[ad_1]

The transient’s key findings are:

- The 2022 Survey of Client Funds exhibits how 401(okay)/IRA saving fared from 2019-2022.

- The reply isn’t apparent given all that went on: COVID, financial disruption, seesawing markets, an enormous fiscal response, and powerful employment.

- The excellent news: for working households nearing retirement with a 401(okay), median mixed 401(okay)/IRA balances rose from $144,000 to $204,000.

- The unhealthy information: these good points for older savers had been primarily among the many greater earnings, and youthful savers typically didn’t do nicely.

- Furthermore, half of households don’t actually have a 401(okay), so the general information on retirement saving stays disappointing.

Introduction

The Federal Reserve’s 2022 Survey of Client Funds (SCF) summarizes modifications in household funds between 2019 and 2022 – three years of COVID, financial disruption, and unprecedented fiscal assist – and 2022 was additionally a horrible yr when it comes to inventory and bond returns. Regardless of the bizarre circumstances, employment remained sturdy, the inventory market – even with the drop in 2022 – ended up considerably greater than in 2019, and the 401(okay) system continued to mature. On steadiness, one would anticipate improved balances between 2019 and 2022 throughout age and earnings teams. The SCF can resolve this situation. The benefit of the SCF over knowledge on 401(okay) plans from monetary service corporations is that it offers data not solely about households’ 401(okay) holdings but additionally about their IRAs, that are predominately rollovers from 401(okay)s and characterize the vast majority of retirement account property.

The dialogue proceeds as follows. The primary part describes the significance of 401(okay) plans and IRAs within the retirement earnings system. The second part paperwork the bettering pattern in particular person selections concerning the buildup of property in 401(okay)s. The third part reviews on 401(okay)/IRA balances. The ultimate part concludes with an evaluation of the general image.

The excellent news from the 2022 SCF is that 401(okay)/IRA balances for older working households with a plan totaled $204,000 in 2022, in comparison with $144,000 for comparable households in 2019. The unhealthy information is that solely half of older households had a 401(okay) plan, and the good points occurred amongst higher-income households, whereas the scenario for the underside 40 % of the earnings distribution deteriorated. Furthermore, in distinction to older households, the balances of households ages 45-54 did not maintain tempo with inflation and people of households 35-44 declined in nominal phrases. On steadiness, given the power of the economic system and the good points within the inventory market over the three-year interval, the 2022 SCF offers a disappointing image of the retirement property for working households. Furthermore, the main target is on the 50 % of households with a 401(okay) plan; the opposite half of households don’t have anything however Social Safety.

The Position of 401(okay)s/IRAs within the Retirement System

Retirement financial savings accounts – 401(okay)s and IRAs – are key to the retirement safety of at present’s staff for 2 causes. First, Social Safety, the spine of the system, will present much less relative to pre-retirement earnings sooner or later – even assuming Congress addresses this system’s monetary shortfall as soon as belief fund balances are depleted within the early 2030s. Second, employer-sponsored plans have shifted nearly totally to 401(okay)s within the personal sector, though conventional outlined profit plans stay the key type of retirement saving for state and native staff.

Social Safety

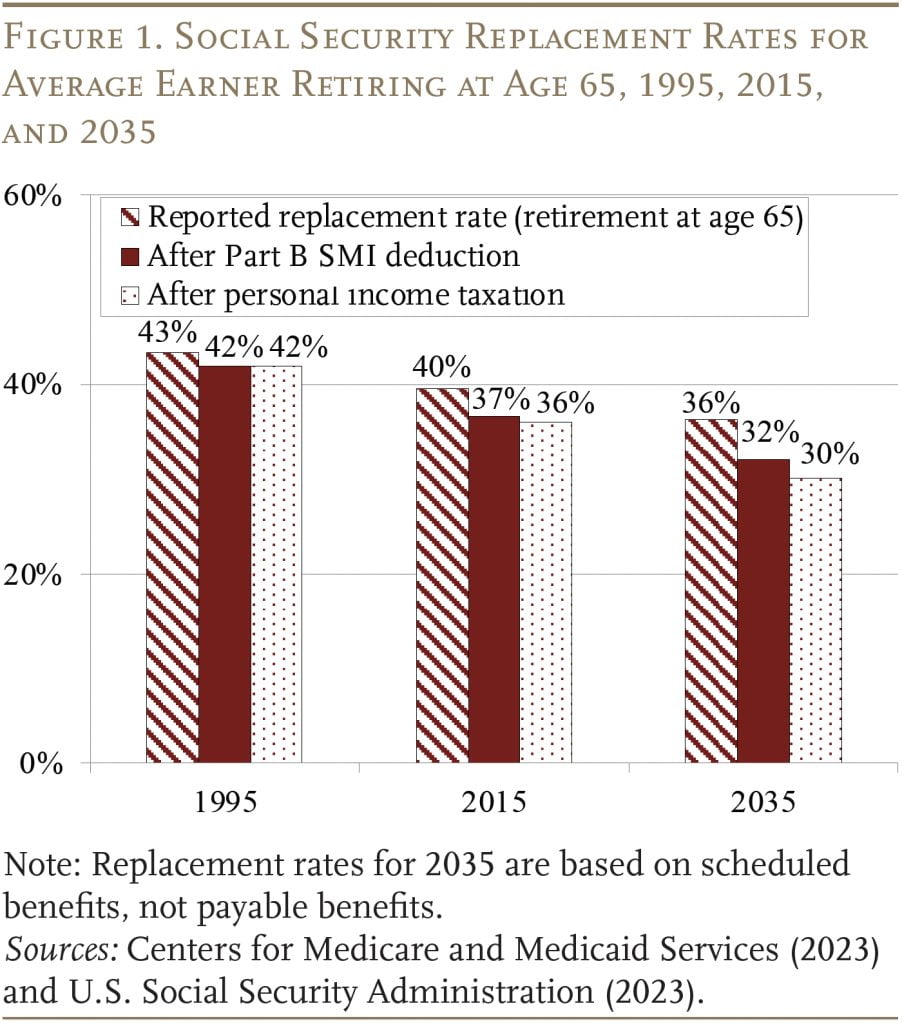

Social Safety will change much less of staff’ earnings for 3 causes. First, the Full Retirement Age – the age at which a employee is entitled to full advantages – has moved from 65 to 67. Consequently, those that proceed to retire at, say, 65 will see a reduce of their month-to-month profit relative to pre-retirement earnings (see Determine 1). Second, rising Medicare premiums, that are deducted earlier than the verify goes within the mail, will scale back the internet Social Safety profit. Lastly, extra Social Safety advantages can be topic to the private earnings tax because the thresholds above which advantages are taxable aren’t adjusted for inflation or wage progress.

