[ad_1]

Accounts payable and accounts receivable are reverse however interconnected procedures. One represents expenditures; the opposite represents revenues. Collectively, they comprise the very fundamentals of enterprise and can be utilized to gauge monetary well being.

When accounts payable and accounts receivable are in stability, a enterprise can plan forward for development. If out of stability, fast consideration is required to regain monetary wellbeing.

As an accountant, your purchasers rely on you to assist handle their funds. Immediately, automation performs an necessary position in optimizing the accounts payable and accounts receivable processes.

For enterprise homeowners, a working information of each accounts payable and accounts receivable is important to maintain enterprise operations. Let’s check out their variations.

What’s the distinction between accounts receivable and accounts payable?

Accounts payable (AP), is the listing of all quantities an organization owes to its distributors. This consists of services or products which can be bought and invoiced. Usually, when an bill is obtained, it’s recorded as a journal entry and posted to the final ledger. When the expense is accepted by the approved worker, a examine is minimize (digital or onerous copy) primarily based on the phrases of the acquisition settlement. Typically these phrases are 30, 60, or 90 days from receipt of the bill.

Accounts receivable is the opposite finish of the accounting spectrum. Accounts receivable (AR) represents the cash owed to an organization for gross sales made on credit score. Accounts receivable is a part of the enterprise life cycle between the supply of products or companies and the cost for these by prospects. They’re thought-about property on a stability sheet, with anticipated funds inside a yr.

Like accounts payable, your purchasers can set cost phrases as a part of their accounts receivable technique. They could additionally provide prospects reductions for early cost or require partial cost on the time of receiving an order.

It is very important be aware that money gross sales, as with a retail shopper, aren’t thought-about a part of accounts receivable.

Examples of accounts payable and accounts receivable

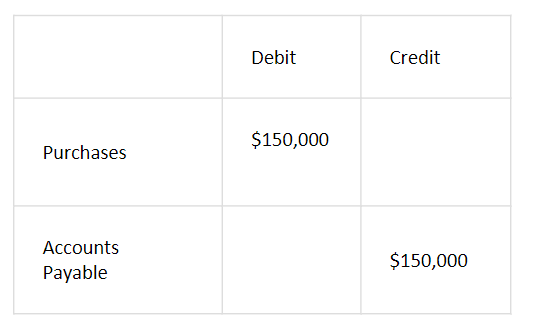

For example of accounts payable, let’s say that Firm ABC bought items price $150,000 on credit score from a vendor. Firm ABC would file a journal entry as follows:

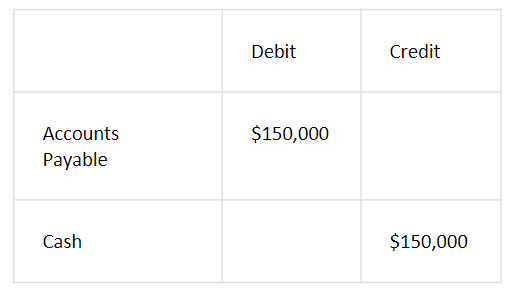

When Firm ABC makes a cost to its vendor, the accounts payable account is debited. Beneath is an instance of the journal entry for money paid to the seller.

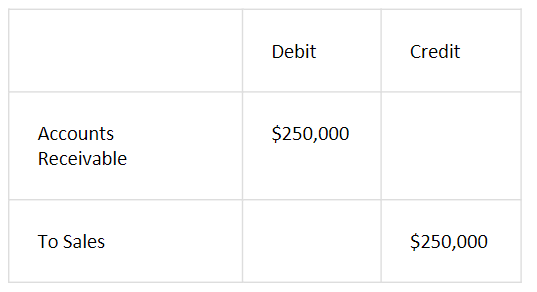

From an accounts receivable perspective, let’s say Firm ABC bought $250,000 price of widgets to Firm XYZ on a 90-day interval credit score. The journal entry on the time the bill is issued could be as follows:

Due to this fact, debiting accounts receivable $250,000 means a rise in accounts receivable by the identical quantity. Equally, crediting the gross sales account by $250,000 means a rise in gross sales by the identical quantity.

