[ad_1]

The temporary’s key findings are:

- Many specialists favor full prefunding of state and native pensions to keep up fiscal sustainability, which suggests massive contribution hikes.

- This evaluation explores an alternate: stabilizing pension debt as a share of GDP.

- Underneath present contribution charges, baseline projections present no signal of a serious disaster within the subsequent 20 years even when asset returns are low.

- But, many plans shall be in danger over the long run of exhausting their property, so motion shall be wanted.

- Plans can attain a sustainable footing by stabilizing their debt-to-GDP ratio, with a lot smaller contribution hikes than below full funding.

Introduction

State and native authorities pension plans are necessary financial establishments in america. They maintain almost $5 trillion in property; their annual funds to beneficiaries are equal to about 1.5 p.c of nationwide GDP; and over 11 million beneficiaries depend on these funds to help themselves in retirement. Lately, consideration has targeted on the plans’ massive unfunded liabilities and the necessity to totally fund these obligations. However is full funding the one technique to obtain fiscal sustainability?

This temporary, which is predicated on a current paper, explores an alternate path to the fiscal sustainability of state and native pension plans – specifically, stabilizing their pension debt as a share of the economic system. To evaluate the feasibility of this strategy requires: 1) projecting the annual money flows for a nationally-representative pattern of 40 state and native pension methods to see the long run evolution of every plan below present contribution ranges; and a pair of) estimating the contribution will increase wanted to stabilize the ratio of pension debt to the economic system.

The dialogue proceeds as follows. The primary part supplies background on the fiscal stability of state and native plans. The second part describes the info and methodology. The third part presents the outcomes for when plans will exhaust their property below present funding ranges and profit provisions. A key discovering is that pension advantages, as a share of the economic system, are at the moment close to their peak and can decline considerably over time because of the reforms instituted by many plans. Nonetheless, many plans are in danger over the long run of exhausting their property, so motion shall be wanted. The fourth part presents the outcomes on the choice path, particularly the contribution adjustments required to stabilize pension debt, each in the long term and to get the ratio on the finish of 30 years again to at the moment’s degree.

The ultimate part concludes that america isn’t going through a state and native pension disaster however, over the long term, a big share of plans face the danger of insolvency. Therefore, they would wish to extend contributions to attain sustainability. However the required changes to stabilize debt relative to the economic system are typically reasonable in measurement and, in all circumstances, considerably decrease than the changes required below the standard full prefunding framework.

Background

Lately, public pension analysts have targeted intensely on the necessity for full prefunding of state and native pensions. The strategy would allow a plan to close down at any time and pay full advantages with out further contributions. This emphasis on full funding is a comparatively new growth. As lately as 2008, many analysts thought of a funding ratio of 80 p.c to be sound apply for state and native plans. However lecturers and policymakers have embraced the total funding aim with gusto.

In tutorial work, some researchers explicitly state that full prefunding is the right aim for plans, whereas others make the argument implicitly by focusing evaluation on the fiscal prices of transitioning to full funding. With regard to policymakers, CalPERS, the nation’s largest state and native pension plan, explicitly advocates for full funding, stating that the “splendid degree” of prefunding is one hundred pc. Alongside comparable strains, a blue ribbon panel commissioned by the Society of Actuaries “wholeheartedly believes that…plans must be pre-funded.” Lastly, rankings companies sometimes view “underfunding of pension…advantages as [a] key credit score challenge.”

But, full prefunding isn’t the one technique to make a pension system sustainable.

Different papers deal with the prices of not prefunding: uneven data between authorities workers and different voters over the price of pensions might enable authorities staff to accrue rents within the absence of prefunding (Bagchi 2019 and Glaeser and Ponzetto 2014); and unfunded pensions might decrease the capital inventory (Feldstein 1974). Lastly, Lucas (2017) supplies a radical dialogue of each the uncertainty surrounding optimum funding ranges for state and native pensions, in addition to arguments for and in opposition to full funding. Certainly, even an unfunded pay-as-you-go program with a devoted revenue stream – comparable to Social Safety – can honor obligations with out recourse to further funding so long as the inner price of return paid to beneficiaries doesn’t exceed the expansion price of the wage base. After all, pay-as-you-go packages can face shortfalls if demographic adjustments improve the expansion in outlays or decrease the expansion of revenues. Nevertheless, mature, partially funded methods, comparable to state and native pension plans, which have accrued property to supply a buffer, can stay sustainable even within the face of adversarial shocks.

Extra broadly, unfunded pension liabilities are merely a type of authorities debt. Such public debt could be sustainable so long as the federal government makes applicable service funds on it. The requirement for holding pension debt secure relative to the economic system relies on the connection between the expansion price of the economic system (g) and the rate of interest (r). If r = g, then the required annual contribution to the pension fund is just the traditional value – the price of advantages accrued in a given yr. When the speed of curiosity is larger than the expansion price of the economic system, r > g, contributions must be adequate to cowl the traditional value and debt service prices. If r < g, then debt could be held fixed as a share of the economic system with contributions lower than the traditional value. Whereas the required contribution price relies on the assumed relationship between r and g, the important thing level is that sustainability doesn’t require full funding – stabilizing pension debt as a share of the economic system ought to enable the federal government to fulfill all its pension obligations with out crowding out different public companies.

Furthermore, transitioning to full funding includes generational transfers – with present generations paying larger taxes/having decrease advantages to be able to scale back taxes/increase advantages on future generations. Stabilizing the extent of funding is a method of equalizing burdens throughout generations.

Information and Methodology

The idea for the evaluation is projecting the long run circulation of advantages for state and native pension plans. The principal supply for these calculations is the Public Plans Database (PPD) maintained by the Middle for Retirement Analysis at Boston Faculty. The PPD comprises plan-level information accounting for 95 p.c of state and native plan membership and property in america. This evaluation makes use of a pattern of 40 plans, which incorporates the most important 20 public pension plans and an extra 20 chosen in order that the pattern matches the nationwide PPD pattern by way of funding, budgetary, and demographic traits.

For the person state and native plans within the pattern, further data comes from the plan’s actuarial valuations and the state’s Complete Annual Monetary Studies for FY 2017.

