[ad_1]

Solely a handful appear to be logical candidates, with large banks topping the listing.

IBM introduced final November that it might now not contribute a conventional firm match and as a substitute reopen the money steadiness part of its beforehand frozen outlined profit plan. The query is, what different firms would possibly comply with go well with? The reply is especially large banks, however let me present a bit background.

Beginning in January 2024, IBM ended its 5-percent matching contribution and 1-percent computerized contribution to workers’ 401(ok) accounts in favor of an computerized 5-percent contribution to a “Retirement Profit Account” for every worker. The Retirement Profit Account is the worker’s “notional” account within the money steadiness part of the corporate’s outlined profit plan. IBM had closed its outlined profit plan to new contributors in 2005 and “frozen” advantages – that’s, ended new accruals – for current contributors in 2008. This shift permits IBM to fund its annual retirement contributions of $530 million with the $5 billion surplus in its overfunded outlined profit plan, relatively than with company money contributed to its 401(ok) plan – bettering its money movement assertion.

My colleagues and I did a bit work to determine who would possibly comply with IBM’s lead.

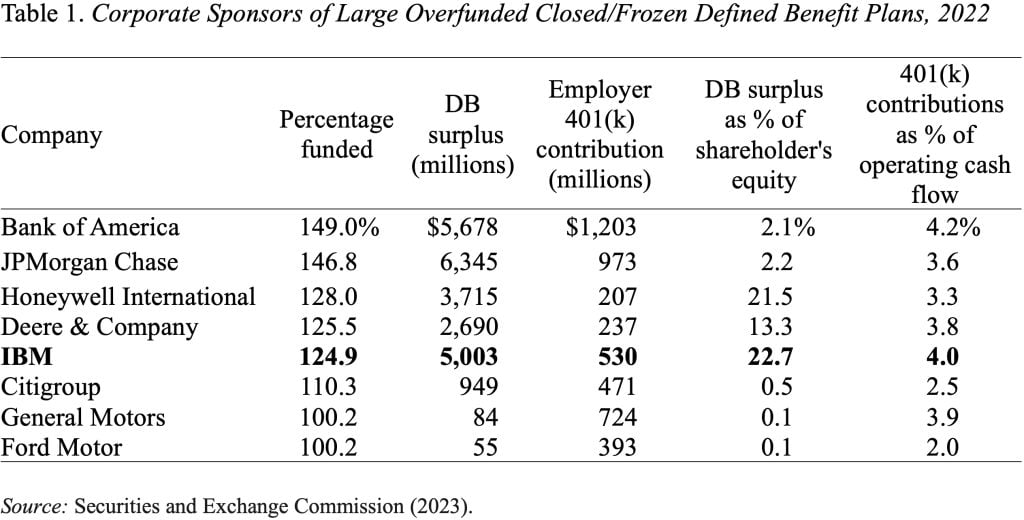

Logically, a possible follower ought to have: 1) a big defined-benefit surplus that may be put to make use of; and a pair of) massive 401(ok) contributions that, as soon as saved or diminished, can considerably enhance the corporate’s money movement. We began by specializing in firms with defined-benefit obligations of greater than $10 billion after which narrowed the main target to these with closed/frozen plans which have a funded ratio of over 100%.

This train resulted within the eight firms proven in Desk 1. Along with the funded ratio, the desk consists of the excess within the firm’s defined-benefit plan, contributions to the corporate’s 401(ok) plan, and two measures that may present an incentive to think about IBM’s method. Not surprisingly, IBM ranks excessive on each incentive measures.

On the highest of the listing are the nation’s two largest banks – Financial institution of America and JPMorgan Chase. The sheer greenback quantity of their pension surpluses might set off critical consideration of potential different makes use of. Additionally, these firms made massive 401(ok) contributions each in greenback quantity and as a share of their annual money movement. Citigroup, the fourth largest U.S. financial institution, can be on the listing with a funded ratio of 110 %, though its outlined profit surplus and 401(ok) contributions are a lot decrease than the highest two.

Honeywell Worldwide and Deere & Co., that are third and fourth on the listing, face a scenario much like IBM’s by way of the relative sizes of their surpluses and 401(ok) prices. Deere & Co. might not take additional actions anytime quickly because it simply closed its outlined profit plan for salaried workers to new hires in January 2023 and significantly enhanced its 401(ok) match. Nevertheless, down the street, a fast improve in 401(ok) prices may set off a reconsideration of the outlined profit choice.

Basic Motors and Ford appear unlikely to comply with IBM in reopening their barely absolutely funded outlined profit plans. In current labor negotiations, the businesses rejected the union’s demand to reopen their outlined profit plans and as a substitute agreed to extend their 401(ok) contributions considerably.

That’s all we all know. It is going to be fascinating to see what occurs subsequent.

[ad_2]