[ad_1]

Have we turn into extra involved about limiting participation than defending the susceptible?

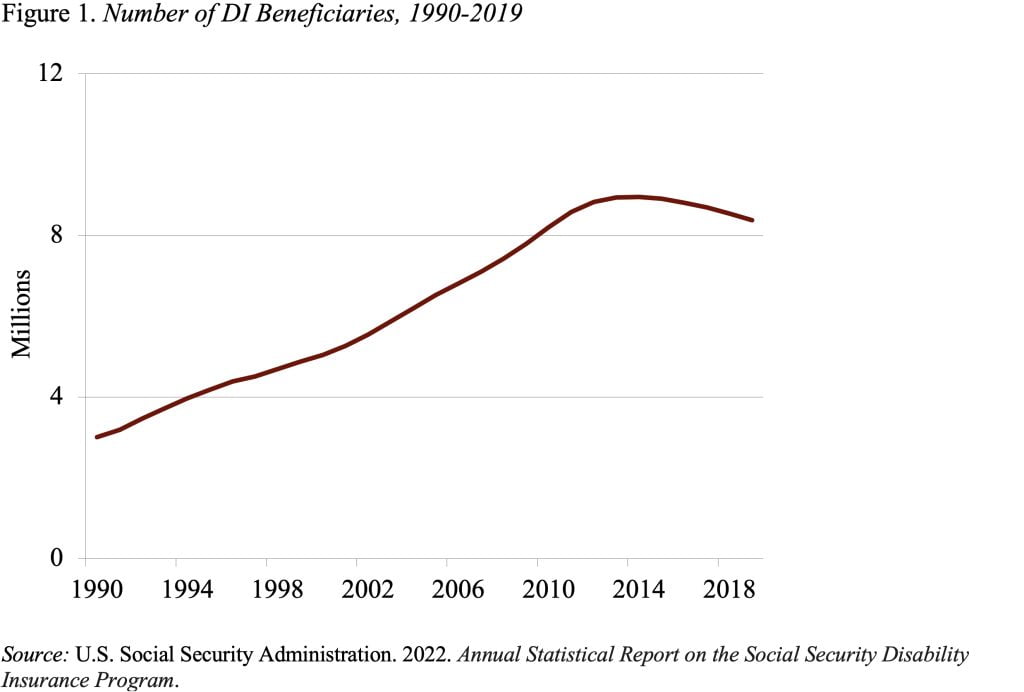

In 2015, the variety of people receiving Social Safety Incapacity Insurance coverage (DI) advantages started to drop, reversing an upward pattern that had continued for twenty years (see Determine 1). My colleagues explored why.

