[ad_1]

The temporary’s key findings are:

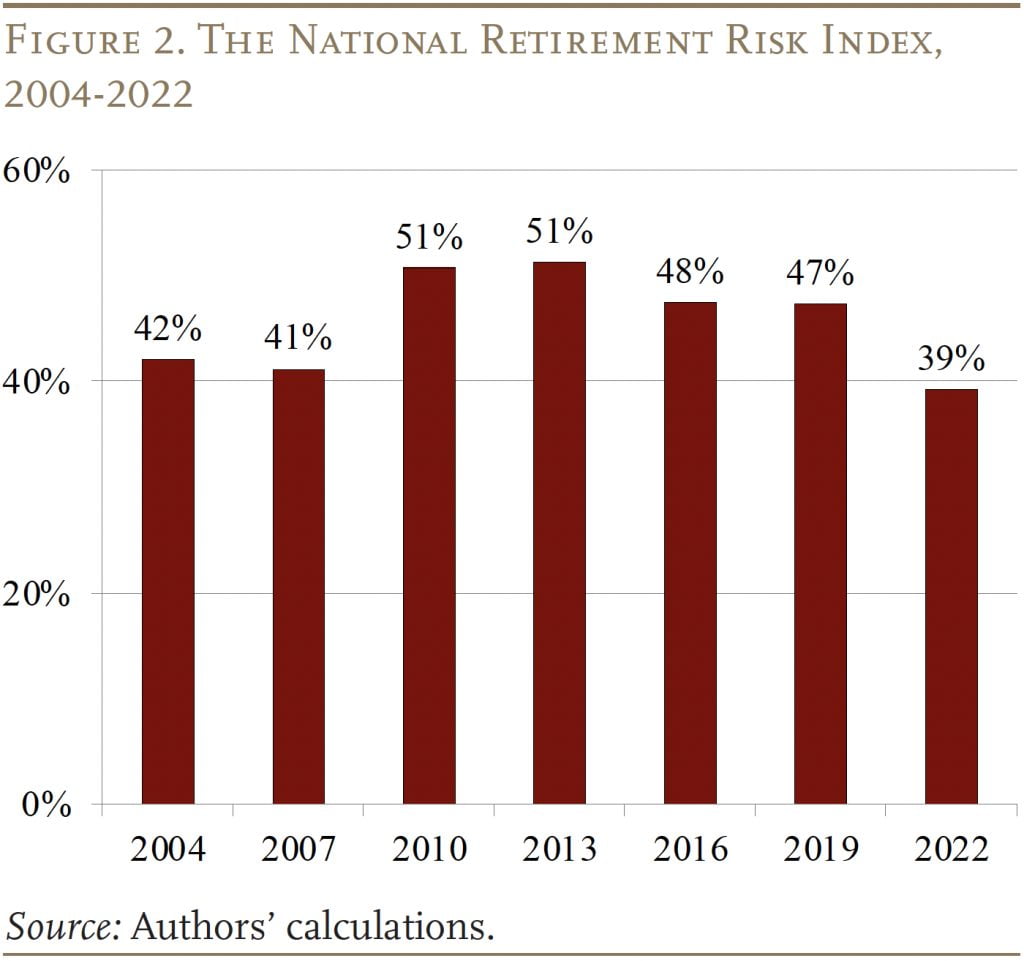

- From 2019 to 2022, the Nationwide Retirement Danger Index improved considerably, dropping from 47 % to 39 %.

- Weathering the pandemic turmoil, households have been buoyed by authorities stimulus, sturdy employment, and rising asset markets.

- The one largest issue driving the development was hovering house values.

- Although these outcomes are encouraging, most individuals don’t faucet their house fairness in retirement and costs might not keep at such excessive ranges.

- Importantly, even with what could also be a short lived enchancment, the NRRI exhibits that 2 in 5 of in the present day’s working households might fall quick.

Introduction

The discharge of the Federal Reserve’s 2022 Survey of Client Funds presents a possibility to reassess People’ retirement preparedness as measured by the Nationwide Retirement Danger Index (NRRI). The NRRI estimates the share of American households which might be susceptible to being unable to keep up their pre-retirement way of life in retirement.

The NRRI was initially constructed utilizing the Federal Reserve’s 2004 Survey of Client Funds (SCF) and has been up to date each three years with the discharge of this triennial survey. For the reason that final SCF was carried out in 2019, the nation skilled a world pandemic and financial disruption, and 2022 was a really unhealthy 12 months for inventory and bond returns. These elements would have decreased households’ retirement preparedness. On the similar time, the federal government supplied unprecedented fiscal assist, employment remained sturdy, house values rose considerably, and the inventory market – even with the drop in 2022 – ended up considerably larger than in 2019. The 2022 survey permits us to see how these disparate elements have affected People’ readiness for retirement.

The dialogue proceeds as follows. The primary part describes the nuts and bolts of the NRRI. The second part updates the NRRI utilizing 2022 SCF knowledge and exhibits that the share of households in danger dropped from 47 % to 39 %, the bottom degree since we began the Index in 2004, largely attributable to rising house values. The third part relates the varied causes for the decline to related subgroups. The fourth assesses the implications of the massive drop within the NRRI for the long run. The ultimate part concludes that, even with the speedy impression of the sturdy housing market, retirement readiness stays a significant problem for a lot of of in the present day’s employees.

Nuts and Bolts of the NRRI

Setting up the NRRI entails three steps: 1) projecting a alternative price – retirement revenue as a share of pre-retirement revenue – for a nationally consultant pattern of U.S. households; 2) establishing a goal alternative price in keeping with sustaining a pre-retirement way of life in retirement; and three) evaluating the projected and goal alternative charges to search out the proportion of households “in danger.”