Employer-sponsored Plans

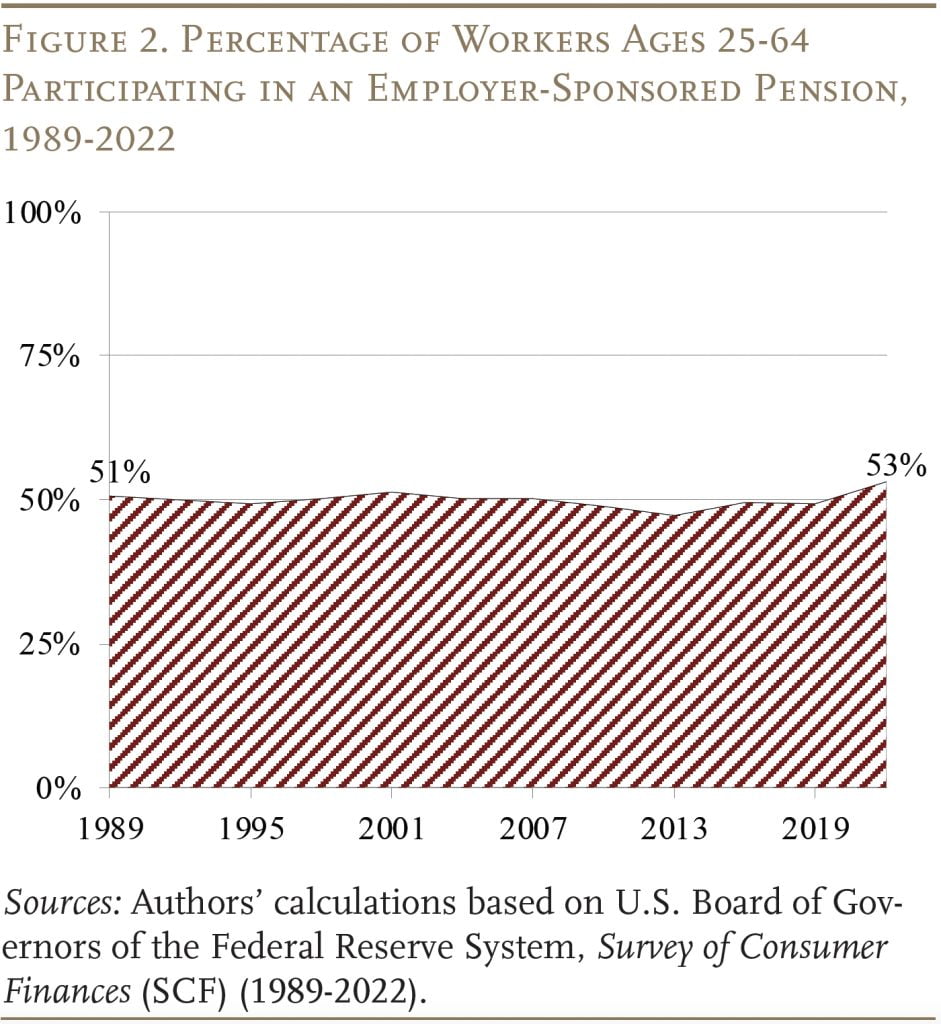

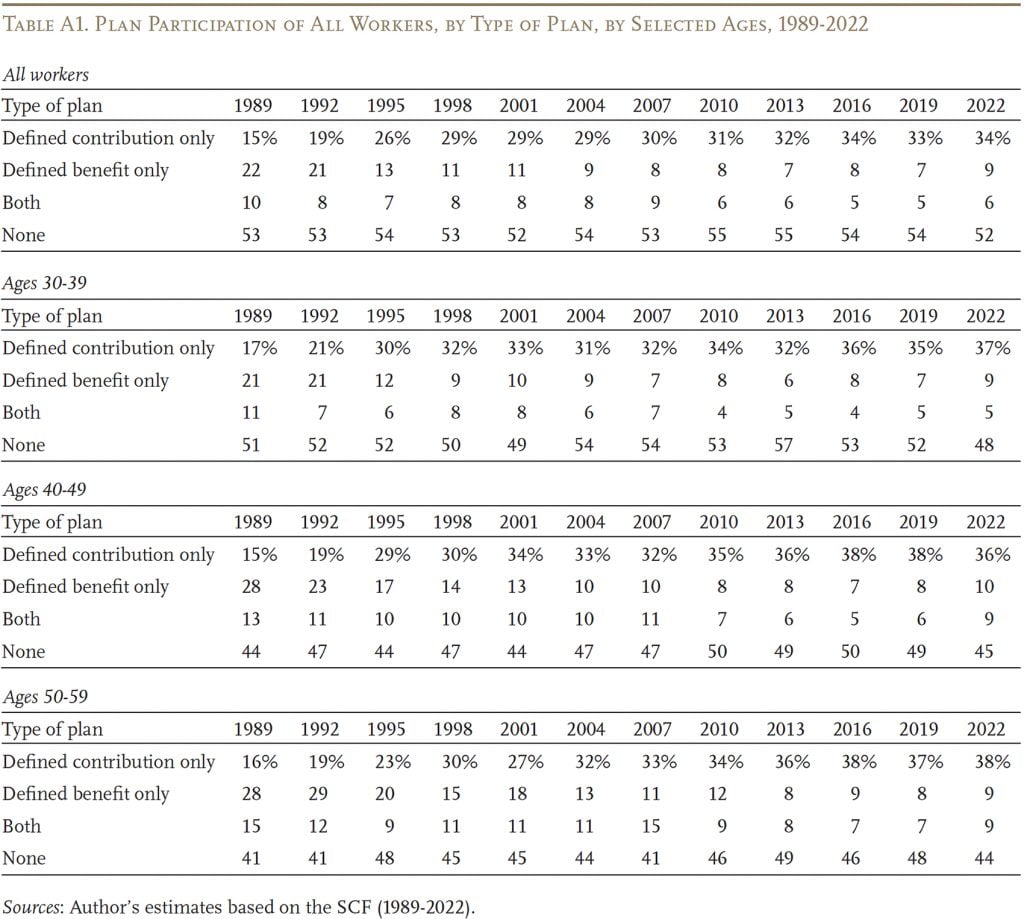

With Social Safety changing a smaller proportion of pre-retirement earnings, staff will change into more and more depending on employer-sponsored retirement plans. Sadly, solely about half of staff – at any second in time – take part in both an outlined profit plan or a 401(okay) plan. That proportion has remained fixed for many years (see Determine 2).

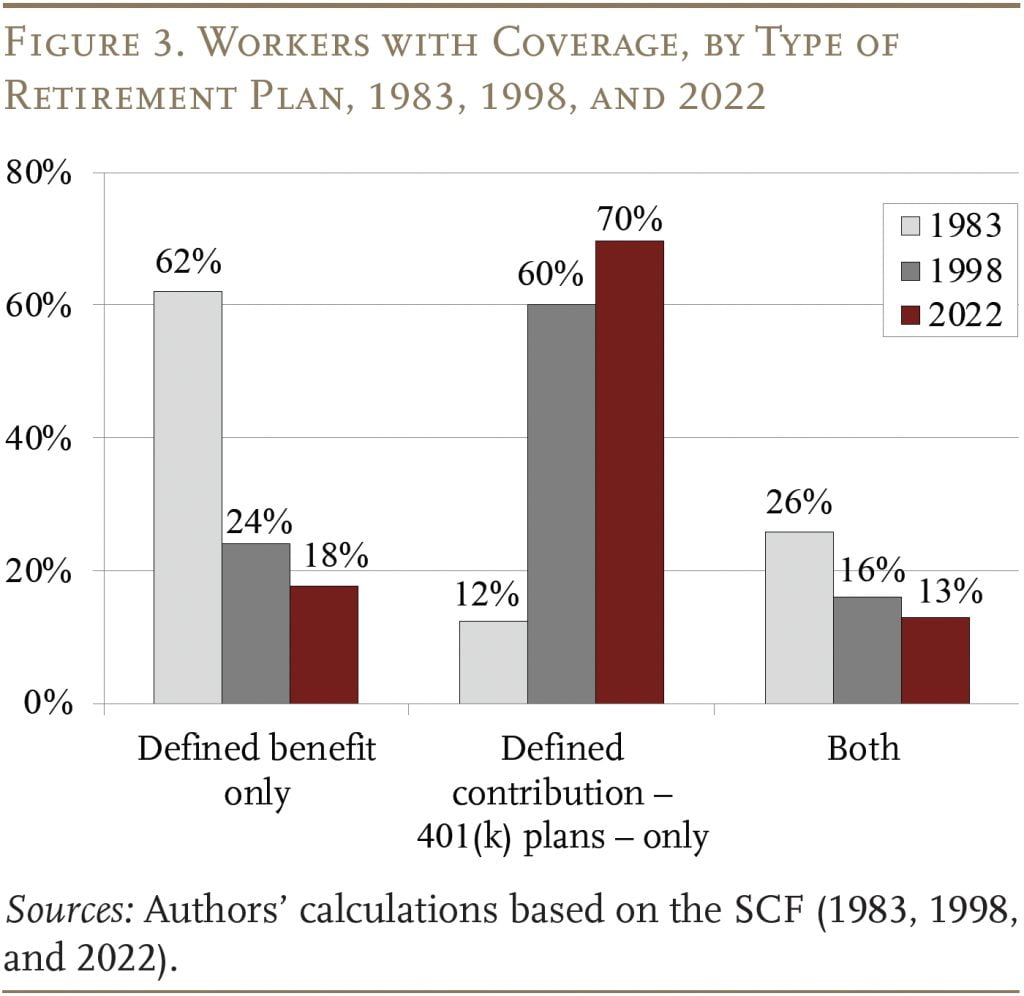

For these fortunate sufficient to work for an employer offering a retirement plan, the character of those plans has modified from outlined profit to 401(okay) (see Determine 3).

