[ad_1]

Older high-income households with a 401(ok) gained; all people else misplaced.

The Federal Reserve’s 2022 Survey of Shopper Funds (SCF) summarizes modifications in household funds between 2019 and 2022 – three years of COVID and financial disruption, and 2022 was additionally a horrible yr by way of inventory and bond returns. On the similar time, the federal government offered unprecedented fiscal assist, employment remained robust, the inventory market – even with the drop in 2022 – ended up considerably increased than in 2019, and the 401(ok) system continued to mature. On steadiness, one would count on improved retirement balances between 2019 and 2022 throughout age and revenue teams.

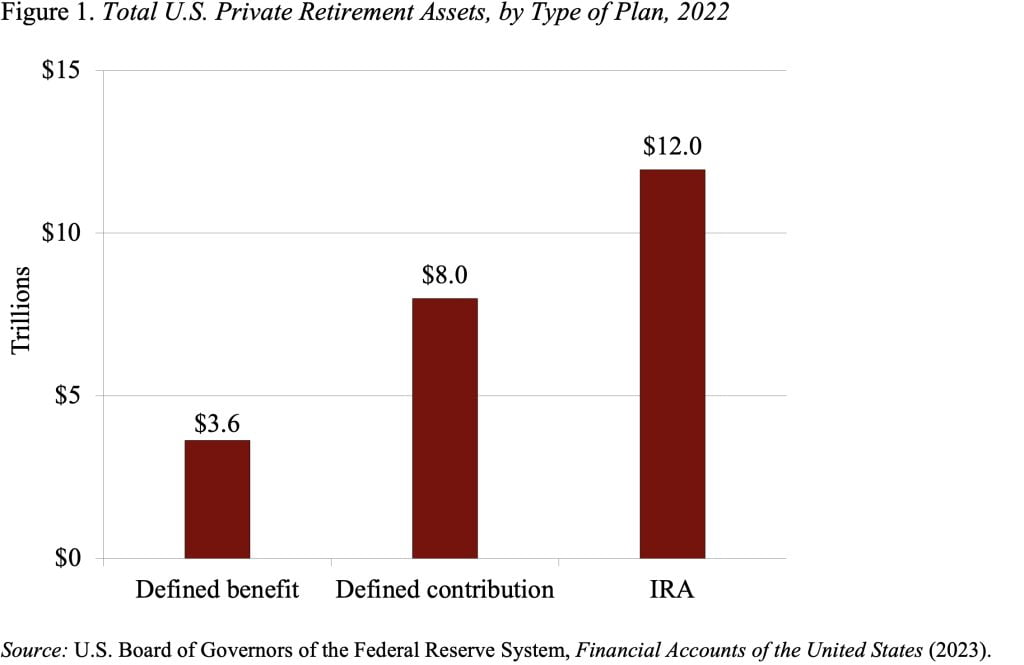

The benefit of the SCF over information on 401(ok) plans from monetary service companies is that it supplies info not solely about households’ 401(ok) holdings but in addition about their IRAs, that are predominately rollovers from 401(ok)s and signify the vast majority of retirement account belongings (see Determine 1).