Projecting Family Substitute Charges

The train begins with projecting retirement revenue for households at three retirement ages – 62 for low revenue, 66 for center revenue, and 67 for top revenue. Retirement revenue is outlined broadly to incorporate revenue from Social Safety and outlined profit (DB) plans; revenue from monetary property in each outlined contribution (DC) plans and saved immediately; and revenue from housing.

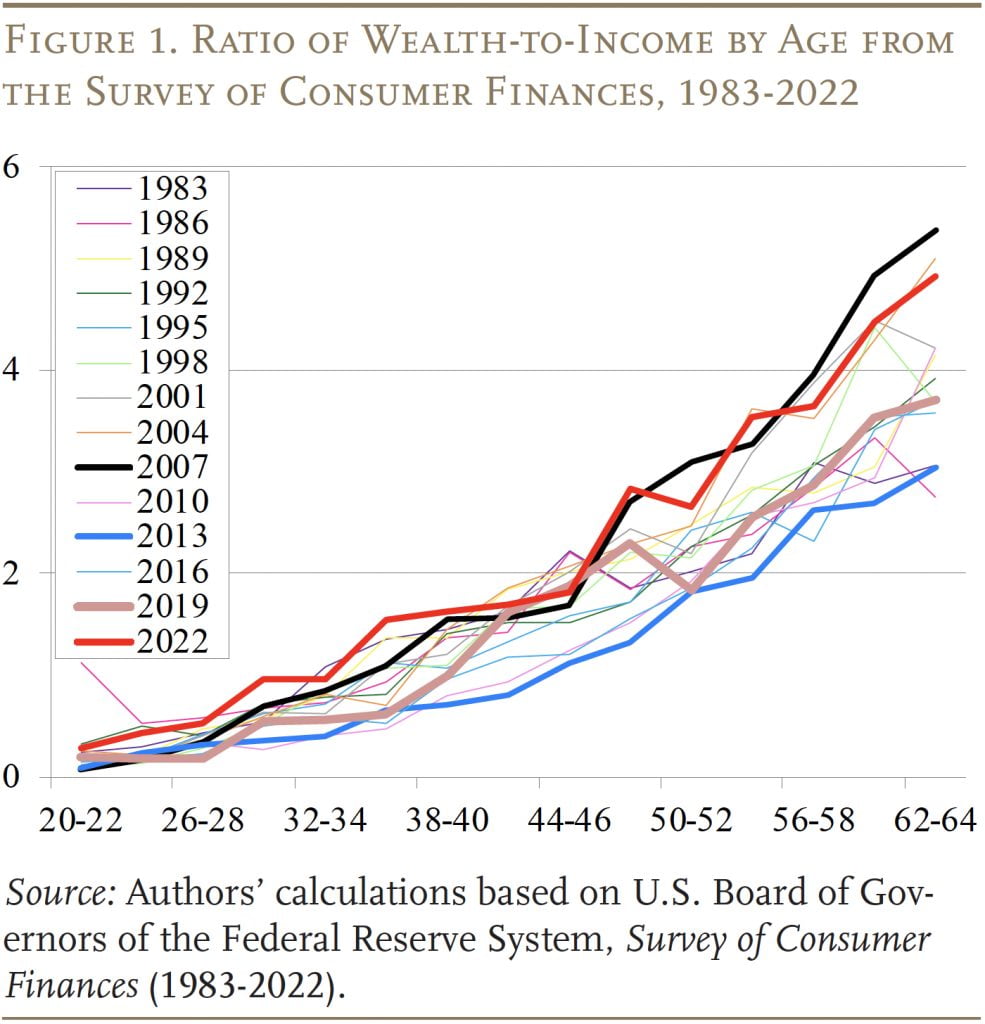

The values for monetary and housing property at retirement are calculated from the ratio of wealth to revenue by age from the 1983-2022 SCFs. As proven in Determine 1, the mixture wealth-to-income by age has been secure over time, within the sense that the strains rested roughly on high of one another. Comparable stability holds with regard to the varied elements of wealth. Utilizing the secure relationship between every part and revenue, the evaluation estimates DC property, non-DC monetary property, and housing fairness individually, at varied retirement ages.

The combination wealth-to-income ratios additionally present some trace of the NRRI for 2022. Traditionally, wealth-to-income strains from every survey have been bracketed by 2007 values on the excessive aspect and 2013 values on the low aspect. The 2022 line (pink) appears to be like much like wealth-to-income ratios in 2007, suggesting sturdy enhancements within the proportion of households in danger between 2019 and 2022.

The NRRI calculations assume that households convert all their property, together with monetary property, 401(okay)/ IRA balances, and proceeds from a reverse mortgage, right into a stream of revenue by buying an inflation-indexed annuity.

Sources of retirement revenue that aren’t derived from reported wealth within the SCF are estimated immediately. Particularly, Social Safety advantages are calculated primarily based on estimated earnings histories for every member of the family, listed to nationwide common wage development. DB pension revenue relies on the quantity reported by survey respondents.

The remaining step is to calculate pre-retirement revenue on the three retirement ages. For owners, this measure contains earnings (once more, listed to common wage development) and imputed hire from housing. Common pre-retirement revenue then serves because the denominator for every family’s alternative price. This measure excludes revenue from property.

Estimating Goal Substitute Charges

Figuring out the estimated share of the inhabitants that’s in danger requires evaluating projected alternative charges with a benchmark price. A generally used benchmark is the alternative price wanted to permit households to keep up their pre-retirement way of life in retirement. Folks usually want lower than their full pre-retirement revenue to keep up this normal as soon as they cease working since they often pay much less in taxes, now not want to save lots of for retirement, and sometimes have paid off their mortgage. Thus, a better share of their revenue is obtainable for spending. The Index estimates the goal alternative charges for several types of households utilizing a consumption-smoothing mannequin, which relies on the idea that households need the identical degree of consumption in retirement as they’d earlier than they retired.