Annual pension advantages are sometimes equal to the years of service multiplied by closing common wage occasions the profit issue. Thus, the profit issue is the share of ultimate wage to which a pension beneficiary is entitled for annually of service. Usually, the typical wage from the very best three to 5 years is used to find out the ultimate wage.

The methodology could be divided into three levels. The primary stage includes estimating the long run circulation of profit funds to present beneficiaries and staff. This course of requires utilizing mortality tables to age the preliminary distribution of present beneficiaries annually and details about their pension advantages by age to calculate annual profit funds. For present staff, the method includes growing old the workforce annually (incrementing years of service and age) and utilizing the possibilities of retirement, incapacity, loss of life, and quits or termination by age and years of service to create a matrix of recent beneficiaries by yr. Info on pension eligibility, profit formulation, and financial assumptions is then used to calculate the pension obligations for these new beneficiaries by yr. Projections are checked in opposition to the liabilities reported within the related actuarial valuations. Then, the money flows are re-estimated utilizing constant financial assumptions – nominal wage development of three.4 p.c and CPI inflation of two.2 p.c. Though these procedures are conceptually fairly simple, the precise implementation could be very complicated.

The second stage includes projecting plan membership development to estimate advantages for future staff. New hires in annually are set equal to the earlier yr’s head depend multiplied by the sum of the projected development price within the authorities’s workforce and the proportion of withdrawals and retirements from the workforce within the earlier yr. Projected workforce development retains fixed the ratio of the federal government workforce to the working-age inhabitants. An extra assumption is that the age distribution and relative salaries of recent hires match the distribution of present workers with fewer than 5 years of service. Every group of recent hires then produces a brand new stream of advantages beginning at every future yr, with the worth of these future advantages calculated in precisely the identical method as they have been for the present energetic staff however adjusting for adjustments to plan provisions instituted for brand new hires.

The ultimate stage requires pairing the profit money circulation projections with data on asset ranges and assumed future returns to evaluate the fiscal outlook for every plan. For plan property, the start line is PPD information for FY 2017, however asset values modified considerably between FY 2017 and FY 2021, so the values are up to date for our evaluation.

Since then, after we accomplished the research on which this temporary is predicated, combination plan property have fallen about 20 p.c, which aligns with the roughly 20-percent drop in equities over the identical interval. Decrease asset ranges make acheiving any funding aim (e.g. full prefunding or stabilizing pension debt as a share of the economic system) more durable.

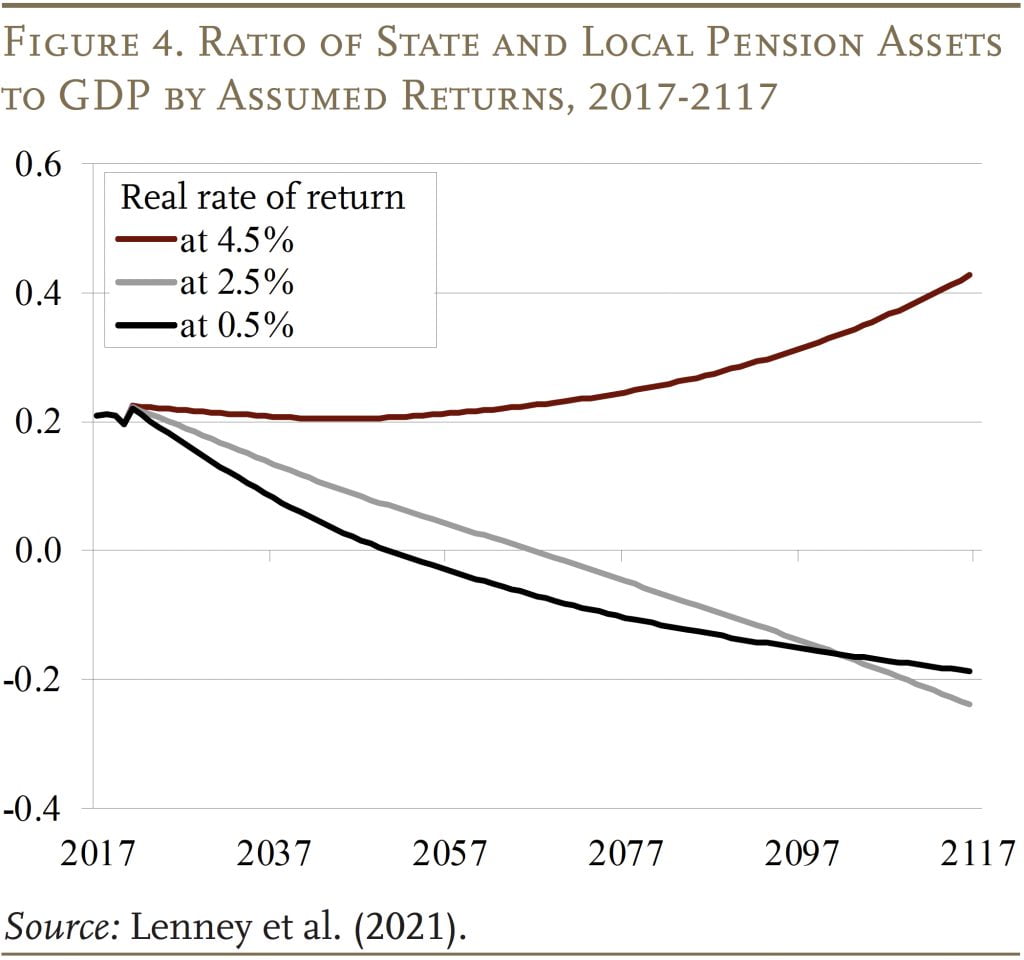

To calculate future asset ranges, the evaluation assumes three various actual charges of return.

- The bottom – 0.5 p.c – is roughly equal to the longer-run risk-free price lately, as mirrored by the yield on the zero-coupon 20-year Treasury Inflation Projected Securities.

- The intermediate assumption – 2.5 p.c – is equal to the return on a combined portfolio containing 60 p.c risk-free property and 40 p.c equities.

- The very best – 4.5 p.c – displays the anticipated return on a pension portfolio comprised of 20 p.c risk-free property and 80 p.c equities.