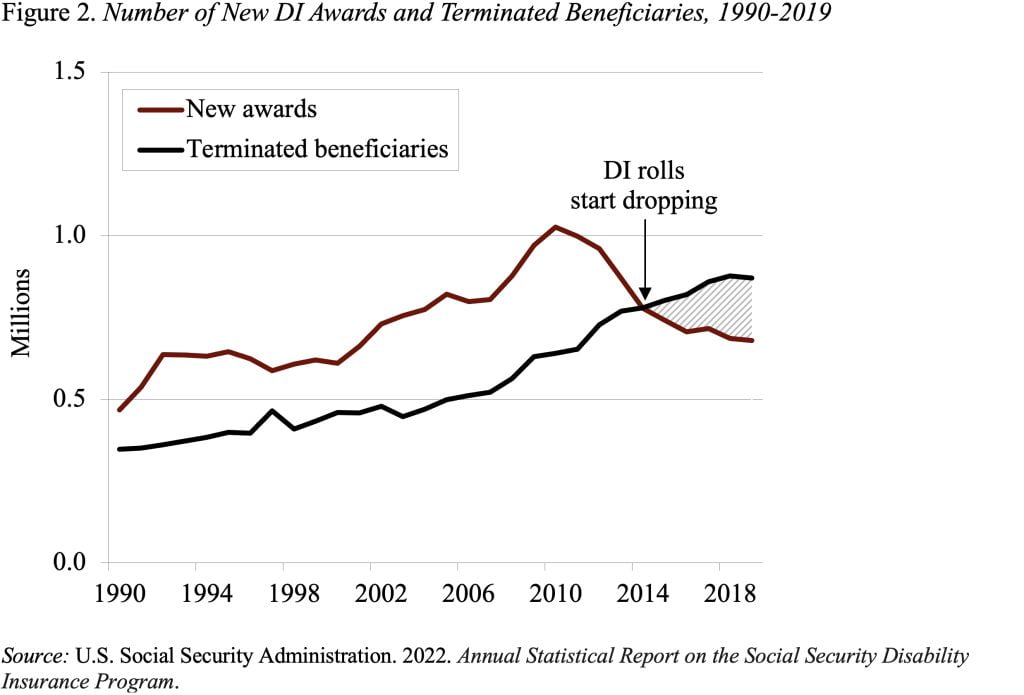

They began by whether or not the drop is because of extra folks leaving or fewer folks approaching the rolls. In reality, the variety of folks leaving the rolls – growing old into Social Safety’s retirement program – has been growing steadily for many years (see Determine 2). However the variety of new DI awards was additionally growing, so extra folks have been approaching than going off. Then in 2010 new DI awards began to drop, and by 2015 new awards lastly fell beneath terminations so the DI rolls started to drop.

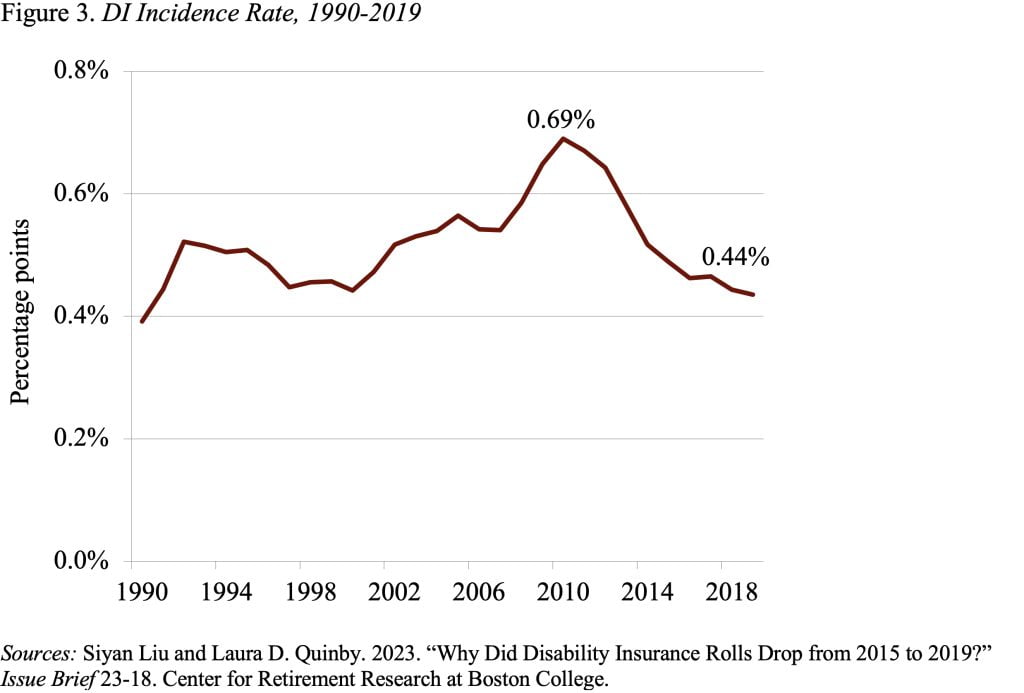

So, the true query is why the DI incidence fee – new awards as a share of lined employees – dropped (see Determine 3). Three elements might be taking part in a task:

- Inhabitants growing old could have decreased the variety of DI purposes as employees as an alternative claimed their retirement advantages.

- A powerful economic system following the Nice Recession made DI much less engaging to potential candidates with some means to work.

- Coverage adjustments on the Social Safety Administration – notably, subject workplace closures and retraining of Administrative Legislation Judges (ALJs) to scale back the speed of advantages awarded on attraction – elevated the problem of making use of and decreased the share of candidates who have been accepted.