Calculating the Index

The ultimate step in creating the NRRI is to check every family’s projected alternative price with the suitable goal. Households whose projected alternative charges fall greater than 10 % beneath their targets are deemed to be susceptible to having inadequate revenue to keep up their pre-retirement way of life. The NRRI is solely the proportion of all households that fall greater than 10 % in need of their goal.

The NRRI in 2022

The sturdy ratio of wealth to revenue proven in Determine 1 prompt that the NRRI would enhance in 2022 – that’s, fewer households can be in danger. And certainly, the share of households in danger dropped from 47 % to 39 % – the bottom degree because the Index began in 2004 (see Determine 2).

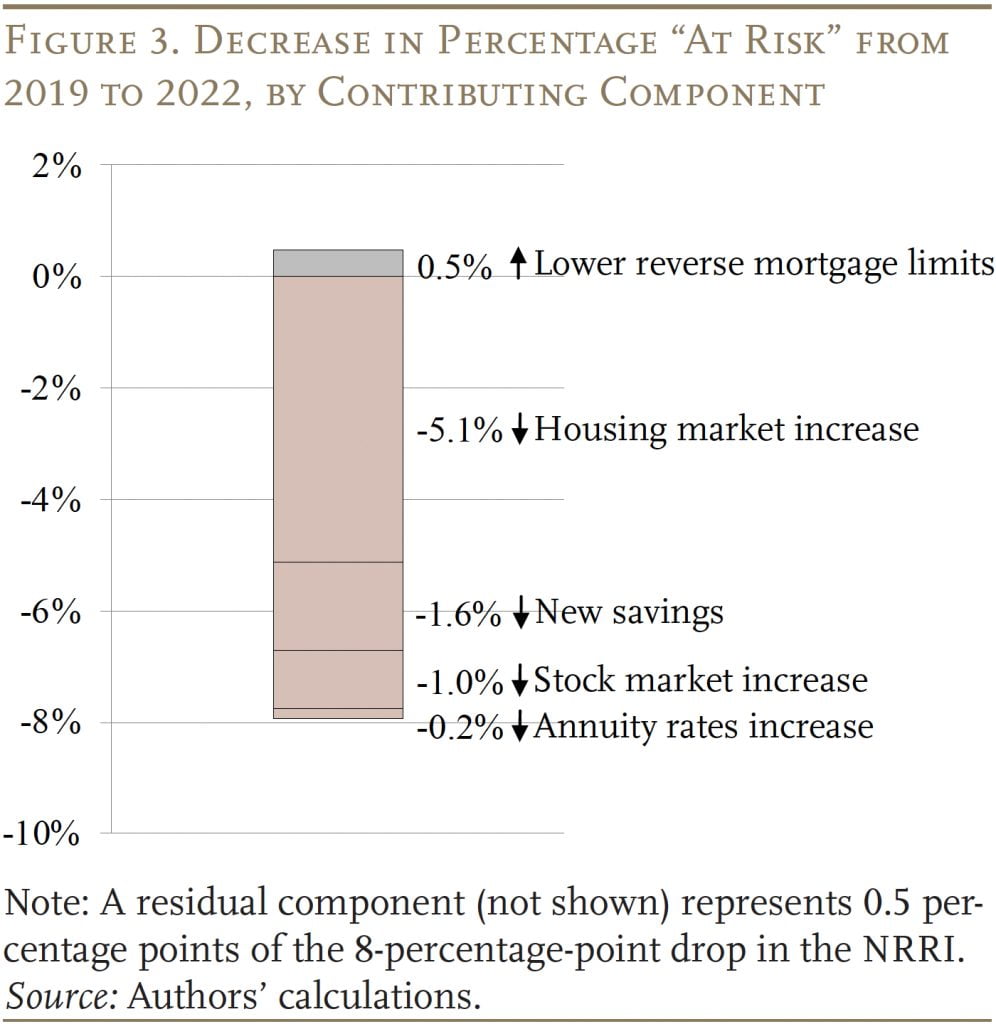

Determine 3 breaks down the explanations for the massive discount within the NRRI. The rise in house costs leads the record, adopted by new financial savings in the course of the pandemic, and inventory market positive aspects. Rising rates of interest had small offsetting results. The next takes a better take a look at every part.