An necessary challenge is whether or not funding returns on pension property ought to be risk-adjusted in authorities finances projections. Such an adjustment would stop plans from showing more healthy just because they put money into riskier property. This challenge is tough and contentious. The Congressional Funds Workplace, for instance, makes use of a risk-free price of return for packages like scholar loans in its “Honest Worth” strategy, however makes use of anticipated returns in its finances accounting.

In all circumstances, plan liabilities on this evaluation are calculated by discounting promised advantages by the 0.5-percent actual risk-free price. This strategy incorporates the belief that pension obligations shall be paid out in full in almost all future states of the world. This assumption is unlikely to be strictly true, which makes it conservative. In any case, the outcomes should not very delicate to the chosen low cost price as a result of the main focus is the soundness of pension debt fairly than its degree. In distinction, workout routines that calculate what’s required for plans to be totally funded are very delicate to the assumed low cost price on liabilities.

Outcomes: Outlook with Present Contributions

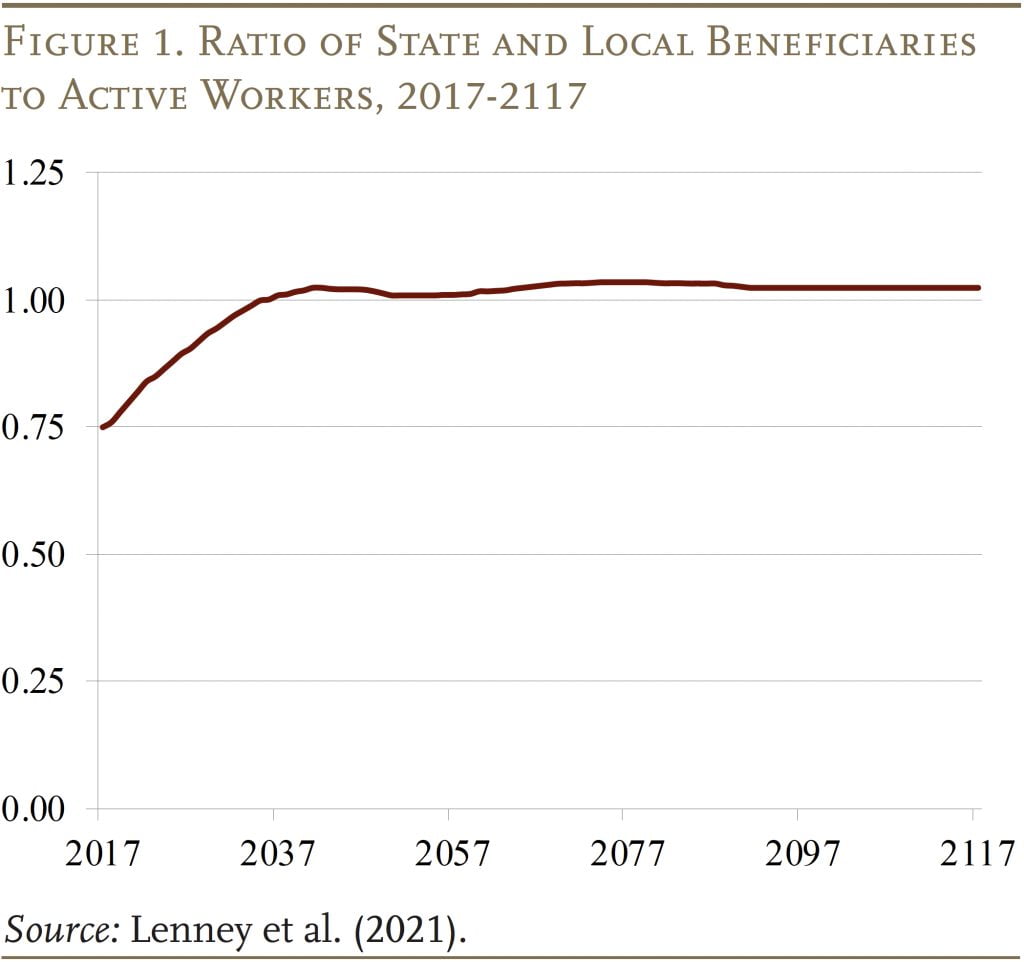

The projections produced 4 main findings. The primary is that the ratio of beneficiaries to staff in state and native governments is projected to extend about 36 p.c from 2017 to 2040 after which roughly stabilize (see Determine 1). This discovering is per projections by the Social Safety actuaries, which present that the ratio of Social Safety beneficiaries to staff is projected to rise about 39 p.c over this time interval. This similarity gives some help that the long run circulation of state and native authorities workers has been appropriately modeled.