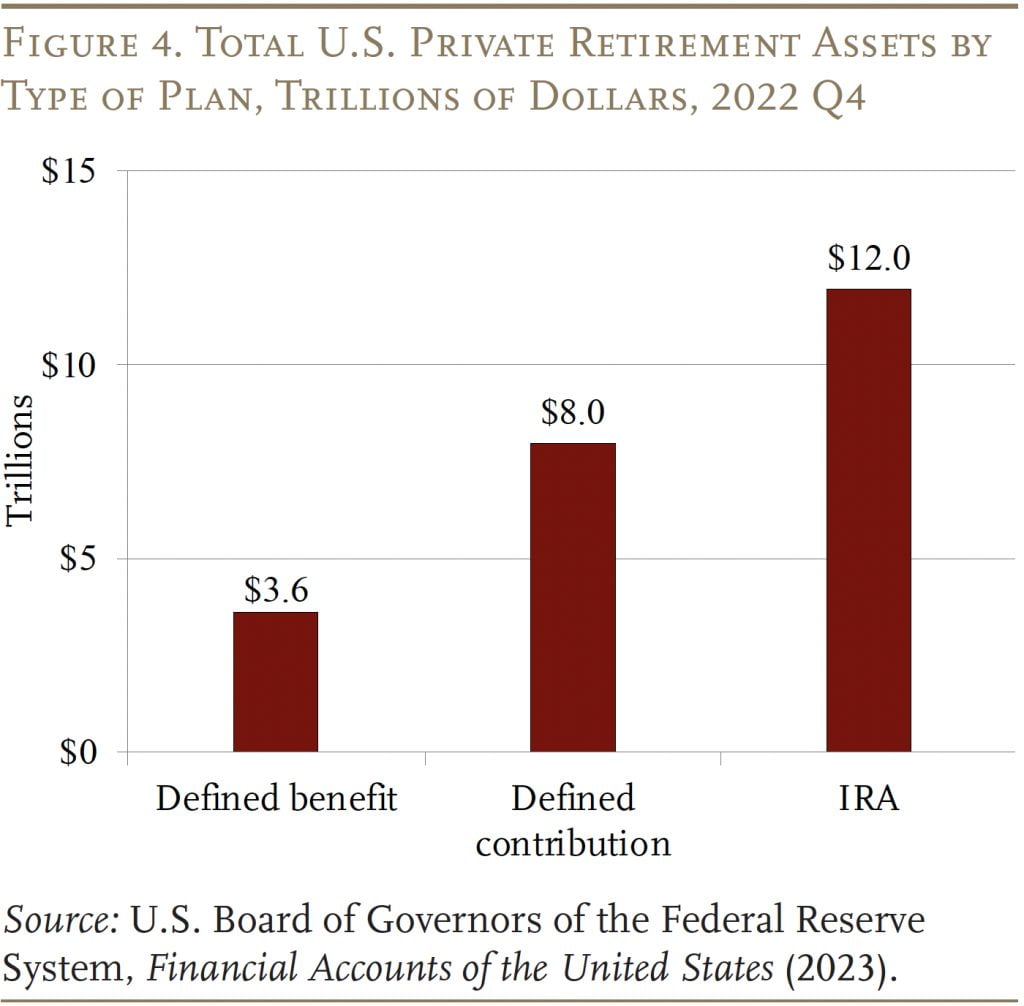

Whereas 401(okay)s plans have unfold dramatically, they’ve primarily was a set mechanism for retirement financial savings; members ultimately roll over the majority of their cash into IRAs. At present, IRA property exceed these in 401(okay)s by 50 % – $12 trillion in comparison with $8 trillion (see Determine 4). Thus, any evaluation of the present employer-sponsored retirement system requires an analysis of how nicely 401(okay)s gather cash and the way a lot folks have of their mixed 401(okay)/IRA holdings.

How Nicely Do 401(okay)s Gather Retirement Cash?

401(okay) plans had been initially considered as dietary supplements to employer-funded pension and profit-sharing plans, so 401(okay) members had been presumed to have their primary retirement earnings wants coated. Consequently, members got substantial discretion over their 401(okay) decisions, together with whether or not to take part, how a lot to contribute, tips on how to make investments, and when and in what kind to withdraw the funds. Over time, policymakers have established steering to place members in the most effective place to build up retirement property.

Participation

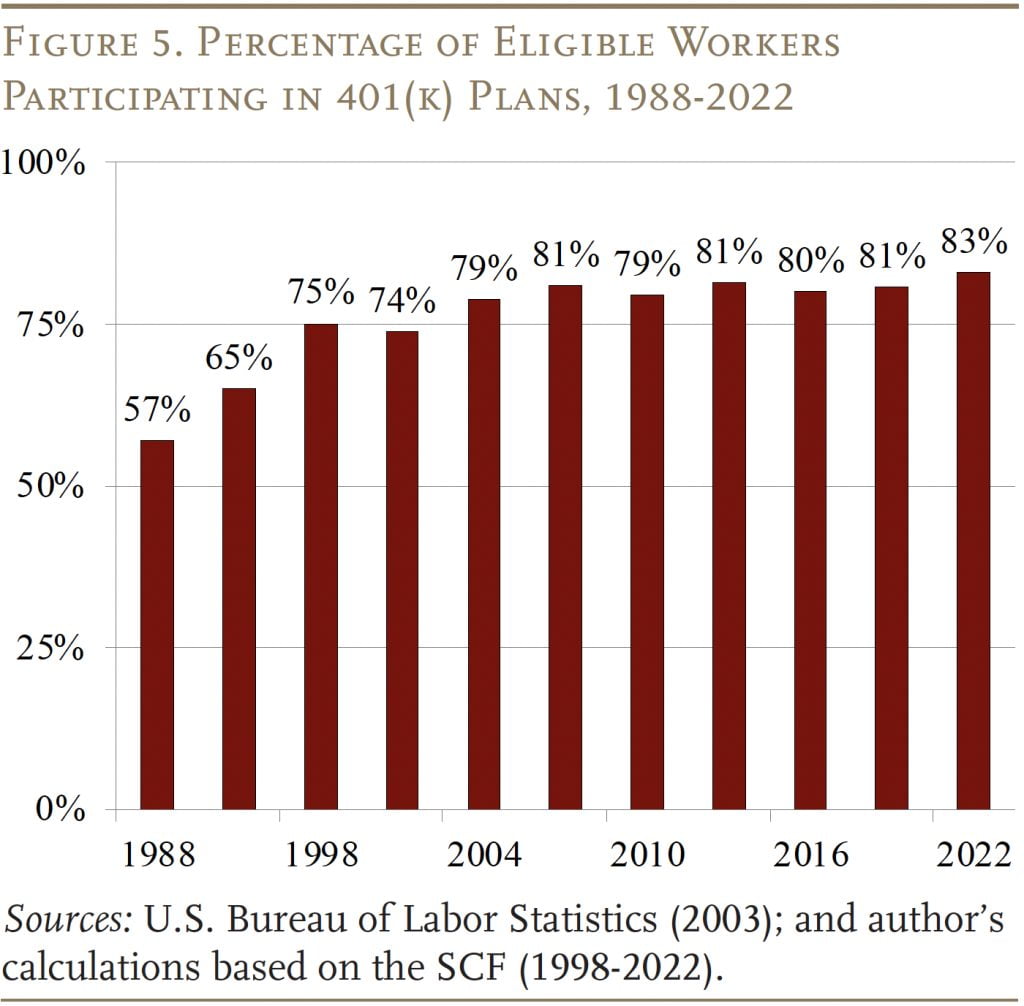

For these people supplied a plan, success first requires that they take part. An intensive literature has demonstrated that mechanically enrolling workers sharply will increase participation charges.. The share of plans with auto-enrollment elevated considerably within the wake of the Pension Safety Act of 2006 (PPA), and now hovers round 58 %. Given the unfold of plans with auto-enrollment, the upward pattern in participation charges as reported within the SCF could seem modest (see Determine 5). One issue is that participation charges in plans with out auto-enrollment truly declined for some time.

