[ad_1]

One of many standards that outline knowledgeable dealer is consistency. Skilled merchants generate income out of buying and selling as their foremost supply of revenue. Many merchants dream to only that. Nevertheless, not all merchants can do that as a result of most merchants will not be constant sufficient to pin their hopes of a month-to-month revenue coming from buying and selling. Skilled merchants however are very constant in the case of their buying and selling. Certain, there shall be just a few intervals right here and there whereby they may very well be on the pink. Nevertheless, for probably the most half skilled merchants are often on the inexperienced. It doesn’t imply that each one their trades are worthwhile. It simply implies that on a interval to interval foundation, skilled merchants are totally on the inexperienced, which permits them to anticipate revenue from buying and selling which they will dwell with.

Consistency in buying and selling comes from a scientific manner of buying and selling the market, which permits merchants to repeat the identical course of many times so long as a commerce setup suits their standards. With the best commerce setup, merchants can considerably lower trades which have a low likelihood of leading to a win and commerce excessive likelihood setups more often than not.

Among the best sorts of commerce setups that merchants can use with the intention to commerce with a comparatively excessive win likelihood is a pattern following or pattern continuation setup. It is because pattern continuation setups are traded within the route of the primary pattern, which considerably will increase the probability of a successful commerce.

Alligator

Invoice William’s Alligator indicator is a well-liked on-chart pattern following technical indicator which was developed with the intention to support merchants in figuring out tendencies.

This indicator is predicated on a set of modified transferring averages, particularly a smoothed transferring common. The long-term transferring common line is named the Jaw line, the mid-term transferring common line is the Tooth, and the short-term transferring common line is named the lips.

Pattern route is predicated on how the strains overlap. If the short-term line is above the opposite two strains, the market in thought of bullish. Nevertheless, the market is taken into account bearish if the short-term line is beneath the opposite two strains. If the strains will not be stacked correctly, then that market may very well be in a ranging situation. Crossovers between the strains signifies a possible pattern reversal.

The market is taken into account to be in a strengthening pattern part at any time when the three transferring common strains begin to develop. Nevertheless, if the three strains would begin to contract in the direction of one another, then the market is taken into account to be in a market contraction part. It’s prudent for merchants to commerce solely when the market is starting to strengthen its pattern route and exit trades because the market begins to chill down.

CCI on Step Channel

The CCI on Step Channel is a customized technical indicator which is simply as its title suggests. It’s based mostly on the Commodity Channel Index (CCI) but is modified based mostly on the Step Channel indicator.

The basic CCI indicator is a momentum-based oscillator used to assist merchants determine the cyclical actions of worth motion, together with overbought and oversold circumstances, which regularly result in a imply reversal. The CCI is an oscillator which is derived from a transferring common of a Typical Value.

The Step Channel indicator however is a pattern following technical indicator is an on-chart indicator which plots a channel like construction based mostly on the volatility of worth motion.

The CCI on Step Channel indicator combines each ideas into one. It plots a CCI oscillator similar to the fundamental CCI. Nevertheless, as a substitute of utilizing Typical Value as its foundation, it computes utilizing the median of the Step Channel indicator.

This indicator plots bars that might oscillate from constructive to unfavorable or vice versa. Optimistic bars point out a bullish momentum bias, whereas unfavorable bars point out a bearish momentum bias. It additionally has markers at ranges +/-80. Bars breaching past this vary may point out a strengthening pattern or momentum.

PPO Indicator

The PPO indicator, also called the Proportion Value Oscillator, is a technical momentum indicator which can also be a part of the oscillator household of indicators. Additionally it is similar to the favored MACD oscillator.

Just like the MACD, this indicator is predicated on the connection between two transferring averages, which is computed in share type. It additionally has a sign line which can also be derived from the unique PPO line. What makes it distinctive is that it’s based mostly on Exponential Shifting Common (EMA) strains, which makes it very responsive to cost actions.

This indicator plots two strains which oscillate round zero. Pattern bias will be recognized based mostly on whether or not the strains are constructive or unfavorable. Reversal alerts will also be generated based mostly on the crossing over of the primary PPO line and the sign line.