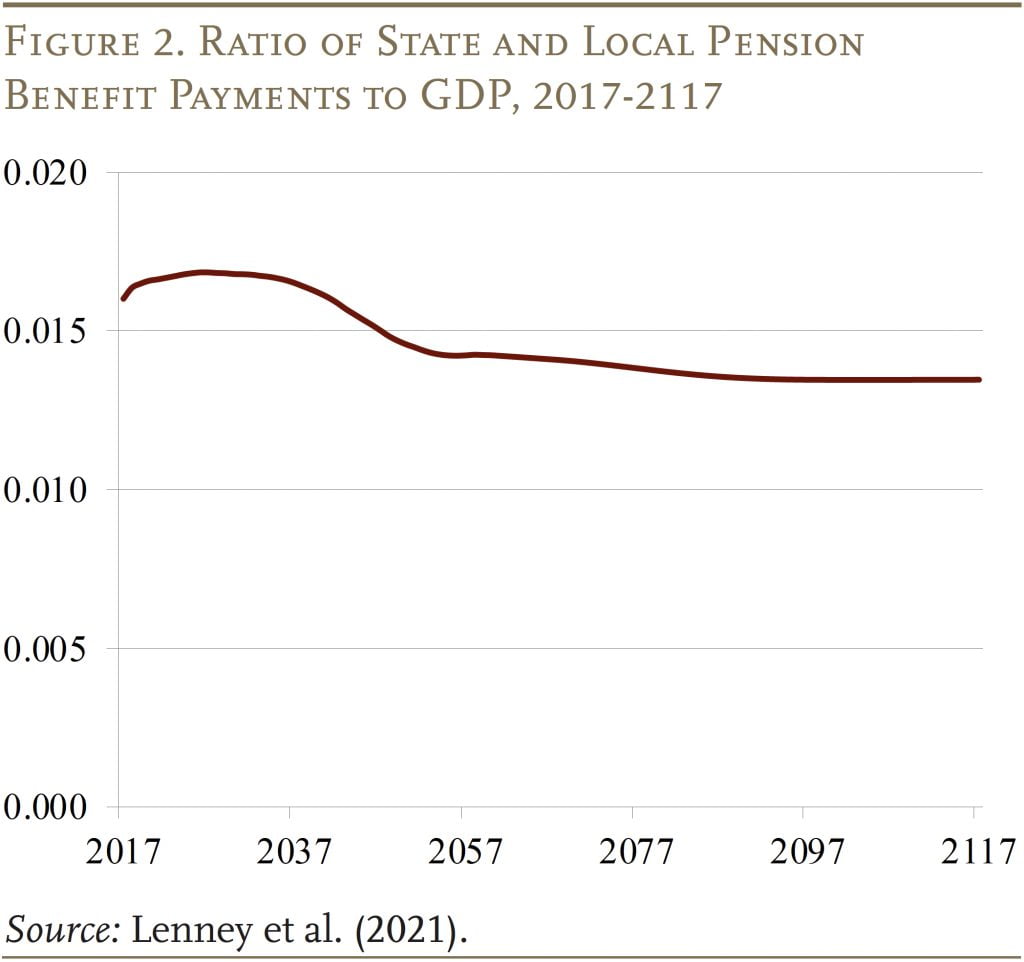

The second discovering is that, regardless of the rising ratio of beneficiaries to staff, annual profit funds as a share of the economic system is already close to its peak (see Determine 2). This stunning consequence could be attributed to 2 components. First, most pension plans don’t totally index their retiree advantages for inflation, which lowers the true worth of common advantages over time. Second, pension plans have steadily been making adjustments to decrease advantages and lift retirement ages for brand new hires. The diminished development in common advantages because of the COLA restraints and new rent reforms offsets a big share of the results of the 36-percent development within the ratio of beneficiaries to staff.

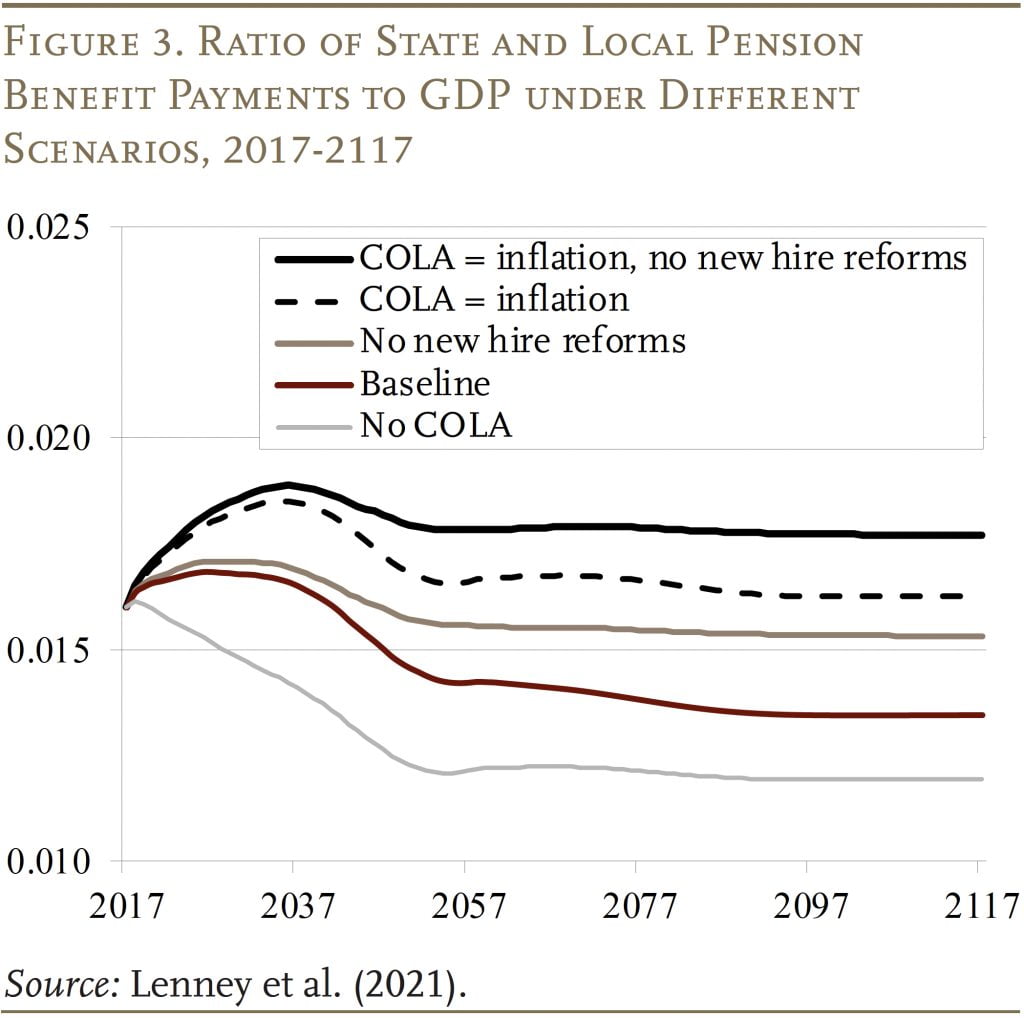

To drive the purpose dwelling relating to the discrepancy between the sample for beneficiaries/staff and advantages/GDP, Determine 3 paperwork the affect of fixing assumptions about COLAs and new rent reforms. The highest line, which assumes a full COLA and no profit reductions for brand new hires, exhibits the identical rising sample evident within the ratio of beneficiaries to staff. Subsequent strains present the affect of incorporating the brand new rent reforms into the projections.

The truth that pension advantages as a share of payroll are, in combination, close to their highest degree anticipated over the subsequent few many years is a vital discovering for understanding the sustainability of state and native funds and the power of plans to easy via this era.

