adaptive T3 Pattern Continuation Foreign exchange Buying and selling Technique for MT5 is obtainable in your Chart

*Word: Not all foreign exchange methods include mq5/ex5 information. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]