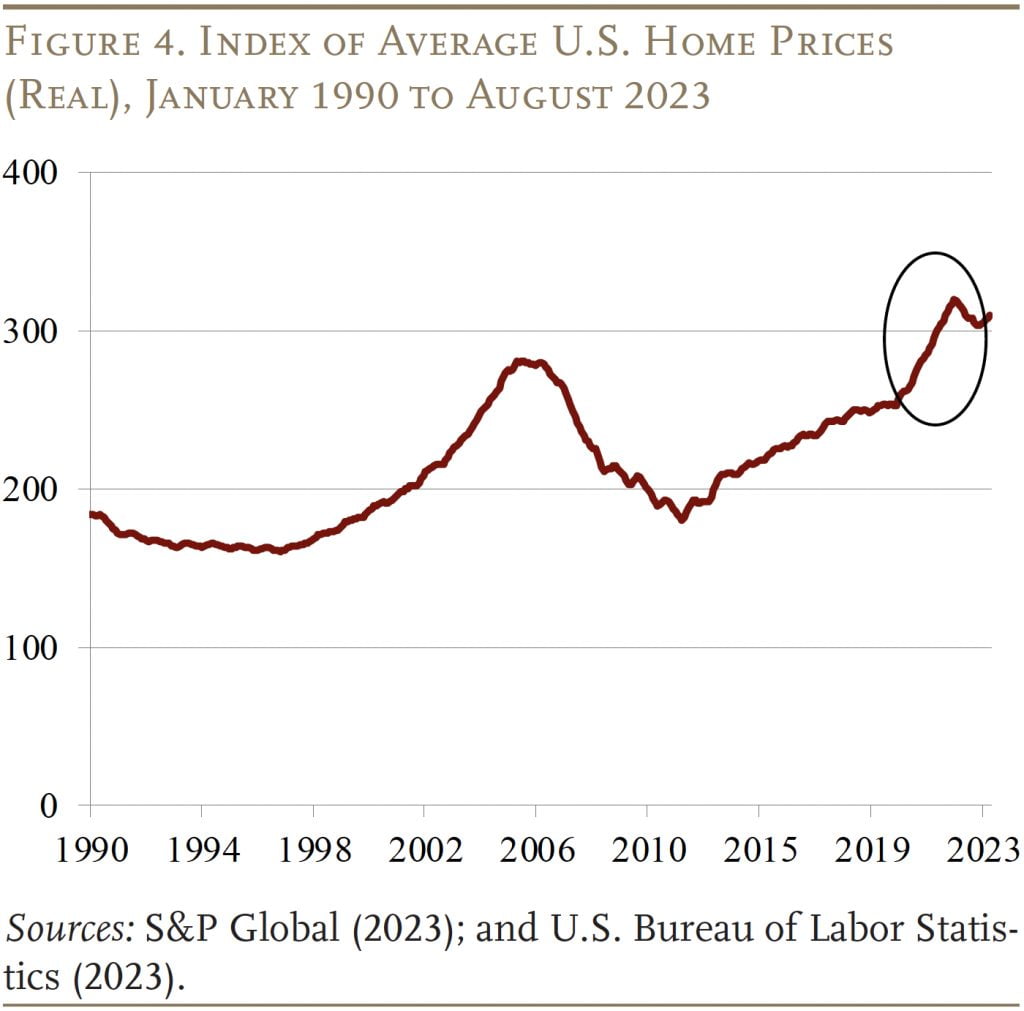

Housing. Between 2019 and 2022, U.S. house costs elevated by about 22 % in actual phrases, (see Determine 4). For context, house costs grew by 27 % between 2001 and 2004. Within the NRRI, house costs have a major impression as a result of households are assumed to entry their house fairness at retirement by taking out a reverse mortgage. The upper the house worth, the extra fairness households can extract via a reverse mortgage.

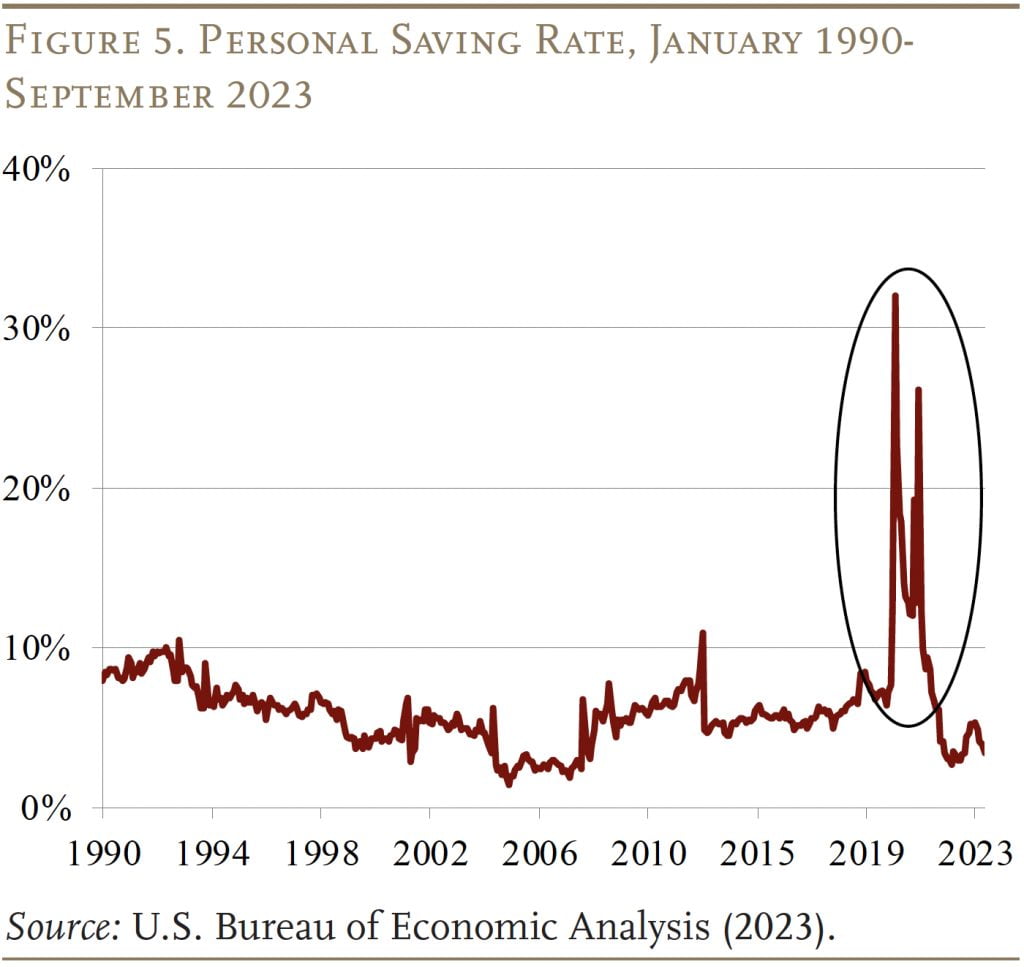

Elevated Financial savings. A novel issue that improved projected retirement funds for a lot of households was a dramatic spike in private saving in the course of the pandemic, fueled by the federal stimulus spending. Private saving charges jumped from roughly 7 % of disposable revenue to over 30 % in the course of the pandemic (see Determine 5). Whereas the saving price returned to pre-pandemic ranges by 2022, the build-up in financial savings in 2020 and 2021 quickly made many households’ stability sheets a lot stronger.

