[ad_1]

What are the Bull and Bear circumstances for 2024?

I don’t do annual forecasts1 as a result of the short-term is method too random. As a substitute, I desire to contemplate market historical past and up to date information, and ask “What are the doable and possible outcomes for this 12 months?”

I discover it very helpful as an investor to have the ability to see each side of the bull-bear debate. Towards that finish, listed here are a dozen bullish and bearish elements I believe are most certainly to affect how the markets will progress this 12 months.

Let’s soar proper in:

~~~

Causes to be Bullish

1. Momentum: The S&P 500 rose 24.2% final 12 months after falling 19.4% throughout 2022. Since 1928, years with beneficial properties of over 20% have been adopted by a median acquire of 5.9%; My colleague Ben Carlson factors out that good years tend to cluster collectively. “Many instances good returns are adopted by good returns (however typically good returns are adopted by losses.)”

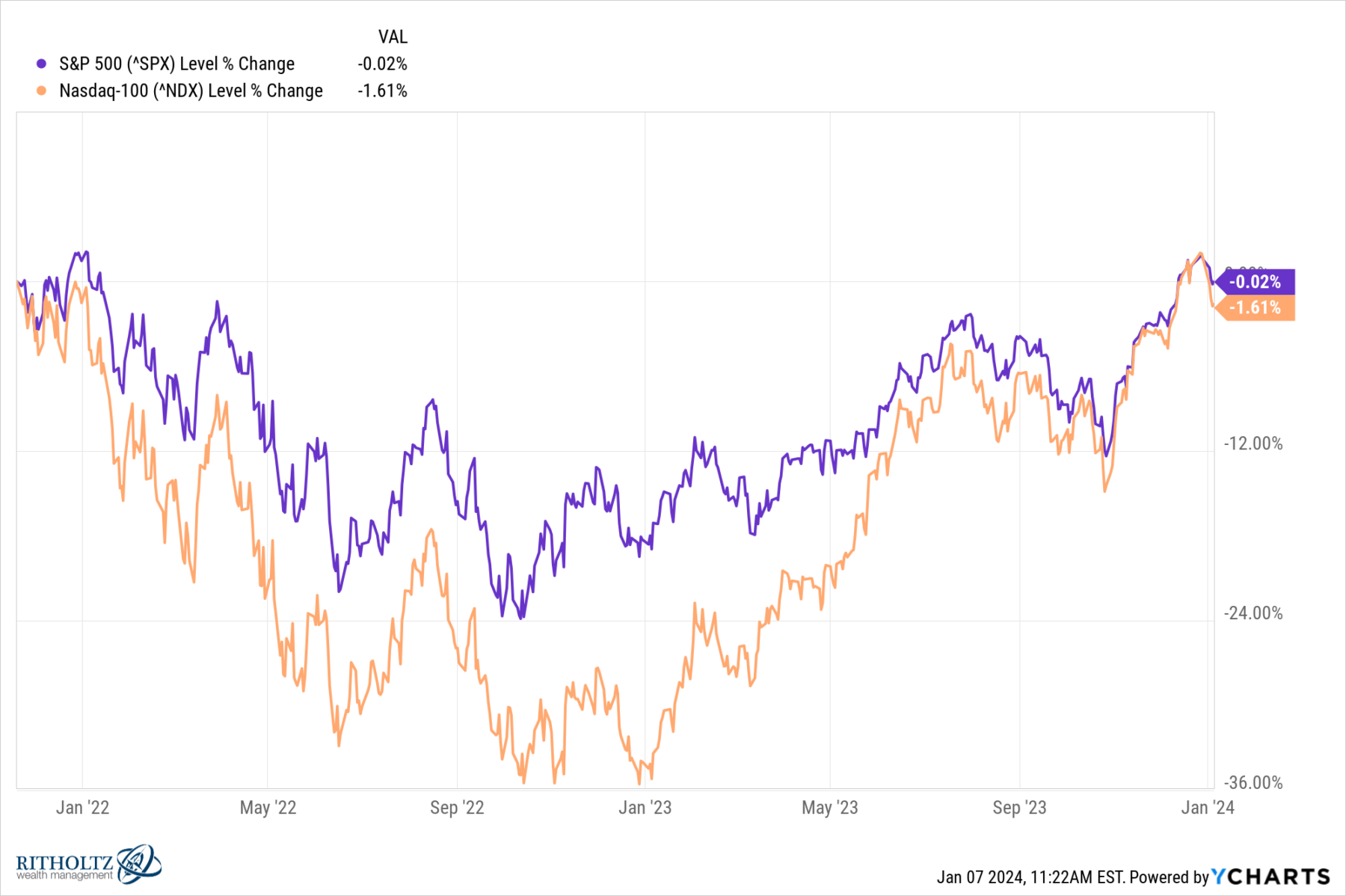

2. Flat over 2 years: The S&P 500 gained >12.1% in This fall 2023 – up ~36% for the reason that October 2022 lows, and up 24.2% for the total 12 months. It completed 2023 with 9 consecutive weeks of beneficial properties. Whereas some people are suggesting that that is “Too far too quick,” I recommend placing it into context: Because the chart above reveals, the S&P 500 has been ~flat since its November 2021 peak, and basically flat over 2022-23 calendar years.

Similar for the Nasdaq 100: It gained 14.3% in This fall, and a whopping 53.8% in 2023, its finest efficiency since 2009. However for context, the Nasdaq 100 can be flat since its November 2021 peak, and up a mere 3.1% over 2022-23.

3. No Recession: Excluding recession years, after a giant up 12 months, the 2nd-year noticed beneficial properties that averaged 9.7%. Throughout recession years losses averaged 10.1%. Down years are way more possible than up years to be related to recessions. Since 1928, markets have fallen in non-recessionary years solely 16 instances, and 2022 was a kind of exceptions (down 19.4%). Moreover 2022, latest examples embody 2018, 2000, and 2002 (the recession was in 2001).

4. Inflation: I’ve repeatedly been pounding the desk that inflation peaked in June 2022; that was a lonely place for some time, with a handful of individuals – Ed Yardeni, Paul Krugman, and Claudia Sahm come to thoughts – who additionally noticed this taking place in real-time.

