[ad_1]

Non-public long-term care insurance coverage is unlikely to be a part of the answer.

One of many best health-related dangers dealing with older individuals is the price of intensive long-term care to assist with actions of every day residing similar to bathing, dressing, and consuming or to cope with dementia or different persistent situations.

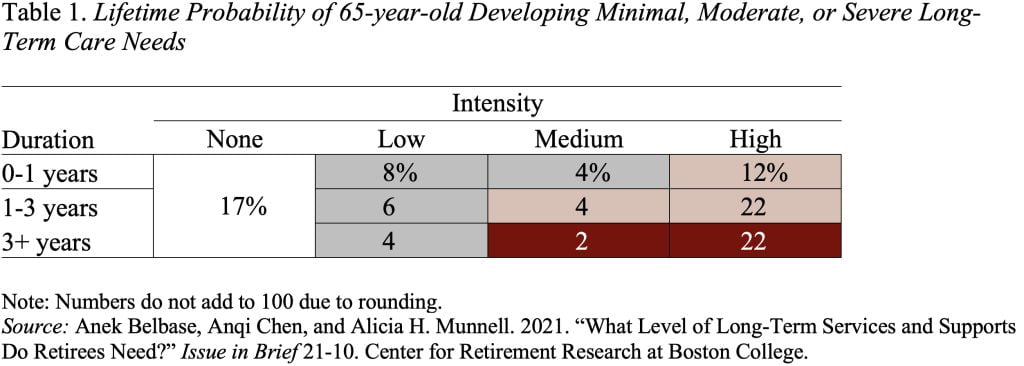

We estimate that roughly one-fifth of 65-year-olds won’t ever require long-term care, whereas about one-quarter can have extreme wants (see white and crimson shading in Desk 1). In between these two extremes, 22 % will expertise minimal wants (grey shading) and 38 % will expertise average wants (pink shading).

For many who want care, the prices might be staggering. Present nationwide estimates put the annual per-person price of nursing residence care at $108,000 and residential well being care at $61,000. Confronted with depleting their property for long-term care – via out-of-pocket bills or spending right down to qualify for Medicaid – some individuals have opted for personal long-term care (LTC) insurance coverage. Certainly, LTC insurance coverage looks as if the suitable product when the chance of maximum want is about 25 % and the prices are terribly excessive.

One downside is that the variety of firms offering LTC insurance coverage has declined dramatically. This decline displays the big losses incurred because of significantly mispricing the product when it was launched within the Nineteen Seventies. The mispricing displays the truth that the product was new and little information had been out there to cost the chance. As well as, shoppers had been assured the flexibility to resume their protection, usually at engaging charges as premium will increase require regulatory approval, making it tough for LTC insurers to regulate their costs rapidly. And at last, the lengthy “tail” related to LTC insurance coverage – premiums paid straight away with claims occurring solely a lot later – meant that precise insured expertise information didn’t develop into out there till a long time after the preliminary rollout.

Prices turned out to be a lot larger than anticipated as a result of firms:

- Overestimated Lapse Charges. A better proportion of policyholders retained their LTC insurance coverage insurance policies (and subsequently made claims) than policyholders of different insurance coverage merchandise, partly as a result of assured renewal characteristic.

- Overestimated Mortality Charges. Extra policyholders reached an older age at which they had been more likely to file LTC insurance coverage claims, and thus extra claims had been initiated than had been anticipated. This consequence mirrored each a basic rise in inhabitants life expectancy and the tendency for many who purchased LTC insurance coverage to stay longer than common.

- Underestimated Morbidity Charges. Extra policyholders used LTC insurance coverage advantages at larger charges than initially projected. Once more, the end result mirrored each larger morbidity charges typically and hostile choice.

On the earnings aspect, curiosity turned out to be considerably decrease than projected by insurers on the time of preliminary providing.

The mix of underestimating prices and overestimating revenues meant that premium charges had been set considerably decrease than had been wanted to maintain insurance policies. Insufficient premiums, in flip, produced substantial monetary losses. These losses prompted insurers to ask regulators to authorize elevated premium charges and, whereas some will increase had been authorised, they had been typically insufficient to unravel the issue.

The affect of the losses on the LTC insurance coverage trade in New York displays the traits nationwide. As of 2021, whereas 38 insurance coverage firms had been servicing present LTC insurance coverage insurance policies bought by New York policyholders, solely 5 provided new LTC insurance coverage merchandise. The variety of LTC insurance coverage insurance policies in New York steadily declined from a peak of roughly 754,000 insurance policies in 2002 to solely 394,000 in 2020.

The underside line is that personal LTC insurance coverage is unlikely to play a big position in ameliorating the dangers related to long-term care.

On the availability aspect, as famous above, solely a handful of firms present the product. On the demand aspect, an intensive literature has documented quite a few the explanation why individuals didn’t purchase the underpriced LTC insurance coverage product when out there. Actually, they might be even much less inclined to purchase an appropriately-priced product.

[ad_2]