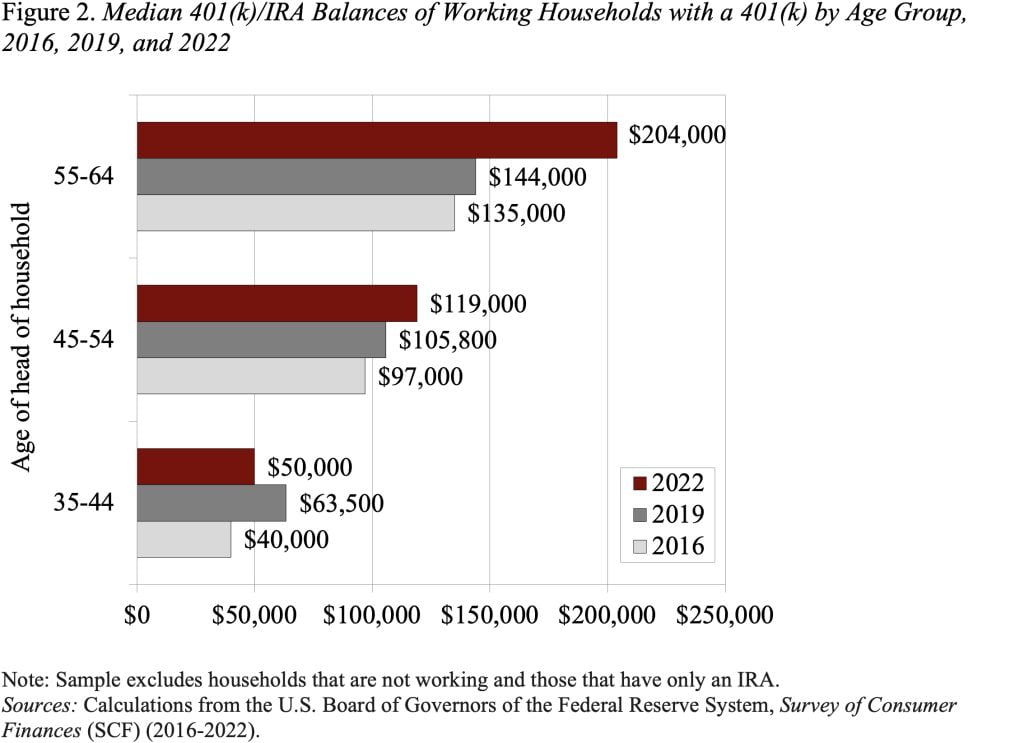

The excellent news from the 2022 SCF is that 401(ok)/IRA balances for older working households with a plan totaled $204,000 in 2022 in comparison with $144,000 for comparable households in 2019. (see Determine 2). The information for youthful households, nonetheless, is much less rosy. The median 401(ok)/IRA balances for households ages 45-54 elevated solely from $105,800 to $119,000 – lower than the speed of inflation. And the holdings of the youngest group (35-44) truly declined.

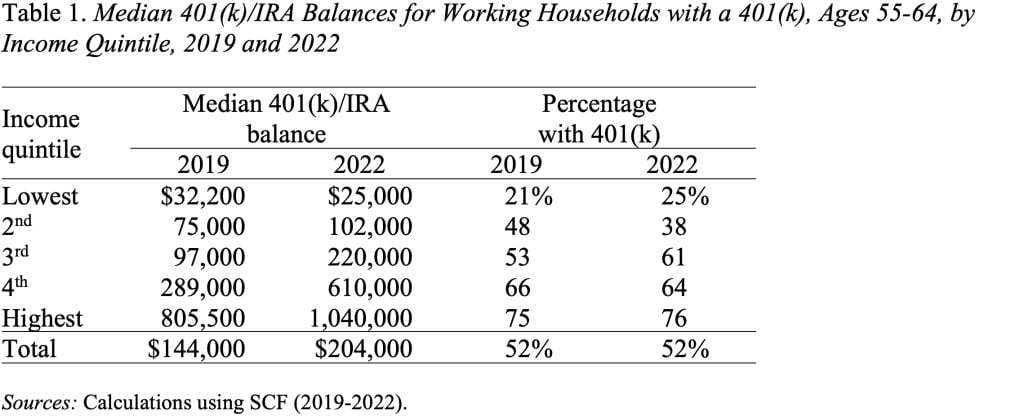

Furthermore, the features in 401(ok)/IRA balances weren’t unfold evenly throughout the revenue distribution of working households. The center quintile gained not solely in balances but in addition within the share of households with a 401(ok) plan. That’s clearly excellent news. Larger-income households noticed even bigger share will increase of their balances, and the share of households with a plan held regular. For the underside two quintiles, the information just isn’t good. Both balances dropped or balances elevated however the share with a plan dropped sharply (see Desk 1).

On steadiness, given the energy of the economic system and the features within the inventory market over the three-year interval, the 2022 SCF supplies a disappointing image of the retirement belongings for working households. Furthermore, the main focus is on the 50 % of households with a 401(ok) plan; the opposite half of households don’t have anything however Social Safety. Clearly, guaranteeing the solvency of Social Safety is a excessive precedence.

[ad_2]