Contributions

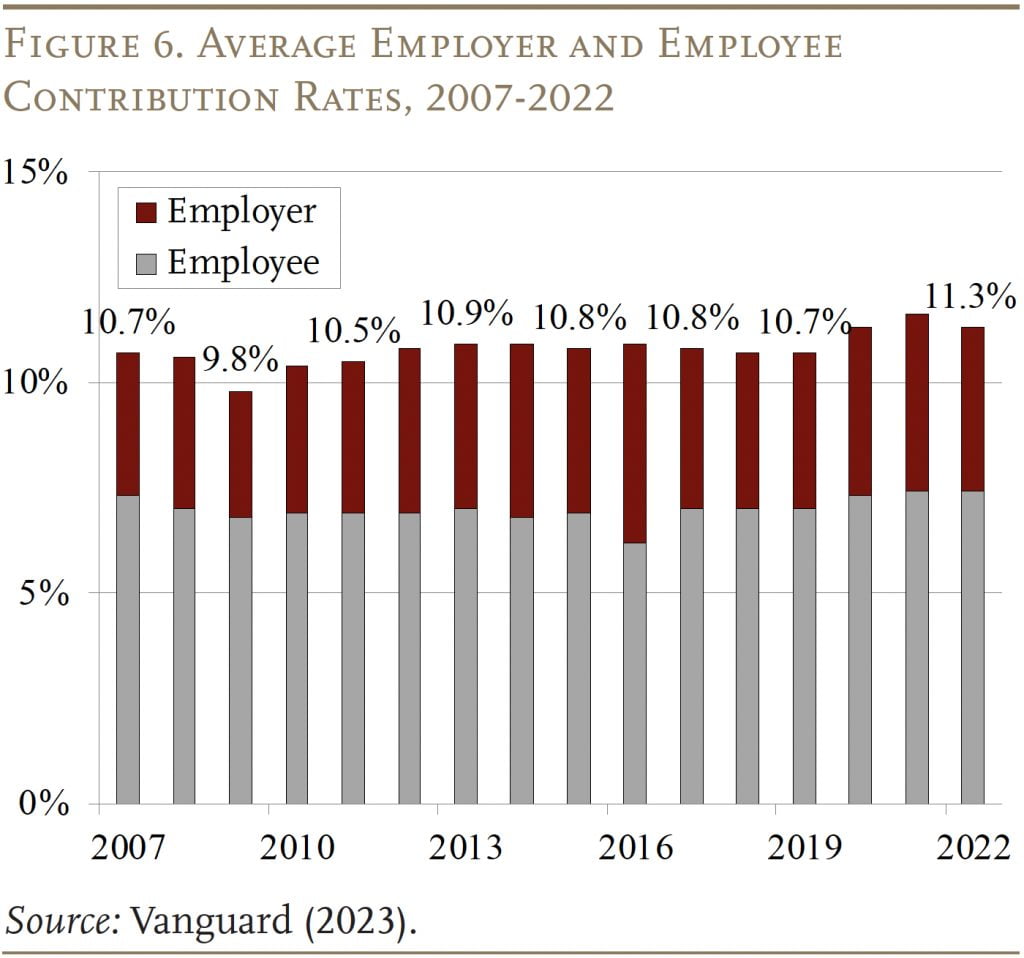

As soon as within the plan, members should determine how a lot to contribute. Common worker contribution charges proceed to hover round 7.4 % (see the grey bars in Determine 6). Employer contributions convey the overall common deferral price to 11.3 %. Whereas in prior years, decrease contribution charges for these mechanically enrolled appeared to cut back the typical, that impact not exists.

Shifting from the typical contribution price to the utmost, workers in 2022 had been entitled to contribute $20,500 on a tax-deductible foundation to their 401(okay) plan. As well as, staff approaching retirement may contribute one other $6,500 beneath “catch-up” provisions launched in 2002. In 2022, 15 % of Vanguard members – principally excessive earners – reached their restrict. Since Vanguard tends to have a disproportionate variety of massive plans and, subsequently, greater earners, the proportion maxing out might be barely decrease for the 401(okay) inhabitants as an entire.

Funding Selections

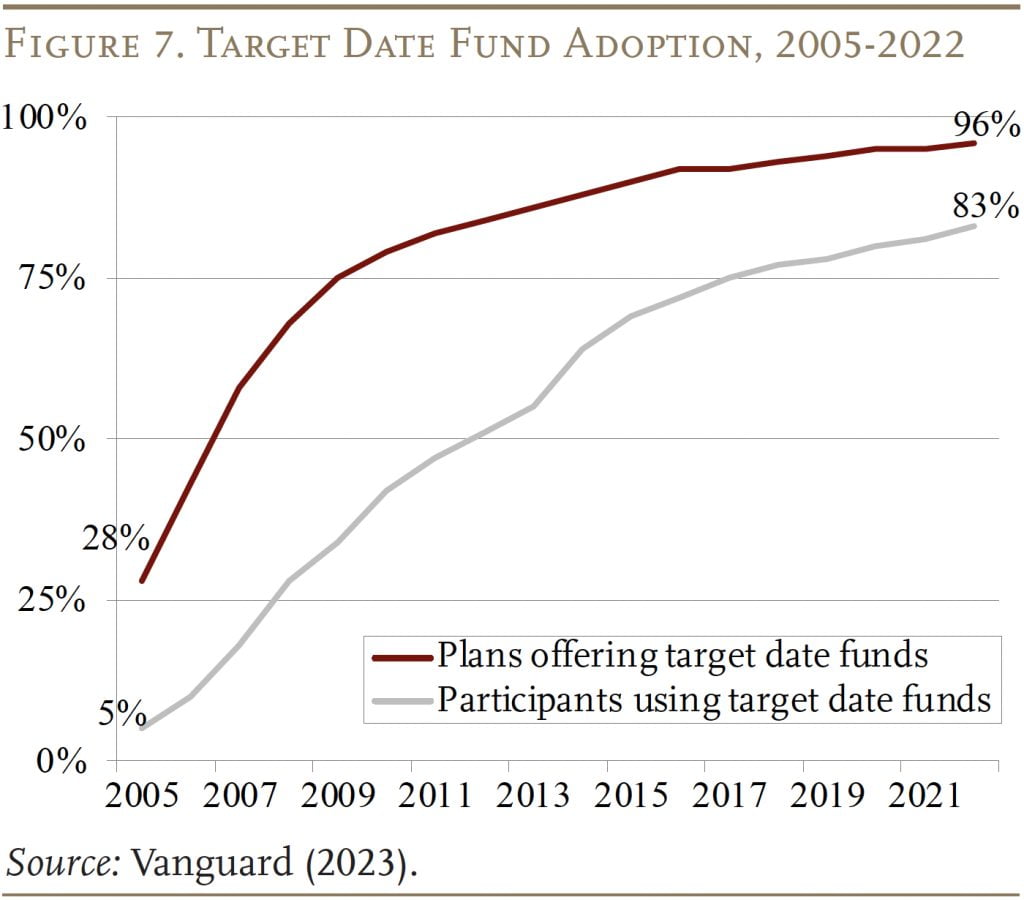

Along with participation and contribution selections, workers should determine tips on how to make investments their cash. This course of has been simplified considerably with the appearance of goal date funds, which be sure that investments are diversified and rebalanced over time (see Determine 7). The opposite profit of those funds is that they scale back the probability of investing in employer inventory, which helps to additional diversify the participant’s portfolio each throughout shares and away from the employer. Based on Vanguard, solely 8 % of corporations presently provide their very own firm’s inventory of their 401(okay) plans.

