[ad_1]

Profit/contribution ratios present no steering on the way to repair Social Safety.

Two of my pals – Andrew Biggs (“No, Social Safety Isn’t Earned”) and Gene Steuerle (“Lifetime Social Safety Advantages and Taxes”) are making my mind ache. They’re each arguing that folks will get lifetime Social Safety advantages far in extra of lifetime contributions, and the “unearned” portion of future advantages needs to be on the chopping block.

Let me make three snippy feedback after which deal with the underlying concern.

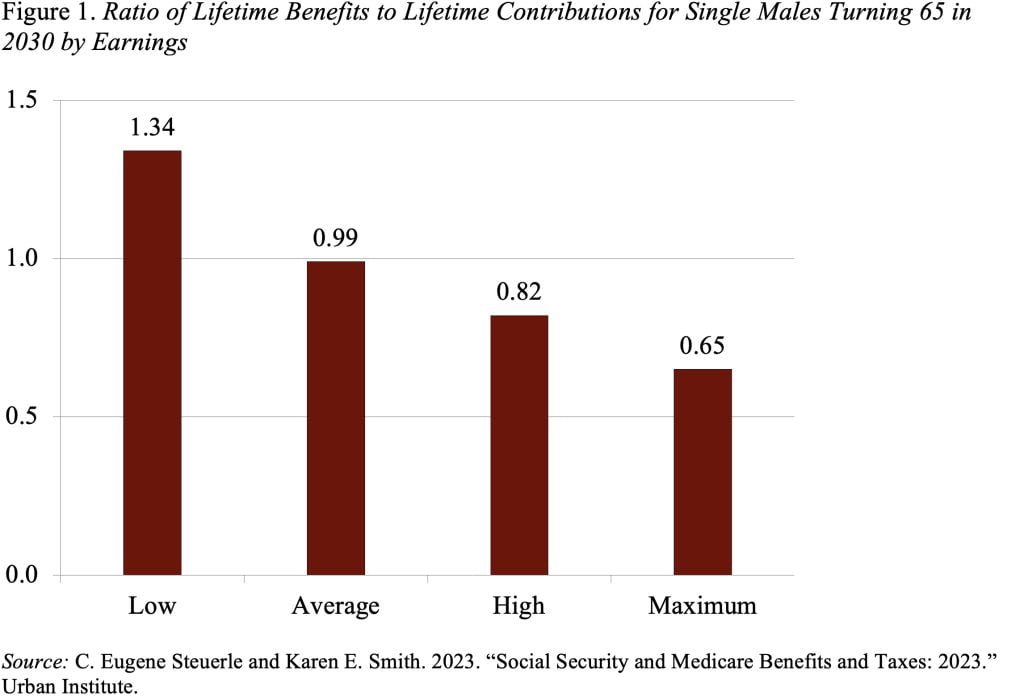

First, the individuals who obtain advantages in extra of contributions should not the group that anybody would goal for cuts (see Determine 1).

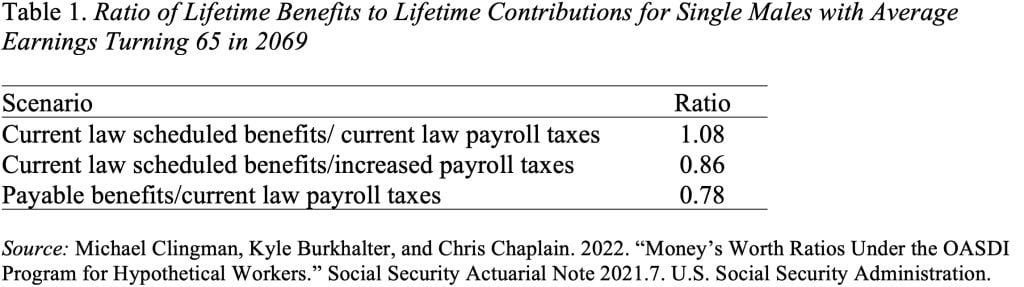

Second, any train that appears at scheduled advantages and present taxes after 2030 is deceptive, because the program can not pay scheduled advantages with out new income. Therefore, the Social Safety actuaries embrace “increased-tax” and “reduced-benefit” situations, which completely change the story (see Desk 1).

