[ad_1]

Zee Enterprise Managing Editor Anil Singhvi expects help for the Nifty50 benchmark at 17,700-17,775 ranges on Wednesday, February 22, and a robust purchase zone within the 17,600-17,650 space. For the Nifty Financial institution — whose 12 constituents embrace HDFC Financial institution, SBI, Financial institution of Baroda, Axis Financial institution and Kotak Mahindra Financial institution, he sees help rising within the 40,350-40,400 and 40,150-40,200 bands, and a robust purchase zone within the 39,425-39,500 space.

Here is how Anil Singhvi sums up the market setup on February 22:

-

International: Detrimental

-

FII: Constructive

-

DII: Impartial

-

F&O: Impartial

-

Sentiment: Detrimental

-

Development: Impartial

For the 50-scrip headline index, Anil Singhvi expects a greater zone at 17,825-17,875 ranges and a robust promote zone at 17,925-18,000 ranges. For the banking index, he sees a greater zone at 40,700-40,875 and a robust promote zone within the 40,950-41,125 vary.

- FII index longs at 23 per cent on Wednesday vs 22 per cent the day before today

- Nifty put-call ratio (PCR) at 0.83 vs 0.74 the day before today

- Nifty Financial institution PCR at 0.61 vs 0.54 the day before today

- Concern index India VIX up 4.67 per cent at 14.01

ANIL SINGHVI MARKET STRATEGY

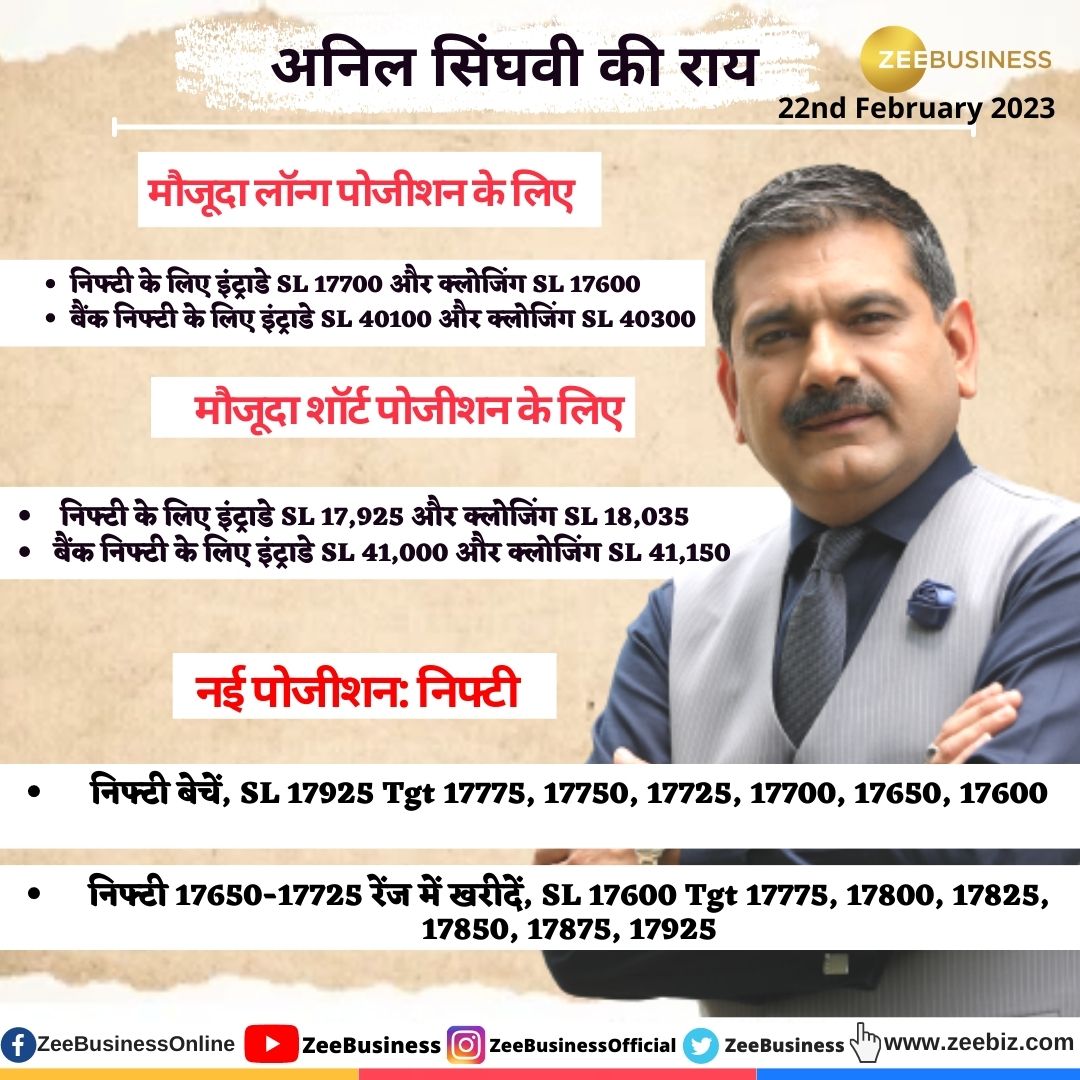

For current lengthy positions:

-

Nifty50 intraday cease loss at 17,700 and shutting cease loss at 17,600

-

Nifty Financial institution intraday cease loss at 40,100 and shutting cease loss at 40,300

For current quick positions:

-

Nifty intraday cease loss at 17,925 and shutting cease loss at 18,035

-

Nifty Financial institution intraday cease loss at 41,000 and shutting cease loss at 41,150

For brand new positions in Nifty:

-

Promote Nifty with a cease loss at 17,925 for targets of 17,775, 17,750, 17,725, 17,700, 17,650 and 17,600

-

Purchase Nifty within the 17,650-17,725 vary with a cease loss at 17,600 for targets of 17,775, 17,800, 17,825, 17,850, 17,875 and 17,925

For brand new positions in Nifty Financial institution:

-

Promote Nifty Financial institution with a strict cease loss at 41,000 for targets of 40,575, 40,500, 40,375, 40,175, 40,075 and 39,925

-

Purchase Nifty Financial institution within the 39,425-39,500 vary with a cease loss at 39,350 for targets of 39,700, 39,850, 39,925, 40,075, 40,150 and 40,350

-

Aggressive merchants should buy Nifty Financial institution within the 40,175-40,375 vary with a strict cease loss at 40,000 for targets of 40,500, 40,575, 40,675, 40,875 and 40,950

F&O ban replace

Catch newest inventory market updates right here. For all different information associated to enterprise, politics, tech, sports activities and auto, go to Zeebiz.com.

[ad_2]