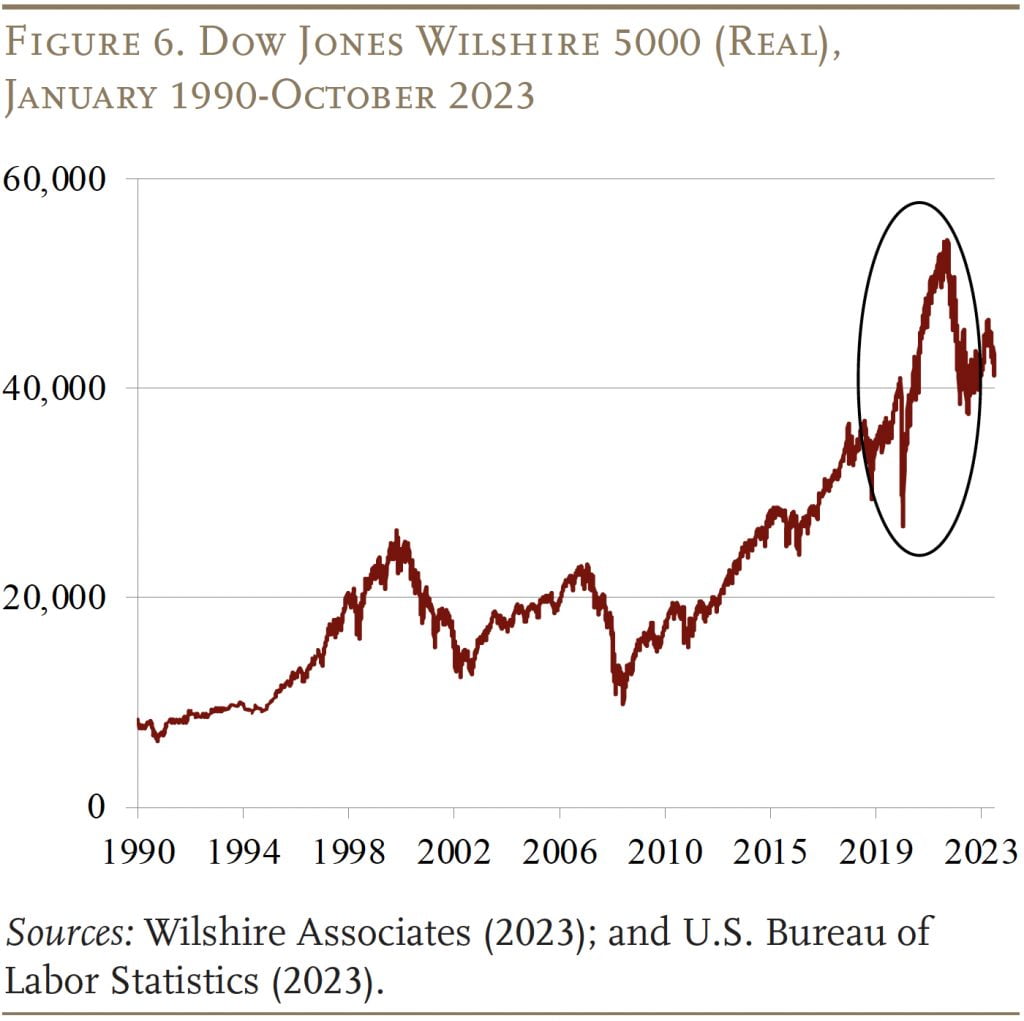

Inventory Market. Regardless of the preliminary dip early within the pandemic and a pullback in 2022, fairness costs elevated by greater than 20 % after adjusting for inflation because the finish of 2019 (see Determine 6). These positive aspects, nonetheless, have been concentrated within the high third of the revenue distribution, which holds about 87 % of all equities. This sample implies that a lot of the positive aspects went to households that have been already not in danger.

