[ad_1]

By the point you learn this, the excitement of what the Fed did and Powell’s presser shall be over… at the very least for the day.

We won’t repeat the plain.

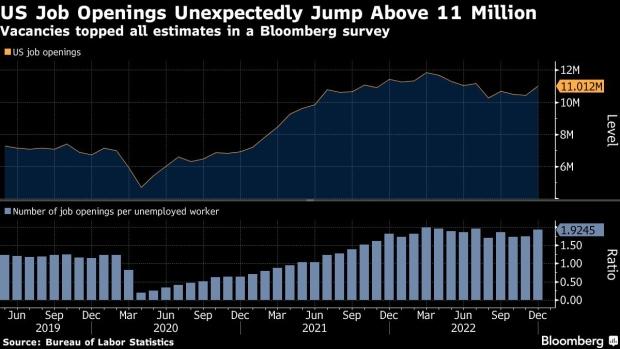

What we’re far more centered on is the underlying causes that the Fed, except they’re keen to goose charges to over 8%, could have little affect on the upcoming Commodities super-cycle and the uniquely undefinable labor market, which is already resulting in demand for increased wages and employers being compelled to maintain the workers they have already got. In different phrases, one more indication of the continued robustness of the labor market and dilemma for the FED.

JOLTS: Ineffective Indicator or Harbinger of Extra Inflation?

The Job Openings and Labor Turnover Survey (JOLTS) program produces knowledge on job openings, hires, and separations.

Right here is the half we discover most fascinating and most tough for the Central Financial institution to reconcile. The most important improve in job openings is within the companies area-hotels and eating places. 1.74 million positions have been posted. Plus, within the UK and in France, employees are placing. They don’t wish to work for pay raises of three% when inflation is at 10%. Then add that many corporations are posting large earnings and inventory buybacks (though by half of what that has been during the last decade).

How far can folks be pushed?

What the JOLTS report tells us is that, whatever the Fed and ECBs battle in opposition to inflation whereas attempting to not spiral economies into recession, there’s a greater battle. Social upheaval, rising meals costs, wages not maintaining. With JOLTS up, company layoffs proceed. FedEx as the newest instance.

Sounds fairly inflationary, no?

Regardless, we’ll proceed to look at what our market indicators (Huge View) inform us about market breadth. We’re significantly within the greenback (collapsing) and the efficiency of gold (cleared $1950). We even have eager eyes on the ratio between the high-yield bonds and lengthy bonds, now flashing extra of a risk-off situation regardless of the current rally within the indices.

For extra detailed buying and selling details about our blended fashions, instruments and dealer schooling programs, contact Rob Quinn, our Chief Technique Marketing consultant, to study extra.

You do not wish to miss Mish’s 2023 Market Outlook, E-available now!

Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-Guide in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

Mish shares her views on easy methods to method the earnings bulletins of Apple, Amazon, and Alphabet, and offers her technical outlook on how the earnings outcomes might affect the S&P 500 and Nasdaq 100 on this look on CMC Markets.

Take heed to Mish on Chuck Jaffe’s Cash Life, starting across the 27-minute mark.

Kristin and Mish focus on whether or not or not the market has run out of fine information on this look on Cheddar TV.

Harry Melandri and Mish focus on inflation, the Federal Reserve, and all of the sparkplugs that might ignite on Actual Imaginative and prescient.

Jon and Mish focus on how the market (nonetheless rangebound) is relying on a dovish Fed on this look on BNN Bloomberg.

Mish discusses value and what indices should do now on this look on Making Cash with Charles Payne.

On this look on TheStreet.com, Mish and JD Durkin focus on the newest market earnings, knowledge, inflation, the Fed and the place to place your cash.

On this look on CMC Markets, Mish digs into her favorite commodity trades for the week and offers her technical tackle the place the buying and selling alternatives for Gold, oil, copper, silver and sugar are.

- S&P 500 (SPY): Nonetheless in search of the December highs; 410.49 to clear, with goal 420

- Russell 2000 (IWM): 190 now assist and 202 main resistance.

- Dow (DIA): 343.50 resistance and the 6-month calendar vary excessive.

- Nasdaq (QQQ): 300 is now the pivotal space.

- Regional banks (KRE): 64.00 resistance.

- Semiconductors (SMH): Have not written “Sister Semi’s on a tear” for some time now.

- Transportation (IYT): Additionally robust, so these are good signs–234.74 December highs to carry.

- Biotechnology (IBB): A number of timeframes rely, and this has failed the 23-month MA thus far

- Retail (XRT): In case you love the fashionable household, then clearly they level to a contented time except the inverted yield curve troubles them quickly. 69 assist, 72 pivotal.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For almost 20 years, MarketGauge.com has offered monetary data and schooling to 1000’s of people, in addition to to massive monetary establishments and publications similar to Barron’s, Constancy, ILX Techniques, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to observe on Twitter. In 2018, Mish was the winner of the Prime Inventory Decide of the 12 months for RealVision.

Subscribe to Mish’s Market Minute to be notified every time a brand new put up is added to this weblog!

[ad_2]