[ad_1]

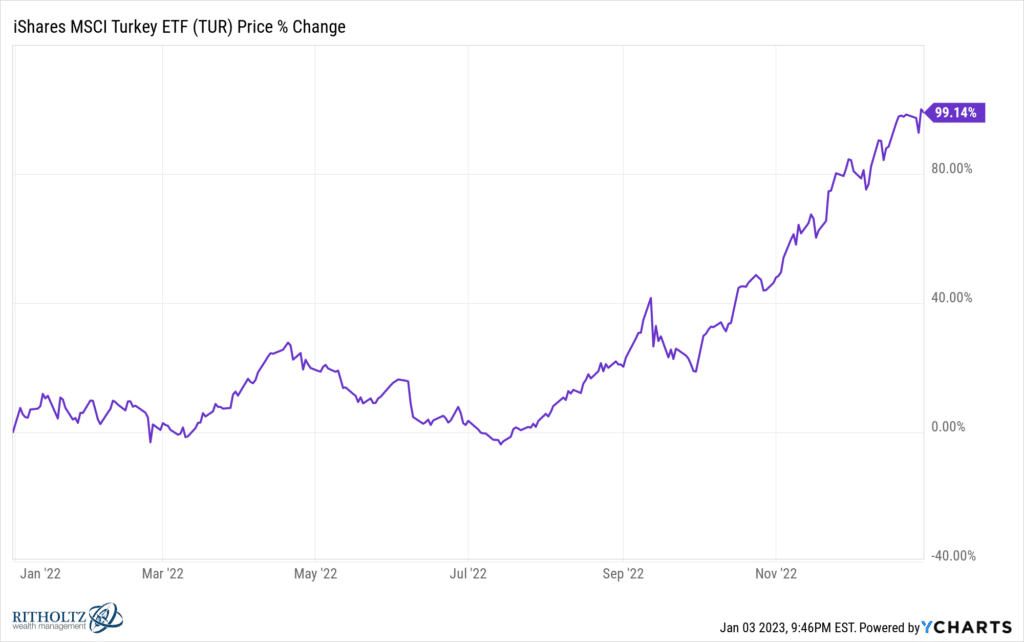

If you happen to’re a monetary advisor or a fund supervisor and also you weren’t down 20% final 12 months, you gained, mainly. The S&P fell right into a 20% bear market whereas the Nasdaq crashed nearly 40%. Bonds had been down double digits as an asset class. Worldwide shares, whereas outperforming the US and never down as a lot, had been nonetheless down rather a lot. Aside from Turkey, which inexplicably doubled final 12 months – right here’s the TUR ETF, up 99% in 2022.

I might Google it to search out out why, however I don’t really feel prefer it. Perhaps there’s no purpose in any respect.

The Dow Jones Industrial Common was down lower than 10% because of bigger weightings towards power shares, however nobody owns the Dow Jones in the best way individuals personal the S&P 500. Proof? The SPY ETF has $356 billion in it and the index has a whole lot of large ETFs and mutual funds monitoring it. The DIA – Dow Jones model of SPY – has lower than a tenth of the AUM ($29 billion) regardless of having existed for simply as lengthy.

Anyway, the silver lining of this bear marketplace for us is that we received to point out off the capabilities of all of the customized indexing and day by day, algorithmic tax loss harvesting we’ve been doing. Plus the advantage of working a tactical technique in tax-deferred accounts alongside our longer-term positions. Plus we raised a ton of cash from new purchasers who had gone into this mess with out a nice advisor or a working monetary plan or any clue about the right way to mitigate threat in a portfolio. We don’t root for bear markets, in fact, however we be certain they repay on the best way out. And it’s good to have optimistic, productive actions to absorb a blood-red tape. That is the seventh bear market of my profession already, we all know the right way to get by this stuff and what to do whereas we’re in them.

So, all issues thought of, this hasn’t been enjoyable however it’s going to all work out in the long run. It all the time does, supplied no one does something silly or irreversible on our watch.

I used to be occupied with the hierarchy of people that have been actually affected by the occasions (and value motion) of 2022 and I assume I might put staff of tech startups on the prime of my listing.

The rank and file startup employee has in all probability obtained plenty of their compensation (and day after day motivation) within the type of shares and inventory choices over the previous few years. In some instances they’ve even paid the taxes up entrance in order to not have to fret concerning the positive factors later. For this cohort, now staring down piles of nugatory or near-worthless shares in 1000’s of firms, it’s been a horrible expertise. The layoffs gained’t cease till the funding markets for enterprise fairness develop into extra forgiving, and so they gained’t for the foreseeable future. Capital has gone from low cost (and even free) to very costly. There isn’t a urge for food for this type of threat proper now. When the best firm on earth is on the verge of shedding half its market cap (as Apple appears to be headed for, for the time being), how on earth might there be demand for the shares of a pre-revenue white board concept masquerading as a enterprise?