To type out the relative significance of every issue, the authors multiplied the extent change in every issue of curiosity (such because the unemployment fee or variety of subject places of work) by its impression on awards. Particularly, for inhabitants growing old, they calculated age-specific incidence charges to assemble a counterfactual incidence fee if all of the elements, besides growing old, had remained at their 2010 ranges. For the impression of a robust economic system, they used regression evaluation based mostly on state knowledge over time to estimate how a 1-percentage-point change within the unemployment fee impacts the DI software fee. For coverage adjustments, they took estimates from the tutorial literature for the impression of closing subject places of work and assumed that any remaining distinction between the precise incidence fee and the counterfactual incidence fee was the impact of ALJ retraining.

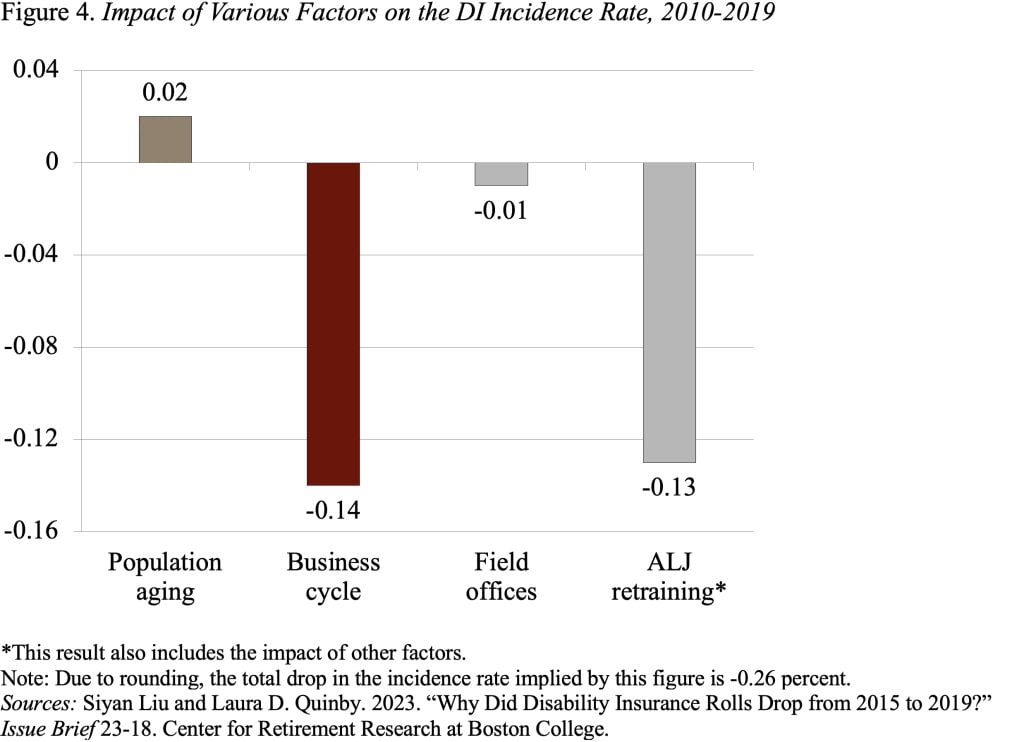

Determine 4 exhibits how a lot of the 0.25-percentage-point drop within the incidence fee is attributable to every issue. The gold bar exhibits that, between 2010 and 2019, inhabitants growing old would have elevated the incidence fee by 0.02 share factors if all the opposite elements had stayed fixed. The purple bar exhibits the impression of the enterprise cycle, which decreased the incidence fee by 0.14 share factors. The primary grey bar incorporates subject workplace closures, lowering the speed by a slight 0.01 share factors. Lastly, ALJ retraining is estimated to have decreased the incidence fee by 0.13 share factors. Finally, the enterprise cycle and a stricter course of for awarding advantages on attraction emerge as the 2 most necessary elements driving down the incidence fee lately.

These findings do elevate the query whether or not, with the funds of DI now on a robust trajectory, the time could have come to rebalance the objectives of DI away from defending this system and extra to defending susceptible folks.

[ad_2]