Buying and selling Technique

Alligator CCI Step Foreign exchange Buying and selling Technique is a pattern following technique which trades on confluences of pattern continuation alerts coming from the CCI on Step Channel indicator and the PPO indicator.

Pattern route is recognized based mostly on the Alligator indicator. That is based mostly on how the three modified transferring common strains are stacked.

Throughout such tendencies, market contraction phases and retracements do happen. This might typically trigger the CCI on Step Channel to point a weakening pattern and the PPO indicator to point out non permanent indicators of reversal.

Commerce setups are deemed legitimate as quickly because the CCI on Step Channel indicator signifies a resumption of pattern energy or momentum, and the PPO indicator exhibits indicators of a attainable pattern continuation based mostly on the crossing over of the 2 strains.

Indicators:

Most well-liked Time Frames:15-minute, 30-minute, 1-hour and 4-hour charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

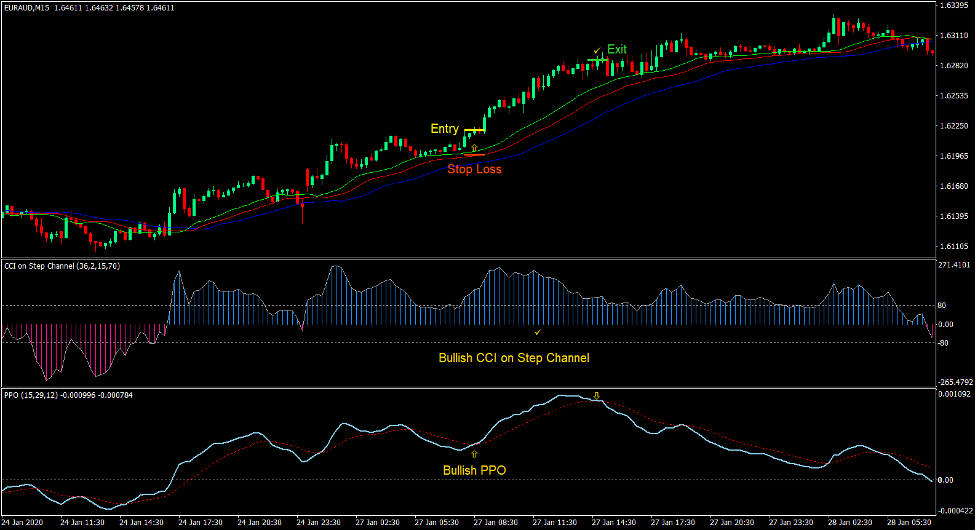

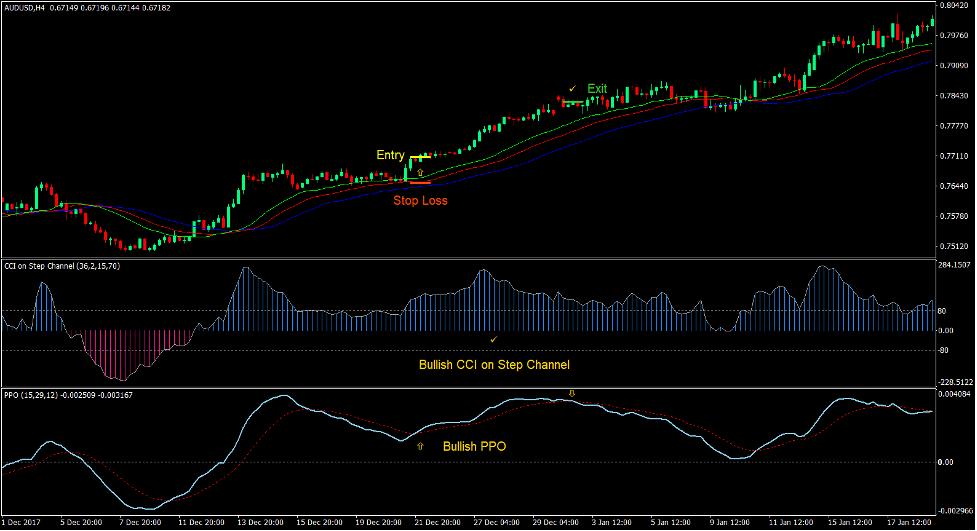

Purchase Commerce Setup

Entry

- The Alligator strains must be stacked within the following order:

- Lips: prime

- Tooth: center

- Jaw: backside

- The CCI on Step Channel bars must be constructive.