Keep in mind the times of “Oh you might have a slide deck and an ex-Google worker, right here’s $80 million in seed capital”? Nicely, lately it’s the alternative. No seeds. Get away from my window.

The younger individuals who’ve flocked to those kinds of firms are going to really feel this uncertainty probably the most. The layoffs have solely simply begun. Subsequent are the wind-downs. That is when an organization is so hopelessly unprofitable and unlikely to be funded that the one accountable possibility is to simply cease. Take what’s unnoticed of the financial institution, return it to the buyers and go away the keys. It takes years for this course of to cleanse the ecosystem of extra and arrange the subsequent era. The individuals with endurance to hold on till then come from household cash or have already been the beneficiaries of an exit or two from a previous cycle. You recognize who they’re. They’ve seven figures within the financial institution and a willingness to spend their time polluting Twitter with half-remembered Clay Christensen aphorisms and threads concerning the exhausting factor about exhausting issues. They’ll do podcasts and hold forth about Ukraine till the Federal Reserve relents and the cash spigot activates once more. Mortimer, we’re again!

However the employees are type of f***ed for the second. They in all probability didn’t money something out or take any threat off the desk just like the founders have. They needed to put all of it on black and hold it there whereas awaiting information on the subsequent funding spherical. That information isn’t coming. And there’s nowhere to go proper now, even in an economic system with one of many tightest labor markets ever. The most important firms in tech, media and telecom are all freezing hiring or shedding workers, so swimming towards a much bigger ship in all probability gained’t assist a lot within the brief time period.

After startup employees, I might in all probability most really feel unhealthy for the mortgage brokers and the realtors. They had been driving one of the vital thrilling bubbles of exercise and motion the housing market has ever seen. A twenty 12 months up-cycle all packed right into a span of simply twenty months. My favourite native realtor began filming himself making an attempt on Gucci belts within the mirror. And posting it.

The years 2020 and 2021 may need been two of the best years of all time for the housing sector. Residence costs rose 40%, finally topping out in June of 2022. It’s been straight down ever since. Costs must fall additional to sync up with prevailing rents. Current residence gross sales have already begun fallen by the ground. Sellers have nowhere to go and no want to re-borrow at 6.5%. Patrons can’t rationalize the large improve in borrowing prices. Contractors can nonetheless promote newly constructed properties as a result of inventories are so tight, however the earnings from promoting a brand new home relative to the price of constructing it are nothing particular. The market has been put right into a deep freeze. Refinancings are executed. Demand for mortgages is falling off a cliff. Transactions are vanishing. It’ll worsen this spring. The comps relative to final spring will likely be laughably unhealthy.

Right here’s Brian Wesbury and Robert Stein at FirstTrust writing concerning the housing market:

The actual impact of the change in rates of interest is obvious within the present residence market. Gross sales hit a 6.65 million annual price in January 2021, the quickest tempo since 2006. However, by November 2022, gross sales had been all the way down to a 4.09 million annual price, a drop of 38.5% to this point. In the meantime a decline in pending residence gross sales in November (contracts on present properties) indicators one other drop in present residence gross sales in December.

Current residence consumers have two main issues: first, a lot larger mortgage charges, which suggests considerably larger month-to-month funds. Assuming a 20% down cost, the rise in mortgage charges and residential costs since December 2021 quantities to a 52% improve in month-to-month funds on a brand new 30-year mortgage for the median present residence.

You will get the remainder of their housing commentary right here.

So if you recognize a startup worker, be good and provide to flow into their resume round. And if you recognize a residential realtor who wasn’t ready for the 2021 atmosphere to vary so abruptly, give them a hug – they might use it proper about now. And if you recognize a mortgage dealer, properly, perhaps simply cross to the opposite facet of the road once you see them coming. No eye contact. Simply let ’em move and say, in low and reverent tones, “There however for the grace of God, go I.”

It’s a tricky atmosphere for most individuals proper now. Attempt to do not forget that it might all the time be worse.

***

Completely happy New 12 months. If you happen to’re not sure of your present monetary plan or portfolio otherwise you’re in search of a second opinion or an expert session, we’ve received a dozen Licensed Monetary Planners standing by to speak at your comfort. Don’t be shy, we do that all day for 1000’s of households throughout the nation. Ship us a be aware right here:

[ad_2]