As Ed Yardeni noticed: “Inflation tends to be a symmetrical phenomenon. It tends to return down as rapidly or as slowly because it went up when measured on a y/y foundation. We are able to see this constant sample within the CPI inflation price for the US since 1921.”

It’s now apparent that inflation fell a lot quicker than was extensively anticipated. However for a very long time, many refused to imagine it, they usually acted on their beliefs by promoting equities.

Regardless, most measures of inflation had already peaked by June 2022. PCE at 7.1% in June 2022; Core inflation at 5.6% in February 2022, then falling to three.2% throughout November 2023. Sturdy items inflation additionally peaked in February 2022 at 10.7%, and fell to -2.1% by November of 2023. Non-durable items inflation price additionally peaked in June 2022 at 13.1% earlier than falling to 0.7% in November 2023. (Information through Yardeni Analysis).

5. Federal Reserve: Whereas a recession is feasible in 2024, it principally relies upon upon how lengthy the FOMC retains charges tighter (greater) than is acceptable for the economic system. I defined this in an open letter/BusinessWeek article in August, to Jay Powell:

“Mazel tov! You beat inflation and prevented a recession. Revel within the candy style of victory as you fly-fish with different central bankers on the annual symposium in Jackson Gap, Wyoming. With inflation at 3.2%, unemployment at 3.5% and gross home product anticipated to high 3% within the third quarter, you’ve earned a trip. Hell, take the remainder of the 12 months off!”

That turned out to be precisely appropriate.

Word: I’ve the Fed in each bullish and bearish sides of the arguments as a result of relying upon what they find yourself doing in 2024 can be vital in every path.

6. Misreading Housing: I preserve mentioning we’re measuring the Housing element of the PCE companies inflation price incorrectly. It has fallen slowly, from 8.3% y/y in April 2023 to six.7% in November – however as I’ve been warning since 2007, we measure this incorrectly utilizing a poor mannequin of housing costs known as “Homeowners Equal Hire.”

OER is the fallacious approach to mannequin residential inflation. We are able to see this in precise real-time measures (versus OER’s modeled lagged extrapolations) corresponding to this. Zillow Analysis and House Listing Hire Indexes. They confirmed 3.0% and -1.2% in November housing value inflation measures respectively. It is extremely possible the Fed’s OER inflation price will drop in coming months from 6.9%