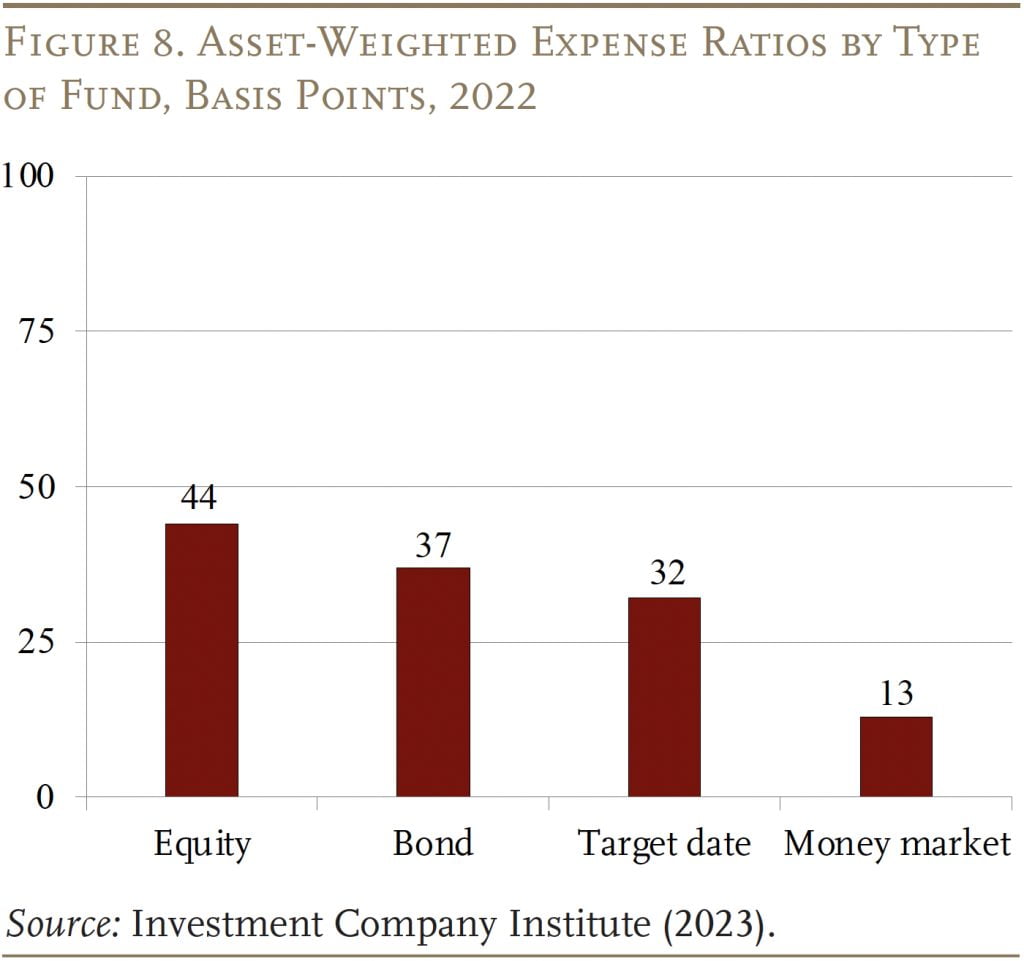

Even with the unfold of goal date funds, charges stay an essential situation. An expense ratio of 1 % – 100 foundation factors – over a 40-year worklife will scale back property at retirement by nearly 20 %. Regardless of a decline over time, expense ratios on mutual funds – the first funding car in 401(okay) plans – stay excessive. Primarily based on how folks truly make investments, the expense ratio in 2022 was 44 foundation factors for fairness funds, 37 foundation factors for bond funds, 32 foundation factors for goal date funds, and 13 foundation factors for cash market funds (see Determine 8).

Maintaining Cash within the Plan

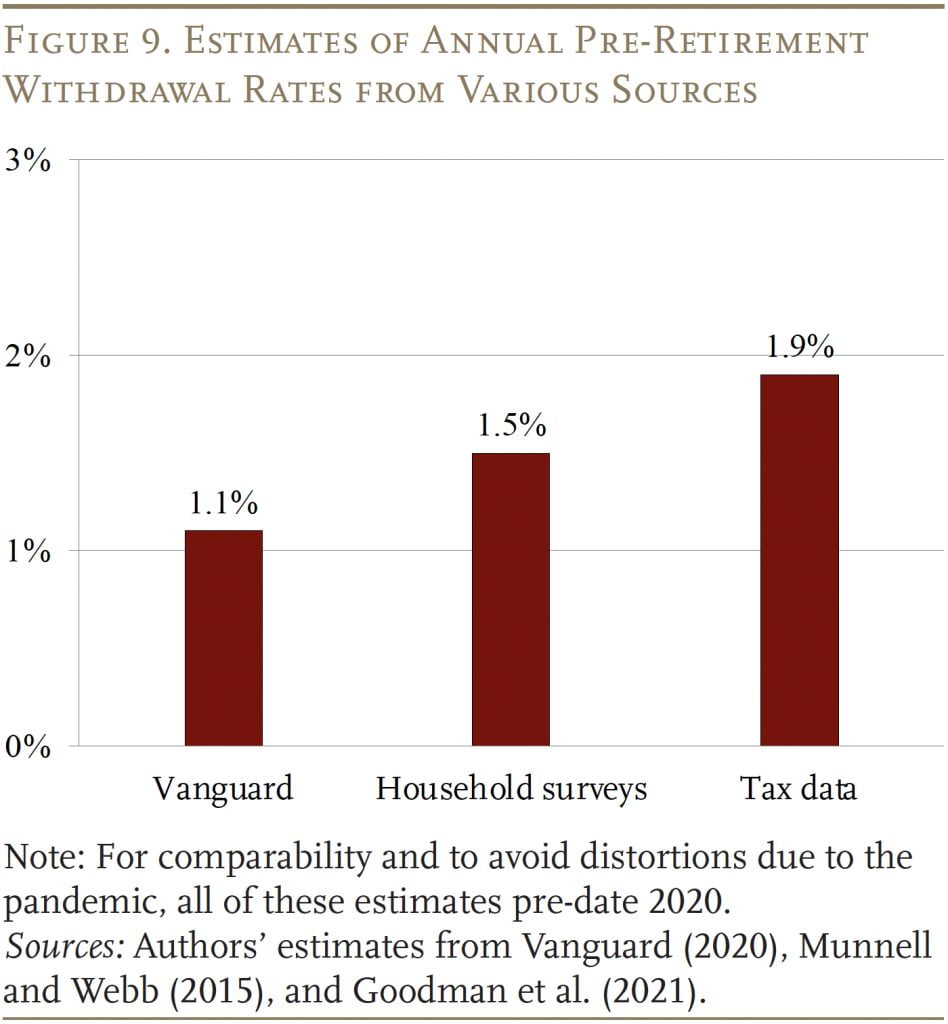

Over the past decade, researchers have undertaken numerous research to estimate the magnitude of pre-retirement withdrawals out of 401(okay)s and IRAs. As well as, Vanguard offers knowledge on flows that make it potential to estimate a pre-retirement withdrawal price. The Vanguard knowledge counsel that 1.1 % of property are taken out annually (see Determine 9). Not surprisingly, given Vanguard’s skew in direction of bigger plans and better-paid workers, research based mostly on family surveys put the withdrawal price considerably greater at 1.5 %. And the newest examine utilizing tax knowledge counsel an excellent greater pre-retirement withdrawal price. Pre-retirement withdrawals from cashouts on the time of a job change stay probably the most significant issue.

