[ad_1]

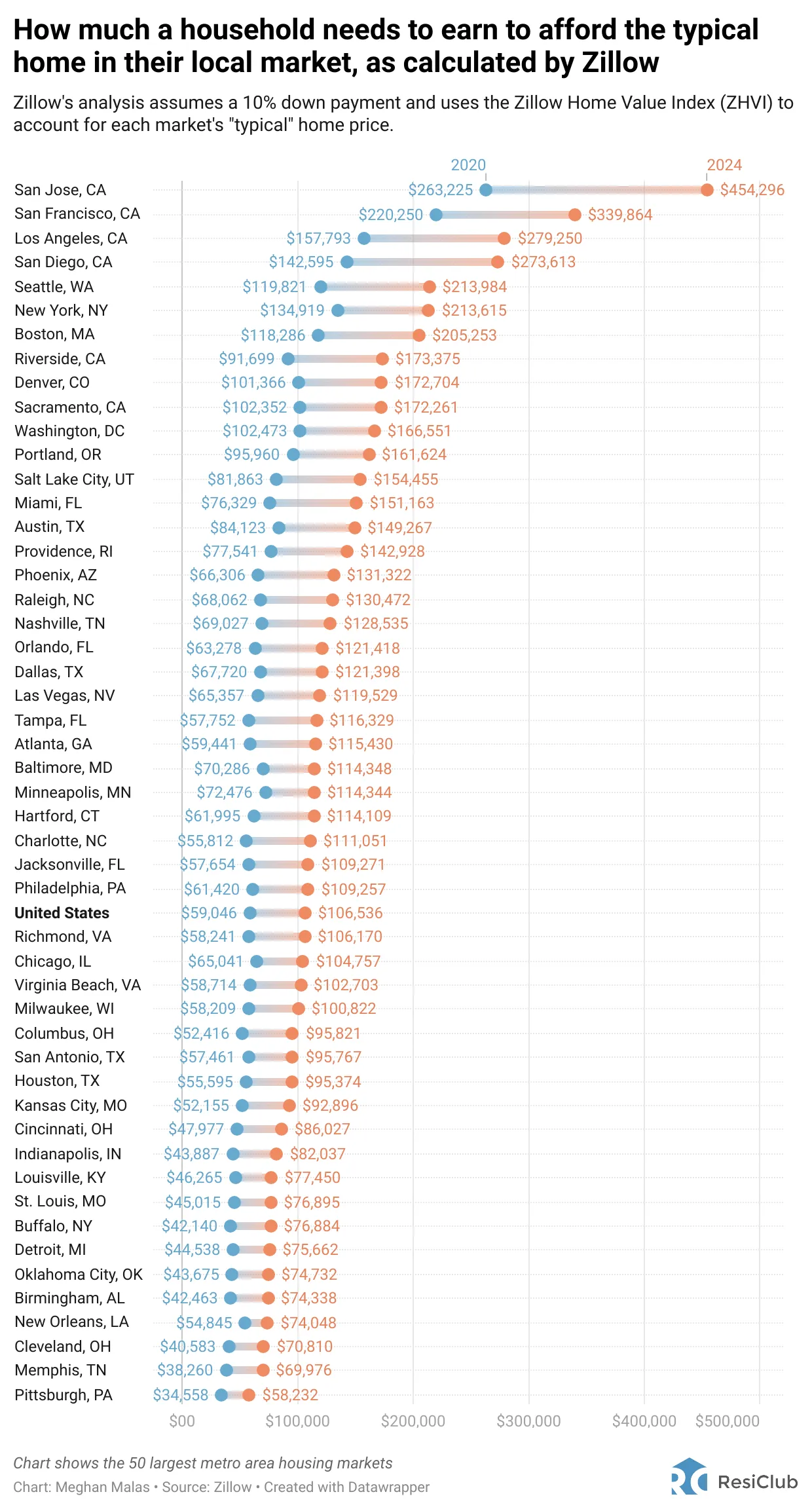

Zillow not too long ago launched an intriguing examine that outlines the revenue wanted to afford a “typical residence” in numerous cities. The examine considers a ten% down fee and makes use of the Zillow Dwelling Worth Index to find out the median residence worth in every metropolis.

Let’s examine the revenue required to buy the median residence in every metropolis between 2020 and 2024.

San Jose instructions the very best revenue requirement to afford a median residence at $454,296, whereas Pittsburg boasts the bottom revenue wanted at simply $58,232. If homeownership is a precedence and finances constraints are a priority, maybe a transfer to Pittsburg, Pennsylvania, is price contemplating!

As a San Francisco resident, I discover it reassuring that the price of dwelling right here is simply $339,864. This represents a considerable $114,432 discount within the required annual revenue, or 25%, in comparison with the revenue wanted for homeownership in San Jose.

Moreover, in the case of life-style issues, San Francisco affords a extra picturesque, vigorous, and satisfying setting in comparison with San Jose. It is not San Jose that attracts world vacationers to the U.S., however moderately the attract of San Francisco!