The third discovering on this present coverage evaluation pertains to the paths for property, relative to the economic system, below the three asset return assumptions (see Determine 4). Summing throughout the plans, with the 0.5-percent actual price of return, present contributions are inadequate to maintain the plans solvent. Regardless of the projected decline in advantages relative to GDP, property relative to GDP start declining instantly and are exhausted in about 30 years. With a 2.5-percent price of return, property are declining, however not as rapidly; they’re exhausted in 47 years. In distinction, if plans earn 4.5 p.c on their property, they’re sustainable: at present contribution charges, property rise indefinitely and the plans face no fiscal stress.

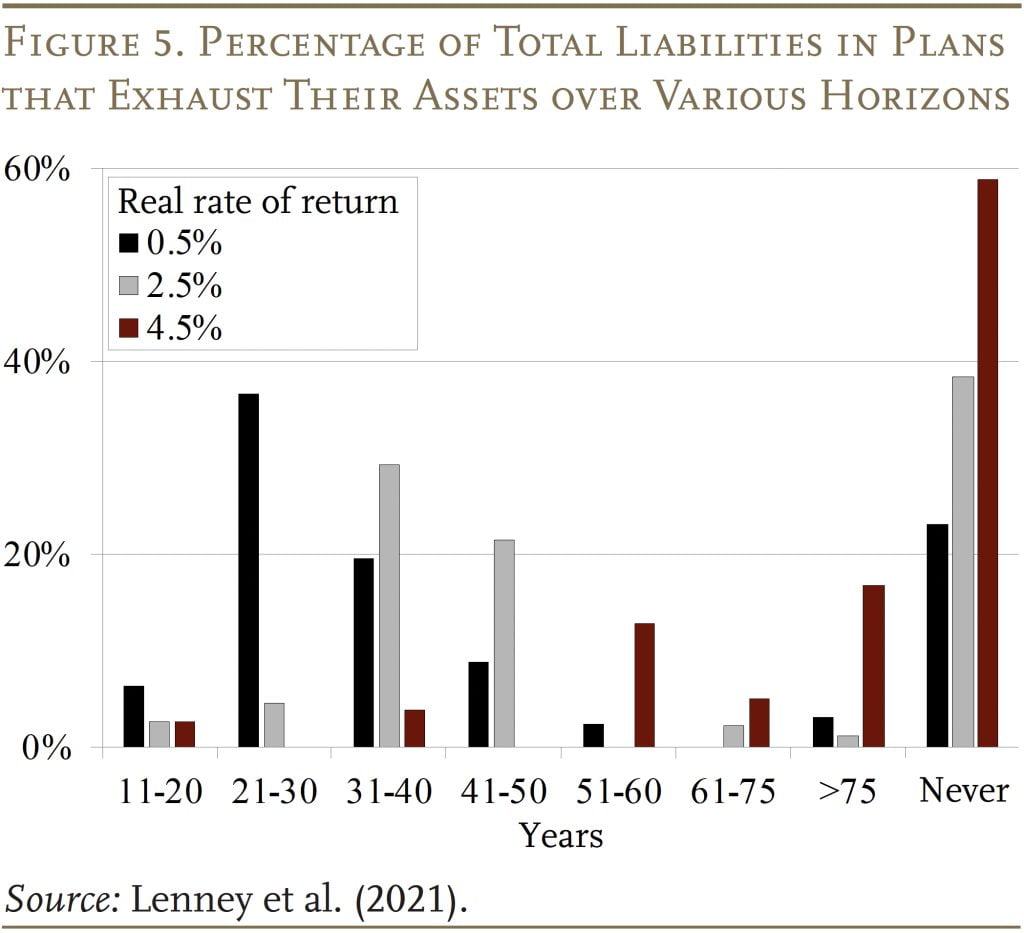

After all, trying on the exhaustion of pension property for the system as a complete masks loads of variation throughout plans. Determine 5 exhibits the share of liabilities in plans that exhaust inside varied time intervals. With a 0.5-percent actual price of return, about 6 p.c of liabilities are in plans that exhaust inside 20 years and 43 p.c are in plans that exhaust inside 30 years; even at this low price of return, 23 p.c of liabilities are in plans that by no means exhaust. At a 2.5-percent actual return, solely 7 p.c of liabilities are in plans that exhaust inside the subsequent 30 years, and 38 p.c are in plans that by no means exhaust. With a 4.5-percent actual return, virtually 60 p.c of liabilities are in plans that by no means exhaust, whereas the opposite plans do exhaust, however principally not for a lot of many years.

The message from these workout routines is that almost all of plans don’t face an imminent disaster within the sense that they’re more likely to exhaust their property inside the subsequent 20 years. However a sizeable share may exhaust their property inside 30 years below the low-return situation. And even below the high-return situation, greater than 40 p.c are vulnerable to depleting their property over longer time horizons. Thus, changes shall be obligatory. The questions are: How massive are these changes? and How pressing are they?

Outcomes: Pension Debt Stabilization

This evaluation includes estimating the adjustments in pension contributions required to stabilize pension debt relative to GDP. The primary train asks what everlasting adjustments within the contribution price would make pension debt finally stabilize as a share of GDP. As a result of very long-run projections are inherently unsure, the second train asks what everlasting adjustments in contributions would get debt as a share of GDP again to at the moment’s degree in 30 years.

