[ad_1]

Three Issues To Think about When Contemplating Whether or not To Be Bullish or Bearish on the SPY.

Shares proceed to climb greater on the again of earnings which have overwhelmed expectations thus far (albeit lowered expectations). The NASDAQ 100 simply closed on the highest stage since final August. The S&P 500 (SPY) is getting ready to a breakout above $4200. The VIX simply closed beneath 16 for the primary time in properly over a yr.

Whether or not or not inventory markets rip even greater stays to be seen. Momentum can definitely take costs past affordable ranges and to extremes.

To cite Keynes- “Markets can stay irrational longer than traders can stay solvent”. Within the quick run, markets can and can do virtually something.

Over a bit longer-term horizon, nevertheless, three issues are value contemplating earlier than you contemplate getting lengthy shares at these ranges. Let’s look again to a couple of yr in the past (11 months) when the S&P 500 was at the same worth to see what has modified in that timeframe.

Implied Volatility

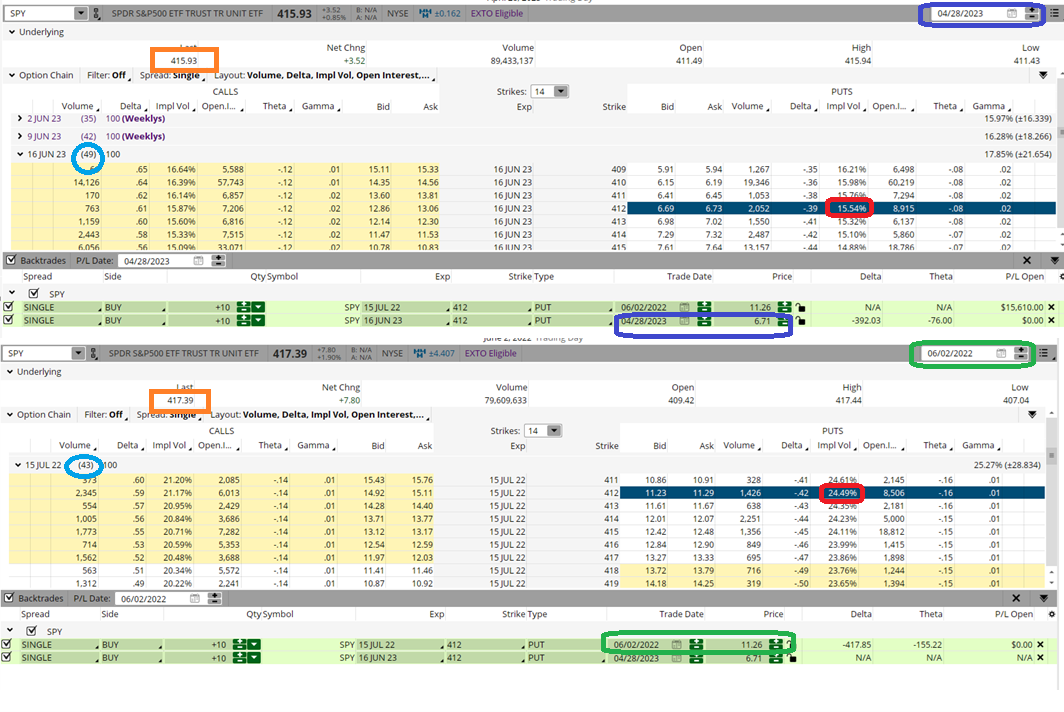

The 2 possibility montages beneath present possibility costs from Friday’s shut and from the shut on June 2, 2022.

Again on June 2, 2002, the SPY closed at $417.39. Friday it completed at $415.93, so just about the identical worth as Friday, only a contact decrease (0.35%) now.

The June 16, 2023, choices have 49 days to expiration (DTE). The July 15, 2022, choices have 43 DTE. So, a bit longer (6 days) for the 2023 choices now.

Usually, places which might be nearer to the cash with extra time to expiration are dearer. However as a result of the VIX -or implied volatility (IV) – is at lows, the places now are literally a lot cheaper ($6.71 now versus $11.26 then).

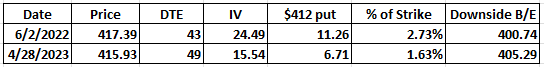

All due to the massive drop in IV from 24.49 to fifteen.54. The desk beneath places the comparability collectively, together with a % of strike (possibility worth /$412 strike worth) and draw back breakeven ($412 strike worth -option worth).

So, a a lot decrease value for significantly better safety. Form of like paying much less insurance coverage premium for a decrease deductible with the very same protection.