Costly Cities Would possibly Truly Be The Least expensive Cities To Reside In

You have perused my submit titled “Why Households Want To Earn $300,000 A 12 months To Reside A Center-Class Way of life At the moment.” When you might need strongly disagreed with my evaluation regarding households residing in costly coastal cities, it is reassuring to search out exterior validation from Zillow supporting it.

The US is huge, with various cost-of-living ranges throughout the nation. Luckily, all of us possess the liberty to decide on the place we wish to reside. If the price of dwelling turns into too burdensome for our revenue, now we have the choice to relocate, trim bills, or search extra work, as we’re all rational decision-makers.

Regardless of cities resembling Boston, New York, Seattle, San Diego, Los Angeles, San Francisco, and San Jose necessitating over $200,000 in family revenue to afford a typical residence, I argue that these cities are extra inexpensive than generally perceived.

Listed here are two the reason why.

1) Costly cities are cheaper to have enjoyable and reside more healthy

As I wrote in my submit about non-public sports activities golf equipment, I pay $180 a month to be part of a community of golf equipment within the Bay Space. I feel $180 a month is nice worth, which is why I am unwilling to chop the expense regardless of not being financially unbiased.

Then Nate, a reader from Pittsburg, PA chimed in and wrote,

“Very bizarre a non-public sports activities membership with indoor pickleball and tennis would solely price $180/m. Clearly you wouldn’t cancel this. There is no such thing as a such factor as non-public indoor sports activities membership for $180/month in Pittsburgh. Solely nation golf equipment with out of doors tennis or pickleball and golf for $1,500/m and up. Different possibility is public park for tennis or pickleball which includes ready/no reservations/no availability.”

Holy moly! $1,500 a month and up to have the ability to play tennis and pickleball indoors? No thanks! Who can afford that?

Nicer Climate Issues For High quality Of Life

Right here in San Francisco, the climate stays average all year long, offering ample free public courts for tennis and pickleball. On this instance, non-public sports activities membership memberships are no less than 88% extra inexpensive.

For these in search of cost-effective out of doors enjoyment virtually year-round, cities like San Jose, San Francisco, Los Angeles, and San Diego supply favorable circumstances. Nevertheless, in areas the place the required revenue is lower than the general U.S. revenue of $106,536 to afford a house, sustaining a year-round out of doors life-style is more difficult.

Improved climate stands out as one of many essential the reason why dwelling on the West Coast surpasses dwelling on the East Coast. Having skilled each coasts for over a decade every, I can attest to the considerably larger high quality of life.

Life is already temporary, and enduring three to 4 months of utmost winter circumstances yearly is suboptimal for a lot of People. Consequently, a considerable variety of People decide to relocate out west.

For these prioritizing favorable climate and homeownership, cities like New York Metropolis ($213,615) and Boston may not be the very best selections.

Given their high-income necessities for housing and difficult climate circumstances, a strategic transfer may contain geoarbitrage to extra inexpensive and hotter cities like Miami ($151,163), Raleigh ($130,472), Baltimore ($114,348), and even Pittsburgh, PA ($58,232).

2) Costly cities are simpler to make more cash and make affordability cheaper

I have been considering a transfer to Honolulu, Hawaii since 2014.

After retiring in 2012, I believed, “Why not relocate to my favourite state in America?” The great climate, scrumptious meals, and laid-back vibe all appeared like elements that would contribute to an extended and extra fulfilling life. With sufficient passive revenue to maintain a easy life-style and the chance to generate supplemental retirement revenue by writing on Monetary Samurai, the thought appeared interesting.

Again then, with no children, retiring to Hawaii seemed to be an easy resolution. Nevertheless, my ardour for actual property made me really feel that if I have been to maneuver, I wanted to personal a house in Honolulu. Simply as shorting the S&P 500 long-term is taken into account a suboptimal resolution, I believed that renting long-term and never proudly owning actual property in Honolulu may also be lower than supreme.

For 3 years, I diligently attended open homes in Honolulu throughout each go to to see my dad and mom. Regardless of leaving every time excited concerning the potential of relocating, I could not shake the concern that I may not comfortably afford to reside in Honolulu.

Honolulu Housing Is ~30% Cheaper Than San Francisco Housing

It may appear unusual to precise concern about retiring in Honolulu, the place comparable housing is about 30% cheaper than in San Francisco. Or is it?

My fear stemmed from the concern that if I bought a house in Honolulu and encountered sudden monetary difficulties, I might discover myself in a good spot. In 2014, my passive revenue was round $100,000, which was already inadequate to qualify for a traditional mortgage.

Given my lack of W2 revenue, I would wish to provide you with a down fee of fifty% or extra to purchase a house priced between $700,000 and $1 million. For context, the median residence worth in Honolulu is roughly $780,000, in line with Zillow.

Upon exploring the job market in Honolulu, I found that the pay was 40% – 60% lower than what I may earn in San Francisco. Furthermore, I wasn’t conscious of any part-time consulting jobs in Honolulu.