~~~

Causes to be Bearish

1. Lengthy and Variable Lags: The recessionistas who’re satisfied a recession state of affairs is probably going for 2024 are basing their forecasts a easy reality: Financial coverage impacts the economic system on a delay (aka “lengthy and variable lags”). This has been exhibiting up in information such because the State Coincident Indicators, that are softening.

550bps will increase within the Federal Funds price from March 2022 by means of July 2023 – and its lengthy and variable lags – continues to exert a drag on the economic system, which might result in additional financial contraction. All of that tightening is why we can’t rule out a recession in 2024.

2. CRE/WFH: The post-pandemic setting continues to be tough for business workplace actual property. The banking sector has funded all the building and purchases over the previous decade. Banks maintain over $3 trillion in CRE; Unrealized losses on Treasuries and mortgages are about $684bn (Supply: Torsten Slok, Apollo).

Weaker demand to extra folks working from dwelling, and naturally greater rates of interest are a drag on this sector. The worst buildings within the least fascinating areas may very well be taking a look at a 40% decline within the value per sq. foot for workplace house.

3. Market Focus: What occurs when the Magnificent 7 is now not so magnificent?

Maybe the market broadens out to incorporate extra massive, mid, and small-cap shares catching a bid. However simply as possible is that fairness markets see their greatest progress engine sputter, dragging the key indices again to a lot smaller beneficial properties — or worse.

4. Yield Curve Inversion: The yield curve has been inverted for the reason that summer time of 2022. Inverted yield curves appropriately anticipated the previous eight recessions. Campbell Harvey of Duke, who created this indicator, factors out they have a tendency to disinvert at the beginning of the recessions. We’re beginning to see indicators of that dis-inversion…

Associated concern: Single-family housing has signaling recession since 2022, when mortgage charges spiked.2 Mortgage charges have fallen since peaking in late October, and if that continues, it’s an enormous constructive (therefore why it doesn’t get its personal bullet)

5. World Slowdown or Recession: Within the US, there are indicators that buyers are operating out of extra financial savings and taking up extra debt. Europe has been in a gentle slowdown, with what some name rolling recessions all through the continent (the slowdown there and in China most likely explains decrease oil costs). China appears to be in or near recession; its actual property market is a perennial potential property disaster.3

6. Warfare: Battle within the Center East dangers disrupting oil manufacturing and sending crude costs greater. A spillover might drag different nations (Iran, USA) into the battle. The Russian invasion of Ukraine is similar; China & Taiwan is a perpetual fear.

~~~

As Elroy Dimson noticed, “Threat means extra issues can occur than will occur.” The dozen variables above are the dangers that I see as more likely to decide how 2024 unfolds. That is earlier than we take into account the “unknown unknowns” that await us. Therefore, why forecasting is so fraught with error.

The world is just method too random a spot to make dependable forecasts a 12 months into the long run. That isn’t sufficient time for the longer-term secular developments to play out, however it’s a lengthy sufficient interval for tens of millions of random occasions to briefly derail the dominant developments in place and derail our expectations.

Beforehand:

Forecasting & Prediction Discussions

Can Economists Predict Recessions? (September 29, 2023)

Spherical Journey: Classes From the 2022 Bear Market (August 1, 2023)

How Bullish Have been You in 2011? (November 29, 2023)

__________

1. Usually round now, probably the most forecasty time of the 12 months, I write a column excoriating all of these individuals who blew their 2023 calls. Why? It’s not that your forecast was fallacious, it’s that you’re forecasting within the first place. Extra on this at a later date.

2. ~40% of all owners are mortgage-free. Many of the relaxation refinanced at record-low mortgage charges.

3. Significantly, who the hell is aware of what’s gonna occur right here…

[ad_2]