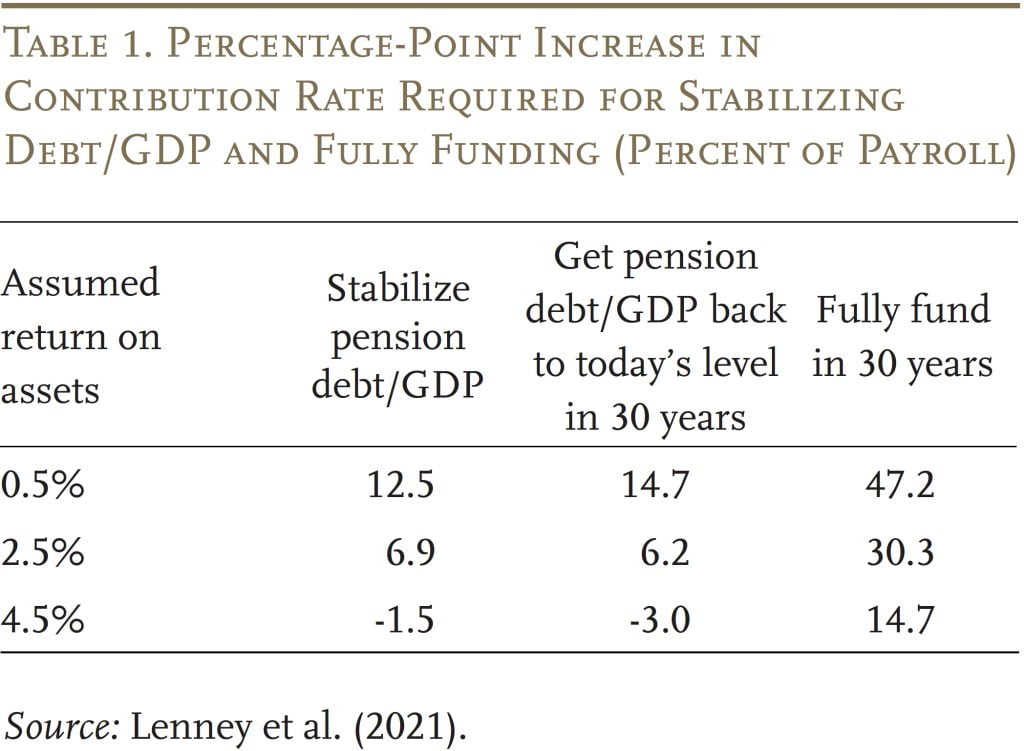

The outcomes of the simulations are proven in Desk 1. The required improve within the contribution price to stabilize the debt-to-GDP ratio is 12.5 proportion factors when property yield 0.5 p.c; 6.9 proportion factors with a return of two.5 p.c; and contributions might be minimize with a return of 4.5 p.c. The numbers look very comparable with a aim of getting the debt/GDP ratio again to at the moment’s degree in 30 years. To place these contribution adjustments into context, combination pension contributions elevated by 10 proportion factors between 2009 and 2019. The ultimate column exhibits that the required percentage-point improve in contribution charges to totally fund these plans can be 4 or 5 occasions bigger. After all, taking a look at outcomes for the complete state and native pension system hides substantial variation amongst plans (see Appendix).

The evaluation additionally produces some stunning outcomes. First, performing sooner fairly than later lowers the required improve, however not by a lot. For instance, assuming property earn an actual price of return of two.5 p.c, even when the plans do nothing for 30 years, the required improve solely rises from 6.9 p.c to eight.6 p.c of payroll. When charges of return are assumed to be very low – particularly, lower than the expansion price of the economic system – the contributions required to stabilize the debt are, after all, larger. However, strikingly, below this situation, it’s also true that performing sooner fairly than later doesn’t assist. The instinct right here is that when rates of interest are lower than the expansion price of the economic system, authorities debt has no fiscal prices.

The second stunning discovering is that the poorly funded plans should not those that must make the best contributions to stabilize. The reason being that these poorly funded plans have elevated their contribution charges considerably, made the most important cuts to advantages for brand new hires, and diminished their COLAs. Plans that made the most important adjustments in contributions since 2007 and the largest reforms to their advantages are at the moment contributing greater than sufficient to stabilize their debt, even at a 0.5-percent price of return in lots of circumstances.

Conclusion

This temporary began by exploring the fiscal outlook for state and native authorities pension plans below present profit and funding insurance policies. The projections present no signal of a large pension disaster within the subsequent 20 years. Actually, regardless of the projected improve within the ratio of beneficiaries to staff, profit funds as a share of the economic system are at the moment close to their peak and can finally decline considerably. In consequence, these plans could be placed on a sustainable footing – by stabilizing the ratio of pension debt to the economic system – with contribution price will increase roughly equal to these adopted during the last 20 years.

Shifting the main focus to reaching sustainability by sustaining a secure debt-to-GDP ratio from the extra typical emphasis on full prefunding deserves severe consideration. In an effort to prefund, state and native governments have elevated their pension contributions dramatically over the previous 20 years. These elevated contributions come at a big alternative value. Regardless of the lengthy financial enlargement that preceded the temporary COVID recession, provision of public items supplied by state and native governments remained depressed: actual per capita spending on infrastructure stood at about 25 p.c under its earlier peak, and state and native authorities employment per capita additionally remained effectively under its earlier peak. Notably, a lot of this relative decline in state and native authorities employment occurred within the Ok-12 and better training sectors.

The analysis summarized on this temporary is definitely not the final phrase on the subject. Certainly, different researchers have critiqued varied features of the evaluation. However, persevering with with established order or more and more stringent full-funding insurance policies additionally has prices. So, hopefully the fundamental concept introduced here’s a first step in direction of constructing a extra sustainable framework for managing state and native pension plan liabilities.

References

Aubry, Jean-Pierre and Caroline V. Crawford. 2017. “State and Native Pension Reform for the reason that Monetary Disaster.” State and Native Plans Subject in Temporary 54. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Bagchi, Sutirtha. 2019. “The Results of Political Competitors on the Generosity of Public-Sector Pension Plans.” Journal of Financial Habits and Group 164: 439-468.

Blanchard, Olivier. 2019. “Public Debt and Low Curiosity Charges.” American Financial Overview 109(4): 1197-229.

Bohn, Henning. 2011. “Ought to Public Retirement Plans Be Totally Funded?” Journal of Pension Economics and Finance 10(2): 195-219.

Boyd, Donald J. and Yimeng Yin. 2016. “Public Pension Funding Practices.” Albany, NY: Nelson A. Rockefeller Institute of Authorities.

California Public Staff’ Retirement System. 2014. Annual Overview of Funding Ranges and Dangers, 2014. Sacramento, CA.

Costrell, Robert M. and Josh McGee. 2020. “Sins of the Previous, Current, and Future: Different Pension Funding Insurance policies.” Paper ready for the Municipal Finance Convention (July 13-14). Washington, DC: Brookings Establishment, Hutchins Middle on Fiscal and Financial Coverage.

D’Arcy, Stephen P., James H. Dulebohn, and Pyungsuk Oh. 1999. “Optimum Funding of State Worker Pension Techniques.” Journal of Threat and Insurance coverage 66(3): 345-380.

Feldstein, Martin. 1974. “Social Safety, Induced Retirement, and Combination Capital Accumulation.” Journal of Political Economic system 82(5): 905-926.