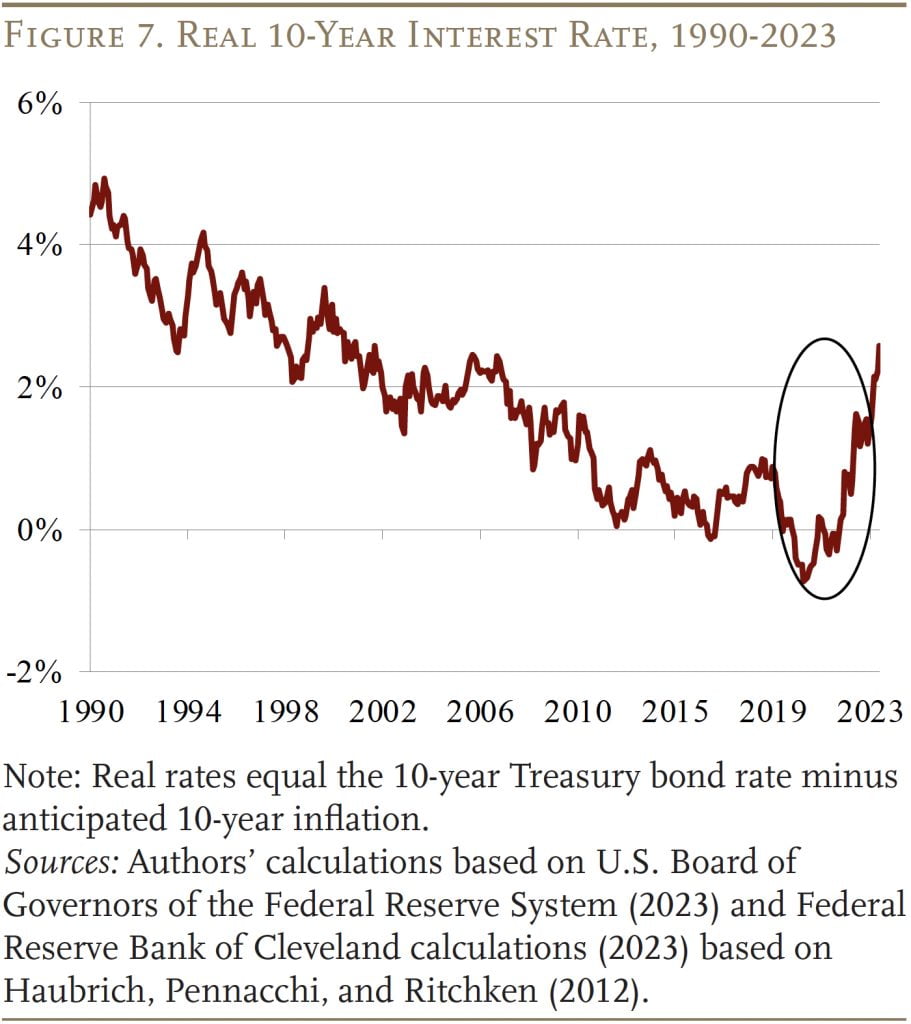

Curiosity Charges. Whereas actual rates of interest had been declining for the final 30 years, in the course of the pandemic they spiked to the very best degree because the early-2000s (see Determine 7). Increased rates of interest have two opposing results on households’ monetary safety in retirement. On one hand, larger charges imply that households get extra revenue from annuitizing their property. Then again, the excessive charges scale back the quantity households can get from a reverse mortgage. On internet, larger charges elevated the proportion of households in danger, however the impact is small.

Impression of 2022 Adjustments for NRRI Subgroups

Given the significance of the varied elements lowering the proportion in danger, it’s attention-grabbing to look at the patterns within the NRRI by homeownership standing, retirement plan protection, revenue degree, and age group.

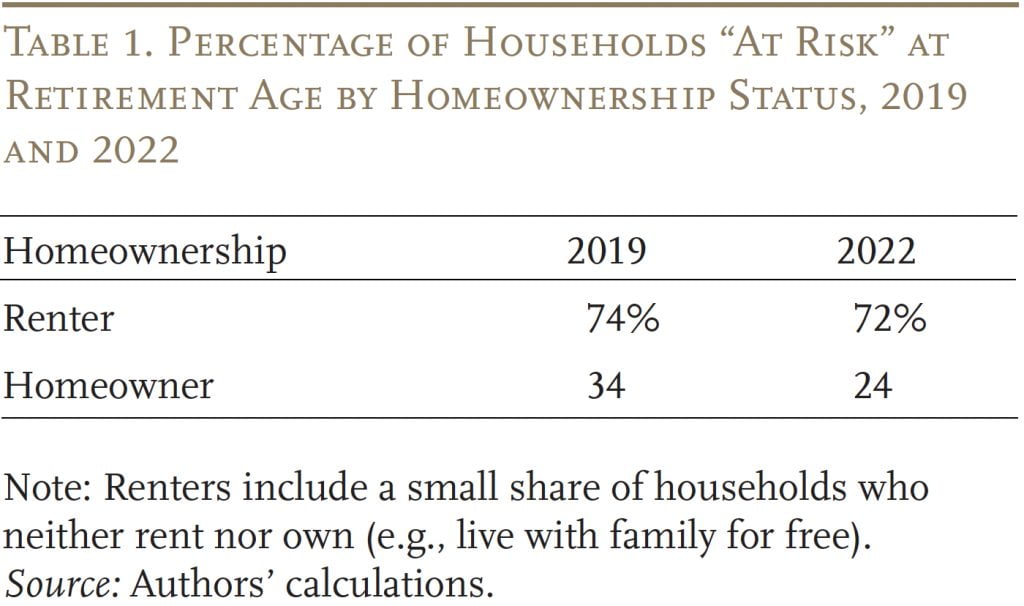

It isn’t stunning that fewer owners are in danger relative to renters, however the hole between the 2 teams elevated. The sturdy development within the housing market decreased the share of householders in danger by 10 proportion factors, whereas the share of renters in danger stayed pretty regular (see Desk 1).