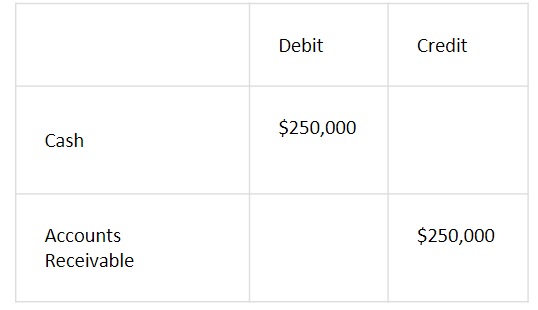

When money is obtained for items bought on credit score, the journal entry on the time money is obtained could be as follows:

Just like the above instance, debiting the money account by $250,000 additionally means a rise in money account by the identical quantity. Moreover, crediting accounts receivable by $250,000 means a lower within the accounts receivable by the identical quantity.

GAAP for accounts payable and receivable

The Usually Accepted Accounting Rules (GAAP) are a algorithm particular to the USA which can be designed to offer oversight for accounting practices. They have been developed by the Monetary Accounting Requirements Board (FASB) and the Governmental Accounting Requirements Board (GASB).

Whereas inside practices could range for accounts payable and accounts receivable, each accounts payable division should use a double entry, accrual-based accounting that follows a model of GAAP. Money-based accounting isn’t GAAP-compliant.

With regards to accounts payable and accounts receivable, guaranteeing the transparency and integrity of monetary information is of the utmost significance and is topic to a number of inside controls.

By automating the accounts payable course of, it’s a lot simpler to stick to GAAP whereas additionally optimizing the accounts payable and receivable course of.

Can the identical particular person do accounts payable and accounts receivable?

No. The segregation of accounts payable and accounts receivable is necessary. In reality, the separation of the 2 capabilities is taken into account a elementary accounting precept, in accordance with the Usually Accepted Accounting Rules (GAAP) issued by the Monetary Accounting Requirements Board (FASB). Totally different folks ought to execute these capabilities to make sure the danger of fraud is lowered.

With two completely different people dealing with accounts payable and accounts receivable, discrepancies can usually be instantly recognized and resolved as a result of using double checks on both sides.

Is invoicing accounts payable or receivable?

If your organization is paying an bill to a different firm (resembling in B2B), will probably be famous in accounts payable. Invoices accumulate cost after an organization delivers items or companies to its prospects.

The accounts payable stability consists of all invoices which can be as a result of be paid to distributors or suppliers for items or companies. It’s mirrored within the stability sheet underneath present liabilities.

Then again, accounts receivable is the place a enterprise information the sale of its items or companies however has not but collected any funds. Accounts receivable are thought-about present property and are listed on the stability sheet.

Is billing AP or AR?

Billing is a part of accounts receivable and is outlined as the method of producing and issuing invoices to prospects.

If a enterprise gives items or companies with out requiring full cost up entrance, this unpaid stability is categorized as accounts receivable.

An internet billing resolution can simplify the accounts receivable course of by making it sooner and simpler to ship invoices. It additionally avoids mail supply points and streamlines record-keeping.

Is accounts payable a nerve-racking job?

A job in accounts payable might be nerve-racking if a enterprise depends on handbook processes. With out know-how to facilitate accounts payable automation, a enterprise could discover it onerous to handle paper-based paperwork, reconcile funds in a well timed method, and preserve good relationships with suppliers and distributors.

With regards to accounts payable, good working relationships are crucial to maintain stress ranges down. From an accountant’s perspective, your purchasers’ prospects (particularly repeat prospects) will anticipate well timed invoicing and favorable phrases. However with automation instruments and proactive communication, accounts payable is not going to be as nerve-racking because it was.

Options for each accounts payable and accounts receivable

Past mere accounting procedures, accounts payable and accounts receivable are the means to grasp the monetary well being of a enterprise. When your purchasers have a stable deal with on accounts payable, they may be capable to set up the place their cash goes and determine find out how to be extra environment friendly. Conversely, scrutinizing accounts receivable will assist your purchasers perceive their profitability and observe as much as procure any late funds.

To streamline these processes and rather more, contemplate Accounting CS, knowledgeable accounting software program for accountants that mixes write-up, trial stability, payroll, monetary assertion evaluation, and extra. It’s designed for skilled accountants who serve a number of purchasers, permitting flexibility to deal with all kinds of business and entity varieties.

With an clever interface that finds and verifies the knowledge you want and integrates with different purposes mechanically, you’ll spend much less time looking for and coming into information. Plus, cloud-based accounting allows you to work securely with purchasers in actual time and permits your workers to collaborate from wherever.

For extra details about automating accounts payable and accounts receivable to your agency, go to the Accounting CS contact web page.

Nonetheless produce other questions on accounts payable? Take a look at our accounts payable FAQ.

[ad_2]