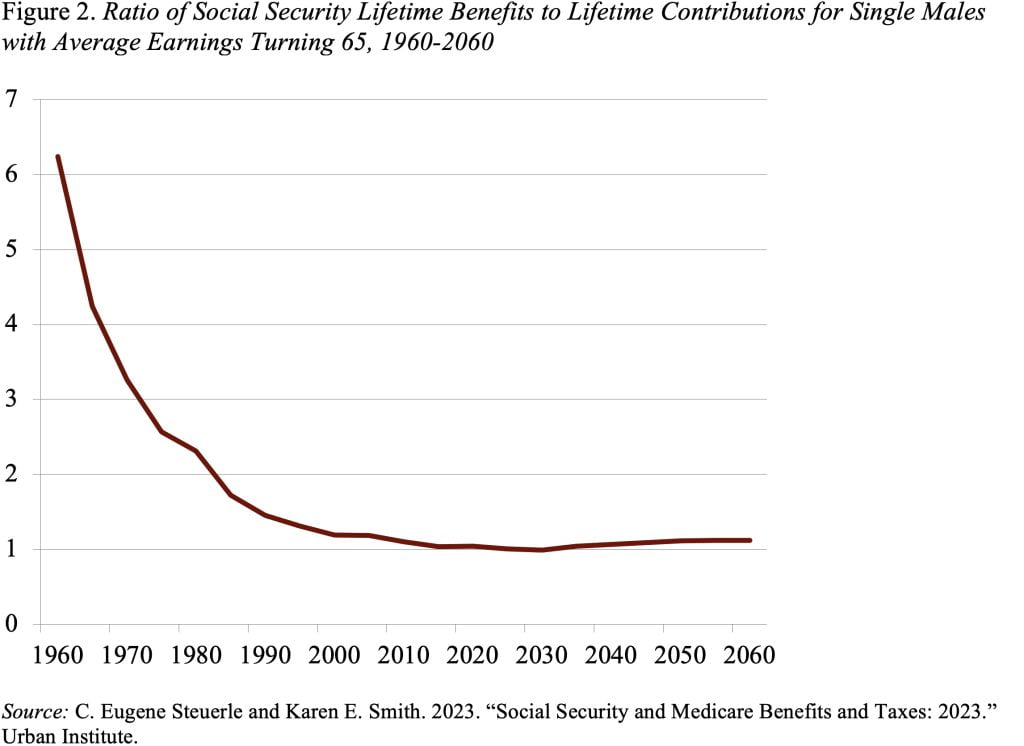

Third, the common male employee did obtain advantages in extra of contributions for many years. However, the state of affairs has improved dramatically (see Determine 2).

The larger query is why the profit/contribution ratio was so excessive traditionally and what that suggests about Social Safety’s funds going ahead. Excluding the buildup of reserves within the wake of the 1983 amendments and the upcoming depletion of those reserves, Social Safety has typically been financed on a pay-as-you-go foundation. This funding methodology differs sharply from the unique 1935 laws, which envisioned the buildup of belief fund property like personal insurance coverage. The 1939 amendments, nevertheless, essentially modified the character of this system and resulted in payroll tax receipts getting used to pay advantages to retirees far in extra of their contributions. In essence, we gave away the belief fund.

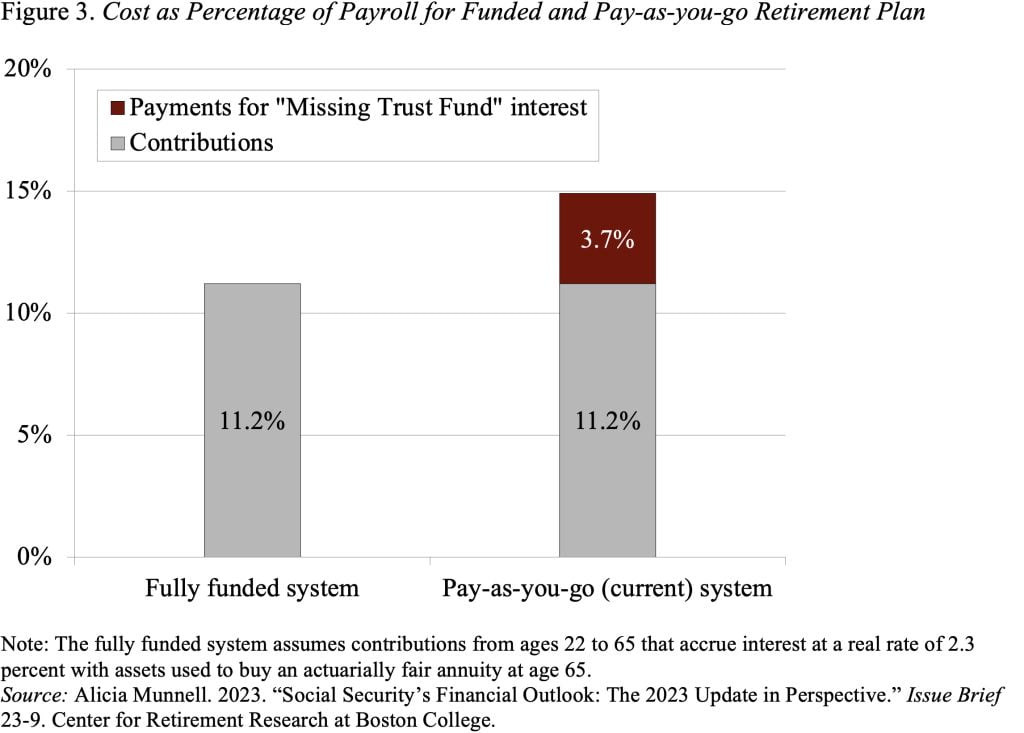

The price to Social Safety of giving freely the belief fund is the distinction within the required contribution charge to finance advantages beneath a funded retirement plan in comparison with a pay-as-you-go system. Beneath a funded system, the mixed employer-employee contribution charge for a typical employee could be 11.2 p.c of earnings to realize a current-law scheduled profit equal to 36 p.c of common listed earnings. Beneath our pay-as-you-go system, the overall price is 14.9 p.c. The ensuing distinction – 3.7 p.c of payroll – is because of the presence of a belief fund that may pay curiosity in a funded system however is lacking within the pay-as-you-go system (see Determine 3).

How this extra price related to the lacking belief fund needs to be financed is an actual concern. Ought to employees be requested to pay greater than the “regular price” related to a funded plan or ought to a number of the financing come from normal revenues? In no case, nevertheless, do disparities between lifetime contributions and lifelong advantages present any steering on how the shortfall in Social Safety’s 75-year financing needs to be resolved.

[ad_2]