In distinction, San Francisco boasted a plethora of consulting and full-time jobs paying $100,000 or extra. At the moment, even 23-year-old school graduates working in tech can begin incomes $150,000 or extra yearly.

In line with Numbeo, you would wish round 7,701.7$ in Honolulu, HI to keep up the identical normal of life you could have with 8,900.0$ in San Francisco, CA (assuming you hire in each cities). This calculation makes use of our Price of Dwelling Plus Lease Index to check the price of dwelling and assume web earnings (after revenue tax).

Shopping for In San Francisco Felt Safer

Though San Francisco residence costs are roughly 42% larger than Honolulu residence costs, I felt extra relaxed buying a fixer-upper in San Francisco for $1,230,000 than shopping for a home in Honolulu for $700,000 – $1 million. I managed to purchase the fixer in 2014 as a result of a few massive CDs matured, and my spouse was in her remaining yr of labor.

I used to be assured that if I confronted monetary difficulties after shopping for the fixer in San Francisco, I may all the time safe a six-figure job as a guide or full-time worker. San Francisco boasts a large tech ecosystem, together with biotech, medical, aerospace, and tourism industries.

In distinction, Honolulu closely depends on tourism as its fundamental supply of revenue. Due to this fact, financial challenges in Japan and China may adversely have an effect on Honolulu. Being profitable in Hawaii is solely tougher.

Shopping for a house in San Francisco merely felt safer as a result of range of industries and the provision of higher-paying jobs. The continued synthetic intelligence growth may improve the returns of my enterprise capital funds. Moreover, if I did not reside in San Francisco, I in all probability would not have had entry to a few these funds.

Extra Examples Of How Prices Are Greater In Cheaper Cities

Price of Automobiles: The worth of a Honda Accord stays constant no matter location. As an illustration, buying a $34,000 Honda Accord Sport would account for 42.5% of an $80,000 wage however solely 23% of a job-equivalent wage of $150,000.

Price of Supplies for Dwelling Transform: Lumber, sheetrock, wiring, and fixtures typically price the identical throughout the nation. Whether or not you are reworking a $500,000 home or a $1,200,000 home, the prices may differ (10% versus 5.8% of the house worth, respectively). Nevertheless, the higher-priced residence yields a higher return on the rework, contemplating the 120% larger worth per sq. foot.

Price of School: School tuition costs are constant nationwide. Nevertheless, the affordability of school has develop into difficult for middle-class households, notably in cheaper cities, the place solely the wealthy or the poor can comfortably afford larger training.

Take into account any product that maintains a constant worth no matter your location, and you may perceive why dwelling in a extra inexpensive metropolis with a decrease revenue could be extra pricey.

Dwelling In An Costly Metropolis Is Like Taking part in Offense

In your journey to monetary independence, you’ve gotten the choice to play offense, striving to maximise your revenue, or play protection, aiming to save lots of as a lot cash as doable. Most people pursuing FIRE (Monetary Independence, Retire Early) undertake a mix of each methods.

Personally, I favor taking part in offense in wealth-building, pushed by the limitless potential for revenue and funding returns. Since 2009, I’ve chosen to reside in New York Metropolis and San Francisco, recognizing the ample alternatives for top earnings. This strategy is akin to investing in progress shares within the first half of your life.

Not solely was I ready to make more cash dwelling in NYC and SF, I used to be additionally in a position to construct connections that granted me non-public funding alternatives, a few of which have turned out nicely.

Whereas the price of dwelling in these cities is undoubtedly excessive, it is a reflection of the alternatives they provide. Proudly owning actual property in such high-opportunity cities, as soon as achieved, facilitates wealth constructing.

Relocate As soon as You have Made Your Fortune

After accumulating enough wealth, one can ponder relocating to a extra budget-friendly metropolis that aligns higher with life-style objectives and revenue ranges. It is simpler to maneuver from New York Metropolis to New Orleans versus the opposite means round.

The revenue potential in an costly metropolis could be so substantial that the perceived drawbacks, primarily the excessive price of dwelling, develop into much less important.

Should you reside in an inexpensive metropolis, all of the extra purpose to capitalize on on-line revenue and earn a living from home alternatives. Luckily, an rising variety of jobs now supply comparable wages no matter your location. Due to this fact, you may as nicely take benefit!

Reader Questions And Options

Resides in an costly metropolis actually less expensive? Are individuals overlooking the truth that these cities are costly due to the revenue alternatives they provide? Which cities do you assume strike the very best steadiness between affordability and revenue potential?

Personally, I plan to proceed investing within the heartland of America, the place the price of dwelling is decrease and rental yields are larger. I strongly consider that technological developments will drive extra People to relocate to extra inexpensive cities over the following a number of many years.

Should you share this long-term perspective, check out Fundrise. Managing over $3.5 billion in property, Fundrise primarily invests in residential and industrial properties within the Sunbelt area. Should you select to stay in an costly metropolis, all of the extra purpose to diversify throughout inexpensive elements of the nation.

[ad_2]