Curiosity Charges

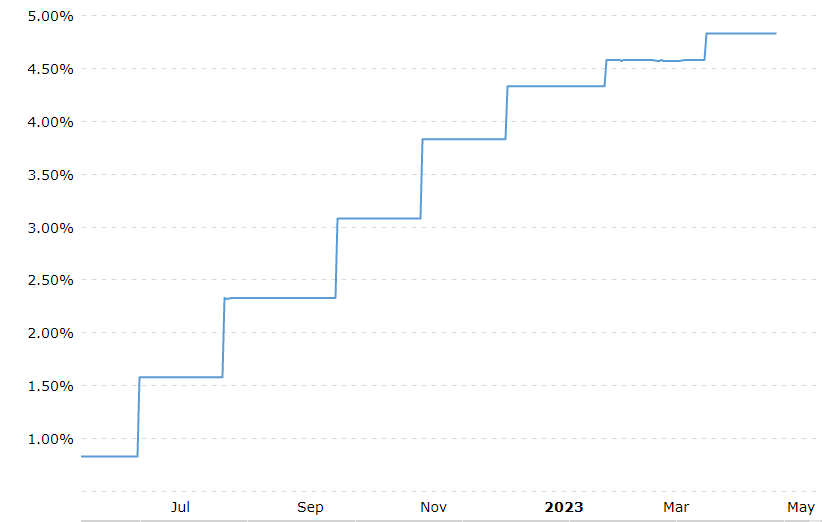

10-year Treasury yield was 2.913% on June 2, 2022. Friday it closed at 3.452%.

Fed Funds price was beneath 1% again then, approaching 5% now.

Little question rates of interest have risen sharply over the previous 11 months.

Valuations

P/E was 21.51 June 2, 2022. P/E at present is 24.14.-and nearing the richest a number of since December 2021. The final time it was above 24 was February 2 of this yr which coincided with a major prime within the S&P 500.

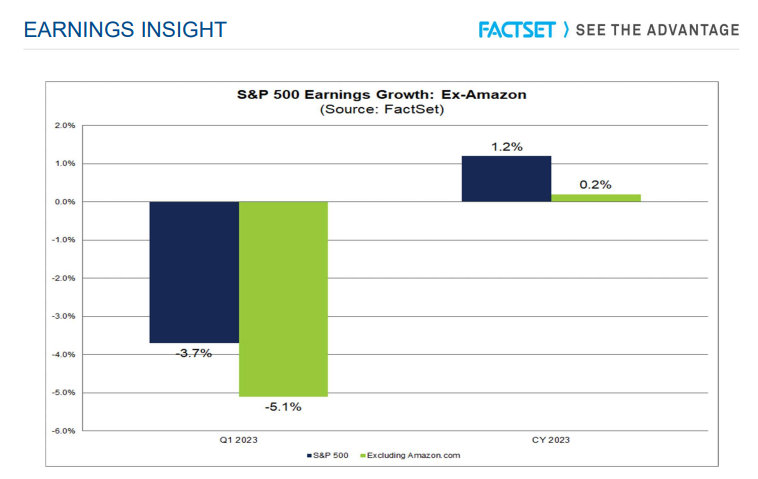

FactSet talked about that it’s fascinating to notice that Amazon.com can also be the biggest contributor to earnings progress for your complete S&P 500 for Q1 and 2023. If this firm have been excluded, the (blended) earnings decline for the S&P 500 for Q1 2023 would improve to -5.1% from -3.7%, whereas the estimated earnings progress price for the S&P 500 for CY 2023 would fall to 0.2% from 1.2%. Both approach, earnings are nonetheless receding and do not look to see a lot progress over the subsequent few quarters.

Elevated rates of interest and decrease earnings ought to result in decrease valuation multiples-and decrease inventory costs. As a substitute, inventory markets are again approaching recent new multi-year highs on valuation and all-time highs on worth.

The assumption within the Fed to begin decreasing charges earlier than projected and earnings to begin bettering extra rapidly than anticipated requires a reasonably good leap of religion.

Merchants and traders alike could need to hedge that religion a bit. Shopping for some draw back safety with places which might be the most affordable they’ve been in a very long time makes a number of sense – all the things thought-about.

POWR Choices

What To Do Subsequent?

In case you’re on the lookout for one of the best choices trades for at present’s market, you must try our newest presentation The way to Commerce Choices with the POWR Rankings. Right here we present you the way to constantly discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you need to study extra about this highly effective new choices technique, then click on beneath to get entry to this well timed funding presentation now:

The way to Commerce Choices with the POWR Rankings

All of the Greatest!

Tim Biggam

Editor, POWR Choices E-newsletter

SPY shares closed at $415.93 on Friday, up $3.52 (+0.85%). 12 months-to-date, SPY has gained 9.17%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the advanced world of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices e-newsletter. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up Are Shares A Good Purchase Now – Or A Good Bye ?? appeared first on StockNews.com

[ad_2]