[ad_1]

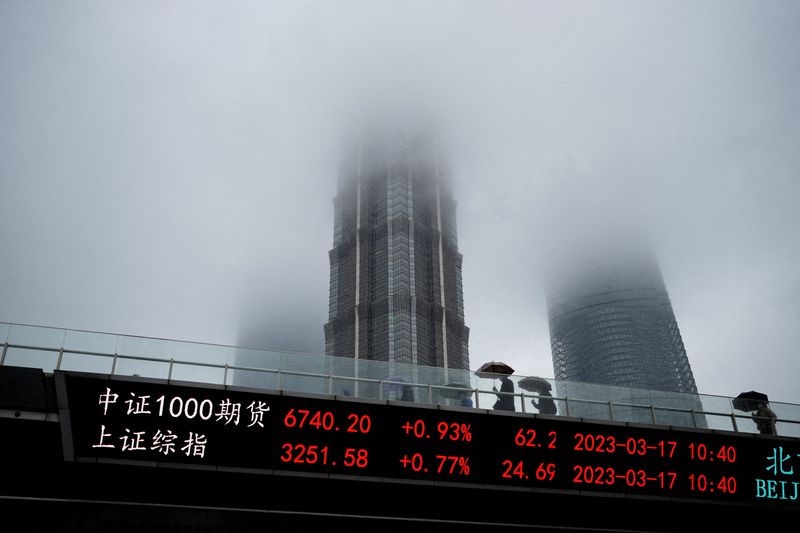

© Reuters. FILE PHOTO: An digital board exhibits inventory indices on the Lujiazui monetary district in Shanghai, China, March 17, 2023. REUTERS/Aly Tune

By Marc Jones

LONDON (Reuters) – Markets have been caught in debt ceiling limbo on Thursday, whereas Europe largely shrugged off information that its greatest financial system, Germany, had sagged into recession and that every one the debt wrangling might value the U.S. a few AAA credit score scores.

With merchants fixated by the funding combat in Washington, there was welcome reduction as chipmaking large Nvidia (NASDAQ:) delivered forecast-smashing income on indicators the brand new wave of synthetic intelligence software program was turbo-charging demand. Its shares have been up 24% in premarket buying and selling. [.N]

Wall Avenue futures have been pointing greater and Europe’s foremost markets in London, Paris and Frankfurt (), the place home-grown points have been exhibiting once more, have been additionally clawing again a few of their morning falls.

Up to date German GDP figures confirmed the euro zone powerhouse slipped into recession within the first few months of the yr regardless of the preliminary studying suggesting in any other case, whereas UK bond markets have been nonetheless reeling from Wednesday’s inflation shock.

MSCI’s broadest index of world shares was down a comparatively modest 0.2% however after two days of promoting, it was sufficient to maintain the temper subdued and carry the safe-haven greenback in direction of a two-month excessive. ()

Washington’s short-term borrowing prices jumped additional above 7% after Fitch put its U.S. score on downgrade watch late on Wednesday whereas sagging close to a 6-month low pointed to its financial system spluttering once more.

“Sadly you might have this plethora of dangers hitting the markets proper now,” mentioned Invesco’s Director of Macro Analysis Ben Jones.

He expects the debt ceiling situation to be resolved earlier than a default is triggered. “Though as soon as we get previous that it isn’t going to be inexperienced open meadows and milk and cookies,” he added, pointing to a backlog of $800 billion of short-term U.S. debt that may have to be issued over the rest of the yr.

Asia had been divided in a single day with Japan plodding greater () however Hong Kong tumbling nearly 2% to its weakest stage of the yr amid renewed geopolitical considerations surrounding Chinese language tech giants resembling Tencent, Alibaba (NYSE:), AIA and Meituan listed there.

Again in Washington, negotiators for President Joe Biden and high congressional Republican Kevin McCarthy held what either side known as productive talks on the debt ceiling. However with no decision in sight, merchants remained cautious of a potential default in early June.

“There is a starting of a way that perhaps this time is slightly bit completely different,” mentioned Rob Carnell, ING’s regional head of analysis, Asia-Pacific.

A downgrade might have an effect on the pricing of trillions of {dollars} of Treasury debt securities. A warning about simply such a transfer by Fitch on Wednesday was mirrored by smaller rival DBRS on Thursday. The strikes revived reminiscences of 2011, when S&P downgraded the U.S. and set off a cascade of different downgrades in addition to a inventory market unload.

“I hope Fitch is aware of the implications of doing this and so they’re nearly doing it simply to attempt to put a little bit of strain on,” ING’s Carnell mentioned. “It does not essentially imply they may downgrade however it’s like saying, ‘you higher be aware, in any other case that is coming’.”

On the rate of interest entrance, Federal Reserve minutes had proven its policymakers “usually agreed” that the necessity for additional rate of interest will increase “had develop into much less sure,” at their the Might 2-3 assembly after they raised charges one other quarter share level to five.00%-5.25%.

The , which measures the U.S. foreign money in opposition to six others, rose 0.2% to a contemporary two-month peak of 104.16 whereas the euro did the identical within the different path after the German information.

shed a greenback to sit down at $77.5 per barrel whereas benchmark European gasoline costs dropped to close 2-year lows and greater than 90% down from the report spikes attributable to Russia’s invasion – or particular navy operation – in Ukraine. [O/R]

[ad_2]