Reported 401(okay) Balances: 2019 and 2022

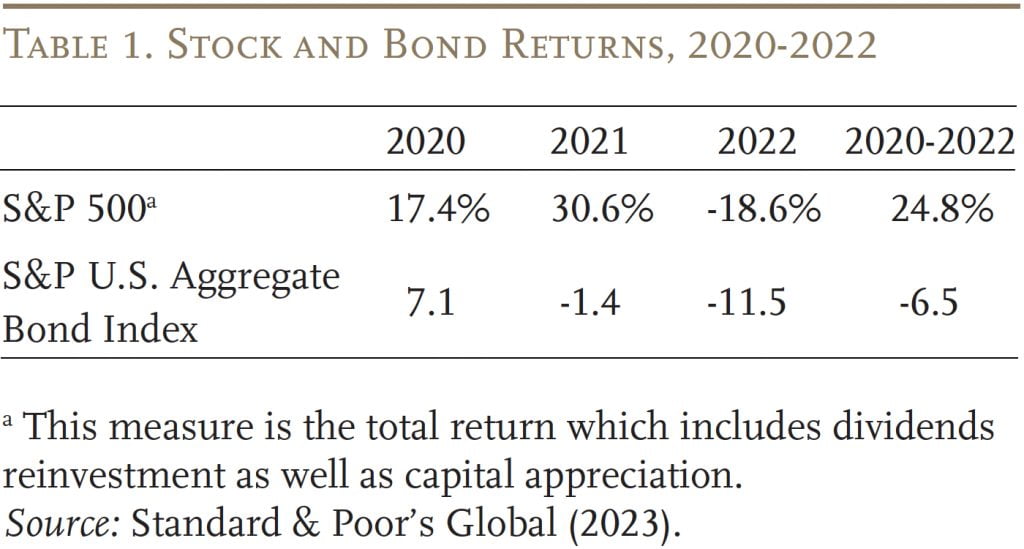

Whereas the developments in 401(okay) participation, contributions, and investments are all optimistic, balances additionally rely critically on market efficiency, and returns for each shares and bonds had been sharply unfavourable in 2022 (see Desk 1).

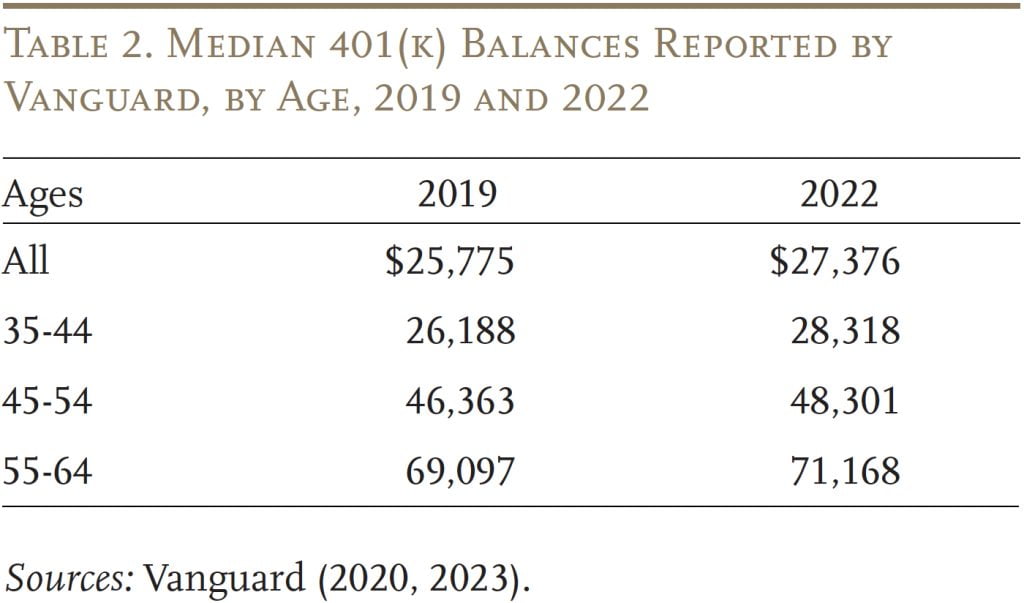

Over the interval, median 401(okay) balances in 2022 had been solely barely greater than in 2019 in nominal phrases (see Desk 2). And, contemplating that the Client Worth Index elevated 15.5 % from December 2019 to December 2022, median balances declined in inflation-adjusted phrases.

Though these particular person 401(okay) balances present a touch of what to anticipate within the 2022 SCF, three elements make it unattainable to find out from these numbers how a lot cash households have gathered for retirement. First, when members change jobs, their 401(okay) accounts might stay with their outdated employer, so people might have multiple 401(okay) account. Second, 401(okay) balances are sometimes rolled over to an IRA, and monetary companies corporations can not observe mixed 401(okay)/IRA holdings. Third, by necessity, balances are supplied on a person, reasonably than a family, foundation. For all these causes, the brand new SCF knowledge are essential.

401(okay)/IRA Balances within the 2022 SCF

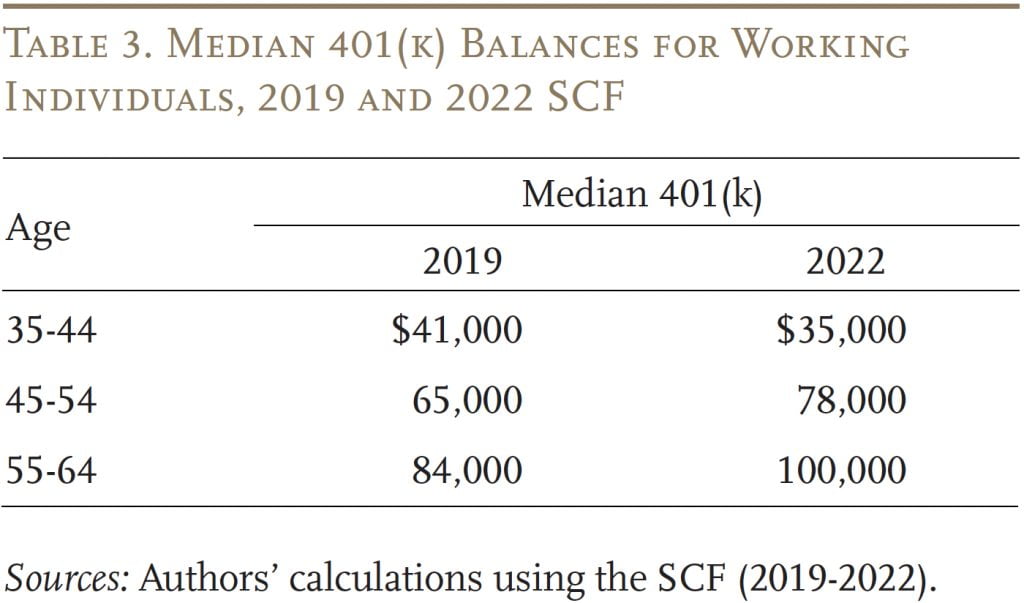

To calibrate the Federal Reserve’s 2022 SCF to the numbers from monetary companies corporations, the most effective place to start out is with single people. The SCF 401(okay) balances are greater than the Vanguard numbers, most definitely as a result of they characterize all of the accounts held by a person, and the sample by age may be very comparable (see Desk 3). For older age teams, balances enhance over this era by about 20 %, reflecting three years of contributions in addition to market returns. The anomaly in comparison with the Vanguard knowledge is that SCF balances for people ages 35-44 truly declined from 2019 to 2022.

