[ad_1]

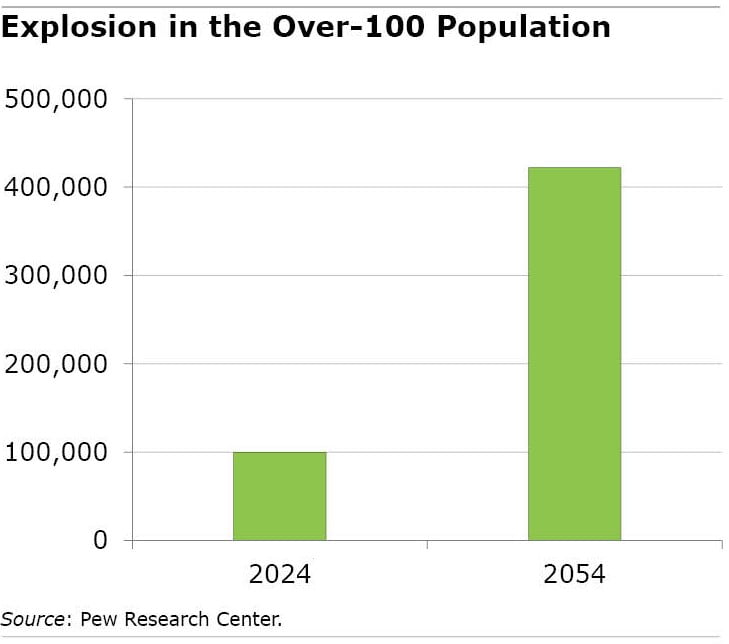

The expansion within the over-100 inhabitants is gob-smacking. In 30 years, Pew studies that the variety of U.S. centenarians will quadruple to greater than 400,000. To get a way of what this can imply, image each resident in Tampa, Fla., being over 100. In 1950, solely 2,300 individuals in the complete nation have been.

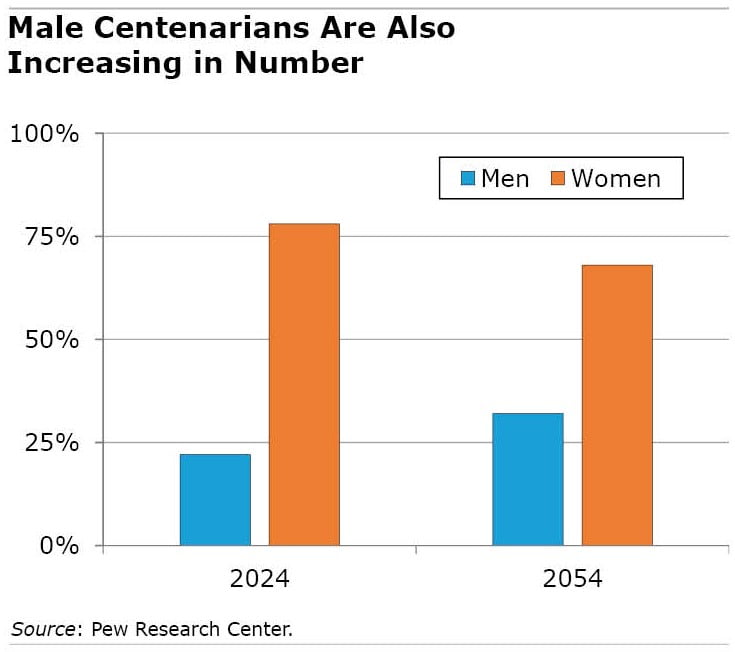

Most centenarians in the present day are girls and will probably be sooner or later however males are additionally dwelling longer. Males will make up a few third of them in 2054, up from a fifth at the moment, based on Pew.

The speedy progress within the over-100 inhabitants is an element of a bigger pattern of an growing old nation, which creates three urgent coverage issues.

First, all these previous persons are going to want much more caregivers. Daughters often handle their growing old mother and father. However somebody who lives to 100 may both outlive their youngsters or their youngsters could be too previous to look after them.

The methods at the moment in place are already below pressure as child boomers more and more want care. Caregiving is troublesome, low-paid work. Job openings for in-home aides are going unfilled, and workers turnover at nursing houses and assisted dwelling services is a power drawback.

One other challenge is the monetary drain on people of a particularly lengthy retirement. Already, about 4 in 10 employees in the present day employees in the present day should not on observe with their 401(okay) financial savings and should expertise a drop of their way of life once they retire.

Amid rising longevity, many older employees are taking steps to enhance their retirement outlook by working longer to avoid wasting extra and maintain out for a bigger month-to-month Social Safety profit. However even when somebody delays retiring till 70 after which lives to 90 or 100, they’ll want sufficient financial savings to cowl two or three a long time.

Lastly, except policymakers act, the Social Safety belief fund is predicted to be depleted within the 2030s, and the payroll taxes paid by employees will present solely about three-fourths of the revenues required to cowl retirees’ advantages.

Social Safety’s fiscal issues must be addressed on the identical time that the Medicare program is being more and more burdened by the price of medical look after the rising aged inhabitants.

These fiscal issues with be compounded by fertility declines. As extra individuals reside to 90, 100 or past, there will probably be fewer and fewer employees funding every retiree. It is a drawback all through developed nations and never simply in the US.

Assembly the rising want for caregivers, doing extra to encourage retirement saving, and repairing Social Safety’s and Medicare’s funds – these are urgent points that Congress wants to handle. The clock is ticking.

Squared Away author Kim Blanton invitations you to observe us @SquaredAwayBC on X, previously often known as Twitter. To remain present on our weblog, be a part of our free e mail record. You’ll obtain only one e mail every week – with hyperlinks to the 2 new posts for that week – if you enroll right here. This weblog is supported by the Heart for Retirement Analysis at Boston Faculty.

[ad_2]