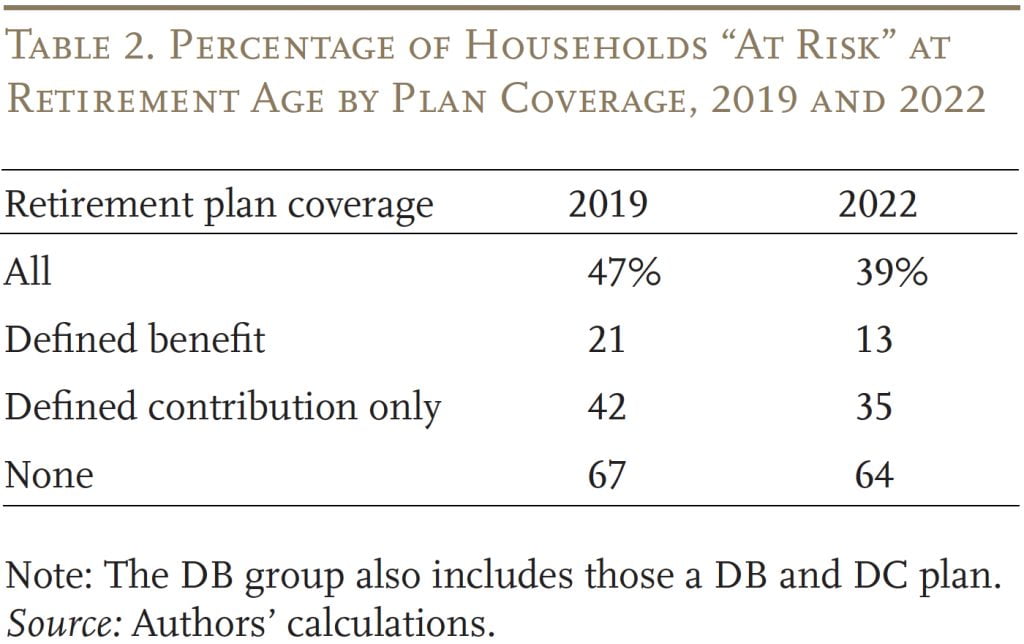

On the similar time, the positive aspects within the inventory market between 2019 and 2022 decreased the proportion susceptible to households with a DC plan, whereas the proportion in danger with no retirement plan dropped solely barely (see Desk 2). The declining NRRI for households with a DB plan displays the truth that an rising share of those plans are within the public sector, the place pensions are a significant part of whole compensation.

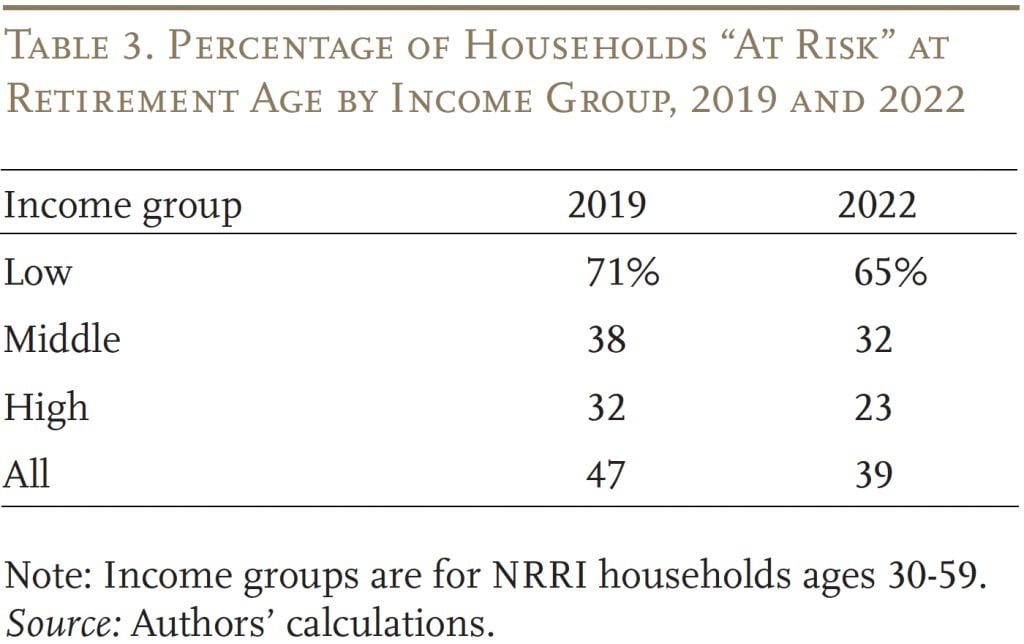

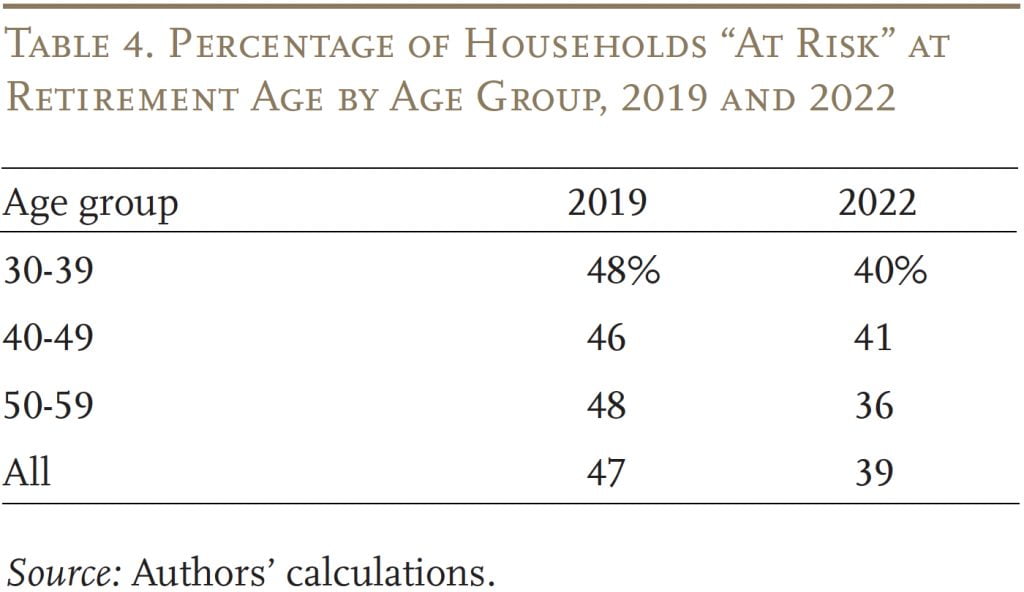

When seen by revenue and age, the most important positive aspects in relative phrases have been loved by high-income households (see Desk 3), who’re largely more likely to personal houses and who maintain a lot of the equities. The positive aspects for the low- and middle-income teams most probably mirror some homeownership and maybe a number of the new financial savings. When it comes to age, the oldest group, who maintain a lot of the property, noticed the most important discount within the NRRI (see Desk 4).