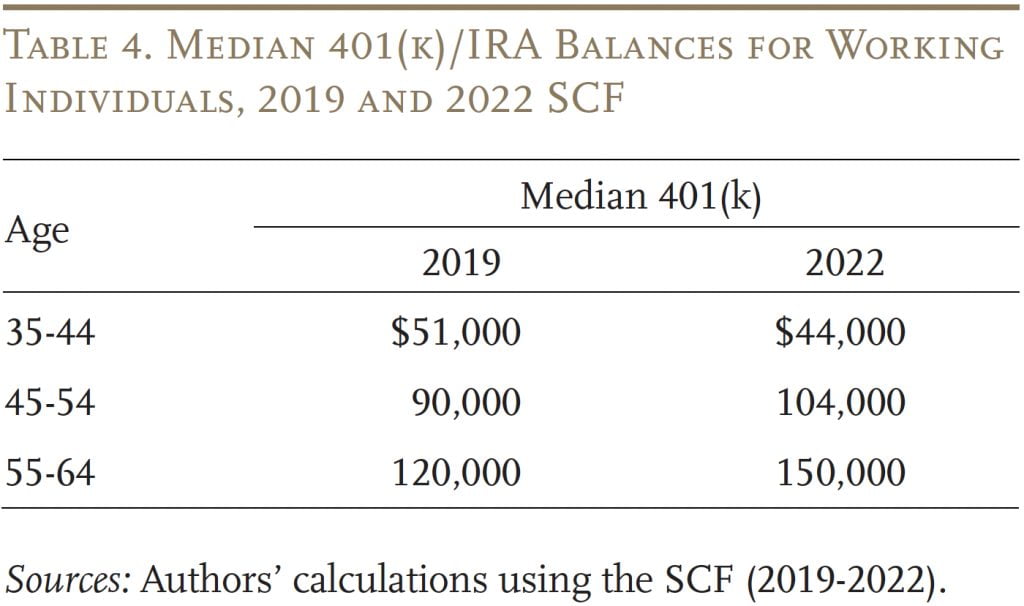

Including IRA balances exhibits that focusing solely on 401(okay)s considerably understates retirement saving by staff. In 2022, the standard employee approaching retirement (ages 55-64) with a 401(okay) had a steadiness of $150,000 in mixed 401(okay)/IRA accounts, up from $120,000 in 2019 (see Desk 4). The proportion good points for the older teams are roughly corresponding to these for 401(okay) balances alone. As soon as once more, balances for people 35-44 truly declined.

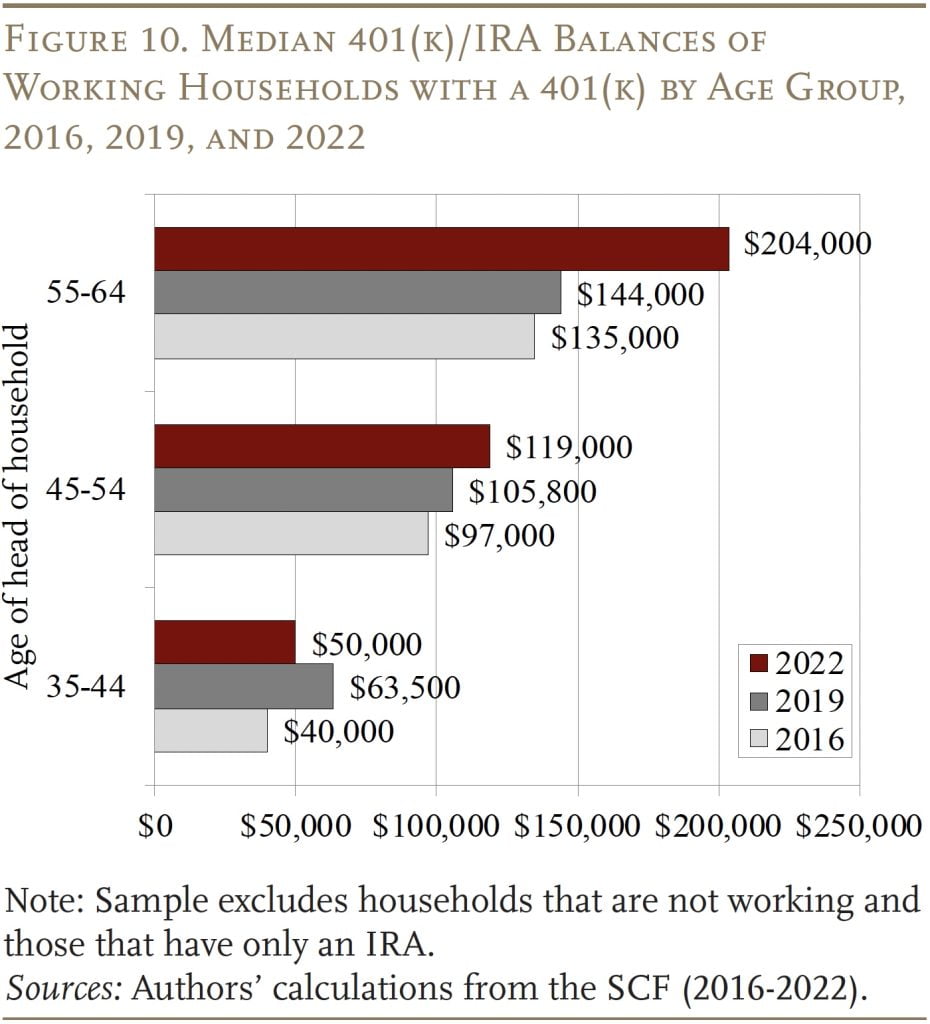

By way of evaluating retirement safety, it is very important do not forget that people reside in households. In 2022, the SCF reviews that the standard working family approaching retirement with a 401(okay) had $204,000 in 401(okay)/IRA balances (see Determine 10). This quantity compares to $144,000 in 2019 – an infinite leap. The information for youthful households, nonetheless, is much less rosy. The median 401(okay)/IRA balances for households ages 45-54 elevated solely from $105,800 to $119,000 – lower than the speed of inflation. And the holdings of the youngest group (35-44) truly declined.

Even the excellent news for the older working households must be put in perspective. First, the 401(okay)/IRA balances for the households approaching retirement will produce a comparatively modest complement to Social Safety. If the couple makes use of their $204,000 to purchase a joint-and-survivor annuity, they’ll obtain $1,100 monthly. Since this quantity isn’t listed for inflation, its buying energy will decline over time. Furthermore, this $1,100 is more likely to be the one supply of further earnings, as a result of the standard family holds just about no monetary property outdoors of its 401(okay).