Glaeser, Edward L. and Giacomo A. M. Ponzetto. 2014. “Shrouded Prices of Authorities: The Political Economic system of State and Native Public Pensions.” Journal of Public Economics 116: 89-105.

Lenney, Jamie, Byron Lutz, Finn Schüle, and Louise Sheiner. 2021. “The Sustainability of State and Native Pensions: A Public Finance Strategy.” Brookings Papers on Financial Exercise (Spring): 1-48.

Lucas, Deborah J. 2017. “In the direction of Honest Worth Accounting for Public Pensions: The Case for Delinking Disclosure and Funding Necessities.” Ready for Gathering Storm: The Dangers of State Pension Underfunding Convention (October 19-20). Cambridge, MA: Harvard Kennedy College. Citations are to an unpublished 2020 model.

Lucas, Deborah. 2021. “Feedback and Normal Dialogue of ‘The Sustainability of State and Native Pensions: A Public Finance Strategy.’” Brookings Papers on Financial Exercise (Spring): 49-57.

Novy-Marx, Robert and Joshua D. Rauh. 2014. “Linking Advantages to Funding Efficiency in US Public Pension Techniques.” Journal of Public Economics 116:47–61.

Public Plans Database. 2001-2021. Middle for Retirement Analysis at Boston Faculty, MissionSquare Analysis Institute, Nationwide Affiliation of State Retirement Directors, and Authorities Finance Officers Affiliation.

Rauh, Joshua. 2021. “Feedback and Normal Dialogue of ‘The Sustainability of State and Native Pensions: A Public Finance Strategy.’” Brookings Papers on Financial Exercise (Spring): 57-63.

Samuelson, Paul A. 1958. “An Actual Consumption-Mortgage Mannequin of Curiosity with or with out the Social Contrivance of Cash.” Journal of Political Economic system 66(6): 467-482.

Sheiner, Louise. 2021. “What Debt Disaster? Time to Cease Worrying and Spend What’s Wanted to Repair the Economic system.” Milken Institute Overview. Obtainable at:

Society of Actuaries. 2014. Blue Ribbon Panel on Public Pension Plan Funding. Schaumberg, IL.

S&P World Scores. 2019. “U.S. Public Finance 2018 Yr in Overview.” New York, NY.

U.S. Authorities Accountability Workplace (GAO). 2008. State and Native Authorities Retiree Advantages: Present Funded Standing of Pension and Well being Advantages. Washington, DC.

U.S. Social Safety Administration. 2020. The Annual Studies of the Board of Trustees of the Federal Previous-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds.Washington, DC: U.S. Authorities Printing Workplace.