- The PPO strains must be constructive.

- Value ought to retrace in the direction of the Alligator strains inflicting the CCI on Step Channel bars to drop beneath 80 and the PPO line to cross beneath the sign line.

- The CCI on Step Channel bars ought to cross above 80.

- The PPO line ought to cross above the sign line.

- Enter a purchase order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on a assist beneath the entry candle.

Exit

- Shut the commerce as quickly because the PPO line crosses beneath the sign line.

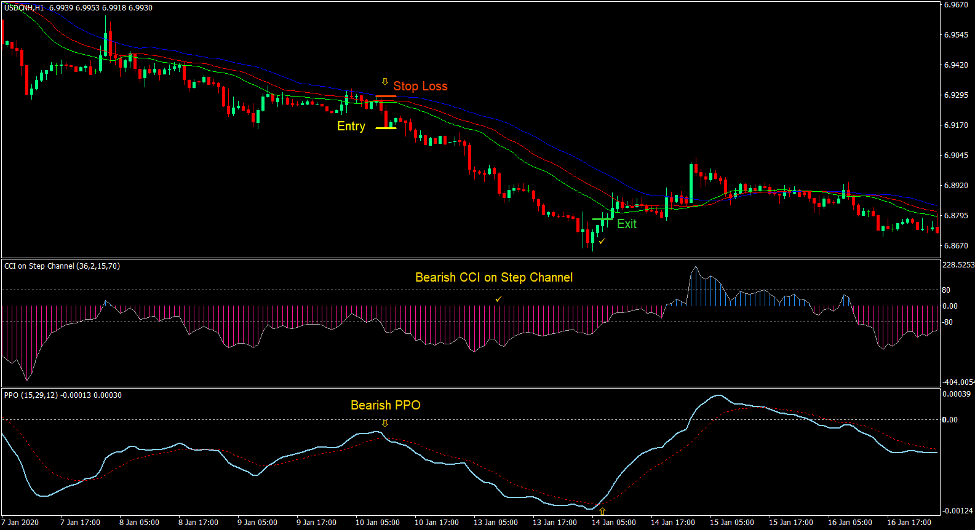

Promote Commerce Setup

Entry

- The Alligator strains must be stacked within the following order:

- Lips: backside

- Tooth: center

- Jaw: prime

- The CCI on Step Channel bars must be unfavorable.

- The PPO strains must be unfavorable.

- Value ought to retrace in the direction of the Alligator strains inflicting the CCI on Step Channel bars to breach above -80 and the PPO line to cross above the sign line.

- The CCI on Step Channel bars ought to cross beneath -80.

- The PPO line ought to cross beneath the sign line.

- Enter a promote order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on a resistance above the entry candle.

Exit

- Shut the commerce as quickly because the PPO line crosses above the sign line.

Conclusion

This buying and selling technique is a straightforward pattern following technique which is predicated on confluences of excessive likelihood customized technical indicators.

The setups that may very well be produced by this technique are likely to end in excessive win percentages supplied that the technique is used within the appropriate market atmosphere.

As such, this technique is greatest used solely throughout clearly trending market circumstances because it supplies merchants with a scientific manner of getting into a trending market within the route of the pattern.

Foreign exchange Buying and selling Methods Set up Directions

Alligator CCI Step Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the accrued historical past information and buying and selling alerts.

Alligator CCI Step Foreign exchange Buying and selling Technique supplies a possibility to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional worth motion and regulate this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Learn how to set up Alligator CCI Step Foreign exchange Buying and selling Technique?

- Obtain Alligator CCI Step Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Alligator CCI Step Foreign exchange Buying and selling Technique

- You will notice Alligator CCI Step Foreign exchange Buying and selling Technique is offered in your Chart

*Observe: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]