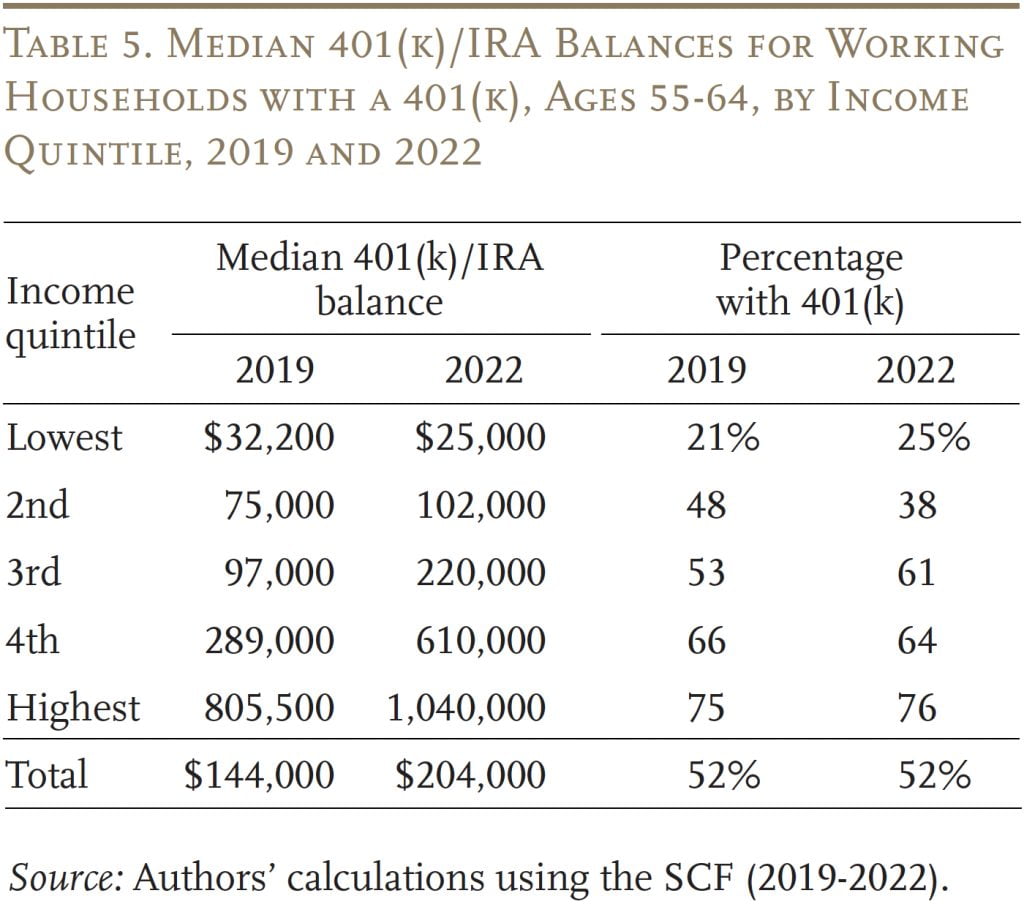

Second, the good points in 401(okay)/IRA balances weren’t unfold evenly throughout the earnings distribution of working households. The center quintile gained not solely in balances but additionally within the proportion of households with a 401(okay) plan. That’s clearly excellent news. Greater-income households noticed even bigger proportion will increase of their balances, and the share of households with a plan held regular. For the underside two quintiles, the information isn’t good. Both balances dropped or balances elevated however the proportion with a plan dropped sharply (see Desk 5).

Conclusion

401(okay) plans are the gathering mechanism for retirement saving, and modifications through the years – auto-enrollment, goal date funds, and declining charges – have tremendously improved the functioning of those plans. The truth is, it’s laborious to see how 401(okay)s as structured may do a greater job. Cash collected in 401(okay) plans is then typically rolled over to IRAs, which maintain 50 % extra property than 401(okay)s. The query is how the mixed system fared from 2019-2022.

The reply isn’t apparent, given all that was occurring. The years between 2019 and 2022 included COVID, financial disruption, unprecedented fiscal assist, after which a horrible yr when it comes to inventory and bond returns. On the similar time, employment remained sturdy, the inventory market – even with the drop in 2022 – ended up considerably greater than in 2019, and the 401(okay) system continued to mature.

The excellent news from the SCF is that 401(okay)/IRA balances for older working households with a plan totaled $204,000 in 2022, in comparison with $144,000 for comparable households in 2019. The unhealthy information is that solely half of older households had a 401(okay) plan, and the good points occurred amongst higher-income households whereas the scenario for the underside 40 % deteriorated. Furthermore, in distinction to older households, the balances of households 45-54 did not maintain tempo with inflation and people of households 35-44 declined in nominal phrases. In brief, the 2022 SCF offers a disappointing image of the retirement property for the half of working households fortunate sufficient to have a retirement plan. The opposite half of households do not need a retirement plan and should rely solely on Social Safety. Making certain the solvency of Social Safety is clearly a excessive precedence.

References

Argento, Roberto, Victoria L. Bryant, and John Sabelhaus. 2013. “Early Withdrawals from Retirement Accounts.” Finance and Economics Dialogue Sequence Paper 2013-22. Washington, DC: U.S. Board of Governors of the Federal Reserve System.

Bernheim, Douglas B., Andrey Fradkin, and Igor Popov. 2015. “The Welfare Economics of Default Choices in 401(okay) Plans.” American Financial Assessment 105(9): 2798-2837.

Beshears, John, James J. Choi, David Laibson, and Brigitte C. Madrian. 2010. “The Impression of Employer Matching on Financial savings Plan Participation beneath Automated Enrollment.” In Analysis Findings within the Economics of Getting old, edited by David A. Sensible, 311- 327. Chicago, IL: College of Chicago Press.

Beshears, John, James J. Choi, David Laibson, and Brigitte C. Madrian. 2009. “The Significance of Default Choices for Retirement Saving Outcomes: Proof from the US.” In Social Safety Coverage in a Altering Surroundings, edited by Jeffrey Brown, Jeffrey Liebman, and David A. Sensible, 167-195. Chicago, IL: College of Chicago Press.

Beshears, John, James J. Choi, David Laibson, Brigitte C. Madrian, and William L. Skimmyhorn. 2022. “Borrowing to Save? The Impression of Automated Enrollment on Debt.” Journal of Finance 77(1): 403-447.

Bhutta, Neil, Jesse Bricker, Andrew C. Chang, Lisa J. Dettling, Sarena Goodman, Joanne W. Hsu, Kevin B. Moore, Sarah Reber, Alice Henriques Volz, and Richard A. Windle, of the Board’s Division of Analysis and Statistics, ready this text with help from Kathy Bi, Jacqueline Blair, Julia Hewitt, and Dalton Ruh. 2020. “Modifications in U.S. Household Funds from 2016 to 2019: Proof from the Survey of Client Funds.” Federal Reserve Bulletin 100(4): 1-41.

Biggs, Andrew G., Alicia H. Munnell, and Anqi Chen. 2019. “Why Are 401(okay)/IRA Balances Considerably Beneath Potential?” Working Paper 2019-14. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Bryant, Victoria L., Sarah Holden, and John Sabelhaus. 2011. “Certified Retirement Plans: Evaluation of Distribution and Rollover Exercise.” Working Paper 2011-01. Philadelphia, PA: Pension Analysis Council.

Butrica, Barbara A. and Nadia S. Karamcheva. 2012. “Automated Enrollment, Worker Compensation, and Retirement Safety.” Working Paper 2012-25. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Butrica, Barbara A., Sheila R. Zedlewski, and Philip Issa. 2010. “Understanding Early Withdrawals from Retirement Accounts.” The Retirement Coverage Program, Dialogue Paper 10-02. Washington, DC: City Institute.

Facilities for Medicare & Medicaid Companies. 2023. Annual Medicare Trustees Report. Washington, DC.

Clark, Jeffrey W., Stephen P. Utkus, and Jean A. Younger. 2015. “Automated Enrollment: The Energy of the Default.” Valley Forge, PA: Vanguard.

Goodman, Lucas, Jacob Mortenson, Kathleen Mackie, and Heidi Schramm. 2021. “Leakage from Retirement Financial savings Accounts in The US.” Nationwide Tax Journal 74(3): 689-719.

Funding Firm Institute. 2023. “2022 Funding Firm Truth Guide.” Washington, DC.

Lu, Timothy (Jun), Olivia S. Mitchell, Stephen P. Utkus, and Jean A. Younger. 2014. “Borrowing from the Future: 401(okay) Plan Loans and Defaults.” Working Paper 2014-01. Philadelphia, PA: Pension Analysis Council.

Munnell, Alicia H. and Anthony Webb. 2015. “The Impression of Leakages from 401(okay)s and IRAs.” Working Paper 2015-2. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Munnell, Alicia H., Anek Belbase, and Geoffrey T. Sanzenbacher. 2018. “An Evaluation of Retirement Fashions to Enhance Portability and Protection.” Particular Report. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Nessmith, William E., Stephen P. Utkus, and Jean A. Younger. 2007. “Measuring the Effectiveness of Automated Enrollment.” Quantity 31. Valley Forge, PA: Vanguard Heart for Retirement Analysis.

Plan Sponsor Council of America. 2013, 2016. 56th and 59th Annual Surveys of Revenue Sharing and 401(okay) Plans. Chicago, IL.

Normal & Poor’s International. 2023. “Dow Jones Indices.” New York, NY.

U.S. Board of Governors of the Federal Reserve System. 2023. Monetary Accounts of the US. Washington, DC.

U.S. Board of Governors of the Federal Reserve System. Survey of Client Funds, 1983-2022. Washington, DC.

U.S. Bureau of Labor Statistics. 2003. Labor Pressure Statistics from the Present Inhabitants Survey. Washington, DC.

U.S. Census Bureau. Present Inhabitants Survey, 1980- 2023. Washington, DC.

U.S. Social Safety Administration. 2023. The Annual Report of the Board of Trustees of the Federal Outdated-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC: U.S. Authorities Printing Workplace.

Vanguard. 2020, 2023. “How America Saves: A Report on Vanguard DC Plan Knowledge.” Valley Forge, PA: Vanguard Institutional Investor Group.

Appendix

[ad_2]