Implications of 2022 NRRI for the Future

The 2022 NRRI represents the largest drop within the Index since its creation, largely pushed by development within the asset markets, and particularly the housing market. Present housing costs are about 14 % above their long-run development for the final 30 years. It could appear affordable that, over time, housing costs might revert to development. Furthermore, you will need to do not forget that the NRRI has retirees buying a reverse mortgage – one thing that few really do. Subsequently, the share of households deemed in danger by the NRRI might be seen as a lower-bound estimate. Actually, a latest examine by researchers at Vanguard discovered that no less than 70 % of households would fall in need of their pre-retirement way of life in retirement when housing fairness is excluded.

The opposite main issue contributing to the decline within the NRRI from 2019 to 2022 that won’t persist sooner or later is “new saving.” Private saving charges have returned to pre-pandemic ranges and so has bank card borrowing. Thus, it seems that households are spending a number of the extra financial savings they constructed up since 2019. Thus, one wouldn’t count on new financial savings to be a significant contributor to improved retirement readiness over the following three years.

In distinction to those transitory results, the constructive impression of the inventory market could also be extra everlasting. As famous, most households noticed an increase in internet monetary wealth and 401(okay)/IRA balances attributable to larger inventory costs and the one-time accumulation in new financial savings. Meaning, even ignoring development within the housing market, households throughout the revenue and age distribution are extra ready for retirement than they have been in 2019. Though all the time unsure, inventory market positive aspects might nicely contribute to bettering the monetary safety of middle- and high-income households sooner or later.

Conclusion

Between 2019 and 2022, the NRRI dropped considerably – from 47 to 39 %. Regardless of a world pandemic and financial disruption, family funds have been buoyed by unprecedented fiscal assist, a powerful labor market, and appreciable development within the housing and inventory markets. The most important issue driving the development in retirement funds is development within the housing market. However most households don’t faucet their house fairness in retirement and residential costs might not stay at traditionally excessive ranges. The underside line is that even a conservative estimate exhibits a considerable portion – about two-fifths – of in the present day’s households won’t have sufficient retirement revenue to keep up their pre-retirement way of life. This evaluation continues to verify that we have to repair our retirement system in order that Social Safety is financially sound and employer plan protection is common.

References

Barbiero, Omar and Dhiren Patki. 2023. “Have US Households Depleted All of the Extra Financial savings They Amassed in the course of the Pandemic?” Present Coverage Views Paper 97263. Boston, MA: Federal Reserve Financial institution of Boston.

Federal Reserve Financial institution of Cleveland. 2023. “Ten-12 months Anticipated Inflation and Actual and Inflation Danger Premia.” Cleveland, OH.

Haubrich, Joseph, George Pennacchi, and Peter Ritchken. 2012. “Inflation Expectations, Actual Charges, and Danger Premia: Proof from Inflation Swaps.” The Evaluate of Monetary Research 25(5): 1588-1629.

S&P International. 2023. “S&P CoreLogic Case-Shiller U.S. Nationwide House Value NSA Index.” New York, NY: S&P Dow Jones Indices.

Tan, Fu, Fiona Greig, Andrew S. Clarke, Kevin Khang, Kate McKinnon, and Victoria Zhang. 2023. “The Vanguard Retirement Outlook: A Nationwide Perspective on Retirement Readiness.” Valley Forge, PA: Vanguard.

U.S. Board of Governors of the Federal Reserve System. 2023. “Chosen Curiosity Charges: Historic Information.” Washington, DC.

U.S. Board of Governors of the Federal Reserve System. Survey of Client Funds, 1983-2022. Washington, DC.

U.S. Bureau of Financial Evaluation. 2023. Private Saving Price Information (accessed from FRED database). Washington, DC.

U.S. Bureau of Labor Statistics. 2023. Client Value Index. Washington, DC.

Wheat, Chris and Erica Deadman. 2023. “Family Pulse: Balances via March 2023.” Washington, DC: JPMorgan Chase Institute.

Wilshire Associates. 2023. “Dow Jones Wilshire 5000 (Full Cap) Value Ranges Since Inception.” Santa Monica, CA.

Yin, Yimeng, Anqi Chen, and Alicia H. Munnell. 2023a. “The Nationwide Retirement Danger Index with Various Claiming Ages.” Problem in Temporary 23-23. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Yin, Yimeng, Anqi Chen, and Alicia H. Munnell. 2023b. “The Nationwide Retirement Danger Index: Model 2.0.” Problem in Temporary 23-10. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Appendix: Methodological Enhancements in NRRI since 2019

Since its inception, the Heart has periodically made modest adjustments to the NRRI. Lately, nonetheless, we undertook a significant overhaul to include new analysis findings and methodological advances. Though the general modeling framework described above stays unchanged, the up to date NRRI contains the next main enhancements:

Accounts for differential claiming. One of many largest and most up-to-date updates within the NRRI is permitting households in numerous revenue teams to assert Social Safety (and cease working) at completely different ages. Differential claiming higher displays the real-world selections households make round retirement.

Captures rising wealth inequality. One other main replace within the NRRI is shifting from common wealth-to-income ratios to median ratios when projecting wealth. Utilizing medians for our projections permits the mannequin to raised seize real-world wealth distributions, significantly given rising wealth inequality.

Higher displays the shift from DB to DC plans. The brand new methodology tasks DC property for various cohorts to account for the rising share of youthful employees coated by DC plans.

Fashions monetary debt individually. Monetary property and non-mortgage debt at the moment are projected individually as a substitute of in a single internet monetary asset variable.

Refines the goal alternative price mannequin. Projected alternative charges are matched to a variety of traits, permitting for a whole lot of targets, as a substitute of simply 12 family sorts within the earlier mannequin.

[ad_2]