Appendix

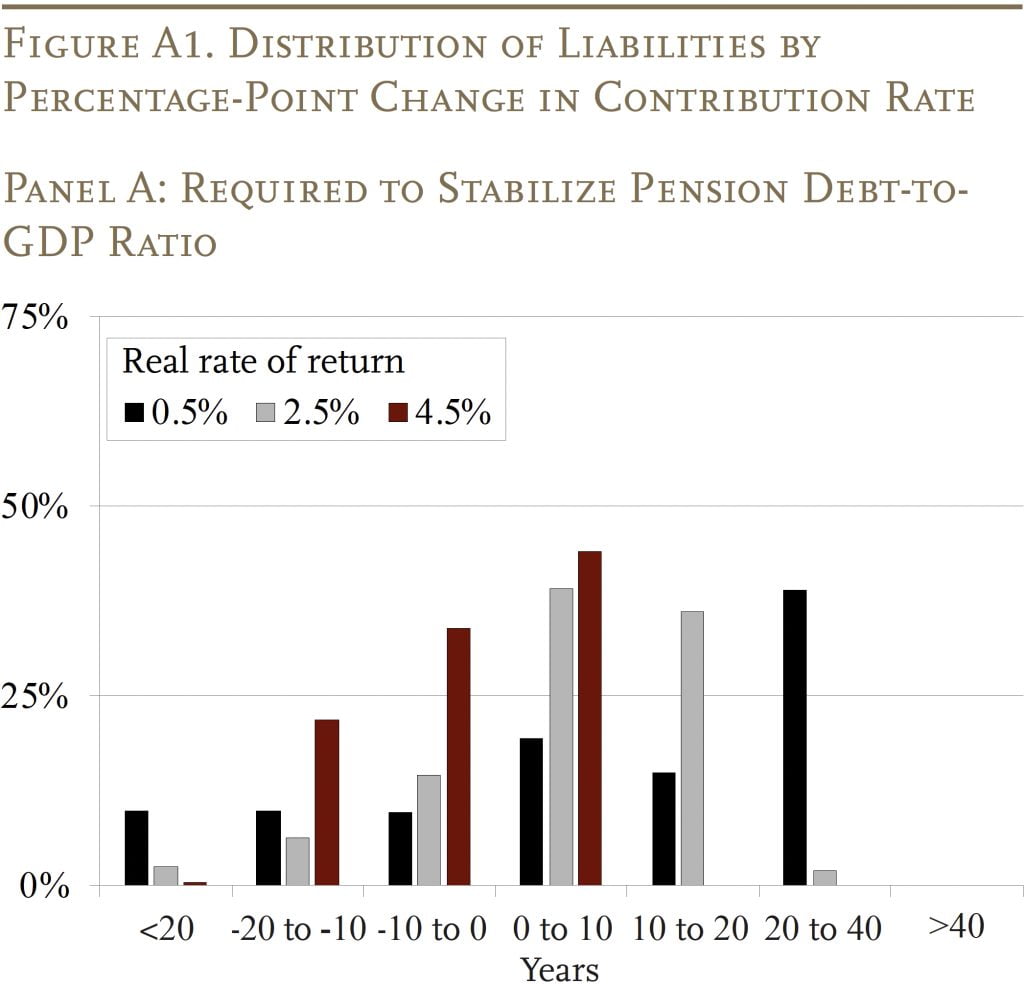

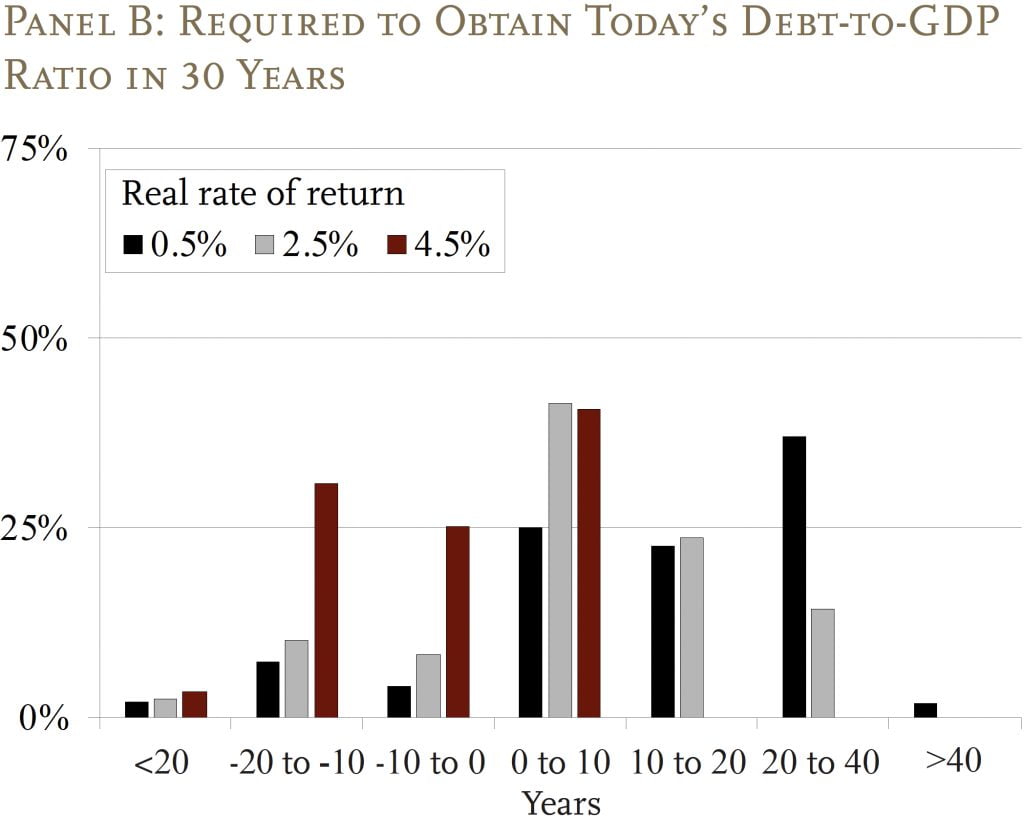

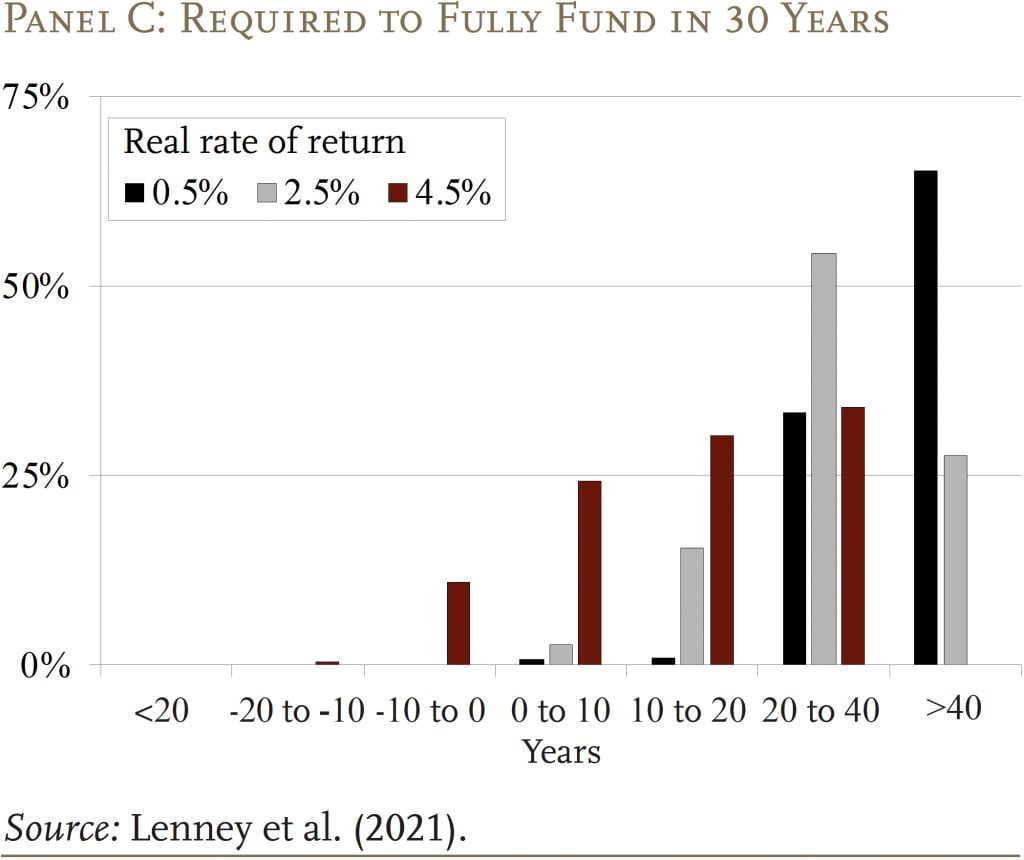

The required improve in contribution charges to totally fund state and native plans varies considerably amongst plans. Panel A of Determine A1 exhibits the distribution of required changes for plans to stabilize the debt over the long term beginning instantly. For instance, on the 2.5-percent price of return, solely 2 p.c of liabilities are in plans that want to extend funding by greater than 20 p.c of payroll, and fewer than 40 p.c of liabilities are in plans the place the contribution improve is greater than 10 p.c of payroll. At a 0.5-percent return, nevertheless, 39 p.c want to extend contributions by greater than 20 p.c of payroll. Panel B exhibits the adjustments required to acquire at the moment’s debt-to-GDP ratio in 30 years, and the outcomes look fairly comparable.

Lastly, Panel C, which presents the distribution of required contribution adjustments to totally fund the plans, exhibits many of the liabilities are in plans that require a minimum of a 20-percentage-point improve within the price, and even when plans earn 4.5 p.c on their property, they should make a considerable improve of their contribution charges.

[ad_2]