[ad_1]

As those that observe, my Twitter account shall be conscious, I used to be concerned in a spat with Warren Mosler and people who observe his concepts on fashionable financial concept over the weekend.

The dispute was on the function of tax inside MMT, and as Warren Mosler, Invoice Mitchell, Randy Wray, Stephanie Kelton and others know, that is at all times been a difficulty of concern with MMT for me, at the very least as most (however not all) of them focus on it. The truth that Warren Mosler nonetheless presents arguments with regard to tax, that are, for my part, deeply harmful to the financial causes that I believe most of those that are drawn to MMT would want to promote troubles me.

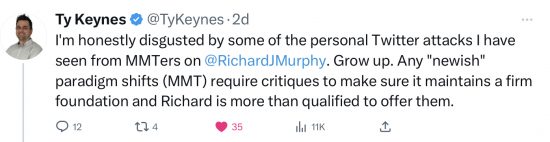

I used to be not alone in caring concerning the tone of the exchanges. Fairly numerous folks, together with lecturers and well-known podcasters, questioned my proper to disagree with Warren Mosler as if as a result of he had spoken an financial fact that was inviolable had been revealed and I had no proper to query it. As Ty Keynes, who works with Steve Keens, needed to say on that concern:

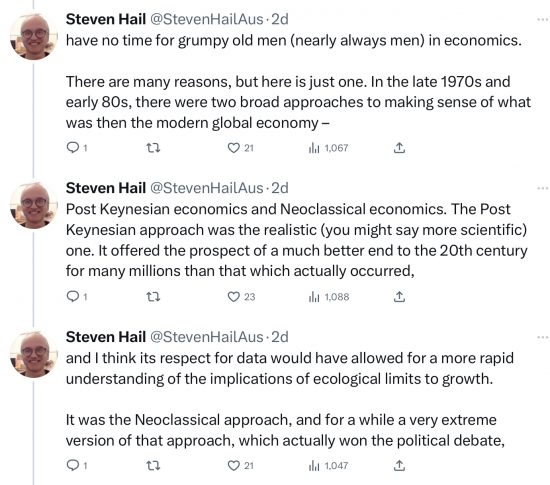

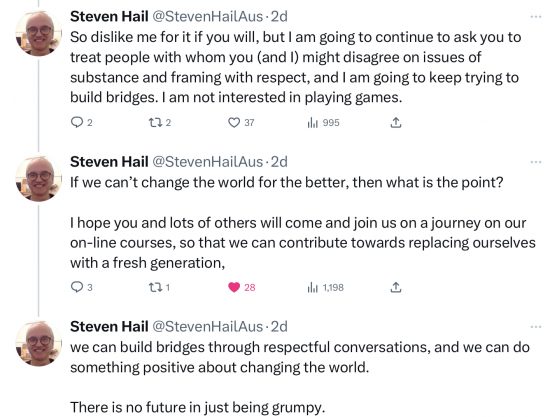

Professor Steven Hail, a famous Australian proponents of MMT who seems to work most carefully with Stephanie Kelton had this to say:

I’m conscious that neither commentator is criticising me. What considerations them and me is the implied suggestion of many these commenting that there could be no challenges to those that first promoted the concepts implicit in MMT. I share Steven’s concern, ably expressed in his Twitter thread, that except MMT could be challenged and due to this fact be developed on account of rigorous debate then it’s neither a self-discipline worthy of research or an utilized methodology worthy of adaptation to actual world eventualities.

I used to be attempting to not work over the weekend and, due to this fact, when challenged by critics to refine my responses did so by reference to papers I had already written. Astonishingly, though I used to be replying to a paper by Warren Mosley, this methodology of response was apparently solely unacceptable to my critics, who instantly claimed that I used to be unable to reply their questions, as if Twitter is the one place the place such discourse can happen.

I wouldn’t have on a regular basis on this planet to handle the problems I raised this week, however will do my finest. I think I’ll accomplish that in three levels. First I plan to submit my glossary clarification of recent financial concept, which has been sitting in draft for a lot too lengthy. In that submit, I count on to distinguish what I believe MMT really says, i.e. what’s concept, and the political financial motion that an understanding of MMT would possibly result in. They don’t seem to be, after all, the identical factor, however they’re continuously confused.

The second submit will focus upon the problems I’ve with Warren Mosler’s paper, which he described as an evidence of MMT. In different phrases, it will likely be able to distinction with the glossary definition that I shall be posting.

Third, I’ll then do a submit highlighting why I believe Warren Mosler is unsuitable, and why we want a significantly better understanding of tax inside MMT, and what that is perhaps. Within the course of I’ll nicely contact upon a few of the different slightly unusual claims that Invoice Mitchell and Warren Mosler, specific, have been accountable for that are, for my part , actual impediments to the acceptance of MMT as the idea for severe tutorial debate.

This debate is required. I’m not going to duck it, even when it makes me unpopular.

[ad_2]